- Home

- »

- Renewable Chemicals

- »

-

Herbal Extract Market Size, Share & Growth Report, 2030GVR Report cover

![Herbal Extract Market Size, Share & Trends Report]()

Herbal Extract Market Size, Share & Trends Analysis Report By Type (Cherry, Aloe, Cranberry, Garlic, Turmeric, Ginseng, Cumin), By Application (Personal Care & Cosmetics, Food & Beverages, Animal Feed), By Region, And Segment Forecasts, 2023 - 2030

- Report ID: GVR-4-68040-054-4

- Number of Pages: 100

- Format: Electronic (PDF)

- Historical Range: 2018 - 2021

- Industry: Specialty & Chemicals

Herbal Extract Market Size & Trends

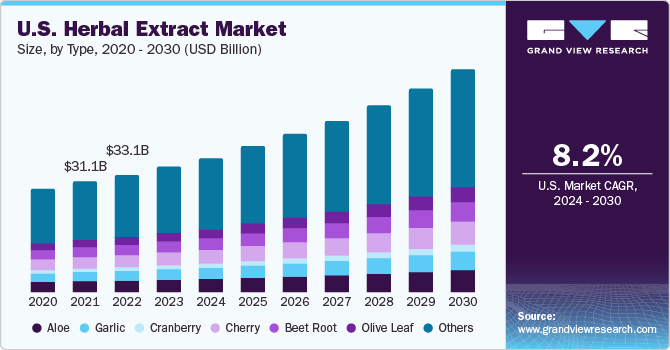

The global herbal extract market size was valued at USD 27.8 billion in 2022 and is projected to grow at a compound annual growth rate (CAGR) of 8.2% from 2023 to 2030. The market is anticipated to be driven by the increased demand for gluten-free, preservative-free, non-artificial flavors, and color-free foods and beverages. The increasing awareness about the therapeutic properties of herbs along with shifting demand toward skincare products with herbal ingredients is expected to further complement the demand for herbal extract over the forecast period. The market is established with major applications in pharmaceutical, food & beverages, cosmetics, and personal care sectors. Asia Pacific and Europe among other regions are the dominant markets. However, the availability of raw materials and a lack of standardization in the manufacturing or production process are likely to be regional challenges for market growth.

The market growth depends upon various factors such as the availability of raw materials, production methods adopted, production cost, and technological advancements. The commercialization of herbal extract is one of the most vital parameters that is projected to influence the overall market growth.

The global personal care & cosmetics industry offers a broad range of bio-based/plant-based products to consumers owing to a surge in demand for such products, especially in developed economies such as the U.S. and the UK. This also presents lucrative growth opportunities for the companies engaged in organic cultivation and extraction of herbs in emerging economies such as China and India for exporting their products to North America and Europe. Personal care & cosmetics, food & beverages, and nutraceuticals industries prefer natural, eco-friendly, and organic ingredients. This, in turn, fuels the demand, thereby driving the growth of the market for them over the forecast period.

Ongoing urbanization and the prevailing hectic lifestyle of the masses has resulted in high demand for nutraceuticals that cater to the nutritional requirements of consumers. This increase in demand for nutraceuticals is in turn anticipated to raise the demand for herbal extracts as they provide all the nutritional values required. Owing surging awareness among consumers about the health benefits associated with herbal extracts will help in propelling the demand for the market.

Various government initiatives and regulatory support are likely to encourage the production of herbal extracts. In India, for example, the Ministry of Finance announced a package of Rs. 4000 crores under the Atma Nirbhar Bharat for the promotion of herbal cultivation. The Ministry has developed a draught scheme for medicinal plant cultivation and marketing.

Product Insights

Cherry dominated the market with a revenue share of more than 10% in 2022. This is attributable to its increasing usage in skin care products as it helps to control the ageing of the skin. Moreover, it has a wide application in the pharmaceutical industry owing to its anti-inflammatory properties. Curcumin is a component of the spice turmeric, a type of ginger. It is insoluble in water; however, it is soluble in ethanol. It has excellent anti-inflammatory and antioxidant properties.

Curcumin is obtained from turmeric and its antioxidant and anti-inflammatory characteristics make it popular in the pharmaceuticals, cosmetics, and food industries. Curcumin, also known as turmeric, is commonly used in the formulation of cosmetics. Turmeric is a prominent element in various Ayurveda treatments in India. It is used to treat acne and eczema, as well as to slow down the aging process and prevent and repair dry skin.

Recent advancements in nano- and micro-formulations of curcumin for better absorption in the gastrointestinal tract have opened a wide range of opportunities for the segment in tissue protection and pain management applications. Duly certified USDA organic 95% curcumin extracts are highly preferred by health-conscious consumers, especially in developed countries.

