- Home

- »

- Advanced Interior Materials

- »

-

Welding Products Market Size & Share Report, 2030GVR Report cover

![Welding Products Market Size, Share & Trends Report]()

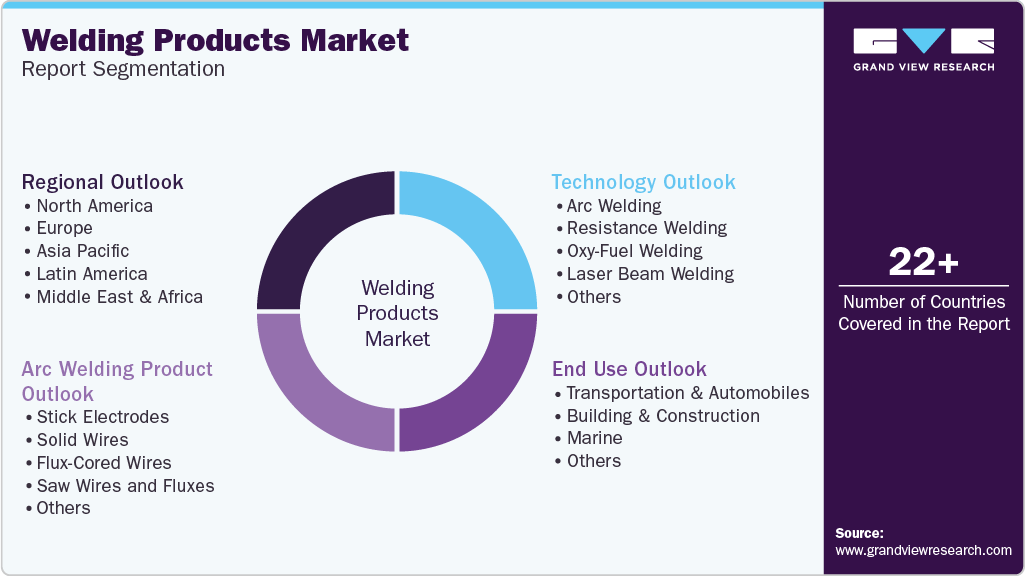

Welding Products Market Size, Share & Trends Analysis Report By Technology, By Product (Stick Electrodes, Solid Wires, Flux-cored Wires, Saw Wires, and Fluxes, Others), By Region, And Segment Forecasts, 2022 - 2030

- Report ID: GVR-2-68038-856-5

- Number of Pages: 198

- Format: Electronic (PDF)

- Historical Range: 2017 - 2020

- Industry: Advanced Materials

Report Overview

The global welding products market size was estimated at USD 13.49 billion in 2021 and is expected to expand at a compounded annual growth rate (CAGR) of 4.4% from 2022 to 2030. Factors such as design flexibility, reduction in the overall weight of the buildings and structures, and the ease in modification are projected to promote the use of welding products in construction and industrial application segments. The global construction sector is undergoing limited growth as a consequence of the economic recession caused by the Covid-19 crisis, which has resulted in low investor confidence and a decline in construction activities, as a result, the market has also experienced a catastrophic setback.

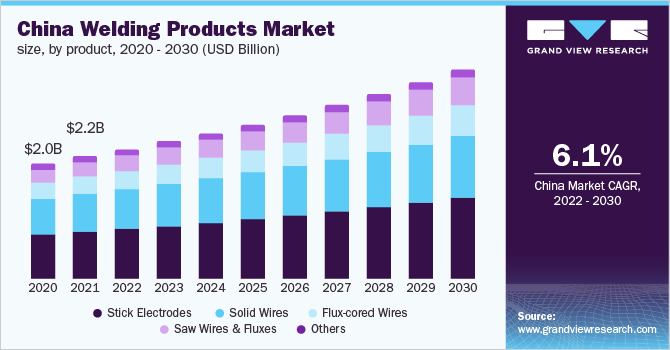

The spread of the COVID-19 in China affected the growth of the engineering and construction industries. The increasing costs of construction materials and equipment, along with supply chain disruptions, are the major factors limiting the growth of this industry. However, the use of aerial measurement and 3D modeling technologies increased during the pandemic, which supported the market growth. The construction sector in China is expected to witness high growth over the forecast period, which, in turn, is predicted to drive the market in the economy. With a wide range of welding applications in construction coupled with technological advancements, the development of innovative manufacturing methods is likely to benefit the market growth.

