- Home

- »

- Advanced Interior Materials

- »

-

Heat Exchangers Market Size, Share & Growth Report, 2030GVR Report cover

![Heat Exchangers Market Size, Share & Trends Report]()

Heat Exchangers Market Size, Share & Trends Analysis Report By Product (Plate & Frame Heat Exchanger,Shell & Tube Heat Exchanger), By End-use (Chemical & Petrochemical, HVAC & Refrigeration), By Region, And Segment Forecasts, 2024 - 2030

- Report ID: GVR-4-68038-718-6

- Number of Pages: 133

- Format: Electronic (PDF)

- Historical Range: 2018 - 2022

- Industry: Advanced Materials

Heat Exchangers Market Size & Trends

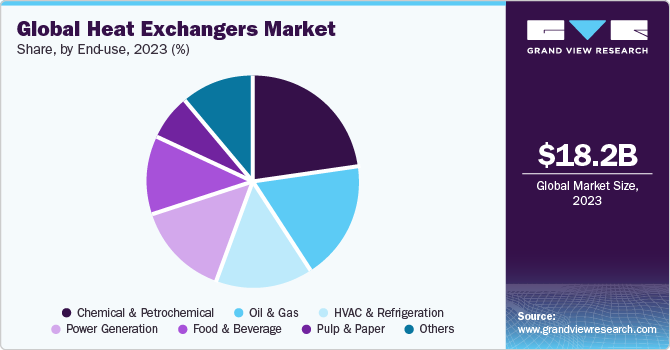

The global heat exchangers market size was estimated at USD 18.2 billion in 2023 and is expected to grow at a compound annual growth rate (CAGR) of 5.4% from 2024 to 2030. Rising focus on efficient thermal management in various industries, including oil & gas, power generation, chemical & petrochemical, food & beverage, and HVAC & refrigeration, is expected to drive the demand for heat exchangers over the forecast period. Rising demand from chemical industry coupled with increasing technological advancements and a growing focus on improving efficiency standards is expected to drive heat exchangers market growth. Most processes in petrochemical facilities involve high pressure and temperature, thus, necessitating the optimization of heat transfer and enhancement of energy savings, which, in turn, is likely to boost the demand for energy-efficient heat exchangers.

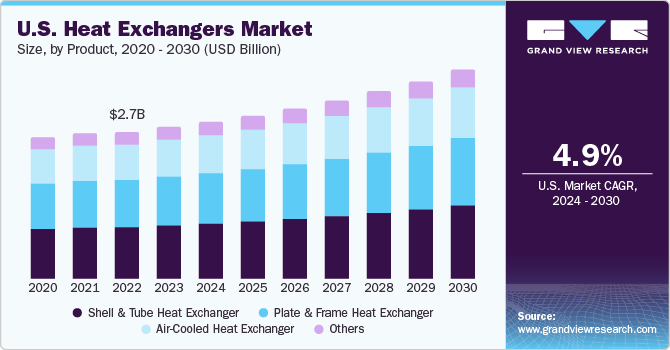

The U.S. dominated the market in 2023, owing to high electricity demand, industrialization, and investments in renewable power generation. Rising investments by oil & gas companies in exploration & production activities in the U.S. are expected to boost the demand for these products in oil & gas industry. Significant power markets such as China, the U.S., India, Russia, and Japan are restructuring their operating models to adopt the structure of renewable energy and efficient utilization of energy by installing heat exchangers and shifting from traditional energy use. This is expected to drive the demand for heat exchangers.

Technological advancements such as tube inserts in heat exchangers are expected to complement the market growth. Furthermore, ongoing technological improvements to improve energy efficiency, total life cycle cost, durability, and compactness of heat exchangers are expected to drive industry growth. Manufacturers of these products face a long list of difficult supply chain challenges, including increasing demand variability, intense global competition, more environmental compliance regulations, increasing human and nature-based risks, and inventory proliferation. The COVID-19 pandemic has created new challenges, which are compelling manufacturers to innovate their supply chains at a faster speed.

End-use Insights

The chemical & petrochemical segment led the market and accounted for 22.6% of the global revenue in 2023. Heat exchangers are used in chemical processing industry (CPI) on account of their properties, such as design flexibility and high corrosion resistance. Their properties provide them with the ability to handle fluids having varying levels of solids.

