- Home

- »

- Advanced Interior Materials

- »

-

Heat Meter Market Size, Share, Growth, Trends Report, 2030GVR Report cover

![Heat Meter Market Size, Share & Trends Report]()

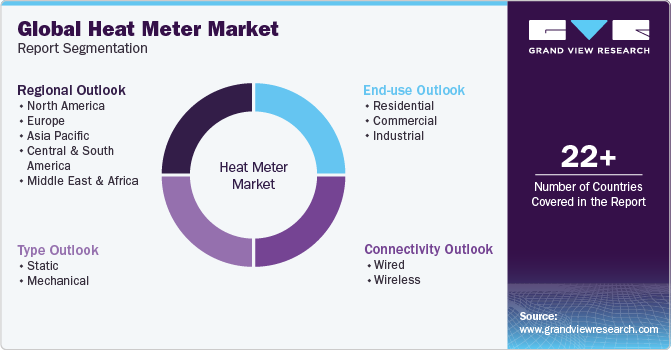

Heat Meter Market Size, Share & Trends Analysis Report By Type (Static, Mechanical), By Connectivity (Wired, Wireless), By End-use (Residential, Commercial), By Region, And Segment Forecasts, 2023 - 2030

- Report ID: GVR-4-68040-143-7

- Number of Pages: 169

- Format: Electronic (PDF)

- Historical Range: 2018 - 2021

- Industry: Advanced Materials

Heat Meter Market Size & Trends

The global heat meter market size was estimated at USD 1,370.0 million in 2022 and is expected to expand at a compound annual growth rate (CAGR) of 6.8% from 2023 to 2030. The market is driven by the rising demand for energy-efficient solutions, along with government regulations encouraging energy conservation, an increasing focus on sustainable practices, and the growing adoption of district heating systems. Moreover, advancements in technology, including smart metering and IoT integration, contribute to market growth by providing more efficient and accurate heat consumption measurements. A highly crucial aspect in any organization today is its effective energy management. Heat meters from Kamstrup and Sontex aid companies in precisely measuring and controlling their energy usage.

An extensive selection of heat meters has made them ideal for use in industrial, commercial, and household settings. Heat meters additionally provide precise data for billing and optimization, and are adaptable enough to accommodate any future changes. For instance, Kamstrup's ultrasonic heat meters offer dependable accuracy. The growing focus on energy efficiency and sustainability in the U.S., driven by consumer awareness and government regulations, encourages the adoption of heat meters as part of broader energy management strategies. Also, the development of district heating projects, especially in urban areas, supports the demand for heat meters.

These projects often aim to enhance energy efficiency by centralizing heating services and require accurate measurement of heat consumption. The trend toward smart buildings and smart city initiatives in the U.S. promotes the adoption of advanced metering systems, including smart heat meters, to enable remote monitoring, data analytics, and efficient energy management. Furthermore, incentive programs or subsidies provided by federal or state governments to promote energy conservation and the use of clean energy solutions drive the adoption of heat meters. The demand for heat meters is influenced by arise in corporate knowledge about the advantages of tracking and regulating heat usage in commercial and industrial settings.

Moreover, grid complexity has increased due to high electrical demand, new rules, and sustainable energy sources. A range of added advantages, such as energy theft identification, lower business losses, and better revenue management, are provided by smart heat meters. Customers using smart meters can monitor their energy use and thus reduce waste. The stated factors are expected to fuel market growth during the projection period. For instance, an International Energy Agency study states that the Americas region saw an increase in its energy consumption for the second consecutive year in 2022, up by 2.3%, though substantially lower than the growth in 2021.

In addition, power consumption in the U.S. increased by 2.6% in 2022; however, it is anticipated that the demand will first decrease by 0.6% in 2023 before rising to an average of 1.2% in 2024 and 2025. Thus, it is anticipated that throughout the projected period, rising power demand in the U.S. will fuel the market growth. As more energy is consumed, there is a growing need to accurately measure and manage heat usage in various applications, such as heating systems in residential and commercial buildings. Heat meters play a crucial role in promoting energy efficiency and sustainability by providing precise measurements, aiding in better energy management, and encouraging responsible consumption practices.

