- Home

- »

- Advanced Interior Materials

- »

-

Heat Treating Market Size & Growth Analysis Report, 2030GVR Report cover

![Heat Treating Market Size, Share & Trends Report]()

Heat Treating Market Size, Share & Trends Analysis Report By Material (Steel, Cast Iron), By Process, By Equipment, By Application (Automotive, Aerospace, Metalworking), By Region, And Segment Forecasts, 2023 - 2030

- Report ID: GVR-2-68038-287-7

- Number of Pages: 125

- Format: Electronic (PDF)

- Historical Range: 2018 - 2021

- Industry: Advanced Materials

Heat Treating Market Size & Trends

The global heat treating market size was valued at USD 103.87 billion in 2022 and is expected to grow at a compound annual growth rate (CAGR) of 3.4% from 2023 to 2030. The rapid growth of the electric vehicle industry, coupled with the growing demand for metallurgical alterations to suit specific applications, is expected to boost the market growth over the forecast period. The pandemic is likely to accelerate the adoption of electric vehicles and is likely to become a key factor for major structural changes in this process, which is highly used in the automotive industry. EVs require heat treatment for specialized materials in DC and AC motors, laminations, bearings, and shafts. Heat treatment for EVs requires a flexible heat treating approach and is likely to increase the demand for new equipment over the forecast period.

The COVID-19 pandemic resulted in significant losses for the automotive industry of the U.S. resulting in supply chain and raw material price volatility. Moreover, the pandemic accelerated the growing environmental concerns, which are anticipated to increase the demand for environmentally-friendly heat treatment equipment over the forecast period.

Heat treatment processes that are commonly used to improve the microstructure of these automotive components encompass annealing, isothermal annealing, normalizing, spheroidizing, quenching, tempering, austempering, and case hardening. Growing requirements for lightweight and fuel-efficient automobiles motivated the demand for heat treating to achieve desirable properties of automotive components.

The pandemic is expected to trigger self-sufficiency in manufacturing, primarily in the U.S. and Europe. Increased use of technologies such as IIOT technology and application of data analytics and continuous monitoring of furnaces are expected to augment the industry growth over the forecast period.

The furnaces used in heat treating consume a significant amount of energy to achieve the desired temperature required for heating the metals. The conventional gas-fired and fuel-fired furnaces use fossil oil (FO) and light diesel oil (LDO) as fuel for heat treating. This leads to higher heat losses and thus high environmental impact, which is likely to hamper the industry growth.

Material Insights

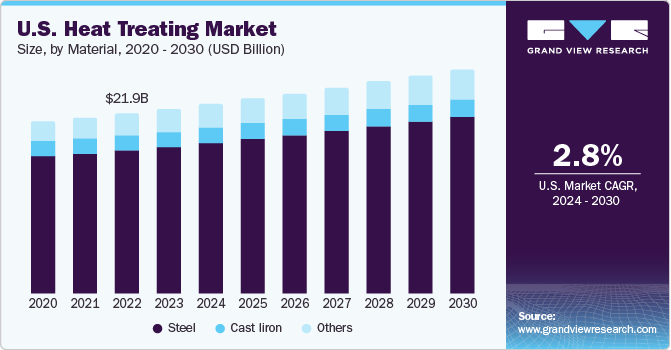

Steel led the market and accounted for over 80.1% share of the global revenue in 2022. Growing demand for heat-treated steel parts in the construction industry, especially in the U.S., China, and India, is expected to propel the demand for heat treating for steel over the forecast period.

Steel is undergone heat treating to obtain certain mechanical properties including strength, wear properties, and surface hardness. Controlled heating and cooling of steel structures improve machining and formability, along with recovering grain size. The aforementioned advantages of heat treating in steel are likely to boost the demand for heat treating for steel.

The cast iron segment is estimated to expand at a CAGR of 3.1% from 2023 to 2030, in terms of revenue. Key factors driving the industry include increasing demand for pipe fittings, electrical fittings, machine parts, and hardware due to several advantages of heat-treated cast iron, which include the prevention of rust and hardening.

The other materials include aluminum, copper, and brass. Growing demand for lightweight aluminum products with high strength due to their ability to bend and superior machinability. Moreover, the manufacturers of aerospace components are focusing on the use of heat-treated alumina as they eliminate the cost of forging.

Process Insights

The case hardening segment led the industry and accounted for over 27.8% share of the global revenue in 2022. The demand for case hardening in automotive is expected to remain in electric vehicles for constant velocity joints (CVJ). Moreover, increasing infrastructural development in railways is expected to positively impact the segment growth.

The annealing heat treating segment is estimated to expand at a CAGR of 4.0% from 2023 to 2030, in terms of revenue. Key factors that are responsible for driving the industry include an increase in demand for various annealing processes such as soft annealing, coarse-graining annealing, and stress relieving in the automotive, semiconductors, and construction industries.

