- Home

- »

- Consumer F&B

- »

-

Healthy Snacks Market Size & Share Analysis Report, 2030GVR Report cover

![Healthy Snacks Market Size, Share & Trends Report]()

Healthy Snacks Market Size, Share & Trends Analysis Report By Product (Frozen & Refrigerated, Dairy), By Claim (Gluten-free, Low/No Fat), By Packaging, By Distribution Channel, By Region, And Segment Forecasts, 2023 - 2030

- Report ID: GVR-1-68038-915-9

- Number of Pages: 100

- Format: Electronic (PDF)

- Historical Range: 2017 - 2021

- Industry: Consumer Goods

Report Overview

The global healthy snacks market size was estimated at USD 90.62 billion in 2022 and is projected to grow at a compound annual growth rate (CAGR) of 6.7% from 2023 to 2030. Growing awareness of health and wellness and an increasing focus on lifestyle-related ailments have led to a surge in consumer interest in healthier snack choices. This has created a demand for convenient, nutritionally balanced snacks that can be enjoyed on-the-go. The market has responded with innovative and diverse product offerings that cater to these evolving preferences. Furthermore, social media has played a significant role in popularizing healthy eating trends and influencing consumer choices.

In addition, workplaces are incorporating wellness programs that encourage healthier snacking habits contributing to the growth of the market for healthy snacks. The growth of this market is strongly driven by continuous innovation and expanding product diversity. Manufacturers attempt to meet the evolving demands and preferences of consumers by introducing fresh and innovative snack options.

They are prioritizing the development of distinctive flavors, utilization of unique ingredients, and integration of emerging food trends, resulting in a wide array of healthier snack choices. For instance, in May 2023, Nourish Organics, a renowned clean label and superfoods company, launched Popeas, marketed as the healthiest pack of chips. It is 100% clean label, organic, baked (not fried), and packed with 12g of protein. In addition, it is vegan and gluten-free, catering to various dietary needs.

The rise in disposable income, along with a corporate culture of long work hours and stressful lifestyles, has led to a shift in eating patterns and increased snacking. Snacks, on the other hand, have historically been considered unhealthy due to their high oil and sugar content, and major contributors to health problems such as obesity, high blood sugar, and hypertension. However, due to a recent shift in consumer behavior, the demand is fast shifting away from oily-spicy products to healthier, sugar-free, and low-calorie snacks packaged in small portions. This is a significant trend driving industry growth.

New-age customers demand nutritious, on-the-go, and economical snacking options that suit their nutritional needs while also satisfying their taste buds. According to a 2020 study by Mondelēz International, approximately 59% of adults globally prefer to consume multiple short meals throughout the day rather than the conventional larger ones. Snacks that meet stated health and nutrition criteria as well as address age-specific requirements or concerns, such as immunity, digestion, memory, weight loss, or energy are being developed by healthy snack manufacturers, thereby propelling their market growth.

The market, in the forecast year, is expected to be dominated by snacks with intriguing new flavors and textures created using sustainable technologies, packed with recyclable materials, and with clean labels. Vegan snacks, zero fats, high/added proteins, whole grains, reduced/zero sugar, zero oil/baked snacks, zero gluten content, and snacks with environment-friendly packaging are just a few examples of emerging trends in this sector. The number of innovations in the market is continually expanding.

Personalized healthy snacks are a trend that is gaining momentum in the global industry. Snacks that match consumer lifestyle, dietary, and health requirements are in high demand. As a result, personalized nutrition is now on the rise. Snacks that are keto-friendly and low in cholesterol, as well as those that are mood-boosting, gut-friendly, and help achieve better sleep, are becoming increasingly popular. For instance, in March 2022, PepsiCo and Beyond Meat launched their first plant-based product, Meatless Jerky. These companies have formed a joint venture to develop plant-based healthy snacks and beverages under their PLANeT Partnership.

Research and development play a crucial role in driving growth and innovation within the market. Companies investing in R&D initiatives can explore new ingredients, technologies, and manufacturing processes for creating healthier snack options that cater to consumer preferences. For instance, in April 2023, Hsu Fu Chi, a snack company in Dongguan, located in Guangdong province, formed a partnership with the South China University of Technology to establish a dedicated research center for healthy snacks. The research center will focus on advancements in raw materials, technology, and the creation of healthier food options. Alongside this initiative, Hsu Fu Chi has also introduced an innovation strategy and a fund aimed at encouraging its employees to make significant breakthroughs in food research and development.