Rising demand for fertilizers, plastics, packaging, digital devices, medical equipment, and clothing is likely to boost petrochemical industry's growth. Furthermore, the penetration of petrochemical products in modern energy systems, such as wind turbine blades, solar panels, and electric vehicle parts, is anticipated to drive the industry’s growth. Thus, the above factors are, in turn, likely to drive the demand for these products in chemical & petrochemical industry.

Heat exchanger demand in oil & gas end-use industry is anticipated to grow at a CAGR of 5.0% over the forecast period. Increasing utilization of shale gas in energy and manufacturing industries, along with growing shale gas exploration activities due to technological advancements in exploration, is expected to boost the demand for heat exchangers. Furthermore, the rising number of oil & gas projects across various economies is likely to drive industrial growth.

Heat exchangers form an essential part of HVAC systems. The increasing awareness regarding energy conservation and reducing energy bills is expected to augment the demand for heat exchangers in HVAC industry. The products are used in heat recovery process involving steam, water, air, and refrigerants. Surging demand for efficient heat recovery systems offering high corrosion resistance is anticipated to propel the product demand.

Regional Insights

Europe led the market and accounted for 31.7% of the global revenue share in 2023. Rising public and private infrastructure investments are anticipated to drive the demand for these products in HVAC & refrigeration industry. Increasing demand from several end-use industries for heat exchangers that offer greater durability, enhanced efficiency, and less fouling is expected to drive growth over the forecast period. Rising oil & gas exploration activities in the U.S. and Canada are expected to drive the demand for these products in North America. Increasing energy demand in various industrial and commercial sectors is likely to boost the power and energy sectors, thereby positively impacting the overall market for heat exchangers.

Asia Pacific heat exchanger demand is likely to grow at a CAGR of 6.5% over the forecast period. Rapid industrialization in the developing economies of Asia Pacific coupled with rising investments in manufacturing, commercial, and industrial projects has contributed to the overall growth of the regional market. Heat exchangers market in China is anticipated to be driven by growing investments in chemical, petrochemical, and HVAC sectors. Factors such as the burgeoning population and the government's efforts to enhance the country's infrastructure are expected to favor the growth of power generation and HVAC & refrigeration sectors, thereby driving the demand for these products over the forecast period.

Market Dynamics

Rapid industrialization in the developing nations of Asia Pacific coupled with increasing investments in manufacturing, industrial, and commercial projects has contributed to the overall growth of the exchangers market in the region. Another factor driving the market is the increased product penetration in various end-use industries including power generation, chemical, HVAC & refrigeration, petrochemical, and food & beverage.

A significant shift in demand for plate & frame heat exchangers is being observed from mature markets including Europe and North America as well as developing nations of Asia Pacific including India and China. The success of plate & frame heat exchangers in chemical industries of China can be attributed to the high industry fragmentation, strong government influence, tightening of environmental regulations, and growing importance of specialty chemicals.

Product Insights

The shell & tube segment led the market and accounted for 35.6% of the global revenue in 2023. Shell & tube products are built from a bundle of tubes placed in a cylindrical shell with the tube axis parallel to that of shell. Three most common types of shell & tube products are floating-head type, U-tube design, and fixed tube sheet design. Shell & tube products are used in applications that require a wide temperature and pressure range as well as transfer between two liquids, between liquids & gases, or between two gases. These exchangers have a simple structure and are ideal for heat transfer from steam to water. However, they require large spaces, which is anticipated to hinder the segment’s growth over the forecast period.

The plate & frame product segment is expected to grow at a CAGR of 5.8% over the forecast period. Plate-type exchangers are built of plates either having some form of corrugation or smoothness. These products are classified as brazed, welded, or gasketed depending on the leak tightness required. Plate & frame products are typically used for liquid-liquid exchange at low to medium pressures. Air-cooled products comprise various components such as a tube bundle, an air-pumping device such as a blower or an axial flow fan, and a support structure. These products are used in petrochemical plants, refineries, compressor stations, gas-treating plants, power plants, and other facilities. Air-cooled products can be installed either vertically, horizontally, or at a sloped angle.

Key Companies & Market Share Insights

The industry is characterized by the presence of multinational as well as regional players that are engaged in designing, manufacturing, and distributing these products. Product manufacturers strive to obtain a competitive edge over their competitors by increasing application scope of their products. Strategies adopted by manufacturers include new product development, diversification, mergers & acquisitions, and geographical expansion. These strategies aid the companies in expanding their market penetration and catering to changing technological demand across various end-use industries.

