- Home

- »

- Medical Devices

- »

-

Hemostasis And Tissue Sealing Agents Market Report, 2030GVR Report cover

![Hemostasis And Tissue Sealing Agents Market Size, Share & Trends Market Report]()

Hemostasis And Tissue Sealing Agents Market Size, Share & Trends Market Analysis By Product (Topical Hemostat, Adhesive & Tissue Sealant), By Region (Europe, APAC, North America), And Segment Forecasts, 2023 - 2030

- Report ID: 978-1-68038-597-7

- Number of Pages: 150

- Format: Electronic (PDF)

- Historical Range: 2018 - 2021

- Industry: Healthcare

Market Size & Trends

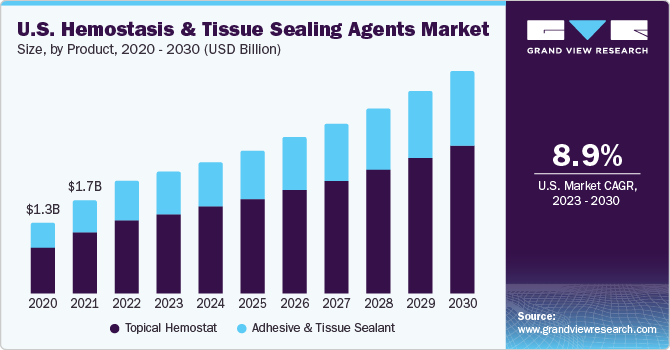

The global hemostasis and tissue sealing agents market size was valued at USD 7.38 billion in 2022 and is anticipated to grow at a CAGR of 8.9% from 2023 to 2030. Hemostats and sealants are medical devices used to cease bleeding and hemorrhage caused by injuries and surgical procedures. The market is anticipated to witness lucrative growth over the next seven years owing to an increase in demand supported by rising surgery volumes. Growth in the geriatric population and the high prevalence of chronic conditions are among the key drivers of the market. As per the Centers for Disease Control and Prevention (CDC) statistics, more than 45% of the American population is affected by at least one chronic condition necessitating specialized care and attention.

Geriatric patients require critical care and are prone to wounds and injuries that take a lot of time to heal. With an increasing demographic tilt toward an active lifestyle, the cases of routine wounds and injuries are on the rise, which is expected to drive market growth. Chronic diseases ultimately lead to surgical procedures being performed on the patient, which, in turn, boosts growth. Urological disorders, Hernia fixation, spinal injuries, diabetes, burns, and ophthalmic injuries and replacements, are a few chronic conditions requiring these products.

The spread of the COVID-19 virus had a significant effect on the market. The coronavirus causes thrombotic bleeding and complications, a major cause of fatality among patients who are infected by the virus. The market grew with the increasing importance of unbalanced hemostasis in COVID-19 patients in favor of a prothrombotic state. The rising instances of hemostatic anomalies in the affected people and their effect on prognosis likewise positively affected the market growth. Critical illness, bleeding, death, and thrombosis among patients affected by COVID-19 were predicted during hospital admission by D-dimer elevation. Therefore, the market witnessed positive growth over and post-COVID-19 period.

In March 2020, the International Society for Thrombosis and Hemostasis launched interim guidelines for managing and recognizing coagulopathy among COVID-19 patients on the basis of the ISTH DIC score. Hemostasis devices and sealants are used to prevent blood loss in various conditions. Preference for these products over other wound closure methods led to their increasing use in multiple conditions, especially in endoscopic procedures. The hemostasis and tissue sealing agents market cater to conditions ranging from mild injuries to burns and neurosurgical management. Since 2006, post a study conducted and published by the National Centre for Biotechnology Information, hemostatic products have found a wide range of applicability in urological treatments.

Minimally invasive surgeries in the field of urology are particularly making use of hemostatic solutions, thereby promoting market growth. The highest demand is witnessed in cardiovascular conditions followed by general surgeries. Higher application in cardiovascular disorders is attributed to better clinical results obtained using sealants and hemostats compared to other wound closure techniques. However, a lack of reimbursements for these products may restrain the growth to a certain extent. The increasing cost of surgical procedures and the high price of surgical products is also expected to challenge the growth to an extent.

