- Home

- »

- Healthcare IT

- »

-

Healthcare IT Market Size, Share And Growth Report, 2030GVR Report cover

![Healthcare IT Market Size, Share & Trends Report]()

Healthcare IT Market Size, Share & Trends Analysis Report By Application (EHR, CPOE, Electronic Prescribing Systems, Medical Imaging Information Systems), By Region (North America, Asia Pacific), And Segment Forecasts, 2023 - 2030

- Report ID: 978-1-68038-071-2

- Number of Pages: 100

- Format: Electronic (PDF)

- Historical Range: 2018 - 2021

- Industry: Healthcare

Report Overview

The global healthcare IT market size was estimated at USD 174.3 billion in 2022 and is expected to grow at a compound annual growth rate (CAGR) of 18.2% from 2023 to 2030. The increasing usage of smartphones, growing demand for remote patient monitoring for improved out-of-hospital care, technologically advanced healthcare IT infrastructure, and rise in the number of initiatives and investments supporting eHealth are driving the overall market growth. For instance, in May 2022, Microsoft collaborated with BeeKeeperAI, a healthcare AI solutions developer, enabling Microsoft Azure users to explore confidential computing's advantages in healthcare AI solutions. Rising government initiatives to promote technologically advanced systems, including those addressing COVID-19 and other primary healthcare challenges, are also driving the market expansion.

For instance, growing economies, such as India, have taken significant steps toward digitalization. In September 2021, the Indian Prime Minister introduced the Pradhan Mantri Digital Health Mission, an initiative aimed at digitizing healthcare services nationwide. This mission seeks to establish a secure and accessible digital healthcare system, enabling individuals to store, access, and authorize the sharing of their health records. In addition, the ease of use, cost-effectiveness, and time efficiency are driving the adoption of healthcare IT in hospitals. The market's expansion is also supported by continuous improvements in services provided by industry players to cater to consumer demands.

For example, in August 2021, Change Healthcare introduced its cloud-based software as a service (SaaS) solution, Change Healthcare Stratus Imaging PACS, tailored for radiological practices. This innovative solution is in beta testing, with plans for future expansion into hospitals in the coming years. Growing smartphone penetration and improving internet coverage are directly contributing to the adoption of healthcare IT solutions. Smartphone penetration has improved the management of chronic disease owing to the usage of mHealth applications. According to the Mass Media Data report, 5.31 billion unique users will be using mobile phones by the beginning of 2022, which indicates that more than two-thirds of the world's population presently utilizing mobile phones.

In addition, at the start of 2022, the global internet user count stood at 4.95 billion, indicating that 62.5 percent of the global population had access to the internet. Furthermore, the growing demand for centralized medical records to enhance care delivery, especially in developed economies like the U.S., where there's a shift towards value-based care, is driving the adoption of health management systems like EHR. This, in turn, contributes to the market expansion. For instance, in March 2022, Google Health collaborated with MEDITECH to use its search & summarization capabilities within MEDITECH's Expanse EHR platform to help clinicians provide the best care via easy and quick access to information from multiple sources.

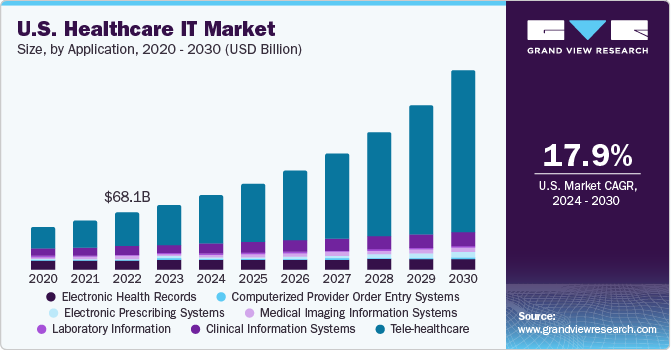

Application Insights

On the basis of application, the market is segmented into Electronic Health Record (EHR), Computerized Provider Order Entry Systems (CPOE), electronic prescribing systems, medical imaging information systems, laboratory informatics, clinical information systems, and telehealthcare. Furthermore, the tele-healthcare segment is divided into tele-care and tele-health. In 2022, telehealthcare holds a dominant segment with a revenue share of 55.8%. This growth can be attributed to the increasing demand for streamlined electronic healthcare systems, advancements in healthcare IT, and the need for technology-integrated tools. In addition, increasing health consciousness, rising demand for cost-effective care, and growing geriatric population are some of the other key factors contributing to the growth of telehealth care.