Key Heat Exchanger Companies:

- Alfa Laval

- Kelvion Holding GmbH

- Danfoss3

- API Heat Transfer

- Xylem Inc.

- HRS Heat Exchangers

- Hisaka Works, Ltd.

- Koch Heat Transfer Company

Heat Exchangers Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 18.9 billion

Revenue forecast in 2030

USD 26.3 billion

Growth rate

CAGR of 5.4% from 2024 to 2030

Base year for estimation

2023

Historical data

2018 - 2022

Forecast period

2024 - 2030

Report updated

November 2023

Quantitative units

Revenue in USD million/billion and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, trends

Segments covered

Product, end-use, region

Regional scope

North America; Europe; Asia Pacific; Central & South America; Middle East & Africa

Country scope

U.S.; Canada; Mexico; Germany; France; Italy; China; Japan; India; Brazil; Saudi Arabia; UAE

Key companies profiled

Alfa Laval; Danfoss; Kelvion Holding GmbH; Güntner Group GmbH; Xylem Inc.; API Heat Transfer; Mersen; Hisaka Works, Ltd.; Chart Industries, Inc.; Johnson Controls International; HRS Heat Exchangers; SPX FLOW, Inc.; Funke Wärmeaustauscher Apparantebau GmbH; Koch Heat Transfer Company; Southern Heat Exchanger Corporation

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

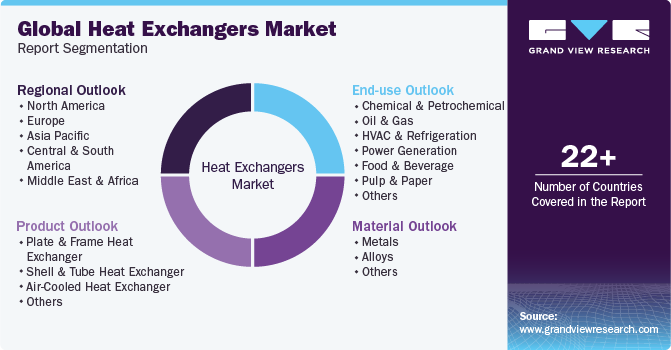

Global Heat Exchangers Market Report Segmentation

This report forecasts revenue growth at global, regional & country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global heat exchangers market report based on product, end-use, and region:

-

Product Outlook (Revenue, USD Million, 2018 - 2030)

-

Plate & Frame Heat Exchanger

-

Brazed Plate & Frame Heat Exchanger

-

Gasketed Plate & Frame Heat Exchanger

-

Welded Plate & Frame Heat Exchanger

-

Others

-

-

Shell & Tube Heat Exchanger

-

Air-Cooled Heat Exchanger

-

Others

-

-

End-use Outlook (Revenue, USD Million, 2018 - 2030)

-

Chemical & Petrochemical

-

Oil & Gas

-

HVAC & Refrigeration

-

Power Generation

-

Food & Beverage

-

Pulp & Paper

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

France

-

Italy

-

-

Asia Pacific

-

China

-

Japan

-

India

-

-

Central & South America

-

Brazil

-

-

Middle East & Africa

-

Saudi Arabia

-

UAE

-

-

Frequently Asked Questions About This Report

b. The global heat exchangers market size was estimated at USD 18.2 billion in 2023 and is expected to reach USD 18.9 billion in 2024.

b. The global heat exchangers market, in terms of revenue, is expected to grow at a compound annual growth rate of 5.4% from 2024 to 2030 to reach USD 26.3 billion by 2030.

b. Europe dominated the heat exchangers market with a share of 31.7% in 2023, owing to the rising consumption of chemicals in various end-use industries coupled with growing demand for heat exchangers that offer greater durability, enhanced efficiency, and less fouling.

b. Some of the key players operating in the heat exchangers market include Alfa Laval, Danfoss, Kelvion Holding GmbH, Güntner Group GmbH, API Heat Transfer, Xylem Inc.; Mersen, Hisaka Works, Ltd.; SPX FLOW, Inc.; and Koch Heat Transfer Company

b. Key factors that are driving heat exchanger market growth include rising trend for efficient thermal management in chemical, oil & gas, and power generation, and a rising focus on improving efficiency standards.

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![ESOMAR Certified Member]()

![Great Place to Work Certified]()

ESOMAR & Great Work to Place Certified

![ISO 9001:2015 & 27001:2022 Certified]()

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."