- Home

- »

- Advanced Interior Materials

- »

-

Gypsum Board Market Size, Share & Growth Report, 2030GVR Report cover

![Gypsum Board Market Size, Share & Trends Report]()

Gypsum Board Market Size, Share & Trends Analysis Report By Product (Wallboard, Ceiling Board, Pre-decorated), By Application (Pre-engineered Metal Building, Residential, Industrial), By Region, And Segment Forecasts, 2023 - 2030

- Report ID: 978-1-68038-722-3

- Number of Pages: 130

- Format: Electronic (PDF)

- Historical Range: 2018 - 2021

- Industry: Advanced Materials

Report Overview

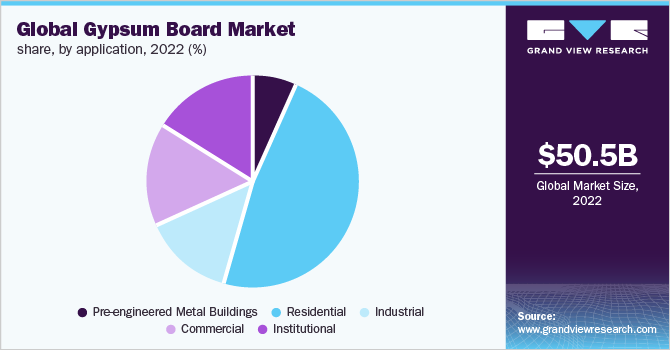

The global gypsum board market size was estimated at USD 50.47 billion in 2022 and is expected to expand at a compound annual growth rate (CAGR) of 12.2% from 2023 to 2030. Gypsum board is being widely used in the construction industry owing to its properties such as fire resistance, sound attenuation, and durability. Developed through modern technology to meet specific requirements, it is mainly used as the surface layer of interior walls and ceilings; as a base for ceramic, plastic, and metal tiles; for exterior soffits; for elevator and other shaft enclosures; as area-separation walls between building units; and to provide fire protection for structural elements. Most gypsum boards are available with an aluminum foil backing that provides an effective vapor retarder for exterior walls when the foil surface is applied against the framing. The wallboard product segment is increasingly gaining popularity and is estimated to witness strong growth over the forecast period. The increasing use of wallboard in shops, offices, and malls for walls and partitions is likely to benefit segmental growth.

The market is anticipated to be driven by increasing residential and commercial construction spending in developing regions of Asia Pacific such as China, India, and Indonesia, coupled with strong economic growth in the aforementioned regions. Developed regions such as North America and Europe are expected to witness significant growth due to the recovery of the housing sector post-recession. The U.S. is expected to remain a key market for gypsum board over the forecast period owing to increasing wallboard usage in non-load-wearing walls and suspended ceilings.

The U.S. gypsum board market is expected to witness sustainable growth during the forecast period owing to the growth in the construction sector in the country. Increased demand for energy-efficient construction solutions is one of the primary factors driving the market growth. In addition, increased incidents of natural calamities, including hurricanes and wildfires hitting different parts of the U.S., are anticipated to have a positive effect on the construction sector in the country, thereby driving the demand for gypsum board over the forecast period. However, the current coronavirus outbreak in the country has locked down manufacturing and construction activities, thus hampering the demand for gypsum boards.

Technological advances and the development of innovative production processes by major industry players have driven the gypsum board industry growth in recent years. The Plasterboard Sustainability Partnership (PSP) has formulated Gypsum Sustainability Action Plan in order to promote the improvement of the environmental performance of various gypsum board products across their lifecycle.

The players in the market are involved in the distribution of the product through direct and third-party distribution channels. Key companies in the market operate their businesses through direct sales that are carried out by the manufacturers themselves. In addition, the companies are also involved in third-party distribution, which is carried out majorly to reduce operational and logistics costs.

Product Insights

Wallboard emerged as the leading gypsum board product segment by accounting for a significant market volume of 7,724.2 million square meters in 2022. Wallboard is widely used in the construction industry for various interior applications such as walls or partitions. Increasing demand for sustainable construction in North America and Europe is expected to drive product demand over the forecast period. Wallboard also has emerged as a speedier alternative to traditional lath and plaster.

Industrialized nations such as the U.S. are primarily using gypsum for manufacturing wallboard products. However, developing countries, including the Middle East and Asia Pacific, are using most of the gypsum for the production of plaster products or cement. The rapidly growing construction industry specifically in the Asia Pacific and the Middle East owing to urbanization, rising disposable income, and increased housing demand from the burgeoning population is anticipated to boost wallboard demand in various construction projects.

Pre-decorated boards are expected to expand at the highest CAGR of 13.2% over the forecast period. Pre-decorated boards are gaining widespread acceptance in various construction projects owing to their low maintenance and easy installation properties, which makes them cost- and time-effective. These gypsum boards are widely utilized in commercial applications since they provide flexibility to changing workspace configurations, whilst offering maximum stability and color retention to surfaces.