According to the China Association of Automobile Manufacturers (CAAM), in 2020, the automotive sector contributed 9.6% of the total retail sales of consumer goods. The government and several major automobile companies are increasingly investing in the country owing to the growing demand for vehicles.

Technology Insights

The resistance welding technology segment led the market and accounted for more than 27.4% share of the global revenue in 2021. The growing use of resistance welding technology in the automotive industry for various processes such as spot welding, projection welding, and seam welding is likely to promote segmental growth over the forecast period.

Continuous innovations in arc welding technology, such as robotic arc welding, by the key market players, are one of the key factors driving the arc welding market across the globe. The technology is used to weld metals in a wide range of thicknesses with good flexibility. The growing use of the technology across various applications is projected to drive market growth.

Oxy-fuel welding technology is gaining significant growth on account of its growing use in industrial manufacturing applications. The welding equipment and products used in this technology are highly cost-efficient which promotes its implementation in welding fillet, butt, and lap joints with the object thickness up to 5mm.

Other welding technologies include electron beam welding, induction welding, flow welding, electro-slag welding, and laser hybrid welding. These technologies are employed in various applications such as heavy plate fabrication, shipbuilding, switchgear devices, railway tracks, and storage tanks among others.

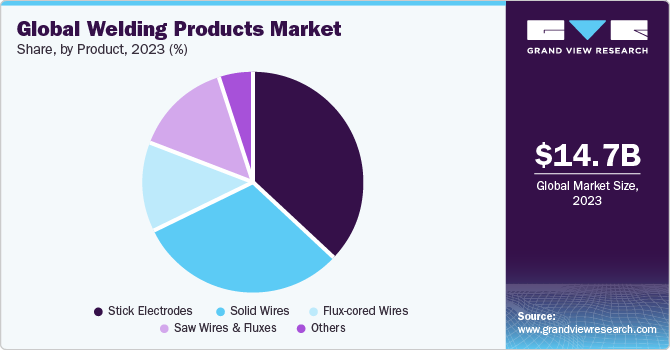

Product Insights

The stick electrodes product segment led the market and accounted for more than 37.0% share of the global revenue in 2021. The demand for stick electrodes for the welding of a wide range of components is witnessing growth in various application areas on account of their ability to increase the welding strength as well as their high corrosion resistance & tensile strength. The solid wire product segment is projected to register a CAGR of 4.0% in terms of revenue over the forecast period. The flexibility and ruggedness of solid wires are properties that increase their utility in application areas such as house electrical wiring and breadboards that require flexible wires.

Saw wired fluxes react with the weld pool to provide high-quality metals with desired properties. This promotes its utilization in applications such as exploration platforms, pressure vessels, fabrication of offshore drilling platforms, and post-weld heat treatment. The growing use of saw wire fluxes in the construction of the aforementioned applications is likely to fuel the segment growth. Other welding products such as stainless-steel alloys, MIG wires, metal-cored wires, aluminum MIG, TIG, and thermal spray wires are contributing significantly to the growth of the market. These products are extensively utilized on account of their unique mechanical properties and cost-efficiency.

