- Home

- »

- Consumer F&B

- »

-

Gluten-free Baking Mixes Market Size Report, 2021-2028GVR Report cover

![Gluten-free Baking Mixes Market Size, Share & Trends Report]()

Gluten-free Baking Mixes Market Size, Share & Trends Analysis Report By Product (Cakes & Pastries, Cookies), By Distribution Channel (Grocery Stores, Club Stores), By Region (North America, APAC), And Segment Forecasts, 2021 - 2028

- Report ID: GVR-4-68039-430-4

- Number of Pages: 96

- Format: Electronic (PDF)

- Historical Range: 2016 - 2019

- Industry: Consumer Goods

Report Overview

The global gluten-free baking mixes market size was valued at USD 391.1 million in 2020 and is expected to grow at a compound annual growth rate (CAGR) of 7.5% from 2021 to 2028. The increasing prevalence of celiac disease, non-celiac gluten sensitivity, and rising demand for convenient healthy food items are anticipated to drive the demand for the product over the forecast period. The COVID-19 pandemic had a positive impact on the product demand as home-baking activities increased significantly during the lockdown period. Google searches for baking tips and bread recipes have been soaring all over the world since the start of the pandemic, as people sought to learn new skills and take up different activities to stay busy. The work-from-home trend, along with the severe restriction of stay-home policy, has been encouraging consumers to indulge in cooking practices at home.

Bakery products are mainly prepared using wheat; however, the high quantity of gluten in the grain has been limiting its utilization. Wheat is, therefore, being replaced with various grains and pulses like quinoa, oats, amaranth, teff, corn, brown rice, buckwheat, and sorghum. The mixes are available for various bakery products-including bread, muffins, pizzas, donuts, and cakes.

Countries including the U.S., Germany, and the U.K. are the major consumers of bakery products in the world. The increasing prevalence of celiac disease and Irritable Bowel Syndrome (IBS) in these countries is the primary factor fueling the demand for gluten-free products. For instance, according to the American College of Gastroenterology, in 2019, around 10 to 15% of the adult population in the U.S. had IBS.

Lately, many health-conscious people, who do not suffer from celiac disease, gluten intolerance, or gluten sensitivity, are also making a sensible effort to avoid gluten-containing foods. Thus, the rising consumption of bakery foods worldwide coupled with high health consciousness, especially among millennials and Gen Z, is driving the market.

With the growing demand for gluten-free foods, key brands offering baking mixes are using a progressive approach to keep up with the current trends. Companies have been increasingly expanding their consumer base by extending their geographical reach. For instance, in June 2020, Aldi Stores Ltd. announced the testing of its own LiveGfree brand’s gluten-free products at different locations across the U.S.

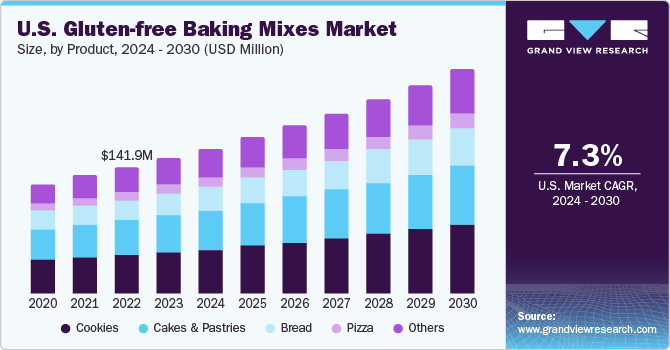

Product Insights

The cookies product segment accounted for the largest revenue share of over 32% in 2020 and is anticipated to maintain its dominance over the forecast period. The rising popularity of cookies among toddlers, children, and millennials as a snack is the major factor driving the growth of this segment. Furthermore, cookies are also gaining traction as a gifting option during celebrations and festivals, such as Christmas, New Year, and Thanksgiving, favoring the segment growth. Major players are launching new products to fulfill the rising product demand. For instance, recently, Nabisco, a subsidiary company of Mondelez International, launched two varieties of gluten-free cookies under the Oreo brand in the U.S.

The bread segment is expected to grow at a substantial CAGR over the forecast period. Bread is a widely consumed bakery product; however, the rising trend of low-carbohydrate diets has affected the product demand. Thus, manufacturers are launching gluten-free bread mixes in the market. For instance, in September 2019, Promise Gluten Free launched a new range of gluten-free sourdough bread for the U.S. market. Such new product launches are anticipated to drive the demand for gluten-free bread mixes over the forecast period.

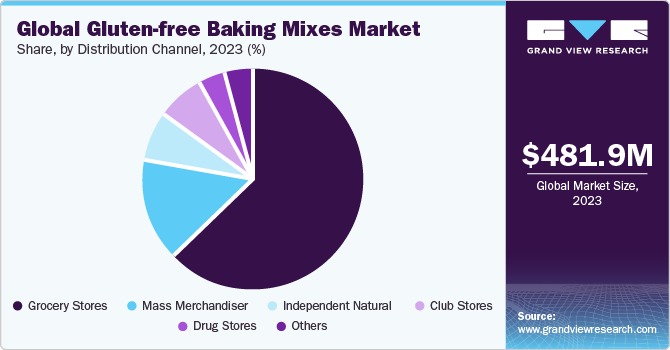

Distribution Channel Insights

The grocery stores segment accounted for the largest revenue share of more than 63% in 2020. The segment is estimated to retain its leading position throughout the forecast period due to the presence of several grocery stores across all big and small economies. Over the past few years, major players have been focusing on expanding their footprint globally by opening up new stores. For instance, in September 2020, Wm Morrison Supermarkets plc, one of the leading supermarkets in the U.K., announced that it would hire thousands of more permanent staff as the company expands its online delivery service. These market trends are increasing product sales through grocery stores sales channel.