Product Insights

Healthy savory snacks dominated the market with a share of 33.2% in 2022.The demand for this segment is driven by working-class people and college graduates, for whom healthy savory snack products have emerged as an alternative to dinner. Savory snack foods allow individuals to satisfy their appetite, as well as prevent them from overeating during mealtime. Companies are developing baked chips that are all-natural, non-GMO, multigrain, and low in salt content, as well as provide many health benefits. Ragi, soya, and vegetables are commonly used to make these chips, which are high in protein and low in fat.

However, healthy fruit snacks are expected to showcase the fastest growth over the forecast period. Fruit bars are still at the forefront of innovation in the market for healthy snacks. A variety of prebiotic, probiotic, and omega-3 fortified bars are present in the market, as well as keto and paleo choices that are low in carbohydrates and high in medium-chain triglycerides. Furthermore, protein content is increasing in bars, with standard whey and soy proteins being used more frequently; however, pea protein is becoming more popular.

Companies are manufacturing snacks that are healthy, convenient, and tasty, and meet consumer demands. Nutritional supplements come in various forms such as dairy and confectionary. Plant-based yogurts have fueled yogurt growth, with newer additions such as Chobani Non-Dairy Greek yogurt and Good Karma Flaxmilk drinkable and spoonable yogurts. For instance, in September 2022, chocolate maker Mondelēz International entered the snack bar category in India with its launch of the Fuse Fit snack bar.

Claim Insights

Low/no sugar snacks dominated the market with a share of 41.2% in 2022. The increasing prevalence of obesity, diabetes, and other lifestyle diseases has fueled the demand for low/no-sugar snacks. These snacks serve as an appealing option for individuals planning to manage their weight and blood sugar levels. Strict regulations and labeling requirements have incentivized manufacturers to create and promote healthier snack choices. Moreover, marketing efforts and enhanced consumer education have played a crucial role in raising awareness about the advantages of low/no sugar snacks, driving their widespread acceptance and popularity.

Gluten-free snacks are projected to register a CAGR of 7.4% over the forecast period The rise of alternative diets, such as paleo, keto, and vegan, has also contributed to the popularity of gluten-free snacks, as these diets often exclude gluten-containing foods. In January 2023, In Good Hands, a California-based snack company introduced its inaugural product line, consisting of Nacho Cheese Protein Puffs and White Cheddar Protein Puffs, which are gluten-free. Each serving of In Good Hands Protein Puffs contains 12 grams of milk protein, making them a good source of protein. In addition, these protein puffs have only 1 gram of sugar and provide 130 calories per serving, making them a lower-calorie option compared to many other traditional snacks.

Packaging Insights

Bags and pouches dominated the market with a share of 33.3% in 2022 owing to the convenience of packaging and handling.Bags and pouches are designed to be easily opened, resealed, and lightweight, which makes them highly suitable for on-the-go snacking. They provide efficient protection for snacks, preserving their freshness and flavor. Transparent or windowed designs enhance visibility and appeal, enabling consumers to make informed choices. In addition, their cost-effectiveness, sustainability feature, and versatility in accommodating various snack types contribute to their widespread preference as the packaging option of choice in the snacks market.

Cans is projected to register the fastest CAGR of 7.3% over the forecast period. Cans provide excellent protection, ensuring the snacks’ freshness and extended shelf life. With ample branding space, cans offer eye-catching marketing opportunities that enhance product visibility and recognition on store shelves. The perceived premium quality associated with metal packaging further drives consumer appeal. In addition, cans are recognized for their sustainability and recyclability which aligns well with the growing environmental consciousness among consumers.

