- Home

- »

- Biotechnology

- »

-

Genomics Market Size, Share, Trends, Growth Report, 2030GVR Report cover

![Genomics Market Size, Share & Trends Report]()

Genomics Market Size, Share & Trends Analysis Report By Application & Technology (Functional Genomics, Epigenomics), By Deliverable (Products, Services), By End-use (Clinical Research, Hospital & Clinics), By Region, And Segment Forecasts, 2024 - 2030

- Report ID: 978-1-68038-188-7

- Number of Pages: 200

- Format: Electronic (PDF)

- Historical Range: 2018 - 2022

- Industry: Healthcare

Genomics Market Size & Trends

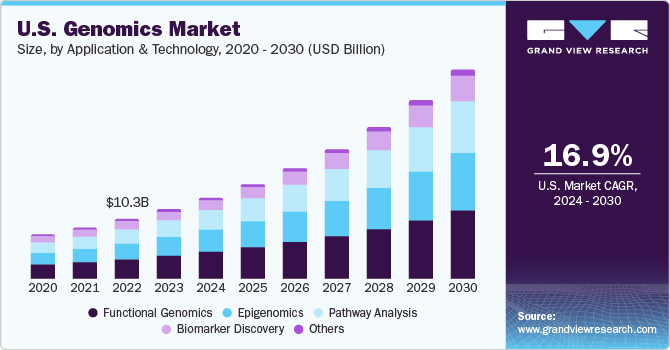

The global genomics market size was estimated at USD 32.65 billion in 2023 and is projected to grow at a compound annual growth rate (CAGR) of 16.5% from 2024 to 2030. The growth of the market is attributed to factors such as the growing demand for gene therapy, personalized medicine, drug discovery, increasing cancer incidence, and a significant increase in demand for consumer genomics in recent years. Moreover, the increasing number of joint ventures and partnerships among market players is also expected to have a positive impact on market growth. For instance, in June 2022, Illumina, Inc., and Allegheny Health Network signed a collaboration for effective evaluation of the impact of in-house Comprehensive Genomic Profiling (CGP) to leverage patient care.

The COVID-19 pandemic outbreak had posed challenges to applications of genomics technology in terms of research and therapeutics. Nevertheless, some niche applications were of great use to mankind during the pandemic situation to facilitate immediate attention for designing effective diagnostics, effective therapeutics, and steps to curb the spread of COVID-19. For example, the viral genome mutational rate (~1-2 bases per month) was gauged for the validity of PCR cycle and was estimated to understand the efficacy of the re-purposed anti-viral treatments and thereby the vaccine development process was streamlined.

Many genomic surveillance programs were launched country-wise to understand the dynamics of the pandemic situation and for effective preventive measures. For instance, in December 2020, the Indian SARS-CoV-2 Genomics Consortium (INSACOG) was launched by the joint efforts of Department of Biotechnology (DBT), Ministry of Health, and ICMR with an aim to screen the genomic variations in the SARS-CoV-2 by sequencing technologies. Furthermore, country-specific companies are providing consumer genomics services, which is also expected to fuel the market size in the coming years. One such company Mapmygenome, which is one of the pioneers in India offers DTC genomics services.

The increasing prevalence of inherited cancers is expected to create a high demand for cancer genomics. The substantial understanding of human genome is targeted at use of various gene therapies for treatment of cancers by modern gene editing techniques such as CRISPR-Cas gene technology. For instance, in September 2022, a group of researchers at the University of California introduced the applications of precision genome editing agents for management of inherited retinal diseases (IRDs).

The implementation of Artificial Intelligence (AI) in genomics is gaining popularity in past few years. Artificial intelligence algorithms are used to analyze genomic data generated through sequencing technologies, enabling faster and more accurate identification of genetic variations that are responsible for a disease. Furthermore, artificial intelligence is used to analyze genetic data and develop personalized treatment plans for patients. This approach takes into account an individual's genetic makeup and can help doctors prescribe the most effective treatment for a particular patient.

The development of high-throughput sequencing technologies such as Next-Generation Sequencing (NGS) and microarrays has generated massive amounts of genomic data. However, the rapid accumulation of this data from DNA sequencing and Electronic Health Records (EHRs) poses significant challenges and opportunities for the extraction of biologically or clinically relevant information. Phenome-wide association study (PheWAS) and genome-wide association study (GWAS) are helping researchers to investigate correlations between genotype and phenotype.

The market players are extensively working towards collaborations, expansions, acquisitions, and huge capital investments for advanced research with aim to understand rare diseases and to aid drug discovery. For instance, PacBio declares a collaboration with the Genomics England society for the utility of PacBio’s technology to detect genetic variation in unexplained rare disorders. The study is intended to re-sequence a selection of samples collected during Genomics England’s 100,000 genomes project to discover potential operational and clinical benefits of long-read sequencing for the identification of mutations associated with rare diseases.

