- Home

- »

- Advanced Interior Materials

- »

-

Heat Pump Market Size, Share, Trends, Growth Report, 2030GVR Report cover

![Heat Pump Market Size, Share & Trends Report]()

Heat Pump Market Size, Share & Trends Analysis Report By Technology (Air Source, Water Source), By Capacity, By Operation Type, By Application (Residential, Industrial), By Region, And Segment Forecasts, 2023 - 2030

- Report ID: GVR-3-68038-589-2

- Number of Pages: 152

- Format: Electronic (PDF)

- Historical Range: 2017 - 2021

- Industry: Advanced Materials

Heat Pump Market Size & Trends

The global heat pump market size was estimated at USD 81.58 billion in 2022 and is expected to grow at a compounded annual growth rate (CAGR) of 9.3% from 2023 to 2030. Favorable government policies for energy-efficient solutions and lowering carbon footprint are anticipated to boost market growth over the forecast period. Many governments are providing subsidies or incentives and tax credits & rebates for the installation of heat pumps are expected to further fuel the demand for energy-efficient heat pumps, thereby, benefitting the growth.

According to the U.S. Department of Energy, a 30% tax credit can be claimed for buying a property in the U.S. that has qualified health pumps installed in connection with an existing or new dwelling unit. In addition, Italy's Conto Termico incentive scheme provides grants that cover 30-35% of the costs of installing renewable heating systems in buildings. Australia also provides national grants to municipals for heat pump installation. Moreover, the heat pump industry is significantly affected by the availability of raw materials, such as metals like iron & steel, adhesives, rubber, chemicals, and plastics. Thus, fluctuations in raw material prices have a direct impact on manufacturing costs, which can limit market growth to some extent.

The temperature of the soil in most areas of the U.S. is warmer than the air during winters and cooler in summers. Ground source heat pumps use the ground's constant temperature to cool and heat buildings. According to the Environmental Protection Agency (EPA), GHPs are the most cost-effective, environmentally clean, and energy-efficient systems for cooling and heating buildings, including homes, offices, schools, and hospitals, owing to which the demand for heat pumps is expected to increase in the U.S. over the forecast period.

The U.S. government has provided personal tax credits and direct incentives on product installation, which encourage the installation of heat pumps. Improving energy efficiency across various industries is one of the major objectives of governments across the world. The rising need for renewable energy sources, along with extensive government support in the form of subsidies, incentives, and other monetary benefits, is projected to fuel the market growth over the forecast period.

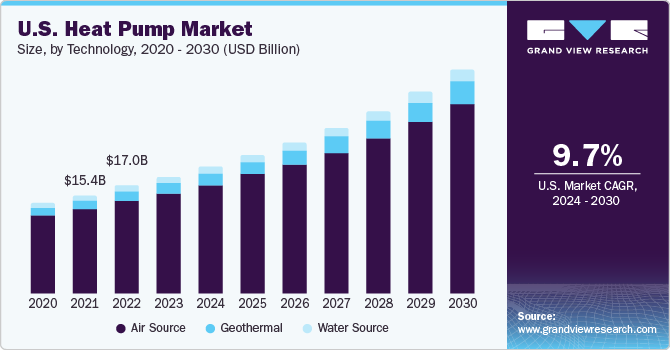

Air Source technology is expected to dominate the market in the U.S. over the forecast period due to the rising awareness about the adverse effects of greenhouse gas emissions. Furthermore, the increasing population along with the increasing need for eco-friendly air conditioning in the housing sector is expected to drive the demand for air-source technology in the U.S.

Fast-paced industrialization along with the growing population has resulted in massive energy consumption across the world. According to EIA’s U.S. residential energy consumption survey, heating, cooling, & ventilation accounted for half of the total home energy consumption. In 2021, based on total fuel consumption, natural gas accounts for 44%, and fuel oil & propane account for 9%. Furthermore, electricity was the most consumed energy source across the U.S. with households accounting for 47%. Thus, increasing demand for energy-efficient solutions and growing carbon footprints across the globe are expected to drive the market’s growth over the forecast period.