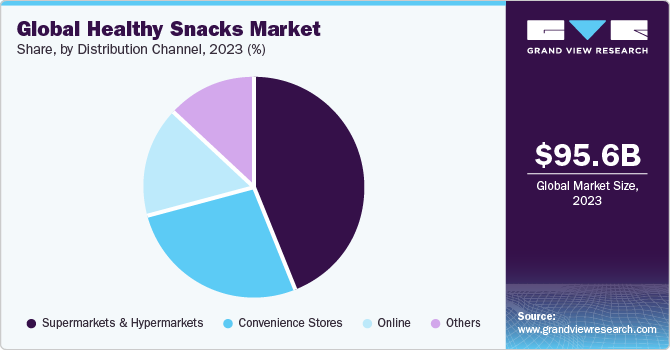

Distribution Channel Insights

Supermarkets and hypermarkets dominated the market with a share of 70.0% in 2022, owing to their wide product assortment that offers a diverse range of healthy snacks for consumers seeking variety. The sheer volume of supermarkets and hypermarkets globally is the major factor for the domination of this distribution channel. For instance, one of the largest supermarket chains in the world is 7-Eleven. It has over 46,000 outlets in 16 countries. Furthermore, the rapid progress of retail infrastructure across developing economies is further accentuating industry growth.

In addition, the convenience and accessibility of these retail channels, typically located in urban and suburban areas, make it easy for individuals to purchase healthy snacks during routine shopping trips. Collaborations with popular brands for in-store promotions and advertising campaigns increase brand visibility and generate consumer interest. Competitive pricing and discounts on healthy snacks further incentivize consumers to select these options over less nutritious alternatives.

Furthermore, instant delivery services are gaining momentum globally, and supermarket chains are joining the trend to maximize their value. Over the last few months, there is an increasing number of supermarkets partnering with or investing in large rapid delivery companies. Supermarkets gain from their current supply chains to raise their margins, while delivery services benefit from their existing supply chains to extend their distribution network and lessen market competition.

The online distribution channel is expected to exhibit the fastest CAGR of 9.0% from 2023 to 2030. The ability to shop from home, access a vast array of products, and easily compare prices and reviews online has appealed to consumers. Moreover, the online channel provides a wider consumer base, including those in remote or underserved areas. It eliminates geographical constraints, allowing healthy snack brands to reach a wider audience and expand their customer base globally.

Regional Insights

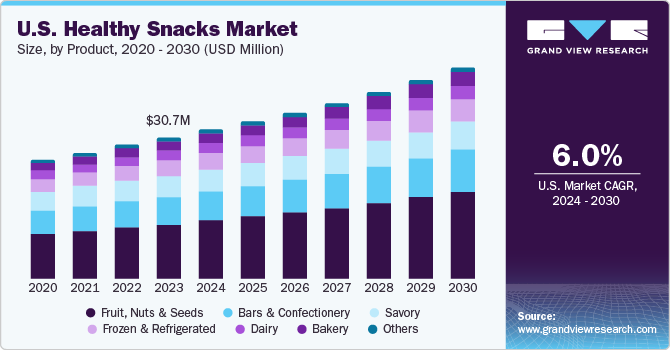

North America held the largest revenue share globally accounting for approximately 33.5% in 2022. The demand for healthy snacks in the U.S. has risen exponentially with the emergence of the COVID-19 pandemic. The U.S. was already a large consumer of snacks, but the consumer focus has now shifted to the consumption of healthy and nutritious snacks to prevent health-related risks posed due to excessive snacking habits. The U.S. market for healthy snacks is expected to grow at a CAGR of 7.2% from 2023 to 2030. Furthermore, the high proliferation rates of supermarkets and hypermarkets, along with convenience stores is another major factor that has driven the sales of healthy snacks in the region. These convenience stores are partnering with delivery platforms to strengthen their presence in e-commerce.

However, Asia Pacific is anticipated to become the fastest-growing region in the global market over the forecast period. In Asia, there is also a growing awareness of foods that are beneficial for the stomach and associated with immunity, such as prebiotics and probiotics. Adding functional ingredients to snacks, such as macronutrients and antioxidants, has become a common approach for many manufacturers to create nutritious snacks in recent years. Furthermore, as a tactic to attract customers, more companies are emphasizing clean labels and product flavors. This is expected to drive the growth of the Asia Pacific market for healthy snacks during the forecast period.

Furthermore, China’s healthy snacks industry has emerged as a dominant market in the Asia Pacific region with a revenue share of 35.25% in 2022, owing to significant innovation and product diversity. Manufacturers have been developing and introducing a wide range of healthier snack options to cater to different consumer preferences and dietary needs. The Australia & New Zealand market for healthy snacks is expected to grow at a CAGR of 8.4% from 2023 to 2030. India’s healthy snacks industry is expected to grow at the fastest CAGR of 9.4% from 2023 to 2030, driven by changing consumer preferences towards nutritious options, expanding urban population, and the rise of e-commerce.