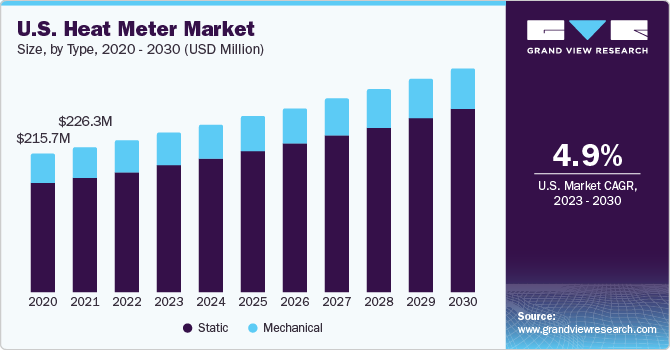

Type Insights

The static segment led the market with a revenue share in 2022. A static heat meter is a device for measuring the thermal energy exchanged in a heating or cooling system without any moving parts. It generally consists of sensors such as temperature sensors, and a flow sensor to measure the temperature difference and flow rate of the heating or cooling medium. These measurements are then used for calculating the amount of transferred thermal energy. Static heat meters are known for their reliability, accuracy, and low maintenance requirements, making them suitable in several applications where precise heat measurement is vital, such as in district heating systems or individual building heating systems. These factors are expected to drive market growth over the forecast period.

A mechanical heat meter is designed to measure the thermal energy exchanged in a heating or cooling system that uses mechanical components. Unlike static heat meters, mechanical heat meters generally involve moving parts. They often incorporate a mechanical flow sensor, which measures the flow rate of the heating or cooling medium, along with a mechanical temperature sensor to assess the temperature difference. The movement of these components is then translated into thermal energy exchange measurements. While mechanical heat meters have been extensively used, static heat meters are gaining popularity due to their advantages with regards to accuracy, reliability, and lower maintenance needs.

Static and mechanical heat meters are utilized in various settings where the precise measurement of thermal energy exchange is critical. Static heat meters are deployed to measure heat consumption in large-scale district heating networks serving several buildings, while mechanical heat meters are generally used in older heating systems for residential and commercial buildings. They are also used in various industrial settings where precise thermal energy measurement is essential for manufacturing processes. Furthermore, the choice between static and mechanical heat meters often depends on factors like accuracy requirements, maintenance considerations, and the specific needs of the application. While static heat meters are gaining popularity for their accuracy and reliability, mechanical heat meters are still utilized in certain contexts.

Connectivity Insights

Wired heat meters are often integrated into building automation systems, enabling centralized monitoring and control of heating or cooling energy consumption. In commercial or industrial settings, wired heat meters can be part of broader energy management systems, offering real-time data for optimal energy usage. Additionally, wired connections allow for the remote monitoring of heat meters, leading to efficient management and troubleshooting without the need for physical access to the meters. A wired heat meter refers to a heat metering system that uses physical wires or cables to transmit data and information.

In the context of heat meters, this usually involves the transfer of measurements and readings from the meter to a central monitoring or control system. The wired connection can be established using different technologies, such as M-Bus, Modbus, or other communication protocols. While wired heat meters offer stability and reliability in data transmission, they may be more complex to install compared to wireless alternatives. However, the choice between wired and wireless heat meters depends on various factors, such as the layout of the building or system, the specific application, and the desired level of connectivity & control.

A wireless heat meter refers to a heat metering system that utilizes wireless communication technologies to transmit data and information. Instead of physical cables or wires, wireless heat meters use methods like radio frequency (RF), Zigbee, Wi-Fi, or other wireless protocols for transmitting measurements and readings to a central monitoring or control system. These aforementioned factors are expected to propel market growth over the forecast period.

For instance, in residential settings, wireless heat meters can be used to monitor and manage energy usage for heating or cooling systems in a convenient and flexible manner. Moreover, wireless heat meters offer increased flexibility and ease of installation compared to their wired counterparts, considerations include the reliability of the wireless signal, potential interference, and the power requirements for wireless devices. These factors are anticipated to propel the product demand over the forecast period.