For instance, Independa, a TV-based platform specializing in remote engagement, care, and education, conducted a survey in November 2022 to examine smart TV users' behavior & attitude toward telehealth. The findings released in March 2023 revealed that over 90% of Americans had utilized telehealth services in the past year, with a satisfaction rate of 90%. These services included doctor's appointments, teledentistry, and vision appointments. The survey also highlighted the significance of increased smartphone penetration, as 71% of users accessed telehealth services using their smartphones. These findings indicate a growing awareness and positive reception of telehealth, which is expected to drive market growth, as telehealth adoption continues to rise in the forecast period.

On the other hand, the electronic prescribing system segment is anticipated to experience the fastest CAGR of 26.5% over the forecast period. An increase in awareness of the advantages of e-prescribing is fueling the adoption of e-prescribing systems. In a study titled “Perception of physicians towards electronic prescription system and associated factors at resource-limited settings" published in PLOS ONE in March 2021, survey participants expressed positive perceptions of electronic prescriptions, with 76.5% showing a favorable attitude. Furthermore, approximately 70.8% of participants had over 5 years of computer usage experience.

The study also revealed that nearly 90% of participants considered their electronic prescriptions to be legible. Furthermore, the medical imaging information systems segment is subdivided into radiology information systems, monitoring analysis software, and picture archiving and communication systems (PACS). Factors such as the increasing need for streamlining healthcare operations, rising awareness about these systems in tracking billing information and orders of radiology imaging, and the growing prevalence of chronic diseases globally are significantly contributing to the overall medical imaging information systems segment growth.

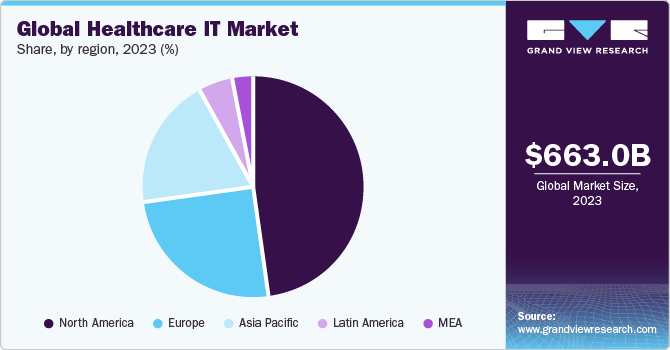

Regional Insights

North America dominated the market in 2022 with the largest revenue share of 48.5%. The region's market growth is fueled by the extensive adoption of healthcare IT solutions and services, especially in the U.S., as providers strive to enhance patient care while reducing costs. The adoption of healthcare IT solutions varies among providers due to various factors. A case in point is the high adoption of Electronic Health Records (EHR) in Oregon, where healthcare providers demonstrate varying adoption rates influenced by distinct digital divisions, as depicted in the following insights. Furthermore, increase in adoption of EHRs is increasing significantly in the U.S. As per the Health IT reports until 2021, nearly 9 out of 10 U.S.-based physicians have adopted EHR.

Thus, a high adoption rate also plays a crucial role in boosting market growth. On the other hand, Asia Pacific is anticipated to hold the fastest CAGR of over 22.5% during the forecast period due to the high demand for healthcare IT services, on account of the increased government spending on healthcare. Furthermore, the demand for healthcare IT systems has been increasing, as it enables efficient management of clinical, financial, and administrative aspects of hospitals. Several government initiatives and supportive programs are also boosting the adoption of such technologies.

For instance, in Australia, the state as well as federal governments support healthcare IT at their level. State-level programs, such as HealthSmart, and nationwide programs, such as HealthConnect, are examples of government programs undertaken to increase the integration of IT in healthcare. In addition, South Australia is also focusing on the development of fully integrated health record systems via its CareConnect. program. Such initiatives and policies in various nations are supporting market growth in the region, and growing business opportunities are leading to many players entering the market.

Key Companies & Market Share Insights

Notable market players are implementing different strategies, including new product development, collaborations, and partnerships, to strengthen their industry presence. For instance, in May 2023, athenahealth made a significant announcement regarding its ‘athenaOne’ integrated cloud-based EHR, medical billing, and patient engagement solution. This solution, along with ‘athenaOne Dental’, was chosen by LCH Health and Community Services to enhance provider and patient experiences while advancing its growth strategy. Moreover, the market is highly competitive, offering diverse applications such as EHR and e-prescribing, with multiple vendors offering tailored solutions. Some of the key players in the global healthcare IT market include:

-

Philips Healthcare

-

McKesson Corporation

-

eMDs, Inc.

-

Veradigm Inc. (formerly Allscripts Healthcare Solutions, Inc.)

