- Home

- »

- Advanced Interior Materials

- »

-

Geosynthetics Market Size, Share And Growth Report, 2030GVR Report cover

![Geosynthetics Market Size, Share & Trends Report]()

Geosynthetics Market Size, Share & Trends Analysis Report By Product (Geotextiles, Geomembranes, Geogrids), By Region (North America, Europe, APAC, MEA), And Segment Forecasts, 2023 - 2030

- Report ID: 978-1-68038-501-4

- Number of Pages: 145

- Format: Electronic (PDF)

- Historical Range: 2018 - 2021

- Industry: Advanced Materials

Report Overview

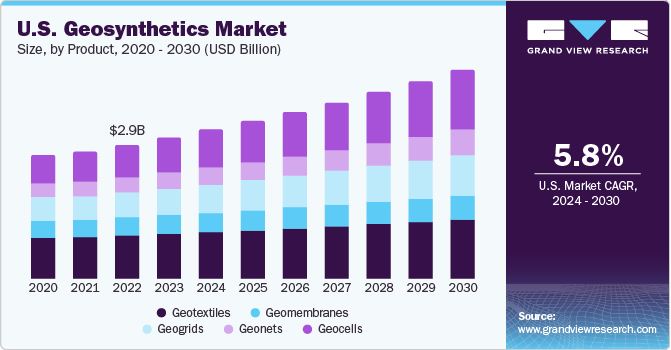

The global geosynthetics market size was estimated at USD 14.63 billion in 2022 and is expected to grow at a compound annual growth rate (CAGR) of 6.7% from 2023 to 2030. Rapid infrastructure development in emerging economies, such as India and Brazil, is anticipated to fuel market growth over the forecast period. The incorporation of geosynthetics entails sustainable development, small volume of earthwork, low carbon footprint, and an increased rate of construction. The growth of the construction industry in Asia Pacific is expected to remain one of the key market drivers over the next seven years.

The spread of the pandemic disease globally has negatively impacted the construction industry in 2020, as numerous projects were halted due to the imposition of lockdown by the governing authorities to contain the spread of coronavirus. The players operating in the market observed lower demand for new office spaces, and other infrastructure owing to supply chain barrier.

The availability of raw materials such as polypropylene on account of high prevalence of petrochemical complexes of companies including Chevron Phillips, ExxonMobil, Shell, and BP encourages market players for increased production. The aforementioned factors are anticipated to drive the demand for geosynthetic products in the U.S. over the forecast period. Furthermore, the U.S. EPA has authorized the application of geosynthetic products in landfills under the Resource Conservation and Recovery Act (RCRA). As a result, the product market is likely to witness a positive impact in the U.S.

Geotextiles are used as lining systems in the construction of ponds, streets, embankments, and pipelines. In addition, these products are also for the development of railway networks on account of their ability to facilitate the separation of soil layers from the subsoil without hindering underground water circulation.

Geonets and geocells play a key role in promoting vegetative growth and providing shore protection, in turn, preventing soil erosion. Moreover, the ongoing soil preservation projects in various economies, including South Africa, Spain, Canada, and India, are expected to drive the market over the forecast period.

Extreme outflow losses from canals have amplified drainage concerns. Geosynthetics are highly effective in controlling seepage problems in irrigation and other development projects. In addition, they are used in the design and construction of low embankment dams, channels, and slope protection and in controlling seepage losses from channels and reservoirs.

Product Insights

Geotextiles led the market and accounted for more than 48.54% share of the revenue in 2022. The segment dominated the market on account of their better performance and functional advantages over other materials. The synthetic fibers used in manufacturing geotextiles are made up of polypropylene, polyethylene polyester, and polyamide. However, natural geotextiles are gaining importance for short-term use or as temporary reinforcement due to rising awareness regarding their eco-friendly benefits, thereby complementing the market growth.

Geomembranes are estimated to expand at a CAGR of 5.3% in terms of revenue from 2023 to 2030 on account of rising awareness regarding the product’s application as floating covers for reservoirs to control evaporation, reduce the Volatile Organic Compounds (VOCs) emission, and minimize the demand for drainage and cleaning. Polyvinyl chloride (PVC)-based geomembranes are witnessing increasing application on account of their properties such as high degree of flexibility, excellent elongation percentage, and reduced expansion coefficient.