With a worldwide rise in the incidence of chronic conditions, the volume of surgical procedures is expected to increase. This is further expected to drive demand for wound healing and closure management. According to the CDC, approximately 150 million Americans are suffering from at least one chronic condition, which leads to the need for surgery. Diabetes as well as neurological, urological, and cardiac diseases are also leading causes of an increase in the volume of surgical procedures. Middle East, Africa, and Asia are witnessing increased incidence of cardiovascular diseases and diabetes. With the growing incidence of chronic diseases, the number of injuries & surgeries are expected to increase, expanding the use of hemostats, adhesives, and tissue sealing agents.

Minimally invasive surgeries in urology are particularly making use of hemostatic agents, thereby promoting market growth. The highest demand for hemostatic and tissue sealing agents is in cardiovascular conditions, followed by general surgeries. The high use of these products in cardiovascular diseases can be attributed to better clinical results as compared to other wound closure techniques. The usage of sealants and hemostats together reduces treatment time, resulting in minimal scarring and quicker recovery. Manufacturing of hemostat and tissue sealing agents falls under regulations of medical device manufacturing Class II and Class III.

These classes require a higher degree of control and monitoring. Class II devices need premarket notification, whereas Class III devices need premarket approval from regulatory bodies. Besides this special compliance, the basic ones include labeling requirements, medical device listing, quality system regulation/good manufacturing practices, and medical device reporting. Adverse reactions and complications worsen a patient’s condition, which is a major market constraint. The most common complications include breathing difficulty (breathlessness), itching, burning & swelling, redness over the area of application, weakness or numbness at the site of application, and headache.

Product Insights

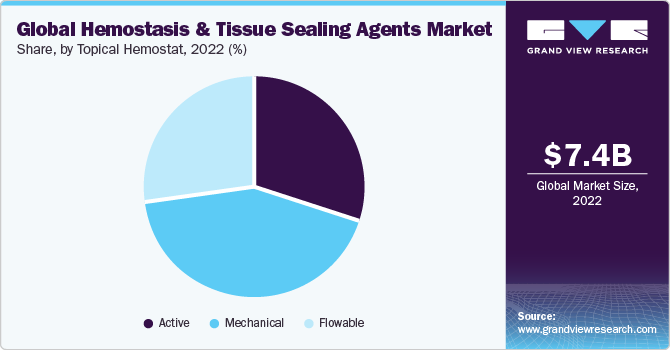

On the basis of product, the hemostasis & tissue sealing agents market is segmented into topical hemostat and adhesive & tissue sealants. The topical hemostat segment accounted for the largest revenue share of 67.2% in 2022. In addition, a segment is expected to grow at the fastest CAGR of 9.2% during the forecast period due to its use with conventional treatment to provide cost-efficiency, quick & easy absorbability of the hemostatic agent, minimal tissue reactivity, and non-antigenicity. Hemostasis involves the completion of coagulation, fibrinolysis, and platelet aggregation pathways by the activation of these factors. The topical hemostat segment is further classified into active, mechanical, and flowable. The flowable segment is anticipated to grow at the fastest CAGR of 10.2% during the forecast period.

The adhesive & tissue sealant segment is expected to grow at a CAGR of 8.1% over the forecast period. Adhesives and tissue sealants are crucial in controlling blood loss during surgical procedures and function by binding with and sealing the damaged tissues. Binding leads to the development of a barrier over injuries and surgical wounds and helps promote coagulation. The factors promoting their demand for sutures are faster procedure rate, minimal invasion, reduced post-surgical infections, and prevention of exudation of other body fluids. These are further sub-segmented on the basis of sealants used in synthetic, natural, and adhesion barrier products. Natural tissue sealant is predicted to grow at the fastest CAGR of 9.2% over the forecast period.

