- Home

- »

- Biotechnology

- »

-

Antisense & RNAi Therapeutics Market Size Report, 2030GVR Report cover

![Antisense & RNAi Therapeutics Market Size, Share & Trends Report]()

Antisense & RNAi Therapeutics Market Size, Share & Trends Analysis Report By Technology, By Application, By Route Of Administration, By Region, And Segment Forecasts, 2023 - 2030

- Report ID: 978-1-68038-805-3

- Number of Pages: 130

- Format: Electronic (PDF)

- Historical Range: 2018 - 2021

- Industry: Healthcare

Report Overview

The global antisense & RNAi therapeutics market size was valued at USD 3.79 billion in 2022 and is expected to register at a compound annual growth rate (CAGR) of 18.06% from 2023 to 2030. Antisense technology is useful for gene expression manipulation, which has been recognized as a successful treatment for a number of medical conditions. Companies are capitalizing on antisense & RNAi technologies by focusing on advancements in this field. For instance, in April 2020, Alnylam Pharmaceuticals, Inc. partnered with Blackstone; under this collaboration, Blackstone invested USD 2 billion to accelerate the advancement of RNAi therapeutics.

Antisense and RNAi therapies for rare diseases have shown improved therapeutic outcomes. For instance, Antisense Oligonucleotides (ASOs) have already been approved to treat rare neurological diseases such as Duchenne muscular dystrophy (DMD) and spinal muscular atrophy (SMA). Thus, it is expected to witness growth in the coming years. Moreover, increasing R&D funding and a robust product pipeline are expected to contribute to the market's expansion. For instance, in January 2023, Agilent invested USD 725 million to expand manufacturing capacity to produce nucleic acid-based therapeutics, including antisense therapies.

There are very few treatment options available for rare diseases globally. As a result, funding and research projects focused on the development of novel treatments for rare conditions have gradually increased. Companies are undertaking various research activities to discover the treatment for rare diseases. For instance, in April 2021, IonisPharmaceuticals, Inc. initiated a clinical study on innovative antisense medicine to treat patients suffering from Alexander disease.

Furthermore COVID-19 pandemic has impacted the antisense and RNAi therapeutics market significantly. Researchers were undertaking various efforts to investigate effective therapeutic approaches for COVID-19 treatment. Numerous nucleic acid‐based technologies, including antisense oligonucleotides, aptamers, short interfering RNAs, DNAzymes, and ribozymes, have been recommended to control SARS‐CoV‐2.Moreover, the companies operating in the industry focused on RNAi and antisense therapies to treat the COVID-19 pandemic. For instance, in March 2020, Alnylam Pharmaceuticals, Inc. and Vir Biotechnology, Inc. expanded their partnership to commercialize and develop RNAi therapeutics targeting SARS-CoV-2, the virus that causes COVID-19.

In addition, several studies were published focusing on antisense oligonucleotide and RNAi therapeutics as promising therapies for treating COVID-19 infections. For instance, a study by the Cambridge University Press published in September 2020 indicated that antisense therapy could be an innovative approach to treating the COVID-19 pandemic by targeting SARS-CoV-2 genomic RNA directly. Furthermore, in February 2023, PLOS ONE published a research article focusing on antisense oligonucleotides to therapeutically target SARS-CoV-2 infection. Such articles and studies help researchers in their research activities related to antisense and RNAi technologies. Thus, the increasing focus on these therapeutic approaches are anticipated to propel the market growth over the forecast period.