Regional Insights

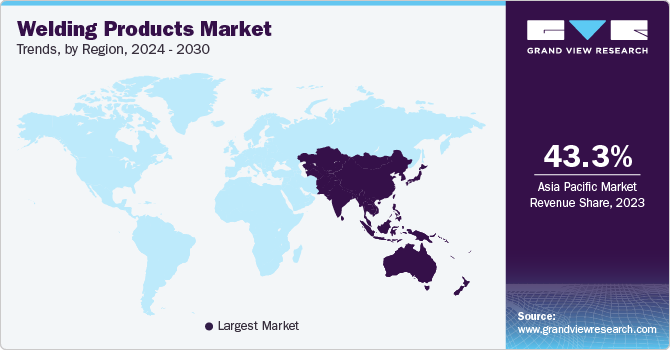

Asia Pacific region led the market and accounted for over 42.49% share of global revenue in 2021. The expansion of residential, commercial, and industrial sectors due to the sustainable economic growth of countries in the region is expected to fuel construction activities, thereby driving the demand for welding products. The market in the Asia Pacific is expected to exhibit the highest growth for the welding products market on account of the rapid expansion of the automotive industry on account of the highest automobile production. The region is expected to benefit from the presence of rapidly growing economies such as China, India, Indonesia, and Japan.

European countries are initiating efforts to balance their economic trade, which is expected to boost the maritime activities in the region. In addition, the rising tourism sector is also expected to drive demand for recreational marine products, thereby driving the growth of shipbuilding activities in the region. This in turn is likely to augment the growth of welding operations.

The increasing demand for electric cars and hybrid cars on account of shifting consumer preferences towards affordable energy-efficient plug-in cars such as Nissan-leaf, Toyota Prius PHV, and others is expected to drive the automotive industry, which in turn is expected to benefit the market for welding products over the forecast period.

Key Companies & Market Share Insights

The global market is characterized by the presence of various small- and large-scale vendors, resulting in a moderate level of concentration in the market. The surging requirement for reliable and precise welding solutions is fueling the growth of the market. Key manufacturers of welding products in the market are focusing on offering suitable and innovative welding products that are rigid and durable. A large number of roofing product manufacturers are focused on backward integration in order to keep the product quality under control. The industry participants emphasize expanding their product portfolio by developing innovative solutions and cheaper products with superior properties to cater to the increasing consumer demand. Some prominent players in the global welding products market include:

-

Colfax Corporation

-

Veostalpine AG

-

The Lincoln Electric Company

-

Illinois Tool Works, Inc.

-

Hyundai Welding Co., Ltd.

-

Obara Corporation

-

Kiswel, Inc.

-

Sandvik AB

-

Tianjin Bridge Welding Materials Co., Ltd.

-

Kemppi Oy

-

Mitco Weld Products Pvt. Ltd.

-

Senor Metals Pvt. Ltd.

-

Metrode Products Ltd.

-

Ador Welding Limited

Recent Developments

-

In April 2023, Kemppi announced the launch of its all-new robotic welding solution – the AX MIG Welder. The welder features an easy-to-use interface, seamless integration, and cutting-edge welding technology to perform challenging tasks and cater to critical production targets.

-

In March 2023, Kemppi introduced new portable welding machines – Master M 205 and Master M 323, for MIG/MAG welding. The latest equipment series is ideal for industrial welding in shipyards and repair shops, as well as for passionate hobby welders. The latest equipment series is ideal for industrial welding in shipyards & repair shops, as well as for passionate hobby welders.

-

In October 2022, Lincoln Electric expanded its Power MIG portfolio of welding machines with the launch of the POWER MIG 211i MIG welder. This new welder is a reliable 200-amp equipment – for MIG, spool gun, and flux-cored welding designed for applications including the farm, the small shop, maintenance & repair work, and more.

-

In June 2022, Lincoln Electric unveiled the launch of the new POWER MIG 215 MPi multi-process welder. The welder is a lightweight ergonomically designed machine with dual-input voltage delivering a broad range of capabilities.

-

In October 2021, Kiswel, in a strategic collaboration with POSCO, announced a successful localization effort resulting in the development of domestic welding material for 9% nickel steel used in onshore LNG storage tanks. With plans to widen applications in both domestic and overseas LNG-focused projects, as well as to enter the offshore storage tank industry, this strategic initiative represented a prominent innovation in the welding products market.