Pre-decorated boards require special care during storage and handling inside a warehouse or other suitable structures, wherein they are not exposed to weather or extreme temperatures. Growing focus on environmentally sustainable green building construction materials, which reduce overall overhead expenses, is the key factor driving pre-decorated board industry growth.

Application Insights

Residential was the dominant application segment in the gypsum board market, with a revenue of USD 24.03 billion in 2022. The increasing urban population, coupled with increasing per capita disposable income, is anticipated to remain the key driving factor for segment growth over the forecast period. China, India, Brazil, and Saudi Arabia are anticipated to witness significant residential construction spending over the forecast period.

The most common gypsum board product utilized in residential applications is wallboard, in which the joints between the panels and internal corners are reinforced with tape and covered with joint compound to create a surface suitable for final decoration. Population expansion, coupled with rapid urban migration, is anticipated to fuel residential construction spending in countries such as China, India, and Brazil over the forecast period. The U.S. residential housing industry also witnessed a rapid growth rate in recent years owing to easy access to home mortgage loans, continued employment growth, rising demand for apartments, and a burgeoning population.

Pre-engineered metal buildings are expected to attain a CAGR of 12.4% over the forecast period. PEBs are progressing at an impressive growth rate of over 25% in India owing to their wide application scope and exceptional inherent characteristics such as easy installation, low-cost maintenance, and easy transportation to other manufacturing sites. Gypsum board is widely used in PEBs in roofing and external wall applications. It is most commonly used in industrial structures since it facilitates easy fitting in windows and doors whilst providing security. Some other properties of PEBs that make it a preferred building material in comparison with other conventional alternatives such as steel are lightweight, flexible design, economical, and easy fabrication.

Pre-engineered metal buildings are essentially rectangular boxes enclosed in a skin of corrugated metal sheeting, which are factory-built and are shipped to the site and bolted together. The concept of these building materials has largely benefitted from technological advancements in recent years, which helped in computerizing their design and producing tailor-made solutions. These high-performance materials are very popular in the U.S. market, wherein 60% of non-residential buildings are pre-engineered buildings (PEBs). However, it is a relatively new concept in emerging economies such as India.

Regional Insights

Asia Pacific gypsum board market accounted for the largest share in 2022, with a volume of 6,589.2 million square meters. The market in the region is characterized by high demand for gypsum boards in residential and corporate construction applications. A favorable business environment coupled with strong economic growth has fueled investments in the construction sector in countries such as China and India.

China is expected to witness an increased demand for gypsum boards in the forecast period owing to growing urbanization in China, which is one of the primary factors boosting the growth of the construction sector and consequently the demand for gypsum boards. China has undergone a massive urbanization process that has transformed the country over the past decade. The government implemented China’s New-Style Urbanization Plan 2014-2020 in order to manage the excessive growth in urban areas. This plan aims to provide sustainable solutions for qualitative growth in urban areas through the development of smart and green buildings. This is expected to bolster the growth of the gypsum board industry over the forecast period.

Middle East & Africa is expected to expand at the highest CAGR of 15.5% over the forecast period, owing to rapid demand in countries such as Oman, Saudi Arabia, Jordan, and Qatar. Major economies are focusing on expanding their production capabilities in order to cater to growing construction markets in the Middle East and Africa region. This trend is positively influencing gypsum board demand across the region.

The gypsum board industry has witnessed a steady growth rate in the Kingdom of Bahrain over the past few years, owing to the rapidly expanding construction industry, along with increasing product demand for internal walls and ceiling applications. Gypsum panels are the most widely utilized gypsum product across the region, and the country is dependent on imports in order to fulfill the entire demand for gypsum panels.

Key Companies & Market Share Insights

Leading players in the market are focusing on increasing production capacities and introducing gypsum boards with improved strength and durability. Moreover, the players are investing in R&D to produce boards that are specific to interior decorative applications, with the addition of design and textures. Some prominent players in the global gypsum board market include:

-

USG Zawawi Drywall LLC SFZ

-

Knauf

-

Gypsemna

-

Global Mining Company LLC (GMC)

-

Gulf Gypsum Co. (ASK Gypsum Factory Ltd.)

-

National Gypsum Company

-

Beijing New Building Material (BNBM) Public Ltd Co.

-

Extex Group

-

United Mining Industries (UMI) Company Ltd.

-

Saint-Gobain Gyproc

-

Lafarge Group

-

Ahmed Yousef & Hassan Abdulla Co. (AYHACO)

-

Yoshino Gypsum Co. Ltd.

Recent Developments

-

In June 2023, Etex announced the completion of the acquisition of Superglass. This move highlighted the expansion of the market presence of Etex in the UK and the strengthening of its position in the European insulation market, with an emphasis on providing advanced and sustainable building materials, including gypsum boards.

-

In May 2023, Etex completed the acquisition of Skamol. With the addition of Skamol to its business, Etex augmented its capabilities in delivering a broad range of insulation solutions to cater to the escalating demand for sustainable and energy-efficient building materials, including gypsum boards.