Technology Insights

The air source technology segment dominated the heat pump market in 2022 by accounting for a share of over 84.8% of the revenue share. Air source heat pump works through wet central heating systems to heat radiators and provides hot water. Air source pumps work similar to a refrigerator and these pumps absorb heat and transfer it to other mediums.

The majority of air-source heat pump integrations involve air-to-air heat pumps, which warm or cool the air. Furthermore, its ability to provide water-heating solutions along with heating and cooling of space is expected to boost the demand for air source technology over the forecast years. For instance, in February 2023, LG introduced an air source heat pump (ASHP) capable of heating 200-270 liters of residential water. The pump has a coefficient of performance (COP) of up to 3.85 and uses R134a as a refrigerant.

The water source technology segment is expected to witness a CAGR of 8.7% over the forecast period. It is most suitable for those who live near to well, lake, river, or other natural water sources. Water source heat pumps provide very high efficiency with a coefficient of performance (COP) of around 5, which means for every unit of electricity it delivers 5 units of heat.

Geothermal heat pumps offer high efficiency than air source heat pumps owing to the advantage of stable temperature of their geothermal subsoil heat source. It is one of the most sustainable and cost-effective solutions available in the market. The growing importance of GSHP in the global market owing to its high energy efficiency is expected to drive the market growth over the forecast period.

Capacity Insights

The heat pump segment with up to 10 kW capacity accounted for a market share of 14.7% in terms of revenue in 2022. The segment growth is attributed to the capacity type being suitable for a wide range of uses such as commercial uses including hotels, swimming pools, factories, restaurants, and schools.

The majority of heat pumps with 10-20 kW capacity provide quiet operation, are environment-friendly, offer high efficiency, and have a wide range of hydraulic options, and communication protocols. For instance, ThermoWise, a heat pump with a 10-20 kW capacity introduced its new product DKRS-200SN4-M2. This particular product is capable of maintaining its temperature at a high 65 degrees Celsius and it widely caters to schools, prisons, and hotels, among others where higher demand for hot water is required.

Operation Type Insights

The electric operation type segment accounted for a revenue share of 83.4% in 2022. The electric heat pump utilizes electricity to transfer heat from a cool space to a warm space. These heat pumps are not only used for heating but also used for cooling during the summer seasons. Owing to the benefits of electric heat pumps such as better air quality, energy efficiency, quiet operation, safer than gas pumps, and others the segment demand is expected to showcase lucrative growth.

Hybrid heat pumps guarantee long-term savings by reducing the end-users’ monthly energy expenditure. By adopting hybrid heat pumps end-users can also benefit from a tax credit or rebate thereby driving this segment’s growth. Moreover, utilizing a hybrid heat pump reduces the carbon footprint as these heat pumps can switch between a gas furnace and a heat pump.

Application Insights

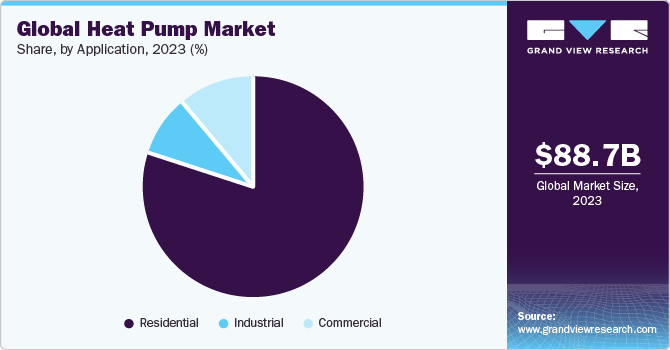

The residential application segment dominated the heat pump market in 2022 by accounting for a share of over 79.9% in terms of revenue share. Rapid urbanization coupled with increasing demand for energy-efficient products is expected to drive the demand for heat pumps in the residential sector. Favorable government initiatives and tax rebates offered on the energy-saving product's installation are also expected to propel the demand for heat pumps over the coming years.