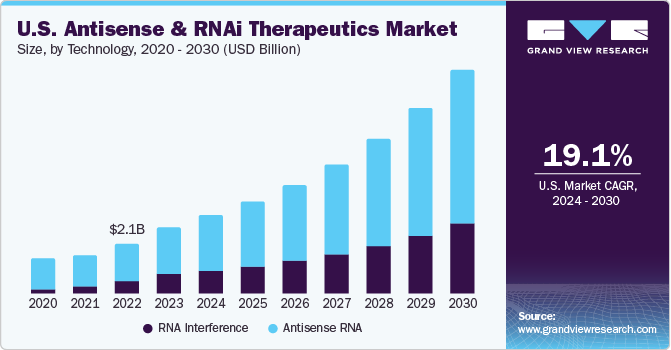

Technology Insights

The antisense RNA segment accounted for the largest revenue share of around 70% in 2022. The antisense RNA has dominated the segment in terms of revenue generation. These molecules are being tested to control various conditions. This technology is used for the regulation of protein expression and gene expression. Furthermore, the wide application of this technology in various areas like cardiovascular, respiratory, neurodegenerative, and genetic disorders is anticipated to boost the segment growth. For instance, in December 2021, the UMass Chan Medical School clinical trial indicated that antisense oligonucleotide safely suppresses the mutant amyotrophic lateral sclerosis (ALS) gene.

On the other hand, RNA Interference technology is anticipated to witness the fastest growth over the forecast period. This technique is utilized to study the functions of genes in model organisms and cell cultures. Moreover, it is being utilized to target specific gene sequences that can cause cancer. Furthermore, the wide applications of RNAi technology include treating bacterial diseases, viruses, & parasites and relieving pain.

Application Insights

The genetic disorder segment held the largest revenue share of 38.9% in 2022. The increasing need for treating and controlling diseases such as Duchenne muscular dystrophy (DMD) and spinal muscular atrophy is expected to influence oligonucleotide product usage rates. The area of research on oligonucleotide medicines is quickly expanding, as seen by the growing number of research studies. Companies are seeking regulatory approvals for products useful to treat genetic diseases. For instance, in December 2019 , the Food and Drug Administration (FDA) approved golodirsen, an antisense oligonucleotide therapy, for treating people suffering from DMD.

The neurodegenerative disorders segment is expected to grow fastest, with a CAGR of 18.63% during 2023-2030. Participants operating in the industry are undertaking efforts to make advancements in RNAi and antisense therapies to treat neurodegenerative diseases. For instance, in April 2019, Alnylam Pharmaceuticals, Inc. partnered with Regeneron Pharmaceuticals, Inc. to discover, design, and commercialize new RNA interference (RNAi) therapeutics for central nervous system diseases.

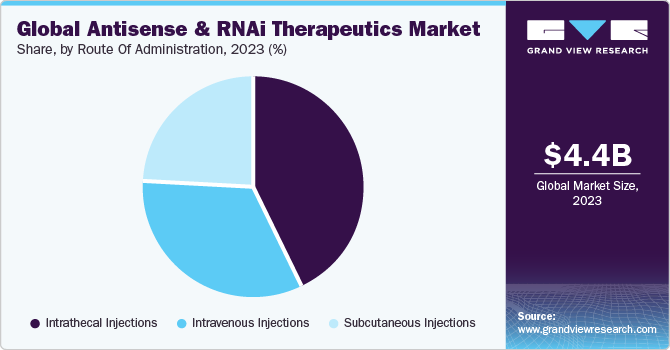

Route Of Administration Insights

The Intrathecal injections segment dominated the market with a revenue share of 44.6% in 2022. It is a path of administration for drugs through an injection into the subarachnoid space or spinal canal to reach the cerebrospinal fluid. This approach is utilized in spinal anesthesia, chemotherapy, pain management, and introducing drugs to combat specific infections, particularly after neurosurgical procedures. One of the most crucial elements of each and every genetically modified molecule is the route of drug administration.

The subcutaneous injection is the fastest-growing segment with a CAGR of 19.27% during 2023-2030. This type of injection is delivered in the fatty tissue just beneath the skin. Subcutaneous administration offers flexibility in choosing the infusion site, with options such as the abdomen, thighs, and the back of the arms. In addition, subcutaneous infusion systems can incorporate smaller needle sizes, potentially reducing discomfort during the infusion process. These benefits associated with subcutaneous administration is anticipated to drive the segment growth over the forecast period.