End-use Insights

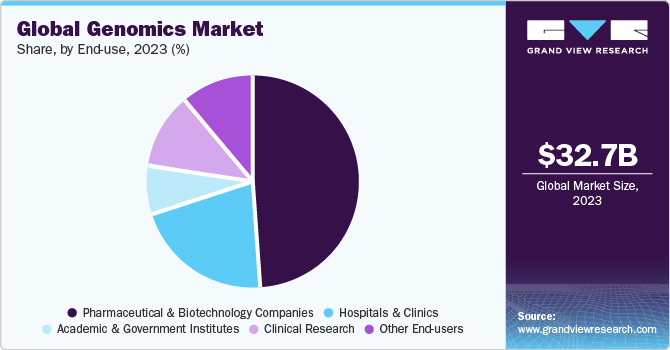

The pharmaceutical and biotechnology companies segment led the market with a revenue share of 48.6% in 2023. This is attributed to the increasing demand for use of genomics in drug discovery. Moreover, the market is driven by increasing adoption of spatial genomics & transcriptomics technologies. Numerous trials are underway for novel drug discovery using underlying knowledge from genomics. For instance, in June 2022, Illumina Inc. declared that it will present seven of their abstracts regarding the key oncology research at the American Society of Clinical Oncology (ASCO) 2022 in further to an event to discuss the transformational impact of comprehensive genomic profiling in precision medicine.

The hospital and clinics segment is estimated to grow at a substantial pace during the forecast period. Several hospitals and clinics are currently offering genomic sequencing services to patients and are using this technology in the daily practice of medicine. Stanford Medicine is one such facility that provides genomic sequencing services to patients with a rare or unidentified condition that is thought to be genetic. The first hospital system to offer general public services for genetic sequencing, analysis, and interpretation is Partners HealthCare based in the U.S. It has enrolled over 200 patients and physicians in a study funded by NIH to study the integration of whole genome sequencing in clinical medicine.

Regional Insights

North America held the largest market share of 42.65% in 2023. This is attributed to the support of research institutes and pharmaceutical giants. Genomics is now an integral part of any disease research and drug discovery due to the implications of genetic expression on human health. There are emerging advancements in the region for the utility of genomics with collaborative efforts. For instance, in January 2022, Illumina, Inc. collaborated with Nashville Biosciences, LLC, (part of Vanderbilt University Medical Center at Tennesee), for drug development by using genomics and to establish a preeminent clinical-genomic resource.

Asia Pacific is estimated to be the fastest-growing segment over the forecast period due to increased demand for genomics applications in diagnostics and growing demand for novel therapeutic drugs to fight the increased incidence of diseases in the region. Several major human genome sequencing projects are being performed, one of the most recent projects is Genome Asia 100K. Under this project, 100,000 Asian genomes would be sequenced and analyzed, which can help accelerate population-specific medical advances and precision medicine. With this project, GA 100K was expected to identify new possible therapeutic drugs and understand the biology of diseases.

Market Dynamics

The growth of genomic data pool from research studies has helped biologists, patients, and physicians to investigate the genetic predisposition for some of the diseases. The clinical application of this data pool is expected to transform the healthcare system related to the provision of more effective, reliable, and accurate, disease management solutions. Although the clinical use of genomic data is still in the nascent stage, the industrial and healthcare communities are making efforts to successfully incorporate genetic data into clinical workflows. Several clinical centers like Stanford Health Care and certain cancer research centers, have begun using available genomic information to devise personalized treatment regimes. This can help bridge the gap between clinical diagnosis & treatment and translational research. For instance, in May 2022, Genomics England released a plan to create the world's largest cancer research platform. The goal of this program is to provide cancer researchers with access to considerably more data and the tools they need to use it to develop better cancer medicines and patient care. Currently, various health fields hold important health data in a variety of different formats and systems (e.g., pathology, genomics, and radiology, such as CT & MRI scans). To assist researchers in discovering novel characteristics of cancer, Genomics England plans to combine various data types at a population scale for the first time.

Lucrative growth is anticipated in the implementation of human genetic studies into various public health programs, such as consumer wellness programs and population screening. The programs are mainly aimed at optimizing preventive care for common chronic diseases such as cancer and heart disease. This is mainly because the use of a combinational approach of genomics data and clinical data facilitates gaining insights into population health at a molecular level. Growing consumer awareness about genetic tests has boosted the growth of genomics companies, as it helps companies in understanding and identifying their potential consumers, which further helps refine and strategize their business development.