Geogrids are increasingly used in railway and road infrastructure development for reinforcement of the structural base over soft soils on account of their exceptional bearing capacity. Moreover, geogrids are used in retaining walls for the reinforcement of railway abutments and bridges. Thus, the aforementioned factors are expected to bolster market growth over the forecast period.

Geonets are incorporated as separation media in the collection of landfill leachates, foundation wall systems in drainage, road and pavement drainage systems, and methane gas collection. Furthermore, increasing penetration of the product in erosion control owing to its attributes of slowing down the surface runoff is likely to complement the segment growth.

Regional Insights

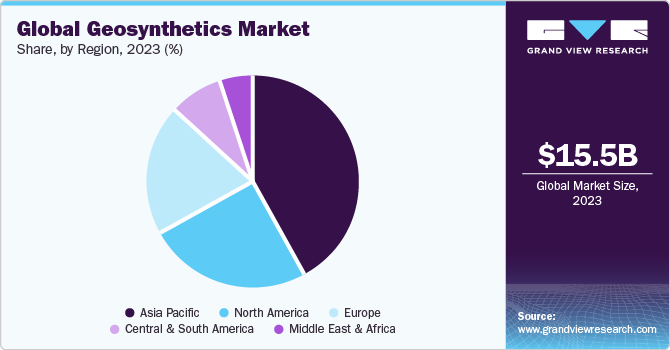

Asia Pacific dominated the market and accounted for about 42.39% share of the revenue share in 2022. Rising demand for oil reinforcement in the foundation work of residential buildings in the emerging economies of China and India is expected to drive the overall regional market over the forecast period. Construction industry in developing regions, such as Asia Pacific, is anticipated to outperform compared to developed regions on account of increasing per capita income and rapid urbanization.

Europe accounted for a significant share owing to various construction directives, such as 89/106/EEC and M/107 European Union, which has mandated the application of geosynthetics for infrastructure projects. Furthermore, the German government imposed stringent regulations related to waste management practices in the municipal and industrial sectors. The significant recovery of the construction industry coupled with the rising penetration of geosynthetic products in the region is expected to drive the market.

Increasing infrastructural activities in the developing economies of Central and South America, including Brazil, are likely to boost the use of geosynthetics over the forecast period. Rising usage of geosynthetics in water management practices is expected to boost the regional market growth. The regional market is also driven by the flourishing offshore oil and gas sector in Argentina, Venezuela, and Brazil.

The Middle East and Africa are projected to be emerging markets for geosynthetics during the forecast period. Increasing civil and commercial construction activities in the region, including the construction of stadiums and hotels, are likely to impact the demand for composite building materials, including geosynthetics, over the forecast period. However, countries such as Saudi Arabia and the United Arab Emirates (UAE) have witnessed stable economic growth owing to the growing construction & infrastructure sector. This growth is expected to positively influence geosynthetics market in the region over the forecast period.

Key Companies & Market Share Insights

Key industry participants are entering into strategic agreements with raw material suppliers and equipment manufacturers to maintain an uninterrupted supply. Factors such as the expansion of manufacturing capacities in the developing economies of the Asia Pacific and the Middle East offer a competitive edge to the geosynthetics manufacturers.

Key players in the market are entering into agreements with emerging players to expand their distribution capacities, thereby increasing their market reach. In addition, companies are likely to establish partnerships with e-commerce portals to ensure that buyers have timely access to geosynthetic products. Some of the prominent players in the geosynthetics market include:

-

GSE Holdings, Inc.

-

Koninklijke Ten Cate N.V.

-

Officine Maccaferri S.p.A.

