- Home

- »

- Advanced Interior Materials

- »

-

Graphite Electrode Market Size, Share Analysis Report, 2030GVR Report cover

![Graphite Electrode Market Size, Share & Trends Report]()

Graphite Electrode Market Size, Share & Trends Analysis Report By Grade (UHP, HP, RP), By Application (EAF, BOF, Non-steel Applications), By Region (Europe, MEA, Asia Pacific, North America), And Segment Forecasts, 2023 - 2030

- Report ID: GVR-4-68040-153-0

- Number of Pages: 120

- Format: Electronic (PDF)

- Historical Range: 2018 - 2021

- Industry: Advanced Materials

Graphite Electrode Market Size & Trends

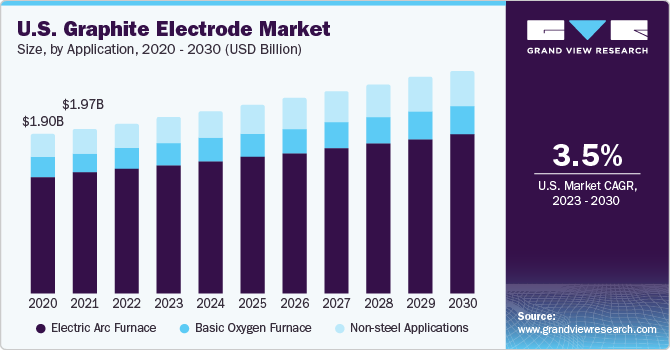

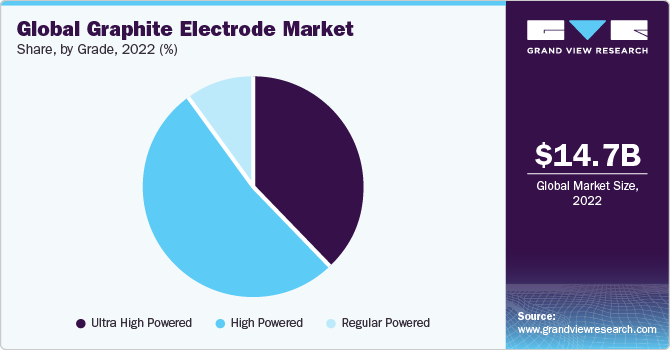

The global graphite electrode market size was estimated at USD 14.7 billion in 2022 and is expected to grow at a compound annual growth rate (CAGR) of 4.2% from 2023 to 2030. This growth can be attributed to increased demand for electric arc furnaces (EAF) in the steel industry as an environmentally friendly alternative to conventional blast furnaces. The growing adoption of electric vehicles (EVs) and renewable technologies is boosting the demand for graphite electrodes used in high-quality steel and other specialty material production. However, the market was influenced by factors, such as fluctuations in raw materials prices, trade tensions, and evolving global economic landscape. The U.S. is a key market for graphite electrodes in North America.

The increasing adoption of EAFs for steel production, driven by their environmental advantages and cost-efficiency, was fostering the demand for graphite electrodes. As steelmakers pursue more ecologically friendly methods of producing steel, the demand for graphite electrodes is expected to increase substantially. Furthermore, the steel sector in the U.S. is responding to the demand for specialty and high-quality steel products, such as those used in electric vehicles and renewable energy infrastructure.

This, in turn, drives the product demand supporting market growth. Such global factors influence the market, and its growth is highly related to the overall performance of the steel sector and the broader economy. Key manufacturers have partnerships with merchants and distributors to ensure timely supply. Strategic partnerships, as well as collaborations, are some of the strategies adopted by major manufacturers to gain competitive advantages.

Application Insights

Based on application, the EAF segment accounted for the largest revenue share of 73.03% in 2022. The increasing use of EAFs in steel production, due to their lower environmental impact compared to other production processes, is driving the segment growth. Furthermore, stringent environmental regulations have encouraged the adoption of EAFs. This regulatory push will drive product demand in EAF applications. The EAF steelmaking using graphite electrodes can be significantly less expensive than standard blast furnaces. It makes scrap steel the principal raw material, minimizing the requirement for iron and coke. This can lead to cost savings and reduced capital expenditure in steel manufacturing facilities.

A rise in demand from the steel industry due to the environmentally friendly option is considerably driving the global market growth. Continuous research has improved electrode quality, reduced consumption rates, and extended electrode lifespan, due to growing technological innovation. As a result, steelmakers' operational costs are reduced. However, price variations in critical raw materials, such as needle coke, have injected an element of unpredictability into the industry. Environmental regulations and sustainability concerns are pushing for clearer technologies, further boosting EAF usage. Integration of digital technologies, such as sensors and data analytics, into EAF, has created a rise in demand, thereby driving global market growth.

Grade Insights

Based on grade, the high-powered (HP) segment accounted for the largest revenue share of 52.4% in 2022. High-power electrodes are critical, especially in applications that require enhanced current-carrying capability and endurance. As global steel demand grows, EAFs are becoming more popular because of their efficiency and environmental benefits, increasing the demand for high-powered electrodes. Furthermore, they are intended to improve energy efficiency, lowering total operational expenses. The incorporation of digital technology, sensors, and data analytics into EAF processes improves electrode efficiency and decreases wear and tear, potentially increasing electrode lifespan.