-

Athenahealth, Inc. (Acquired by Hellman & Friedman and Bain Capital)

-

Carestream Health

-

GE Healthcare

-

Agfa- Gevaert Group

-

Hewlett Packard Enterprise Development LP

-

eClinicalWorks

-

Novarad

Healthcare IT Market Report Scope

Report Attribute

Details

Market size value in 2023

USD 199.5 billion

Revenue forecast in 2030

USD 644.9 billion

Growth rate

CAGR of 18.2% from 2023 to 2030

Base year for estimation

2022

Historical data

2018 - 2021

Forecast period

2023 - 2030

Quantitative units

Revenue in USD million/billion and CAGR from 2023 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Application, Region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; UK; Germany; France; Italy; Spain; Russia; Sweden; Norway; Denmark; China; Japan; India; Australia; South Korea; Thailand; Singapore; Brazil; Mexico; Argentina; South Africa; Saudi Arabia; UAE; Kuwait

Key companies profiled

Philips Healthcare; McKesson Corp.; eMDs, Inc.; Veradigm Inc. (formerly Allscripts Healthcare Solutions, Inc.); Athenahealth, Inc. (Acquired by Hellman & Friedman and Bain Capital); Carestream Health; GE Healthcare; Agfa- Gevaert Group; Hewlett Packard Enterprise Development LP; eClinicalWorks; Novarad

Customization scope

Free report customization (equivalent up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional & segment scope

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

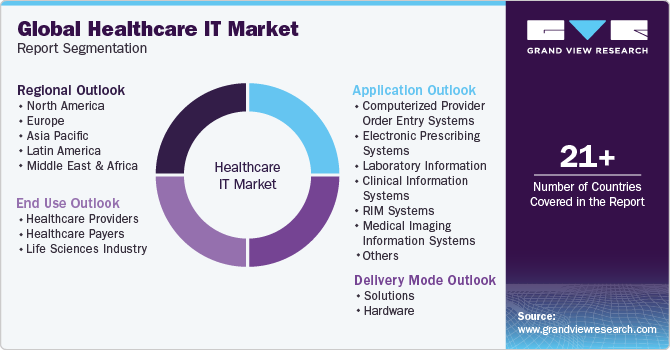

Global Healthcare IT Market Report Segmentation

This report forecasts revenue growth and provides an analysis of the latest trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the healthcare IT market report on the basis of application and region:

-

Application Outlook (Revenue, USD Million, 2018 - 2030)

-

Electronic Health Records

-

Computerized Provider Order Entry Systems

-

Electronic Prescribing Systems

-

Clinical Information Systems

-

Laboratory Informatics

-

Medical Imaging Information Systems

-

Radiology Information Systems

-

Monitoring Analysis Software

-

Picture Archiving and Communication Systems

-

-

Tele-healthcare

-

Tele-care

-

Tele-health

-

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

Sweden

-

Norway

-

Denmark

-

Russia

-

-

Asia Pacific

-

China

-

India

-

Japan

-

Australia

-

South Korea

-

Singapore

-

Thailand

-

-

Latin America

-

Brazil

-

Mexico

-

Argentina

-

-

Middle East and Africa (MEA)

-

South Africa

-

Saudi Arabia

-

UAE

-

Kuwait

-

-

Frequently Asked Questions About This Report

b. The global healthcare IT market size was estimated at USD 174.3 billion in 2022 and is expected to reach USD 199.5 billion in 2023

b. The global healthcare IT market is expected to grow at a compound annual growth rate of 18.2% from 2023 to 2030 to reach USD 644.9 billion by 2030.

b. North America dominated healthcare IT market in 2022 with the revenue share of 48.5%. The region's market growth is fueled by the extensive adoption of healthcare IT solutions and services, especially in the U.S., as providers strive to enhance patient care while reducing costs.

b. Some key players operating in the healthcare IT market include Philips Healthcare; McKesson Corporation; eMDs, Inc.; Veradigm Inc. (formerly Allscripts Healthcare Solutions, Inc.); Athenahealth, Inc. (Acquired by Hellman & Friedman and Bain Capital); Carestream Health; GE Healthcare; Agfa- Gevaert Group; Hewlett Packard Enterprise Development LP; eClinicalWorks; Novarad.

b. Key factors that are driving the healthcare IT market growth include the increasing usage of smartphones, growing demand for remote patient monitoring for improved out-of-hospital care, technologically advanced healthcare IT infrastructure, and increase in number of initiatives and investments supporting eHealth and digital health.

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![ESOMAR Certified Member]()

![Great Place to Work Certified]()

ESOMAR & Great Work to Place Certified

![ISO 9001:2015 & 27001:2022 Certified]()

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."