- Home

- »

- Advanced Interior Materials

- »

-

Graphite Market Size, Share & Growth Analysis Report, 2030GVR Report cover

![Graphite Market Size, Share & Trends Report]()

Graphite Market Size, Share & Trends Analysis Report By Type (Natural, Synthetic), By Application (Electrodes, Refractories, Lubricants, Foundries, Battery Production), By Region, And Segment Forecasts, 2023 - 2030

- Report ID: GVR-4-68040-142-0

- Number of Pages: 100

- Format: Electronic (PDF)

- Historical Range: 2018 - 2021

- Industry: Advanced Materials

Graphite Market Size & Trends

The global graphite market size was estimated at USD 15.64 billion in 2022 and is expected to grow at a compounded annual growth rate (CAGR) of 6.4% from 2023 to 2030. The recent surge in demand for electric vehicles (EVs) and energy storage systems has been a significant driver for the market. Graphite is a key component in lithium-ion batteries used in EVs and renewable energy storage. Its main focus is on reducing the charging time and increasing the density of energy storage. Historically, the steelmaking industry has primarily been a driver of the industry, however, a robust rise in demand for battery production and the transition toward green energy is expected to further fuel the demand for graphite over the forecast period.

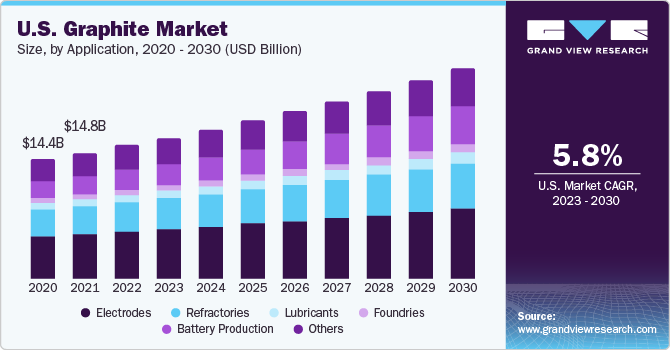

The U.S. has witnessed significant growth in the EV industry, which in turn has augmented the demand for natural and synthetic graphite. The rising focus on renewable energy and the need for efficient energy storage systems is further propelling the product demand in the country. In addition, graphite finds applications in various industrial sectors, including metallurgy, lubricants, and refractories. Growth in industrial activities and manufacturing contributes to the demand for graphite, and this trend is expected to continue over the forecast period.

Rising investments in EV facilities across the world are expected to positively influence the market growth for graphite. For instance, in May 2022, Hyundai announced that it was going to invest USD 5.5 billion to set up an EV and battery plant in Bryan County, Georgia, U.S. The company plans to begin commercial production in the first half of 2025 and expects to reach a capacity of 300,000 units per year. Electrodes are one of the largest applications in the market. For a long time, the use of graphite electrodes has been standard in electric arc furnaces for steel production. These electrodes are used for providing conductivity, and heat resistance in the steel industry.

According to the Global Wind Energy Council, 77.6 GW of new capacity was added to power grids in the year 2022, resulting in a total installed wind capacity of 906 GW. This marked a 9% growth compared to the previous year. The transition to green and sustainable technologies provides opportunities for graphite applications, especially in the development of lightweight materials for EVs and renewable energy technologies.

Type Insights

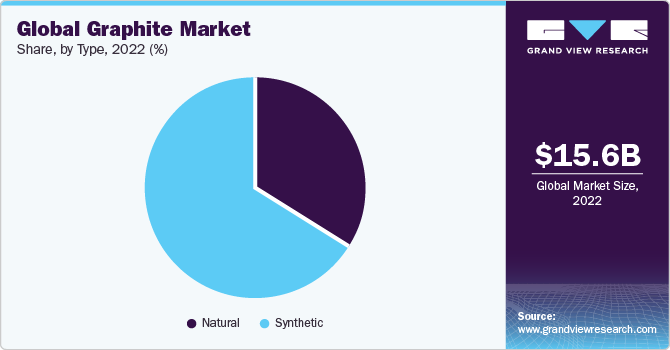

Based on type, the synthetic segment accounted for the largest revenue share, of over 61.0% in 2022, of the global market. It is produced through a complicated process involving heating petroleum coke at high temperatures to achieve carbon purity. It is largely used for manufacturing electrodes, refractories, lubricants, and for recarburizing. Natural graphite is a crystalline element extracted from mining. It has a layered structure and is obtained in an atom-like natural structure made from igneous rock, meteorites, and metamorphic rocks.