The demand for fenugreek seed extract is expected to be driven by changing dietary trends of consumers as well as increased demand for health supplements from athletes. The rising prevalence of diabetes, particularly type 2 diabetes, owing to obesity and the hectic lifestyle of consumers, as well as the rising consumption of nutrient-dense foods and energy-rich foods, is likely to drive the demand for fenugreek seeds.

Growing demand for natural ingredient-based medicines is fueling R&D initiatives by various firms and researchers. Furthermore, the rising usage of fenugreek seed extract in Ayurvedic medicinal formulations is anticipated to propel its demand over the forecast period.

Anise seed extract is used in baked goods and as a flavoring in beverages. Owing to increasing awareness regarding the health benefits associated with herbs and spices, the demand for anise seed-based culinary products is likely to rise over the forecast period. In the Asia Pacific region, anise seeds are consumed after meals to aid digestion. Additionally, the demand for anise seed extracts is rising owing to the surging demand for spices and herbs for use in herbal teas, sauces, non-alcoholic beverages, and dressings, as well as bread and confectionery items.

Application Insights

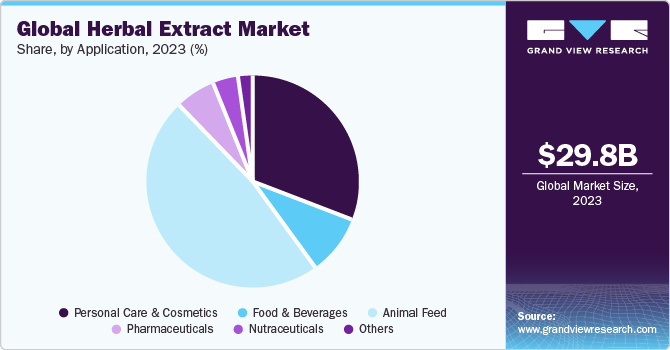

The personal care and cosmetics application segment dominated the market with a revenue share of over 47% in 2022 owing to the anti-inflammatory, anti-bacterial, and other properties of herbal extracts. These properties have fueled the demand for herbal extracts in the formulation of personal care & cosmetic applications.

The ongoing development of new products and the increasing usage of natural ingredients such as essential oils in personal care products and cosmetics are expected to fuel the demand for natural herbal extracts used in them. These ingredients are also used for cleaning teeth. They are also incorporated into baby products, soaps, and shampoos. General hygiene is a major application of essential oils in the personal care & cosmetics segment of the market. In addition, essential oils are widely used in perfumes, body sprays, and air fresheners.

Major brands such as JĀSÖN, Melvita, Annemarie Borlind, and Avalon Organics are continuously making efforts to increase consumer awareness by organizing educational and promotional campaigns focused on communicating the benefits of using organic personal care & cosmetics products. Such trends signify the strong growth of personal care & cosmetics segment of the market in the coming years. This is due to the rising consumer awareness about ensuring their health and beauty, coupled with surging disposable income of consumers in emerging economies such as India, and Mexico among others that enable consumers to spend increasingly on innovative products.

Increasing global demand for natural, safe, and minimally processed food products & beverages has emerged as a major factor driving the growth of the food & beverages segment of the market during the forecast period. The antimicrobial properties of herbal extracts help preserve food products and beverages for a long duration. This is expected to contribute to the increased usage of herbal extracts in food products and beverages to increase their shelf life without compromising on their quality.

Regional Insights

Asia Pacific region dominated the market with a revenue share of more than 43% in 2022. Factors such as the wide availability of herbal plants, the age-old tradition of people using natural herbs, the therapeutic effect of herbal products, adoption of healthy lifestyle after pandemic, awareness about the harmful effects of synthetic ingredients, use of herbal cosmetics products, government policies, and business sustainability programs are expected to influence the demand for herbal extract in the region.

In Asia Pacific, countries like India and China are projected to lead the herbal extracts market and have emerged as the largest exporters of some of the most precious extracts in the world such as curcumin, ashwagandha, kale, and others. China and Japan historically are among the largest markets of nutraceuticals in the entire region. The market is witnessed healthy growth with increased use in pharmaceutical products and nutraceutical supplements in Japan, China, and other countries.

China is the world’s largest consumer market for food & beverages, making it highly appealing for foreign brands and players in the food & beverages industry. The growing food & beverages industry is expected to significantly impact the herbal extracts industry in China during the forecast period.

India is considered the largest market for herbal extracts; it is one of the key producers of herbs worldwide and holds a dominant position in the global market. India is among the major exporters of herbal extracts for the European and American markets. In addition, the products manufactured in this country are highly preferred over those produced in China owing to the high degree of stability under variable light and heat conditions.