Welding Products Market Report Scope

Report Attribute

Details

Market size value in 2022

USD 14.13 billion

Revenue forecast in 2030

USD 19.94 billion

Growth Rate

CAGR of 4.4% from 2022 to 2030

Base year for estimation

2021

Historical data

2017 - 2020

Forecast period

2022 - 2030

Quantitative units

Revenue in USD Billion and CAGR from 2022 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Technology, product, region

Regional scope

North America; Europe; Asia Pacific; Central & South America; Middle East & Africa

Country scope

U.S.; Canada; Mexico; U.K.; Germany; France; China; Japan; India; Australia; Brazil; Saudi Arabia; South Africa

Key companies profiled

Colfax Corporation; Veostalpine AG; The Lincoln Electric Company; Illinois Tool Works, Inc.; Hyundai Welding Co., Ltd.; Obara Corporation, Kiswel, Inc.; Sandvik AB; Tianjin Bridge Welding Materials Co., Ltd.; Kemppi Oy; Mitco Weld Products Pvt. Ltd.; Senor Metals Pvt. Ltd.; Metrode Products Ltd. & Ador Welding Limited

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Segments covered in the reportThis report forecasts revenue growth at global, regional & country levels and provides an analysis of the industry trends in each of the sub-segments from 2017 to 2030. For this study, Grand View Research has segmented the welding products market report based on technology, product, and region:

-

Technology Outlook (Revenue, USD Million, 2017 - 2030)

-

Arc Welding

-

Resistance Welding

-

Oxy-Fuel Welding

-

Laser Beam Welding

-

Others

-

-

Product Outlook (Revenue, USD Million, 2017 - 2030)

-

Stick Electrodes

-

Solid Wires

-

Flux-Cored Wires

-

Saw Wires and Fluxes

-

Others

-

-

Regional Outlook (Volume, Billion Square Feet, Revenue, USD Billion, 2017 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

United Kingdom

-

France

-

-

Asia Pacific

-

China

-

India

-

Japan

-

Australia

-

-

Central & South America

-

Brazil

-

-

Middle East & Africa

-

Saudi Arabia

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global welding products market size was estimated at USD 13.49 billion in 2021 and is expected to reach USD 14.13 billion in 2022.

b. The welding products market is expected to grow at a compound annual growth rate of 4.4% from 2022 to 2030 to reach USD 19.94 billion by 2030.

b. Stick electrodes product segment dominated the market and accounted for more than 37.0% share of the global revenue in 2021. Stick electrodes are widely employed in arc welding owing to their beneficial properties such as corrosion resistance, high tensile strength, and ductility.

b. Some of the key players operating in the welding products market include Colfax Corporation, Veostalpine AG, The Lincoln Electric Company, Illinois Tool Works, Inc., Hyundai Welding Co., Ltd., Obara Corporation, Kiswel, Inc., Sandvik AB, Tianjin Bridge Welding Materials Co., Ltd., Kemppi Oy, Mitco Weld Products Pvt. Ltd., Senor Metals Pvt. Ltd., Metrode Products Ltd. & Ador Welding Limited.

b. The key factors driving the welding products market include rapid expansion of construction industry across the globe owing to the rising demand for residential and non-residential construction across economies such as India, China, and Indonesia, is projected to propel the industry growth.

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![ESOMAR Certified Member]()

![Great Place to Work Certified]()

ESOMAR & Great Work to Place Certified

![ISO 9001:2015 & 27001:2022 Certified]()

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."

Important: Covid19 pandemic market impact

The mining industry accounts for a vital share of the global economy and is responsible for supplying key raw materials for several applications and end-use industries, thus being a key sector of focus amidst the ongoing pandemic outbreak. Mining industries in China are expected to return to normal operations by Q3 of 2020 as enterprises indicated towards the returning of their workers soon. Moreover, Iron ore producers are known to be the least impacted. Major players such as BHP and Vale reported experiencing no major influence on their operations due to the COVID-19 virus. The iron ore prices reached above USD 90 per ton amidst the pandemic situation which may negatively impact the end-use industries. The report will account for COVID-19 as a key market contributor.