The industrial application segment is expected to witness a CAGR of 9.0% over the forecast period. Increasing demand for waste heat recovery heat pumps is projected to drive the demand over the coming years. Heat pumps are used in multiple industrial processes including dehumidification, evaporation processes, distillation, and water heating or cooling applications. Food & beverage, chemical, and petroleum are the major end-use sectors of heat pumps that are expected to drive the market growth.

A growing focus on energy efficiency coupled with increasing efforts by commercial stakeholders to combat global warming is anticipated to boost the demand for heat pumps over the forecast period. Increasing demand for heat pumps on account of various factors, including lower electrical power requirements, low lifecycle costs, eco-friendly aspects, and tax credit incentives, is expected to drive market growth.

Heat pump products are used in commercial facilities like office buildings, hotels, schools, houses of worship, and historic buildings since their variable refrigerant flow heat pump systems enable them to offer cooling zones and heating to other zones simultaneously in a facility. These products also can help achieve carbon neutrality along with providing improved comfort and efficiency.

Regional Insights

Asia Pacific led the market and accounted for 53.1% of the global revenue share in 2022. The Asia Pacific is characterized by the availability of large skilled labor at low cost. The rising trend of shifting production bases to emerging economies, mainly China and India, is expected to positively influence the market growth over the forecast period. Energy-saving solutions are expected to gain high prominence in countries such as China, Japan, Indonesia, and India.

North America, led by the U.S. and Canada, accounted for a significant share of the global heat pump market in 2022. Government initiatives and rebates offered to promote the incorporation of energy-saving technologies and environment-friendly are projected to augment the demand for advanced heat pumps. Furthermore, increasing carbon emissions and fluctuating energy prices have encouraged consumers to use renewable heating sources, which are expected to boost the growth of the regional market.

According to a report published by European Commission in 2020, in Europe, the economic potential of geothermal power comprising enhanced geothermal systems is estimated to be 19 GWe in 2020, 22 GWe in 2030, and 522 GWe in 2050, respectively. Geothermal energy has numerous applications including district heating, agriculture, and industrial processes. With two million systems installed, ground source heat pumps are the most widely adopted technologies for geothermal energy use in the EU, half of which are found in Sweden and Germany, which is expected to drive the growth of the Europe heat pump market in the coming years.

The construction sector of the Middle East & Africa is projected to witness significant growth in the coming years owing to the strong support of the local governments for infrastructure development. In addition, the region is witnessing new developments in the form of sports facilities, hotels, and restaurants. As the construction industry in the Middle East & Africa is growing, the demand for sustainable cooling solutions such as heat pumps is expected to increase in the region. This is anticipated to contribute to the growth of the Middle East & Africa heat pump industry in the coming years.

Key Companies & Market Share Insights

The manufacturers adopt several strategies, including acquisitions geographical expansions, new joint ventures, product developments, and mergers to enhance market penetration and cater to the changing technological requirements of various applications such as residential, commercial, and industrial.

For instance, in January 2023, Johnson Controls acquired Hybrid Energy AS. Hybrid Energy's innovative technology will provide customers with fresh, cost-effective solutions while tackling decarbonization and sustainability efforts in Europe and beyond. Some prominent players in the global heat pump market include:

-

Carrier

-

Daikin Industries, Ltd

-

Robert Bosch GmbH

-

Lennox International

-

Johnson Controls, Inc.

-

Midea Group

-

Hitachi, Ltd.

-

Ingersoll Rand Plc.

-

Rheem Manufacturing Company

-

HAIER(GENERAL ELECTRIC)

-

Panasonic Holdings Corporation

-

Danfoss

-

Fujitsu

-

LG Electronics, Inc.