Europe is expected to witness a steady CAGR of 6.0% over the forecast period. This growth is driven by the high prevalence of obesity and lifestyle diseases in the region, prompting individuals to adopt healthier eating habits. There is a strong demand for snacks with lower calories, reduced sugar, healthier ingredients, and functional benefits. The UK healthy snacks industry emerged as a dominant market in Europe region with a revenue share of 21.8% in 2022. The Germany healthy snacks industry is expected to grow at a CAGR of 6.4% from 2023 to 2030.

Key Companies & Market Share Insights

The market includes both international and domestic participants. Brand market share analysis indicates that key market players are focusing on strategies such as new product launches, partnerships, mergers & acquisitions, global expansion, and others. Some of the initiatives include:

-

In March 2022, CLIFexpanded its snack category with the launch of CLIF Thins, a crispy and crunchy variation of the original CLIF BAR. CLIF Thins are consciously crafted using plant-based ingredients. Each pack contains 100 calories and 5 grams of sugar, making it an ideal choice for those who desire flavorful snacks with genuine ingredients, including organic rolled oats.

-

In February 2022, DaburIndia, a prominent Natural Health Care and Ayurvedic Company, expanded its Réal portfolio by introducing a line of healthy snacks in the Superfoods Seeds category. The range features Roasted Pumpkin Seeds and Chia Seeds and is currently accessible through major eCommerce platforms for online purchase.

-

In May 2022, HUNGRY , a comprehensive food and events platform for corporate America, acquired NatureBox, a manufacturer of healthy snacks. This acquisition enhances HUNGRY's better-for-you options and expands its national reach, solidifying its position in the corporate food-tech industry.

Some key players in the global healthy snacks market include:

-

Nestlé

-

The Kellogg Company

-

Unilever

-

Danone

-

PepsiCo

-

Mondelēz International

-

Hormel Foods Corporation

-

Dole Packaged Foods, LLC.

-

Del Monte Foods, Inc.

-

Select Harvests

-

B&G Foods

-

Monsoon Harvest

Recent Devlopments

-

In January 2023, RXBAR successfully launched a new line of Granola, featuring three enticing flavors - Original, Peanut Butter, and Chocolate - each infused with wholesome, real ingredients and boasting an impressive 10g protein per serving. This strategic move further solidified their reputation for unwavering dedication to authentic, no-nonsense snacking solutions

-

In July 2023, Applegate Farms LLC made a significant market entry with the introduction of APPLEGATE NATURALS™ Frittata Bites, becoming the trailblazer in the breakfast industry by offering the exclusive Certified Humane® frozen egg bites. This strategic expansion marked the brand's successful foray into the handheld, frozen breakfast segment, with a primary focus on incorporating eggs as a key ingredient in their innovative product line

-

In August 2022, PepsiCo Australia successfully unveiled its ambitious healthy snack strategy, securing an industry-leading position by ensuring 30 percent of its snack portfolio attained a Health Star Rating (HSR) of 3.5 or higher. This milestone was underscored by the successful launch of Simply, the inaugural potato chip on Australian retail shelves to boast an impressive HSR of 4, solidifying the company's commitment to offering healthier snack options to consumers

Healthy Snacks Market Report Scope

Report Attribute

Details

Market size value in 2023

USD 96.06 billion

Revenue forecast in 2030

USD 152.55 billion

Growth rate

CAGR of 6.7% from 2023 to 2030

Base year for estimation

2022

Historical data

2017 - 2021

Forecast period

2023 - 2030

Report updated

July 2023

Quantitative units

Revenue in USD billion and CAGR from 2023 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, claim, packaging, distribution channel, region

Regional scope

North America; Europe; Asia Pacific; Central & South America; Middle East & Africa

Country scope

U.S.; Canada; Mexico; Germany; UK; France; Italy; Spain; China; Japan; India; Australia & New Zealand; Brazil; UAE; South Africa

Key companies profiled

Nestlé; The Kellogg Company; Unilever; Danone; PepsiCo; Mondelēz International; Hormel Foods Corporation; Dole Packaged Foods, LLC.; Del Monte Foods, Inc.; Select Harvests; B&G Foods; Monsoon Harvest