The market growth, however, faces obstruction as the graphite mining and processing industry has severe impacts on the environment, which restrains its market growth. Improper waste disposal and extraction may lead to soil and underground water contamination. Furthermore, the stringent rules & regulations, and compliance standards pertaining to graphite lead to higher costs and act as a restraining factor for the industry.

Application Insights

Based on application, electrodes accounted for the largest revenue share of over 35.0% in 2022, and this trend is anticipated to continue over the forecast period. The rise in the usage of electric arc furnaces as the world transitions toward green steel is the growth driver for the segment. Moreover, graphite is consumed in producing crucibles, molds, and ladles to pour molten metal.

The refractory industry is another key application that uses the product to withstand high temperatures in furnaces, kilns, reactors, incinerators, and linings. Refractories are primarily used in the steel industry and are made from amorphous and small flakes of natural graphite. The discovery of an alternative technology named HYBRIT, other than the traditional steelmaking technology, is a positive outlook for the industry.

The technology is expected to revolutionize the steelmaking process by increasing production and reducing the carbon footprint during the manufacturing process. As a result, Europe is propelling the growth of the steel industry toward sustainable development and thus enhancing the demand for graphite. In July 2023, the European Commission approved the development of a 2.5-million-ton DRI (Direct Reduced Iron) and 2 electric arc furnaces project by ArcelorMittal in Dunkirk, France, estimated at around EUR 850 million (USD 924.2 million).

Regional Insights

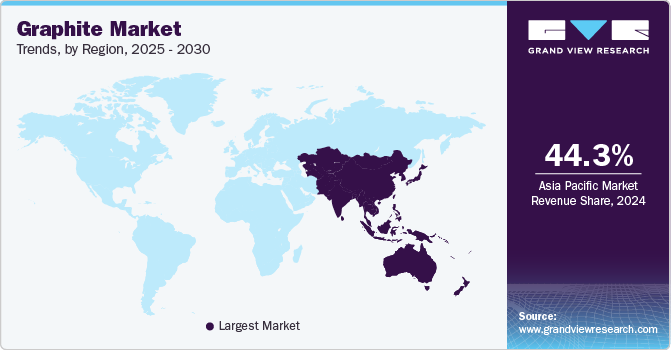

Asia Pacific dominated the global market in 2022 with a revenue share of over 60.0%. Growth in foreign investments on account of the expansion of the manufacturing sector is benefiting market growth. Further, investments in end-use industries such as electronics, automotive, and building & construction in the region are also anticipated to contribute to the increased consumption of graphite in the region over the forecast period.

As per the UNCTAD World Investment Report 2023, Asia experienced FDI inflows totaling USD 662 billion in 2022, representing nearly half of the global inflows. The concentration of these inflows was predominantly observed in five key countries: China, Singapore, Hong Kong, India, and the UAE. The upsurge in foreign direct investments across the Asia Pacific region has notably contributed to the advancement of various industries, consequently fueling increased demand for graphite in the market.

North America is another vital region for the market, in terms of both production and consumption. As a result, the market players in the region are engaged in expanding their production capacity. For instance, in October 2022, Syrah Resources announced its plan to expand its graphite plant located in Louisiana, U.S. The plan to expand the plant four-fold was announced after the grant of USD 219.8 million from the U.S. government. This is a part of the government’s total USD 2.8 billion grant to 20 different companies to help boost the production of EV batteries and components in the country.

Key Companies & Market Share Insights

The market witnesses high competitive rivalry, which compels the players to adopt strategies such as new capacity expansion, joint ventures, acquisitions & mergers, and engage in R&D activities. For instance, in September 2023, Stora Enso and Amperex Technology Ltd. along with other investors invested a sum of USD 18 million in a New Zealand-based start-up, CarbonScape. The company has patented a process to use products like wood chips to produce graphite. It will commercialize bio-graphite to be used in batteries.