-

In June 2022, GYPSEMNA introduced a multipurpose and high-performance glass mat gypsum board. It is user-friendly and can be implemented in a diverse range of applications that require additional protection from moisture or humidity.

-

In February 2022, National Gypsum unveiled the launch of a glass mat roof board – DEXcell FA VSH. The board contains a reinforced gypsum panel with an advanced moisture-resistant gypsum core purposed to be implemented in buildings of areas that are prone to damages caused by very severe hail (VSH).

Gypsum Board Market Report Scope

Report Attribute

Details

Market size value in 2023

USD 55.91 billion

Revenue forecast in 2030

USD 127.06 billion

Growth rate

CAGR of 12.2% from 2023 to 2030

Base year for estimation

2022

Actual estimates/Historical data

2018 - 2021

Forecast period

2023 - 2030

Quantitative units

Volume in Million Square Meters and Revenue in USD million and CAGR from 2023 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, application, region

Regional scope

North America; Europe; Asia Pacific; Latin America; Middle East & Africa

Country scope

U.S.; Canada; UK; Germany; Russia; India; China; Japan; South Korea; Brazil; Mexico; Bahrain; Kuwait; Qatar; Oman; Saudi Arabia; UAE; Jordan; Iraq; Iran; Egypt; Syria; Turkey; Libya; Sudan

Key companies profiled

USG Zawawi Drywall LLC SFZ; Knauf; Gypsemna; Global Mining Company LLC (GMC); Gulf Gypsum Co. (ASK Gypsum Factory Ltd.); National Gypsum Company; Beijing New Building Material (BNBM) Public Ltd Co.; Extex Group; United Mining Industries (UMI) Company Ltd.; Saint-Gobain Gyproc; Lafarge Group; Ahmed Yousef & Hassan Abdulla Co. (AYHACO); Yoshino Gypsum Co. Ltd.

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Gypsum Board Market Segmentation

This report forecasts revenue and volume growth at global, regional & country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global gypsum board market report based on product, application, and region:

-

Product Outlook (Volume, Million Square Meters; Revenue, USD Million, 2018 - 2030)

-

Wallboard

-

Ceiling Board

-

Pre-decorated Board

-

Others

-

-

Application Outlook (Volume, Million Square Meters; Revenue, USD Million, 2018 - 2030)

-

Pre-engineered Metal Buildings

-

Residential

-

Industrial

-

Commercial

-

Institutional

-

-

Regional Outlook (Volume, Million Square Meters; Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

-

Europe

-

U.K.

-

Germany

-

Russia

-

-

Asia Pacific

-

China

-

India

-

Japan

-

South Korea

-

-

Latin America

-

Mexico

-

Brazil

-

-

Middle East & Africa

-

Bahrain

-

Kuwait

-

Qatar

-

Oman

-

Saudi Arabia

-

UAE

-

Jordan

-

Iraq

-

Iran

-

Egypt

-

Syria

-

Turkey

-

Libya

-

Sudan

-

-

Frequently Asked Questions About This Report

b. The global gypsum board market size was estimated at USD 50.47 billion in 2022 and is expected to reach USD 55.91 billion in 2023.

b. The gypsum board market is expected to grow at a compound annual growth rate of 12.2% from 2023 to 2030 to reach USD 127.06 billion by 2030.

b. Ceiling board accounted for the largest product segment on the basis of volume of 3,385.5 million square meters in 2022 as the product is increasingly replacing other conventional counterparts including plaster in ceilings and interior walls.

b. Some of the key players operating in the gypsum board market include USG Zawawi Drywall LLC SFZ, Knauf, Gypsemna, Global Mining Company LLC (GMC), Gulf Gypsum Co. (ASK Gypsum Factory Ltd.), National Gypsum Company, Beijing New Building Material (BNBM) Public Ltd Co., and Extex Group.

b. The key factors that are driving the gypsum board market includes increasing residential and commercial construction spending in developing regions such as Asia Pacific and North America coupled with strong economic growth in aforementioned regions.

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![ESOMAR Certified Member]()

![Great Place to Work Certified]()

ESOMAR & Great Work to Place Certified

![ISO 9001:2015 & 27001:2022 Certified]()

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."

Important: Covid19 pandemic market impact

The mining industry accounts for a vital share of the global economy and is responsible for supplying key raw materials for several applications and end-use industries, thus being a key sector of focus amidst the ongoing pandemic outbreak. Mining industries in China are expected to return to normal operations by Q3 of 2020 as enterprises indicated towards the returning of their workers soon. Moreover, Iron ore producers are known to be the least impacted. Major players such as BHP and Vale reported experiencing no major influence on their operations due to the COVID-19 virus. The iron ore prices reached above USD 90 per ton amidst the pandemic situation which may negatively impact the end-use industries. The report will account for Covid19 as a key market contributor.