-

NAUE GmbH & Co. KG

-

Propex Operating Company, LLC

-

Low and Bonar PLC

-

TENAX Group

-

Fibertex Nonwovens A/S

-

Global Synthetics

-

AGRU America

-

TYPAR

-

HUESKER Group

-

PRS Geo-Technologies

-

Tensar International Corporation

-

Solmax

Recent Developments

-

In December 2021, Solmax acquired Propex for making expansion in its position, and declare itself as the leading supplier of geosynthetics worldwide. With this expansion, Solmax gained non-woven geosynthetics expertise, and the ability to strengthen its footprint in the civil-infrastructure market

-

In September 2021, Solmax unveiled the development of the next generation of pit thermal energy storage (PTES). The purpose was to establish geosynthetic system solutions for meeting the demands of the PTES in terms of durability, robustness, resistance, and impermeability

Geosynthetics Market Report Scope

Report Attribute

Details

Market size value in 2023

USD 15.53 billion

Revenue forecast in 2030

USD 24.59 billion

Growth rate

CAGR of 6.7% from 2023 to 2030

Base year for estimation

2022

Historical data

2018 - 2021

Forecast period

2023 - 2030

Quantitative units

Volume in million square meters, revenue in USD million and CAGR from 2023 to 2030

Report coverage

Volume forecast, revenue forecast, competitive landscape, growth factors, and trends

Segments covered

Product, region

Regional scope

North America; Europe; Asia Pacific; Central & South America; Middle East & Africa

Country scope

U.S.; Canada; Mexico; France; U.K.; Germany; Italy; Spain; China; India; Japan; New Zealand; Australia; Malaysia; Thailand; Brazil; Saudi Arabia; UAE; South Africa

Key companies profiled

GSE Holdings, Inc.,; Koninklijke Ten Cate N.V.; Officine Maccaferri S.p.A.; NAUE GmbH & Co. KG; Propex Operating Company, LLC; Low and Bonar PLC; TENAX Group; Fibertex Nonwovens A/S; Global Synthetics; AGRU America; TYPAR; HUESKER Group; PRS Geo-Technologies, Tensar International, Solmax

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional, and segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Geosynthetics Market Report Segmentation

This report forecasts market share and revenue growth at global, regional, and country levels and provides an analysis of industry trends in each of the sub-segments from 2017 to 2030. For the purpose of this study, Grand View Research has segmented the global geosynthetics market report based on product and region:

-

Product Outlook (Volume, Million Square Meters; Revenue, USD Million, 2018 - 2030)

-

Geotextiles

-

Geomembranes

-

Geogrids

-

Geonets

-

Geocells

-

-

Regional Outlook (Volume, Million Square Meters; Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

France

-

Germany

-

U.K.

-

Italy

-

Spain

-

-

Asia Pacific

-

China

-

India

-

Japan

-

New Zealand

-

Australia

-

Malaysia

-

Thailand

-

-

Central & South America

-

Brazil

-

-

Middle East & Africa

-

Saudi Arabia

-

UAE

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global geosynthetics market size was estimated at USD 14.63 billion in 2022 and is expected to reach USD 15.53 billion in 2023.

b. The global geosynthetics market is expected to grow at a compound annual growth rate a CAGR of 6.7% from 2022 to 2030 to reach USD 24.59 billion by 2030.

b. Asia Pacific dominated the geosynthetics market with a share of 42.39% in 2022. This is attributable to the construction industry in developing regions in Asia Pacific, is anticipated to outperform compared to developed regions on account of increasing per capita income and rapid urbanization

b. Some key players operating in the geosynthetics market include Koninklijke Ten Cate B.V., GSE Holdings, Inc., NAUE GmbH & Co. KG, Officine Maccaferri S.p.A., Low and Bonar PLC, Propex Operating Company, LLC, Fibertex Nonwovens A/S, TENAX Group, AGRU America, Global Synthetics, HUESKER Group, TYPAR, Machina-TST, Gayatri Polymers & Geo-synthetics

b. Key factors that are driving the market growth include the rapid infrastructure development in emerging economies, such as India and Brazil, is anticipated to fuel the market growth over the forecast period.

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![ESOMAR Certified Member]()

![Great Place to Work Certified]()

ESOMAR & Great Work to Place Certified

![ISO 9001:2015 & 27001:2022 Certified]()

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."

Important: Covid19 pandemic market impact

The global construction industry once booming due to the residential and commercial construction in China and the U.S., has been affected by the suspension of the construction activities across the impacted economies. The construction industry in the U.S. is expected to take a major hit due to labor shortages and the lockdown imposed by the government during COVID-19, which is expected to be aggravated by the resulting supply chain issues and financing pressures due to the non-adherence to the completion times. The report will account for COVID-19 as a key market contributor.