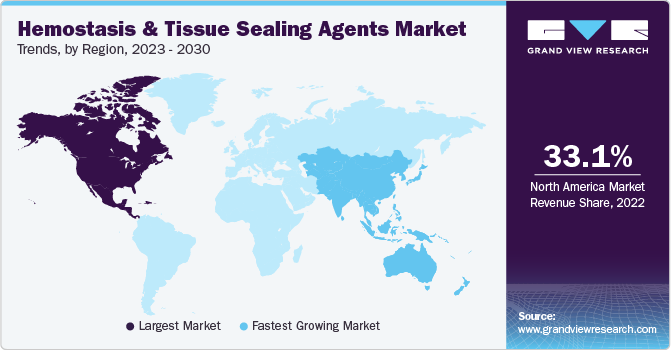

Regional Insights

North America dominated the market and accounted for the largest revenue share of 33.1% in 2022, owing to the growing prevalence of cardiovascular disorders, diabetes, and cancer within the region. Adhesives and sealants account for a large share of the North American regional market. In October 2020, Teleflex Incorporated, a prominent global healthcare supplies and services provider, finalized a definitive agreement to acquire Z-Medica, LLC, a prominent manufacturer of hemostatic products. This strategic acquisition aligns with Teleflex's commitment to invest in innovative solutions that possess the potential to significantly improve clinical efficacy, enhance patient safety and comfort, mitigate complications, and ultimately reduce the overall cost of healthcare.

Europe held the second-largest market share of 28.7% in 2022 and is expected to register the second-fastest CAGR of 9.0% over the forecast period. The launch of advanced and innovative products, such as FLOSEAL, TISEEL, and HEMOPATCH, is expected to propel the demand from European countries. The regional market is expected to be driven by the rising geriatric population, which ultimately leads to a higher number of surgeries. The market in Italy is driven primarily by the increasing demand for more effective and quicker healing post-surgery. An increase in healthcare spending is expected to further boost the market growth in Italy. One of the major factors responsible for market growth in Spain is increasing awareness about the use of hemostatic agents, adhesives, and tissue sealants to avoid the risk of postoperative bleeding.

Various conferences are organized in Spain to spread education and awareness. The major factor responsible for the large share is the aggressive marketing of such devices in the region. Other factors fostering growth are the regular launch of new products, increasing applications of such devices in surgeries and other medical applications, and the demand for sealing agents that minimize postoperative complications and boost the speed of healing. In January 2020, Terumo Corporation introduced AQUABRID, a new surgical sealant, to the EMEA (Europe, Middle East, and Africa) market. AQUABRID is specifically designed for use in aortic procedures, providing a safe and effective solution for achieving hemostasis. This strategic launch of innovative surgical sealant aims to support surgeons in delivering optimal care.

Asia Pacific is expected to grow at the fastest CAGR of 9.1% during the forecast period. This is due to increased medical tourism and surgical procedure volume. Liberal policies coupled with a cost-effective environment are the major drivers of regional growth. China, India, and Japan are the leading countries with the presence of relatively advanced treatments, a large pool of patients, and a more developed healthcare infrastructure. The market in Malaysia, Singapore, and other Asian countries is expanding at a rapid pace with the booming medical tourism industry and improving healthcare services due to government support. The market in India is expected to witness rapid growth over the forecast period. This is due to an increase in healthcare expenditure and the presence of less stringent regulations on the use of such medical devices, lower costs, & availability of labor, which facilitate easy entry of manufacturers in this region.

Key Companies & Market Share Insights

Strategic trends expected to be followed by the players include tie-ups with hospitals and care centers, R&D in the field of formulation development, incorporation of bacteriostatic properties, and aggressive marketing plans for natural adhesives, especially fibrin sealants. Companies are also involved in mergers and acquisitions aimed at ensuring sustainability and expanding regional presence.

In July 2021, Baxter International Inc. announced the acquisition of PerClot Polysaccharide Hemostatic System-related certain assets from CryoLife, Inc. The acquisition is expected to enhance its ability to address a wide range of intraoperative bleeding with the help of both passive & active hemostatic solutions, thereby optimizing patient care. In January 2022, CryoLife, Inc., a leading provider of cardiac and vascular surgical solutions with a primary focus on aortic disease, rebranded as Artivion, Inc. The new name and brand align with the company's commitment to delivering innovative technologies to aortic surgeons. As part of this transition, the company's ticker symbol on the New York Stock Exchange will be changed from "CRY" to "AORT." This strategic move reflects Artivion's dedication to advance in the field of aortic surgery and reinforces its presence in the market. In addition, in May 2023, Artivion announced the FDA premarket application (PMA) approval OF PerClot to use in controlling bleeding in certain laparoscopic and open surgical procedures

In April 2022, Ethicon, (Johnson & Johnson), unveiled the Enseal X1 Straight Jaw Tissue Sealer. This innovative surgical tool offers enhanced sealing capabilities, improved efficiency, and convenient access to targeted tissue during various surgical procedures. In December 2021, BD (Becton, Dickinson, and Company), a renowned medical technology company, completed the acquisition of Tissuemed, a prominent player in the development of self-adhesive surgical sealant films. This strategic acquisition intends to improve BD's comprehensive portfolio of surgical solutions by offering surgeons a more comprehensive range of innovative and integrated products.