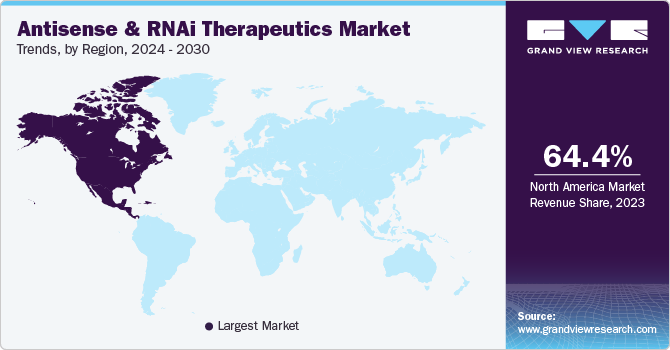

Regional Insights

North America accounted for the largest revenue share of around 43.7% in 2022. It is also expected to witness the fastest growth over the forecast period. Various RNAi therapies are being developed in the U.S. Furthermore, most players in the biotechnology sector have made substantial expenses on the innovation of RNAi therapeutics. Major pharmaceutical organizations have undergone partnership or license agreements with a group of small enterprises in this sector. For instance, in December 2021, AstraZeneca partnered with Ionis Pharmaceuticals, Inc., the U.S.-based Company, to develop and commercialize antisense medicine, eplontersen, to treat all types of ATTR

Europe is expected to register a significant growth during the forecast period. The presence of various companies focusing on antisense and RNAi therapeutics is anticipated to drive regional growth over the forecast period. Moreover, these companies are undertaking numerous initiatives to expand their product portfolio and business avenues. For instance, in September 2021, Evotec SE expanded its partnership with Secarna, a Europe-based company for the development in the domain of antisense drug discovery. Such collaborations are anticipated to propel the regional expansion during the forecast period.

Key Companies & Market Share Insights

The market is competitive, with many manufacturers accounting for most of the market share. These companies are developing RNAi therapies and platforms that provide diagnostics, medicines, and personalized treatment choices for key conditions. Many participants operating in the industry are undertaking various initiatives such as partnerships, product launches, investment & funding to strengthen their position in the antisense and RNAi therapeutics industry. For instance, in March 2023, Switch Therapeutics received funding of USD 52 million to advance RNAi technology. Moreover, many players are conducting clinical trials for drugs based on antisense and RNAi technologies. For instance, in March 2023, OliX Pharmaceuticals, Inc. dosed the first patient in a Phase 1 clinical trial of an investigational RNAi therapeutic designed to treat age-related macular degeneration (AMD).Some prominent players in the global antisense & RNAi therapeutics market:

-

GSK plc

-

Olix Pharmaceuticals, Inc.

-

Sanofi

-

Alnylam Pharmaceuticals, Inc.

-

Arbutus Biopharma

-

Benitec Biopharma Inc.

-

Silence Therapeutics

-

Ionis Pharmaceuticals, Inc

-

Bio-Path Holdings Inc.

-

Antisense Therapeutics Limited.

Antisense & RNAi Therapeutics Market Report Scope

Report Attribute

Details

Market size value in 2023

USD 4.46 billion

Revenue forecast in 2030

USD 14.25 billion

Growth Rate

CAGR of 18.06% from 2023 to 2030

Base year for estimation

2022

Historical data

2018 - 2021

Forecast period

2023 - 2030

Report updated

September 2023

Quantitative units

Revenue in USD million/billion and CAGR from 2023 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Technology, application, route of administration, region

Regional scope

North America, Europe, Asia Pacific, Latin America, MEA

Country scope

U.S.; Canada; UK; Germany; France; Spain; Italy; Denmark; Norway; Sweden; China; Japan; India; South Korea; Australia; Thailand; Brazil; Mexico; Argentina; South Africa; Saudi Arabia; UAE; Kuwait

Key companies profiled

Olix Pharmaceuticals,Inc. GSK plc., Sanofi, Alnylam Pharmaceuticals, Inc., Ionis Pharmaceuticals, Inc., Benitec Biopharma Inc.Silence Therapeutics, Arbutus Biopharma, Bio-Path Holdings Inc.,Antisense Therapeutics Limited.