Normalizing is similar to annealing; it involves heating the metal at a temperature much above the critical temperature and then air cooled. This results in uniform carbide distribution of the metal, which improves the fatigue and wear resistance of the metal and the end product. The increase in demand for carbon and low alloyed steels in body panels, tin plates, and wire products is expected to boost the demand for normalizing heat treatment.

Other processes include vacuum heat treatment, thermal processes, and case hardening processes such as nitriding, laser beam hardening, and others. This segment is also expected to grow at a healthy rate on account of the growing use of newer and special processes due to technological advancements and the growing need for greener technologies.

Equipment Insights

Electrically heated furnaces led the industry and accounted for over 46.0% share of the global revenue in 2022. High operational efficiency achieved using an electrically heated furnace and higher environmental sustainability as compared to conventional fuel-fired systems is expected to propel the demand for electrically heated furnaces over the forecast period.

Electrically heated furnaces have easy installation and automated temperature control that improves operational efficiency. Moreover, the implementation of high-end technology ensures temperature uniformity and the ability to perform high-temperature operations. Growing demand for environmentally friendly technology is expected to propel the industry growth of electrically-heated furnaces over the next few years.

Other equipment such as induction furnace and plasma heated furnace is estimated to expand at a CAGR of 3.2% from 2023 to 2030, in terms of revenue. Key factors that are responsible for driving the industry include energy-efficient, easy to clean, fast, and well-controlled melting process.

Low cost as compared to electrically-heated furnaces had led to a high preference for fuel-fired furnaces among the industry players. However, unstable fuel prices and emissions of greenhouse gas have restrained the growth of conventional fuel-fired furnace. The demand for natural gas-fired furnaces from developing economies is likely to boost the segment growth.

Application Insights

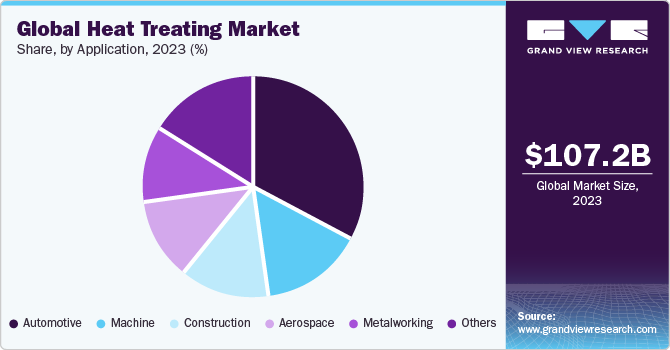

The automotive segment led this industry and accounted for over 33.5% share of the global revenue in 2022 on account of the growing EV industry and the increasing demand for greener technologies, which can deliver energy-efficient heat treating. Moreover, new and advanced equipment required for EVs is expected to propel industry growth.

Various metal workpieces require this process to improve the metallurgical structure and residual stress state. They are subjected to various methods including normalizing, annealing, hardening & tempering, quenching, stress relieving, and cold treating. Localization in manufacturing in countries such as the U.S. and India is further expected to boost the demand for heat treating in metalworking.

The aerospace segment is expected to expand at a lucrative CAGR of 4.4% over the forecast period owing to the increase in demand for this process for several aerospace components such as spacecraft and satellites. Supportive government policies such as the implementation of FDI in the aerospace and defense sectors fueled the entry of foreign manufacturers through public and private partnerships boosting the industry growth.

Construction is one of the key applications where steel structures used in construction such as beams, columns, and grills routinely undergo this process. Increasing government expenditure on key infrastructure projects in Asia Pacific is expected to drive the construction application segment over the forecast period.

Regional Insights

Asia Pacific led the industry and accounted for over 39.4% share of the global revenue in 2022. Resilience and the positive economic outlook post-COVID-19 pandemic leading to a rise in manufacturing output and growing end-use industries such as aerospace and construction are expected to augment the demand in the region.

Central and South America is estimated to expand at a CAGR of 3.8% over the forecast period. Opening up of growth opportunities in the region, particularly in the mining and automobile industries, and the entry of established heat treating companies in the region are expected to boost the industry growth over the forecast period.

Stringent government regulations around the use of green technologies have been a major factor behind the increase in demand for environmentally-friendly heat treatment technologies in Europe. Moreover, growing construction and automotive industries in Germany and the U.K. are expected to augment the demand for heat treating in the region.

The aerospace industry in the U.S. is expected to accelerate its process of innovation to mitigate the losses caused due to the pandemic, thereby positively affecting the market. Moreover, an increase in localized manufacturing to secure future supply chain disruptions is likely to boost the market growth in the U.S.

Key Companies & Market Share Insights

COVID-19 has prompted market participants to take steps to secure their future. Implementing automation to ensure uniformity in their operations and boost production and efficiency is one of them. Furthermore, increasing demand for customizations is expected to transform the conventional processes.