Technology & Application Insights

The functional genomics segment dominated the overall market in 2023 with the largest revenue share of 32.1%. The dominance of the segment can be attributed to research studies aiming to understand a particular phenotypical expression of a given disease condition. Many gene therapies for cancers are designed based on functional genomic technology. For instance, in June 2020, researchers at European Molecular Biology Laboratory (EMBL) at Heidelberg increased the scalability and precision metrics of functional genomics CRISPR/Cas9 gene-based screens through targeted single-cell RNA sequencing. Single-cell RNA sequencing gives deep insights into levels of gene expression in individual cells and can capably analyze CRISPR/Cas9 functional genomics screens.

The pathway analysis segment is predicted to emerge as the most lucrative of all by 2030. The segment is anticipated to grow at a CAGR of 17.3% from 2024 to 2030. Usage of pathway analysis in developing next-generation therapeutics has emerged as one of the most growing applications. Pathway-based analysis has gained more attention after the emergence of clinical genomics and personalized therapies. This is mainly because genomics and personalized therapies aid in the in-depth analysis of the ability to navigate signaling pathways and disease networks.

Deliverables Insights

The products segment dominated the market with a revenue share of 70.0% in 2023. The products used in genomics are broadly segmented into two categories—instruments or systems that are required for the synthesis and sequencing of the nucleic acid sequences and consumables & reagents.

The increase in preference for personalized medicines and decline in costs of DNA sequencing owing to the launch of NGS technology resulted in the development of novel products or systems. The market is gradually becoming more competitive with new product launches. For instance, in June 2022, PerkinElmer introduced an automated benchtop system for NGS, the research-use only BioQule NGS System to automate library preparation.

The services segment is expected to register a steady CAGR by 2030. The high cost of products, demand for expertise required for genomics, and focus on core operations by the end-user are the major factors driving the services segment. NGS-based services held a major share in the genomics services segment due to the rapid adoption of Whole Genome Sequencing (WGS) and applications of sequence databases for disorder screening and prognosis. However, data processing and interpretation, rather than data production has become the need for current development and application.

Key Companies & Market Share Insights

Key players operating in the market are focused on strategic collaborations, new product launches, and geographical expansions as needed in emerging and favorable regions across the globe.

Key Genomics Companies:

- Agilent Technologies

- Bio-Rad Laboratories, Inc.

- BGI Genomics

- Color Genomics, Inc.

- Danaher Corporation

- Eppendorf AG

- Eurofins Scientific

- F. Hoffmann-La Roche Ltd.

- GE Healthcare

- Illumina, Inc.

- Myriad Genetics, Inc.

- Oxford Nanopore Technologies

- Pacific Biosciences of California, Inc.

- QIAGEN N.V.

- Quest Diagnostics Incorporated

- Thermo Fisher Scientific, Inc.

- 23andMe, Inc.

Recent Developments

-

In November 2023, Fabric Genomics collaborated with DNAnexus and Oxford Nanopore Technologies for deployment of CLIA/CAP labs in pediatric and neonatal ICUs. The labs will use Oxford Nanopore’s platforms to study genetic disorders in infants.

-

In February 2023, Illumina, Inc. entered into a collaboration with African Centre of Excellence for Genomics of Infectious Diseases to start a training institute to increase genomic capabilities in African region.

-

In January 2023, SOPHiA GENETIC collaborated with the Memorial Sloan Kettering Cancer Center (MSK), a U.S. Cancer Center, to offer researchers and clinicians solutions to expand analytical and testing capabilities.

Genomics Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 37.89 billion

Revenue forecast in 2030

USD 94.86 billion

Growth rate

CAGR of 16.5% from 2024 to 2030

Base year for estimation

2023

Historical data

2018 - 2022

Forecast period

2024 - 2030

Report Updated

November 2023

Quantitative units

Revenue in USD million/billion and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Application & Technology, deliverables, end-use, region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; UK; Germany; France; Italy; Spain; Denmark; Sweden; Norway; Japan; China; India; Australia; Thailand; South Korea; Brazil; Mexico; Argentina; South Africa; Saudi Arabia, UAE; Kuwait

Key companies profiled

Agilent Technologies; Bio-Rad Laboratories, Inc.; BGI Genomics; Color Genomics, Inc.; Danaher Corporation; Eppendorf AG; Eurofins Scientific; F. Hoffmann-La Roche Ltd.; GE Healthcare; Illumina, Inc.; Myriad Genetics, Inc.; Oxford Nanopore Technologies; Pacific Biosciences of California, Inc.; QIAGEN N.V.; Quest Diagnostics Incorporated; Thermo Fisher Scientific, Inc.; 23andMe, Inc.