Companies, such as Advanced Medical Solutions Group plc, own direct sales force teams in Germany, the U.K., and Russia to effectively market the products in Europe. Companies are now introducing cost-effective hemostasis and tissue sealing agents to expand their customer base and this is anticipated to contribute to the rising demand from emerging countries.

Key Hemostasis And Tissue Sealing Agents Companies:

- Johnson & Johnson

- Artivion, Inc

- Pfizer

- C R Bard

- B Braun

- Covidien

- Advance Medical Solutions Group

- Smith & Nephew

Hemostasis And Tissue Sealing Agents Market Report Scope

Report Attribute

Details

Market size value in 2023

USD 7.99 billion

Revenue forecast in 2030

USD 14.47 billion

Growth Rate

CAGR of 8.9% from 2023 to 2030

Base year for estimation

2022

Historical data

2018 - 2021

Forecast period

2023 - 2030

Quantitative units

Revenue in USD million/billion and CAGR from 2023 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; U.K.; Germany; France; Italy; Spain; Denmark; Sweden; Norway; China; Japan; India; Australia; South Korea; Thailand; Brazil; Mexico; Argentina; Saudi Arabia; South Africa; UAE; Kuwait

Key companies profiled

Johnson & Johnson; Artivion, Inc; Pfizer; C R Bard; B Braun; Covidien; Advance Medical Solutions Group; Smith & Nephew

Customization scope

Free report customization (equivalent up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional & segment scope

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Hemostasis And Tissue Sealing Agents Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global hemostasis and tissue sealing agents market based on product, and region:

-

Product Outlook (Revenue, USD Million, 2018 - 2030)

-

Topical Hemostat

-

Active

-

Mechanical

-

Flowable

-

-

Adhesive & Tissue Sealant

-

Synthetic Tissue Sealant

-

Natural Tissue Sealant

-

Adhesion Barrier Products

-

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

Sweden

-

Norway

-

Denmark

-

-

Asia Pacific

-

China

-

Japan

-

India

-

Australia

-

Thailand

-

South Korea

-

-

Latin America

-

Brazil

-

Mexico

-

Argentina

-

-

Middle East and Africa

-

Saudi Arabia

-

South Africa

-

UAE

-

Kuwait

-

-

Frequently Asked Questions About This Report

b. The global hemostasis and tissue sealing agents market size was estimated at USD 7.38 billion in 2022 and is expected to reach USD 7.99 billion in 2023.

b. The global hemostasis and tissue sealing agents market is expected to grow at a compound annual growth rate of 8.9% from 2023 to 2030 to reach USD 14.47 billion by 2030.

b. North America dominated the hemostasis and tissue sealing agents market with a share of 33.1% in 2022. This is attributable to the rising prevalence of cardiovascular disorders, diabetes, and cancer in the region.

b. Some key players operating in the hemostasis and tissue sealing agents market include CryoLife, C. R. Bard, B. Braun, and Advance Medical Solutions Group

b. Key factors that are driving the hemostasis and tissue sealing agents market growth include growth in geriatric population and prevalence of chronic conditions

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![ESOMAR Certified Member]()

![Great Place to Work Certified]()

ESOMAR & Great Work to Place Certified

![ISO 9001:2015 & 27001:2022 Certified]()

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."

Important: Covid19 pandemic market impact

With Covid-19 infections rising globally, the apprehension regarding a shortage of essential life-saving devices and other essential medical supplies in order to prevent the spread of this pandemic and provide optimum care to the infected also widens. In addition, till a pharmacological treatment is developed, ventilators act as a vital treatment preference for the COVID-19 patients, who may require critical care. Moreover, there is an urgent need for a rapid acceleration in the manufacturing process for a wide range of test-kits (antibody tests, self-administered, and others). The report will account for Covid19 as a key market contributor.