Key Graphite Companies:

- AMG

- Asbury Carbons

- Eagle Graphite

- EPM Group

- GrafTech International Ltd.

- Graphite India Limited

- Imersys

- NIPPON GRAPHITE INDUSTRIES CO. LTD.

- NORTHERN GRAPHITE CORPORATION

- Qingdao Tennry Carbon Co., Ltd.

- SGL Carbon

- SHOWA DENKO K.K.

- Syrah Resources Limited

- Tokai Carbon Co., Ltd.

Graphite Market Report Scope

Report Attribute

Details

Market size value in 2023

USD 16.52 billion

Revenue forecast in 2030

USD 25.56 billion

Growth rate

CAGR of 6.4% from 2023 to 2030

Base year for estimation

2022

Historical data

2018 - 2021

Forecast period

2023 - 2030

Quantitative units

Volume in kilotons; revenue in USD million/billion, and CAGR from 2023 to 2030

Report coverage

Volume forecast, revenue forecast, competitive landscape, growth factors, and trends

Segments covered

Type, application, region

Regional scope

North America; Europe; Asia Pacific; Central & South America; Middle East & Africa

Country scope

U.S.; Canada; Mexico; Germany; UK; France; Russia; China; India; Japan; South Korea; Brazil; Saudi Arabia; South Africa

Key companies profiled

Syrah Resources Limited; AMG; Asbury Carbons; EPM Group; Eagle Graphite; Imersys; Graphite India Ltd; GrafTech International Ltd.; SGL Carbon; Tokai Carbon Co., Ltd.; Qingdao Tennry Carbon Co., Ltd.; NIPPON GRAPHITE INDUSTRIES CO. LTD.; SHOWA DENKO K.K.; NORTHERN GRAPHITE CORPORATION

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

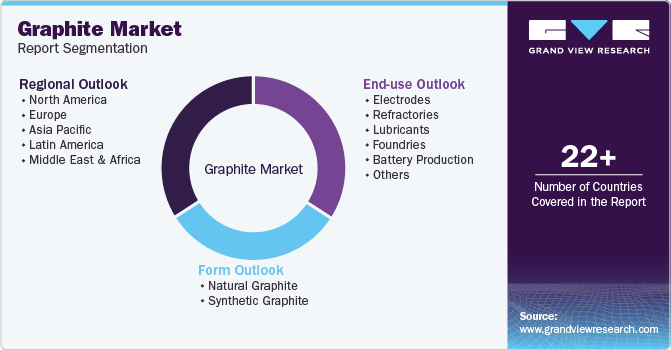

Global Graphite Market Report Segmentation

This report forecasts revenue and volume growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global graphite market report based on type, application, and region:

-

Type Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2030)

-

Natural

-

Synthetic

-

-

Application Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2030)

-

Electrodes

-

Refractories

-

Lubricants

-

Foundries

-

Battery Production

-

Others

-

-

Regional Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

Russia

-

-

Asia Pacific

-

China

-

India

-

Japan

-

South Korea

-

-

Central & South America

-

Brazil

-

-

Middle East & Africa

-

Saudi Arabia

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global graphite market size was estimated at USD 15.64 billion in 2022 and is expected to reach USD 16.52 billion in 2023.

b. The global graphite market is expected to grow at a compound annual growth rate of 6.4% from 2023 to 2030 to reach USD 25.56 billion by 2030.

b. By application, electrodes dominated the market with a revenue share of over 35.0% in 2022.

b. Some of the key vendors of the global graphite market are Syrah Resources Limited, AMG, Asbury Carbons, EPM Group, Eagle Graphite, Imersys, Graphite India Limited, GrafTech International Ltd., SGL Carbon, Tokai Carbon Co., Ltd., Qingdao Tennry Carbon Co., Ltd., NIPPON GRAPHITE INDUSTRIES CO. LTD., SHOWA DENKO K.K., and NORTHERN GRAPHITE CORPORATION.

b. The key factor driving the growth of the global graphite market is the surge in demand for electric vehicles and energy storage systems.

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![ESOMAR Certified Member]()

![Great Place to Work Certified]()

ESOMAR & Great Work to Place Certified

![ISO 9001:2015 & 27001:2022 Certified]()

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."