Customization scope

Free report customization (equivalent up to 8 analysts’ working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Healthy Snacks Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest trends in each of the sub-segment from 2018 to 2030. For this study, Grand View Research has segmented the healthy snacks market report based on product, claim, packaging, distribution channel, and region:

-

Product Outlook (Revenue, USD Billion, 2017 - 2030)

-

Frozen & Refrigerated

-

Fruit

-

Bakery

-

Savory

-

Confectionery

-

Dairy

-

Others

-

-

Claim Outlook (Revenue, USD Billion, 2017 - 2030)

-

Gluten-Free

-

Low/No Fat

-

Low/No Sugar

-

Others

-

-

Packaging Outlook (Revenue, USD Billion, 2017 - 2030)

-

Bags & Pouches

-

Boxes

-

Cans

-

Jars

-

Others

-

-

Distribution Channel Outlook (Revenue, USD Billion, 2017 - 2030)

-

Supermarkets & Hypermarkets

-

Convenience Stores

-

Online

-

Others

-

-

Regional Outlook (Revenue, USD Billion, 2017 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

Italy

-

Spain

-

-

Asia Pacific

-

China

-

India

-

Japan

-

Australia & New Zealand

-

South Korea

-

-

Central & South America

-

Brazil

-

-

Middle East & Africa

-

UAE

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global healthy snacks market size was estimated at USD 90.62 billion in 2022 and is expected to reach USD 96.06 billion in 2023.

b. The global healthy snacks market is expected to grow at a compound annual growth rate of 6.2% from 2023 to 2030 to reach USD 152.55 billion by 2030.

b. North America held the largest market share globally accounting for around 33.5% of global revenue in 2022. The U.S. was already a large consumer of snacks, but the consumer focus has now shifted to the consumption of healthy and nutritious snacks to prevent all kinds of health-related risks posed due to excessive snacking habits. Furthermore, the high proliferation rates of supermarkets and hypermarkets, along with convenience stores is another major factor that has driven the sales of the healthy snacks market in the region.

b. Some of the key market players in the healthy snacks market are Nestlé; The Kellogg Company; Unilever; Danone; PepsiCo; Mondelēz International; Hormel Foods Corporation; Dole Packaged Foods, LLC.; Del Monte Foods, Inc.; Select Harvests; B&G Foods; Monsoon Harvest, among others.

b. Growing awareness of health and wellness, along with an increasing focus on lifestyle-related ailments, has led to a surge in consumer interest for healthier snack choices. This has created a demand for convenient, nutritionally balanced snacks that can be enjoyed on-the-go. The market has responded with innovative and diverse product offerings that cater to these evolving preferences. Furthermore, social media has played a significant role in popularizing healthy eating trends and influencing consumer choices. Additionally, workplaces are incorporating wellness programs that encourage healthier snacking habits, contributing to the growth of the healthy snacks market.

b. The U.S. healthy snacks market dominated the North America market with a revenue share of 66.6% in 2022. Higher consumer spending power, and increasing health and wellness awareness, with more consumers seeking healthier food options, is consolidating market growth in the region. Furthermore, the U.S. has a vibrant and innovative food industry, with numerous companies dedicated to developing and marketing healthy snack products.

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![ESOMAR Certified Member]()

![Great Place to Work Certified]()

ESOMAR & Great Work to Place Certified

![ISO 9001:2015 & 27001:2022 Certified]()

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."

Important: Covid19 pandemic market impact

Amidst the global pandemic crisis and the indefinite lockdown across nations, the consumer food & beverage industry first witnessed high demand for household staples, healthy food items, and consumables with longer shelf lives. The demand for frozen food products, fruits & vegetables, eggs, flour, and whole grains, among others, witnessed a considerable increase during the early stages of the crisis. Presently, most companies in the industry are faced with low consumption of their products and supply chain challenges. The companies are focusing more on altering their supply chains in order to reinforce their online presence and delivery measures, in an attempt to adapt to the present business environment. The changes in consumer buying behavior and the dynamic shifts towards online and D2C distribution channels may have serious implications on the near future growth of the industry. Our team is diligently working towards accounting these factors in our report with the aim of providing you with the up-to-date, actionable market information and projections.