As a result, high-powered electrodes are critical for modern steel production and are driven by factors, such as steel demand, energy efficiency, technological improvements, and environmental concerns, making it an important component in the worldwide steel and industrial industries. The adoption of HP electrodes as an environmentally friendly alternative to traditional methods is also projected to drive segment growth. However, in many applications, it is being replaced with Ultra-high powered (UHP) graphite electrodes, resulting in a somewhat flat growth rate. UHP graphite electrodes can endure high temperatures, corrosive slag, and molten metal within an EAF or basic oxygen furnace (BOF).

They can also carry the enormous electrical currents required to heat & agitate the liquid steel. It is a popular choice among steel producers. The UHP grade segment is expected to grow at a rapid pace due to rising demand for high-performance steel and increased use of EAFs in the steel sector. Regular-powered (RP) types are favored for their balanced performance and cost-effectiveness, making them indispensable in several industries. They are widely used in applications, such as conventional welding, metal fabrication, and various industrial processes, where moderate heat and electrical currents are required.

Regional Insights

Asia Pacific regional market size was estimated at USD 6,730 million in 2022. The region's growth can be linked to economic expansion, rising energy prices, and higher manufacturing production. Moreover, well-established steel and aluminum industries are driving market growth. China is a major product buyer in Asia Pacific, followed by India and Japan. Furthermore, rapid urbanization and industrialization have resulted in a rise in construction activities, driving overall market demand in this region. Growing environmental consciousness has resulted in a preference for eco-friendly materials over the old approach of employing petroleum-derived coke.

North America is expected to register a CAGR of around 3.5% from 2023 to 2030. The region's steel industry is experiencing technological advancements, with a focus on sustainability, which has led to a rise in demand for sustainable methods for steel manufacturing and, eventually, an increased market demand. Construction practices in this region are prioritizing sustainable and environmentally friendly methods for steel production to align with climate goals. The demand has been steadily increasing across North America and is expected to grow at a significant pace from 2023 to 2030.

Key Companies & Market Share Insights

The market exhibits high competition owing to the presence of established players. Key companies opt for various strategies, such as partnerships and collaborations, to gain higher market share. Companies also engage in R&D to increase the usage of sustainable materials to manufacture graphite electrodes, resulting in high competition and creating barriers to the entry of new players. A few major manufacturers, such as GrafTech International, Showa Denko, and Graphite India, are increasing their spending in R&D to enhance the efficiency and quality of graphite.

Key Graphite Electrode Companies:

- GrafTech International

- Zhongze Group

- Dan Carbon

- Showa Denko

- Tokai Carbon

- Graphite India

- Resonac Holdings Corporation

- Fangda Carbon New Material Co., Ltd.

- Sangraf International

- SEC Carbon, Ltd.

- Nippon Carbon.

Graphite Electrode Market Report Scope

Report Attribute

Details

Market size value in 2023

USD 15.09 billion

Revenue forecast in 2030

USD 20.13 billion

Growth rate

CAGR of 4.2% from 2023 to 2030

Base year for estimation

2022

Historical data

2018 - 2021

Forecast period

2023 - 2030

Report upated

November 2023

Quantitative units

Volume in kilotons, revenue in USD million/billion, and CAGR from 2023 to 2030

Report coverage

Revenue and volume forecast, competitive landscape, growth factors, and trends

Segments covered

Grade, application, region

Regional scope

North America; Europe; Asia Pacific; Central & South America; Middle East & Africa

Country scope

U.S.; Canada; Mexico; Germany; UK; France; Italy; Spain; China; India; Japan; South Korea; Australia

Key companies profiled

GrafTech International; ZHONGZE GROUP; Dan Carbon; Showa Denko; Tokai Carbon; Graphite India; Resonac Holdings Corp.; Fangda Carbon New Material Co., Ltd; Sangraf International; SEC Carbon, Ltd.; Nippon Carbon

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Graphite Electrode Market Report Segmentation

This report forecasts revenue and volume growth at the global, regional, and country levels and provides an analysis of the latest trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global graphite electrode market report based on grade, application, and region:

-

Grade Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2030)

-

Ultra High Powered (UHP)

-

High Powered (HP)

-

Regular Powered (RP)

-

-

Application Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2030)

-

Electric Arc Furnace (EAF)

-

Basic Oxygen Furnace (BOF)

-

Non-steel Application

-

-

Regional Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

Italy

-

Spain

-

-

Asia Pacific

-

China

-

India

-

Japan

-

South Korea

-

Australia

-

-

Central & South America

-

Middle East & Africa

-

Frequently Asked Questions About This Report

b. The global graphite electrode market size was estimated at USD 14.7 billion in 2022 and is expected to reach USD 15.09 billion in 2023.

b. The global graphite electrode market is expected to grow at a compound annual growth rate, a CAGR of 4.2% from 2023 to 2030, to reach USD 20.13 billion by 2030.

b. The Electric Arc Furnace segment of the graphite electrode market accounted for the largest revenue share of 43.80% in 2022.

b. Some key players operating in the graphite electrodes market include GrafTech International, Zhongze Group, Dan Carbon, Showa Denko, Tokai Carbon, Graphite India, Resonac Holdings Corporation, Fangda Carbon New Material Co., Ltd, Sangraf International, SEC Carbon, Ltd, Nippon Carbon.

b. Key factors that are driving the market growth include the rising demand of graphite electrode from steel industry and increasing awareness regarding the use of environmentally-friendly method for the production of steel across the globe.

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![ESOMAR Certified Member]()

![Great Place to Work Certified]()

ESOMAR & Great Work to Place Certified

![ISO 9001:2015 & 27001:2022 Certified]()

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."