Key Companies & Market Share Insights

The global market is fragmented with the presence of numerous global and regional players. The herbal extract market is very competitive in Asia Pacific countries like India and China. It has a limited number of players in Europe, North America, and the Middle East & Africa.

Most of the players are clustered in India and China as these countries offer easy access to raw materials. Companies engage in expansion activities such as merger and acquisition and develop their product portfolios to expand their footprint across the globe. In addition, they are heavily investing in research & development and technology innovation to enhance their product offering. Some of the key companies in the global herbal extract market include:

-

Botanic Healthcare

-

VIDYA HERBS Pvt. Ltd

-

Allicin Pharm

-

HerbalHills

-

Acara bioherb PVt. LTD.

-

Pioneer Enterprises (I) Private Limited

-

Sydler India Pvt. Ltd

-

Herbal Creations

-

Alpspure Lifesciences Private Limited

-

IDOBIO CO., LTD.

-

Döhler GMB

-

MartinBauer

Global Herbal Extract Market Report Scope

Report Attribute

Details

Market size value in 2023

USD 29.8 billion

Revenue forecast in 2030

USD 53.43 billion

Growth Rate

CAGR of 8.2% from 2023 to 2030

Base year for estimation

2022

Historical data

2018 - 2021

Forecast period

2023 - 2030

Quantitative units

Revenue in USD thousand, Volume in tons and CAGR from 2023 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Type, application, region

Regional scope

North America; Europe; Asia Pacific; Central & South America; Middle East & Africa

Country scope

U.S.; Canada; Mexico; Germany; U.K.; France; Italy; Spain; China; India; Japan; Vietnam; Malaysia; Brazil; Argentina; South Africa; Saudi Arabia

Key companies profiled

Botanic Healthcare; VIDYA HERBS Pvt. Ltd; Allicin Pharm; HerbalHills; Acara bioherb PVt. LTD.; Pioneer Enterprises (I) Private Limited; Sydler India Pvt. Ltd; Herbal Creations; Alpspure Lifesciences Private Limited; IDOBIO CO., LTD.; Döhler GMB; MartinBauer

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Herbal Extract Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis on the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global herbal extract market report on the basis of type, application, and region:

-

Type Outlook (Revenue, USD Thousand; Volume, Tons; 2018 - 2030)

-

Turmeric

-

Rosemary

-

Ginseng

-

Aloe

-

Nutmeg

-

Sage

-

Garlic

-

Cranberry

-

Saw Palmetto

-

Cumin

-

Lecithin

-

Valerian

-

Cherry

-

Pygeum Africanum

-

Beet Root

-

Olive Leaf

-

Holy Basil

-

Elder Berry

-

Horehound

-

Lycium

-

Ginger

-

Orange

-

Cinnamon

-

Green Tea

-

Flax

-

Curcumin

-

Fenugreek Seed

-

Capsaicin

-

Anise

-

Ashwagandha

-

Kale

-

Others

-

-

Application Outlook (Revenue, USD Thousand; Volume, Tons; 2018 - 2030)

-

Personal Care & Cosmetics

-

Food & Beverages

-

Animal Feed

-

Pharmaceuticals

-

Nutraceuticals

-

Others

-

-

Regional Outlook (Revenue, USD Thousand; Volume, Tons; 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

Italy

-

Spain

-

-

Asia Pacific

-

China

-

India

-

Japan

-

Malaysia

-

Vietnam

-

-

Central & South America

-

Brazil

-

Argentina

-

-

Middle East & Africa

-

South Africa

-

Saudi Arabia

-

-

Frequently Asked Questions About This Report

b. The global herbal extract market size was estimated at USD 27.8 billion in 2022 and is expected to reach USD 29.8 billion in 2023.

b. The global herbal extract market is expected to grow at a compound annual growth rate of 8.2% from 2023 to 2030 to reach USD 53.43 billion by 2030.

b. Asia Pacific dominated the herbal extract market with a share 44.45 % in 2022. This is attributable to availability of wide variety of herbal plants and age-old tradition of people using natural herbs.

b. Some key players operating in the herbal extract market include Botanic Healthcare, VIDYA HERBS Pvt. Ltd, Allicin Pharm, HerbalHills, Acara bioherb PVt. LTD., Pioneer Enterprises (I) Private Limited, Sydler India Pvt. Ltd, Herbal Creations, Alpspure Lifesciences Private Limited, IDOBIO CO., LTD., Döhler GMB and MartinBauer.

b. Key factors that are driving the market growth include increasing awareness about the therapeutic properties of herbs along with shifting demand toward skincare products with herbal ingredients.

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![ESOMAR Certified Member]()

![Great Place to Work Certified]()

ESOMAR & Great Work to Place Certified

![ISO 9001:2015 & 27001:2022 Certified]()

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."