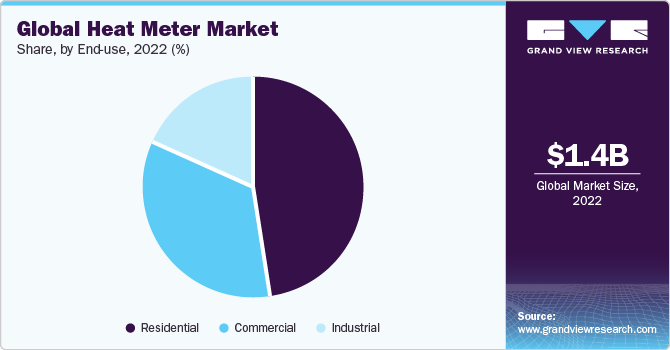

End-use Insights

The residential application segment held the leading revenue share of 46.0% in 2022. A heat meter used in residential settings measures the amount of heat energy consumed. It is generally used in conjunction with heating systems to monitor and bill for the energy used. Moreover, building managers and residents can monitor and optimize heating systems for efficiency. Heat meters aid in the optimization of HVAC systems by providing data on energy consumption. This helps in making informed decisions to improve energy efficiency. In the commercial segment, heat meters play an important role to manage and monitor energy consumption for heating purposes.

Many commercial buildings are subjected to regulations involving energy efficiency and environment sustainability. Heat meters help in ensuring compliance with these regulations by offering accurate data. In industrial applications, heat meters play a major role in monitoring and managing energy consumption for different processes. Heat meters are used to monitor and control fluid temperature in industrial processes, ensuring that the desired levels are maintained for optimal efficiency. Moreover, industrial facilities often have complex heating systems.

Heat meters provide valuable data for energy management, helping industries optimize energy usage and reduce operational costs. Industries often implement heat recovery systems to capture and reuse excess heat generated during processes. Heat meters quantify the amount of recovered heat, contributing to overall energy efficiency. In certain manufacturing processes, maintaining precise temperatures is critical for ensuring product quality. Heat meters aid in monitoring and controlling temperature variables to meet quality standards. These factors are anticipated to drive the product demand in the coming years.

Regional Insights

North America held the leading revenue share of 22.0% in 2022. The product demand in the region is driven by energy efficiency initiatives, renewable energy integration, environmental regulations, and other factors. There is an increasing emphasis on energy efficiency, with heat meters performing a crucial role in optimizing energy consumption in heating systems. Furthermore, the rising focus on environmental sustainability and the need to reduce carbon emissions has led to the adoption of technologies such as heat meters to improve energy management. As the integration of renewable energy sources has risen, accurate measurement of heat has become essential, driving the demand for advanced heat metering technologies.

The European market is driven by the increasing awareness about energy efficiency and the implementation of regulations promoting energy conservation. Countries have been adopting heat metering systems to improve energy management and billing accuracy in heating systems. Also, government initiatives for reducing carbon emissions, promoting district heating systems, and encouraging the usage of renewable energy sources support market growth. The market growth in the Asia Pacific region is being driven by a combination of factors. Rapid industrialization and urbanization in key regional economies are driving the need for efficient energy management, making heat meters a necessity for precise measurement and billing in heating systems.

The increasing adoption of district heating and cooling solutions in urban areas, coupled with a growing awareness about environmental impact, fosters the deployment of heat meters. Moreover, as the region embraces renewable energy sources, the integration of accurate heat measurement becomes integral, positioning heat meters as crucial components in the pursuit of energy efficiency and environmental sustainability across diverse sectors. The demand in the Middle East & Africa is being driven by several key factors.

The UAE, particularly Dubai and Abu Dhabi, is experiencing rapid urbanization and infrastructural development, leading to a significant rise in the construction of residential and commercial buildings. With a focus on sustainable development and energy efficiency, the Middle East & Africa government has implemented regulations and initiatives promoting the use of advanced technologies, including heat meters, to monitor and optimize energy consumption in heating systems. The region’s commitment to diversifying its energy mix by incorporating renewable energy sources further underscores the importance of precise heat measurement.