Companies operating in the market are focusing on using sustainable technologies to reduce environmental impact. They are focusing to reduce energy consumption and pollutant emission. This has led to a significant change in the heating process and is expected to positively impact the industry growth over the forecast period. Some prominent players in the global heat treating market include:

-

Bluewater Thermal Solutions LLC

-

American Metal Treating Inc.

-

East-Lind Heat Treat Inc.

-

General Metal Heat Treating, Inc.

-

Shanghai Heat Treatment Co. Ltd.

-

Pacific Metallurgical, Inc.

-

Nabertherm GmbH

-

Unitherm Engineers Limited

-

SECO/WARWICK Allied Pvt. Ltd.

-

Triad Engineers

Heat Treating Market Report Scope

Report Attribute

Details

Market size value in 2023

USD 107.18 billion

Revenue forecast in 2030

USD 136.25 billion

Growth rate

CAGR of 3.4% from 2023 to 2030

Base year for estimation

2022

Historical data

2018 - 2021

Forecast period

2023 - 2030

Quantitative units

Revenue in USD billion and CAGR from 2023 to 2030

Report coverage

Revenue forecast, company market position analysis, competitive landscape, growth factors, and trends

Segments covered

Material, process, equipment, application, region

Regional scope

North America; Europe; Asia Pacific; Central & South America; Middle East & Africa

Country Scope

U.S.; Canada; Mexico; Germany; France; U.K.; Italy; Spain; China; Japan; India; South Korea; Brazil; Argentina; UAE; Saudi Arabia

Key companies profiled

Bluewater Thermal Solutions LLC; American Metal Treating Inc.; East-Lind Heat Treat Inc.; General Metal Heat Treating, Inc.; Shanghai Heat Treatment Co. Ltd.; Pacific Metallurgical, Inc.; Nabertherm GmbH; Unitherm Engineers Limited; SECO/WARWICK Allied Pvt. Ltd.; Triad Engineers

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Heat Treating Market Report Segmentation

This report forecasts revenue growth at global, regional & country levels and provides an analysis of the industry trends in each of the sub-segments from 2018 to 2030. For the purpose of this study, Grand View Research has segmented the global heat treating market report on the basis of material, process, equipment, application, and region:

-

Material Outlook (Revenue, USD Million, 2018 - 2030)

-

Steel

-

Cast Iron

-

Others

-

-

Process Outlook (Revenue, USD Million, 2018 - 2030)

-

Hardening & Tempering

-

Case Hardening

-

Annealing

-

Normalizing

-

Others

-

-

Equipment Outlook (Revenue, USD Million, 2018 - 2030)

-

Fuel-fired Furnace

-

Electrically Heated Furnace

-

Others

-

-

Application Outlook (Revenue, USD Million, 2018 - 2030)

-

Automotive

-

Aerospace

-

Metalworking

-

Machine

-

Construction

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

France

-

Italy

-

Spain

-

UK

-

-

Asia Pacific

-

China

-

India

-

Japan

-

South Korea

-

-

Central & South America

-

Brazil

-

Argentina

-

-

Middle East & Africa

-

UAE

-

Saudi Arabia

-

-

Frequently Asked Questions About This Report

b. The global heat treating market size was estimated at USD 103.87 Billion in 2022 and is expected to reach USD 107.18 Billion in 2023.

b. The heat treating market, in terms of revenue, is expected to grow at a compound annual growth rate of 3.4% from 2023 to 2030 to reach USD 136.25 Billion by 2030

b. Asia Pacific dominated the heat treating market with a revenue share of 39.4% in 2022, on account of several factors including surge in metalworking activities and growing construction industry in China and India

b. Some of the key players operating in the heat treating market include Bluewater Thermal Solutions LLC, American Metal Treating Inc., East-Lind Heat Treat Inc., General Metal Heat Treating, Inc., Shanghai Heat Treatment Co. Ltd., Pacific Metallurgical, Inc.

b. The key factors that are driving the heat treating market include growing automotive industry and demand for heat-processed metals & alloys in industrial activities and construction industry

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![ESOMAR Certified Member]()

![Great Place to Work Certified]()

ESOMAR & Great Work to Place Certified

![ISO 9001:2015 & 27001:2022 Certified]()

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."

Important: Covid19 pandemic market impact

The global construction industry, once thriving with increased investments, has been severely affected by the suspension of the construction activities in the wake of the ongoing pandemic. Shortage of labors coupled with potential supply chain bottlenecks of materials and equipment is expected to cause project delays in the ongoing funded projects and may lead to reduced spending in the upcoming projects. Uncertainty around the actual duration of the prevailing lockdown makes it hard to anticipate how a recovery in the construction industry will unfold. On similar lines, the HVAC industry has been adversely affected by the COVID-19 outbreak due to the shutting down of several component manufacturing facilities across China, European countries, Japan, and the U.S. This has consequently led to a significant slowdown in the production of HVAC equipment. Lockdowns imposed by the governments in the wake of the COVID-19 outbreak has not only affected manufacturing but also pegged back the consumer demand for HVAC equipment. The report will account for COVID-19 as a key market contributor.