-

Samsung

Heat Pump Market Report Scope

Report Attribute

Details

Market size value in 2023

USD 88.75 billion

Revenue forecast in 2030

USD 166.65 billion

Growth rate

CAGR of 9.3% from 2023 to 2030

Base year for estimation

2022

Historical data

2018 - 2021

Forecast period

2023 - 2030

Report updated

May 2023

Quantitative units

Revenue in USD billion and CAGR from 2023 to 2030

Report coverage

Revenue forecast, company market position analysis, competitive landscape, growth factors, and trends

Segments covered

Technology, capacity, operation type, application, region

Regional scope

North America; Europe; Asia Pacific; Central & South America; Middle East & Africa

Country Scope

U.S.; Canada; Mexico; Germany; France; Italy; Sweden; Norway; Finland; Spain; China; India; Japan; Australia; South Korea; Brazil; Argentina; Saudi Arabia; UAE

Key companies profiled

Carrier; Daikin Industries, Ltd.; Robert Bosch GmbH; Lennox International; Johnson Controls, Inc.; Midea Group; Hitachi, Ltd.; Ingersoll Rand Plc.; Rheem Manufacturing Company

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Heat Pump Market Report Segmentation

This report forecasts revenue growth at global, regional & country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global heat pump market report based on technology, capacity, operation type, application, and region:

-

Technology Outlook (Revenue, USD Billion, 2018 - 2030)

-

Air Source

-

Air to Air

-

Air to Water

-

-

Water Source

-

Geothermal

-

-

Capacity Outlook (Revenue, USD Billion, 2018 - 2030)

-

Up to 10 kW

-

10-20 kW

-

20-50 kW

-

50-100 kW

-

100-200 kW

-

Above 200 kW

-

-

Operation Type Outlook (Revenue, USD Billion, 2018 - 2030)

-

Electric

-

Hybrid

-

-

Application Outlook (Revenue, USD Billion, 2018 - 2030)

-

Residential

-

Industrial

-

Commercial

-

-

Region Outlook (Revenue, USD Billion, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

France

-

Italy

-

Sweden

-

Norway

-

Spain

-

Finland

-

-

Asia Pacific

-

China

-

Japan

-

Australia

-

India

-

South Korea

-

-

Central & South America

-

Brazil

-

Argentina

-

-

Middle East & Africa

-

UAE

-

Saudi Arabia

-

-

Frequently Asked Questions About This Report

b. The global heat pump market size was estimated at USD 81.58 billion in 2022 and is expected to be USD 88.75 billion in 2023.

b. The heat pump market, in terms of revenue, is expected to grow at a compound annual growth rate of 9.3% from 2023 to 2030 to reach USD 166.65 billion by 2030.

b. Asia Pacific dominated the heat pump market and accounted for 53.1% in 2022. The The region is characterized by the availability of large skilled labor at low cost. The rising trend of shifting production bases to emerging economies, mainly China and India, is expected to positively influence the growth of heat pump market over the forecast period. Energy-saving solutions are expected to gain high prominence in countries such as China, Japan, Indonesia, and India.

b. Some of the key players operating in the heat pump market include Carrier, Daikin Industries, Ltd, Robert Bosch GmbH, Lennox International, Johnson Controls, Inc., Midea Group, Hitachi, Ltd., Ingersoll Rand Plc., among others.

b. The market for heat pump is primarily being driven by favorable government policies for energy efficient solution & to lowering carbon footprint expected to boost heat pump market over the forecast period. In addition, consumer-driven demand for energy-efficient heat pumps to reduce energy consumption and lower operating expenses are expected to benefit the overall heat pump market over the forecast period.

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![ESOMAR Certified Member]()

![Great Place to Work Certified]()

ESOMAR & Great Work to Place Certified

![ISO 9001:2015 & 27001:2022 Certified]()

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."

Important: Covid19 pandemic market impact

The global construction industry, once thriving with increased investments, has been severely affected by the suspension of the construction activities in the wake of the ongoing pandemic. Shortage of labors coupled with potential supply chain bottlenecks of materials and equipment is expected to cause project delays in the ongoing funded projects and may lead to reduced spending in the upcoming projects. Uncertainty around the actual duration of the prevailing lockdown makes it hard to anticipate how a recovery in the construction industry will unfold. On similar lines, the HVAC industry has been adversely affected by the COVID-19 outbreak due to the shutting down of several component manufacturing facilities across China, European countries, Japan, and the U.S. This has consequently led to a significant slowdown in the production of HVAC equipment. Lockdowns imposed by the governments in the wake of the Covid-19 outbreak has not only affected manufacturing but also pegged back the consumer demand for HVAC equipment. The report will account for Covid19 as a key market contributor.