Key Companies & Market Share Insights

Key manufacturers use a variety of tactics to increase their market penetration and adjust to changing technical demands, such as global expansions, product launches, and mergers & acquisitions. For instance, in April 2022, Kamstrup and Thvilum A/S, entered into an arrangement. With Thvilum A/S being under its ownership, Kamstrup will have even more options to support Danish utilities. In addition, it will lay the groundwork for the utilities to provide services and solutions that will improve their ability to base decisions on facts and knowledge, a crucial element for taking advantage of digital opportunities.

Key Heat Meter Companies:

- Sycous Limited

- Zenner International GmbH & Co. KG

- Kamstrup

- Danfoss

- Apator S.A.

- BMETERS Srl

- ITRON

- Diehl Stiftung & Co. KG

- Siemens AG

- Trend Control Systems Ltd.

- Premier Control Technologies Ltd.

- Cosmic Technologies

- Grundfos

- Spire Metering Technology

- Omni Instruments

Heat Meter Market Report Scope

Report Attribute

Details

Market size value in 2023

USD 1,450.9 million

Revenue forecast in 2030

USD 2,320.3 million

Growth rate

CAGR of 6.8 from 2023 to 2030

Base year for estimation

2022

Historical data

2018 - 2021

Forecast period

2023 - 2030

Quantitative units

Revenue in USD million and CAGR from 2023 to 2030

Report coverage

Revenue forecast, company market position analysis, competitive landscape, growth factors, and trends

Segments covered

Type, connectivity, end-use, and region

Regional scope

North America; Europe; Asia Pacific; Middle East & Africa; Central & South America

Country Scope

U.S.; Canada; Mexico; Germany; France; Italy; UK; Spain; China; India; Japan; South Korea; Australia; Brazil; Argentina; Saudi Arabia; South Africa

Key companies profiled

Sycous Ltd.; Zenner International GmbH & Co. KG; Kamstrup; Danfoss; Apator S.A.; BMETERS Srl; ITRON; Diehl Stiftung & Co. KG; Siemens AG; Trend Control Systems Ltd.; Premier Control Technologies Ltd.; Cosmic Technologies; Grundfos; Spire Metering Technology; Omni Instruments

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Heat Meter Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global heat meter market report on the basis of type, connectivity, end-use, and region:

-

Type Outlook (Revenue, USD Million, 2018 - 2030)

-

Static

-

Mechanical

-

-

Connectivity Outlook (Revenue, USD Million, 2018 - 2030)

-

Wired

-

Wireless

-

-

End-use Outlook (Revenue, USD Million, 2018 - 2030)

-

Residential

-

Commercial

-

Industrial

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

France

-

Italy

-

UK

-

Spain

-

-

Asia Pacific

-

China

-

Japan

-

Australia

-

India

-

South Korea

-

-

Central & South America

-

Brazil

-

Argentina

-

-

Middle East & Africa

-

Saudi Arabia

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global heat meter market size was estimated at USD 1,370.7 million in 2022 and is expected to be USD 1,450.9 million in 2023.

b. The heat meter market, in terms of revenue, is expected to grow at a compound annual growth rate of 6.8% from 2023 to 2030 to reach USD 2,320.3 million by 2030.

b. Residential application segment led the market and accounted for 46.0% of the global market share in 2022. A heat meter in residential applications measures the amount of heat energy consumed for heating purposes. It's commonly used in conjunction with heating systems to monitor and bill for the energy used. Moreover, residents and building managers can monitor and optimize heating systems for efficiency.

b. Some of the key players operating in the heat meter market include Sycous Limited, Zenner International GmbH & Co. KG, Kamstrup, Danfoss, Apator S.A., BMETERS Srl, ITRON, Diehl Stiftung & Co. KG, Siemens AG, Trend Control Systems Ltd, Premier Control Technologies Ltd, Cosmic Technologies, Grundfos, Spire Metering Technology, Omni Instruments.

b. The market is driven by increasing demand for energy-efficient solutions, government regulations promoting energy conservation, a growing focus on sustainable practices, and the rising adoption of district heating systems.

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![ESOMAR Certified Member]()

![Great Place to Work Certified]()

ESOMAR & Great Work to Place Certified

![ISO 9001:2015 & 27001:2022 Certified]()

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."