Customization scope

Free report customization (equivalent up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional & segment scope

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

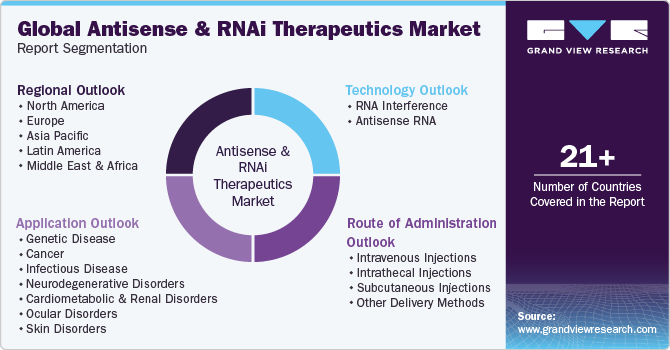

Global Antisense & RNAi Therapeutics Market Report Segmentation

This report forecasts revenue and volume growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For the purpose of this study, Grand View Research has segmented the global antisense & RNAi therapeutics market report on the basis technology, application, route of administration, and region:

-

Technology Outlook (Revenue, USD Million, 2018 - 2030)

-

RNA Interference

-

Antisense RNA

-

-

Application Outlook (Revenue, USD Million, 2018 - 2030)

-

Genetic Disease

-

Cancer

-

Infectious Disease

-

Neurodegenerative Disorders

-

Cardio Metabolic & Renal Disorders

-

Ocular Disorders

-

Respiratory Disorders

-

Skin Disorders

-

Others

-

-

Route Of Administration Outlook (Revenue, USD Million, 2018 - 2030)

-

Intravenous Injections

-

Intrathecal Injections

-

Subcutaneous Injections

-

Other Delivery Methods

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

-

Europe

-

Germany

-

UK

-

France

-

Italy

-

Spain

-

Denmark

-

Sweden

-

Norway

-

-

Asia Pacific

-

China

-

Japan

-

India

-

South Korea

-

Australia

-

Thailand

-

-

Latin America

-

Brazil

-

Mexico

-

Argentina

-

-

MEA

-

South Africa

-

Saudi Arabia

-

UAE

-

Kuwait

-

-

Frequently Asked Questions About This Report

b. Key factors that are driving the market growth include technological advancements in drug delivery mechanisms, increasing investments and collaborations between drug companies to accelerate new product development in this space

b. The global antisense & RNAi therapeutics market size was estimated at USD 3.79 billion in 2022 and is expected to reach USD 4.46 billion in 2023.

b. The global antisense & RNAi therapeutics market is expected to grow at a compound annual growth rate of 18.06% from 2023 to 2030 to reach USD 14.26 billion by 2030.

b. North America dominated the global antisense & RNAi therapeutics market with a share of 42.72% in 2022. This is mainly attributed to increasing investments in antisense technology and development of RNAi therapeutics.

b. Some key players operating in the antisense & RNAi therapeutics market include Olix Pharmaceuticals, Inc. GSK plc., Sanofi, Alnylam Pharmaceuticals, Inc., Ionis Pharmaceuticals, Inc., Benitec Biopharma Inc. Silence Therapeutics, Arbutus Biopharma, Bio-Path Holdings Inc., and Antisense Therapeutics Limited.

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![ESOMAR Certified Member]()

![Great Place to Work Certified]()

ESOMAR & Great Work to Place Certified

![ISO 9001:2015 & 27001:2022 Certified]()

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."

Important: Covid19 pandemic market impact

Multiple therapeutic regimens are being followed across the globe in attempts to come up with a reliable treatment for Covid-19. One line of treatment includes the use of hydroxychloroquine, while a second treatment line focuses to use antiviral drugs used in the disease management of HIV. Both these approaches have surged demand from advanced antivirals and antimalarial drugs. This impacts the drug manufacturers as an off label indication for these drug classes has to be worked upon. At the moment, the WHO has not prescribed any of these approaches, neither they have commented if one is better than the other. The report will account for Covid19 as a key market contributor.