The others segment that includes e-commerce platforms and online portals is expected to ascend at the fastest CAGR over the forecast period. Over the past few years, players in the FMCG industry have realized the potential of e-commerce and hence host their shopping websites to better cater to their customers’ needs and earn a higher profit margin.

Third-party sellers offer a wide range of products, manufactured by both major companies and local producers. These sellers are successful since they establish a strong supply chain that extends beyond geographical borders. Thus, when customers want to buy products from international brands, which might not be available in a certain country, third-party suppliers are the ideal option.

Regional Insights

North America accounted for the largest revenue share of more than 40% in 2020 and is expected to continue its dominance over the forecast period. The U.S. accounted for the largest revenue share in the North America regional market owing to rising consumer willingness to try new variants of food, such as gluten-free, vegan, and sugar-free. The high prevalence of celiac disease in the U.S. and growing awareness regarding the possible side effects of gluten on one’s health are also expected to bode well for the market over the forecast period.

Asia Pacific is anticipated to gain limelight owing to the rising demand for healthy food items and the increasing adoption of a healthy lifestyle among consumers in China, Australia, Japan, and India. Moreover, a rise in the cases of allergic diseases and other gluten-related diseases is propelling the product demand, thereby boosting the regional market growth. The rising consumer awareness about the consequences of gluten consumption will also augment the product demand. Furthermore, the increasing popularity of western food items, such as pizzas, burgers, sandwiches, and hamburgers, is estimated to fuel the regional demand.

Key Companies & Market Share Insights

Key companies are engaging in partnerships, collaborations, product expansions, online marketing, and product differentiations to maintain their position in the highly competitive market. For instance, in June 2020, SalDoce Fine Foods launched its products on eBay and Amazon Australia through its brand YesYouCan. A lot of emerging players are focusing on quality and innovation to capture a larger market share. Some of the key players in the global gluten-free baking mixes market include:

-

General Mills, Inc.

-

Conagra Brands, Inc.

-

Kinnikinnick Foods, Inc.

-

Williams-Sonoma, Inc.

-

Continental Mills, Inc.

-

Partake Foods

-

Chebe

-

Naturpro

-

King Arthur Baking Company, Inc.

-

SalDoce Fine Foods

Gluten-free Baking Mixes Market Report Scope

Report Attribute

Details

Market size value in 2021

USD 418.5 million

Revenue forecast in 2028

USD 698.2 million

Growth Rate

CAGR of 7.5% from 2021 to 2028

Base year for estimation

2020

Actual estimates/Historical data

2016 - 2019

Forecast period

2021 - 2028

Quantitative units

Revenue in USD thousand/million and CAGR from 2021 to 2028

Report coverage

Revenue forecast, company share, competitive landscape, growth factors, and trends

Segments covered

Product, distribution channel, region

Regional scope

North America; Europe; Asia Pacific; Central & South America; Middle East & Africa

Country scope

U.S.; Canada; Mexico; U.K.; Germany; France; Italy; Australia; China; India; New Zealand; Brazil; South Africa

Key companies profiled

General Mills, Inc.; Conagra Brands, Inc.; Kinnikinnick Foods, Inc.; Williams-Sonoma, Inc.; Continental Mills, Inc.; Partake Foods; Chebe; Naturpro; King Arthur Baking Company, Inc.; SalDoce Fine Foods

Customization scope

Free report customization (equivalent to up to 8 analyst working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Segments Covered in the ReportThis report forecasts revenue growth at the global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2016 to 2028. For the purpose of this study, Grand View Research has segmented the global gluten-free baking mixes market report on the basis of product, distribution channel, and region:

-

Product Outlook (Revenue, USD Million, 2016 - 2028)

-

Cookies

-

Cakes & Pastries

-

Bread

-

Pizza

-

Others

-

-

Distribution Channel Outlook (Revenue, USD Million, 2016 - 2028)

-

Grocery Stores

-

Mass Merchandiser

-

Independent Natural or Health Food Store

-

Club Stores

-

Drug Stores

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2016 - 2028)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

U.K.

-

Germany

-

France

-

Italy

-

-

Asia Pacific

-

Australia

-

China

-

India

-

New Zealand

-

-

Central & South America (CSA)

-

Brazil

-

-

Middle East & Africa (MEA)

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global gluten-free baking mixes market size was estimated at USD 391.1 million in 2020 and is expected to reach USD 418.5 million in 2021.

b. The global gluten-free baking mixes market is expected to grow at a compound annual growth rate of 7.5% from 2021 to 2028 to reach USD 698.2 million by 2028.

b. North America accounted for the largest revenue share of more than 40% in 2020 and is expected to continue its dominance over the forecast period in the gluten-free baking mixes market share.

b. Some key players operating in the gluten-free baking mixes market include General Mills Inc.; Conagra Brands, Inc.; Kinnikinnick Foods Inc.; Williams-Sonoma Inc.; Continental Mills, Inc.; Partake Foods; Chebe; Naturpro; King Arthur Baking Company, Inc.; and SalDolce Fine Foods.

b. The cookies product segment accounted for the largest revenue share of over 32% in 2020 and is anticipated to maintain its dominance over the forecast period in the gluten-free baking mixes market.

b. The grocery stores segment accounted for the largest revenue share of more than 63% in 2020 in the gluten-free baking mixes market.

b. Key factors that are driving the gluten-free baking mixes market growth include the increasing prevalence of celiac disease, non-celiac gluten sensitivity, and rising demand for convenient healthy food items.

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![ESOMAR Certified Member]()

![Great Place to Work Certified]()

ESOMAR & Great Work to Place Certified

![ISO 9001:2015 & 27001:2022 Certified]()

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."