Customization scope

Free report customization (equivalent up to 8 analyst's working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

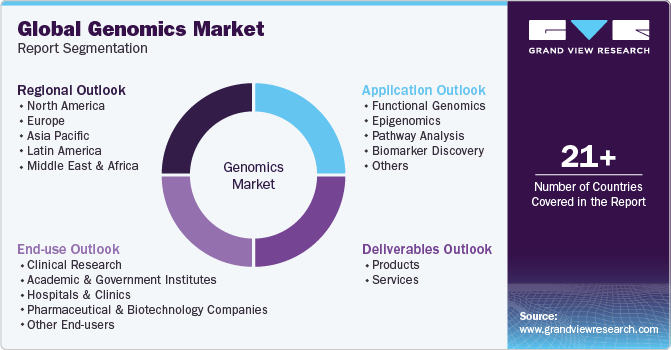

Global Genomics Market Report Segmentation

This report forecasts revenue growth and provides an analysis of the latest trends in each of the sub-segments from 2018 to 2030. For this report, Grand View Research has segmented the genomics market report based on application & technology, deliverables, end-use, and region:

-

Application & Technology Outlook (Revenue, USD Billion, 2018 - 2030)

-

Functional Genomics

-

Transfection

-

Real-Time PCR

-

RNA Interference

-

Mutational Analysis

-

SNP Analysis

-

Microarray Analysis

-

-

Epigenomics

-

Bisulfite Sequencing

-

Chromatin Immunoprecipitation (ChIP & ChIP-Seq)

-

Methylated DNA Immunoprecipitation (MeDIP)

-

High-Resolution Melt (HRM)

-

Chromatin Accessibility Assays

-

Microarray Analysis

-

-

Pathway Analysis

-

Bead-Based Analysis

-

Microarray Analysis

-

Real-time PCR

-

Proteomics Tools (2-D PAGE; yeast 2-hybrid studies)

-

-

Biomarker Discovery

-

Mass Spectrometry

-

Real-time PCR

-

Microarray Analysis

-

Statistical Analysis

-

Bioinformatics

-

DNA Sequencing

-

-

Others

-

-

Deliverables Outlook (Revenue, USD Billion, 2018 - 2030)

-

Products

-

Instruments/Systems/Software

-

Consumables & Reagents

-

-

Services

-

NGS-based Services

-

Core Genomics Services

-

Biomarker Translation Services

-

Computational Services

-

Others

-

-

-

End-use Outlook (Revenue, USD Billion, 2018 - 2030)

-

Clinical Research

-

Academic & Government Institutes

-

Hospitals & Clinics

-

Pharmaceutical & Biotechnology Companies

-

Other End Users

-

-

Regional Outlook (Revenue, USD Billion, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

-

Europe

-

Germany

-

U.K.

-

France

-

Italy

-

Spain

-

Denmark

-

Sweden

-

Norway

-

-

Asia Pacific

-

China

-

India

-

Japan

-

South Korea

-

Australia

- Thailand

-

-

Latin America

-

Brazil

-

Mexico

-

Argentina

-

-

Middle East & Africa

-

South Africa

-

Saudi Arabia

-

UAE

- Kuwait

-

-

Frequently Asked Questions About This Report

b. The global genomics market size was estimated at USD 32.65 billion in 2023 and is expected to reach USD 37.89 billion in 2024.

b. The global genomics market is expected to witness a compound annual growth rate of 16.5% from 2024 to 2030 to reach USD 94.86 billion by 2030.

b. The pharmaceutical and biotechnology companies segment accounted for the major revenue share owing to the increasing number of genetic research studies aimed at the development of efficacious drugs with fewer side effects and improving the drug discovery process.

b. Major players in the genomics market include F. Hoffmann-La Roche Ltd..; Agilent Technologies, Thermo Fisher Scientific, Inc.; Bio-Rad Laboratories, Inc.; 23andMe, Inc.; Illumina, Inc.; Myriad Genetics, Inc.; Foundation Medicine, Inc.; Danaher, Pacific Biosciences; Oxford Nanopore Technologies; and BGI.

b. Technological advancements in genetic tools, as well as molecular diagnostics, is one of the key driving force that has accelerated investment by genomic companies in the market.

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![ESOMAR Certified Member]()

![Great Place to Work Certified]()

ESOMAR & Great Work to Place Certified

![ISO 9001:2015 & 27001:2022 Certified]()

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."

Important: Covid19 pandemic market impact

Biopharmaceutical innovators are at the forefront of the human response to the coronavirus pandemic. A significant number of major biotech firms are in the midst of a race to investigate the Sars-Cov-2 genome and prepare a viable vaccine for the same. As compared to the speed of response to SARS/MERs etc, the biotech entities are investigating SARs-Cov-2 at an unprecedented rate and a considerable amount of funds are being put into the R&D. With multiple candidates in trial, the public and private sectors are anticipated to work in unison for the foreseeable period, until a vaccine is developed for COVID-19. The report will account for COVID-19 as a key market contributor.