- Home

- »

- Food Additives & Nutricosmetics

- »

-

Gelatin Market Size, Share & Growth Analysis Report, 2030GVR Report cover

![Gelatin Market Size, Share & Trends Report]()

Gelatin Market Size, Share & Trends Analysis Report By Source (Bovine, Porcine), By Function (Stabilizer, Thickener), By Application (Food & Beverages, Healthcare), By Region, And Segment Forecasts, 2023 - 2030

- Report ID: 978-1-68038-110-8

- Number of Pages: 200

- Format: Electronic (PDF)

- Historical Range: 2018 - 2021

- Industry: Specialty & Chemicals

Report Overview

The global gelatin market size was valued at USD 6.08 billion in 2022 and is anticipated to grow at a compound annual growth rate (CAGR) of 10.1% from 2023 to 2030. Gelatin is anticipated to witness high demand from functional food application, due to its ability to prevent several diseases, improve food quality, and in food fortification. Gelatin is a highly viscous semi-solid gel; its composition includes 2% to 4% mineral salts, 85% to 90% protein, and 8% to 12% water. Its most common form commercially available is edible gelatin, which does not contain any other preservatives or additives. Non-edible products are mostly used in photography (nail photographic films & papers, glue, and polish) and cosmetics.

Gelatin is derived from collagen, which is a natural protein present in the skin and bones. Raw materials including pig skin, bovine hides, and bones are primarily obtained from slaughterhouses. As a protein, it contains numerous amino acids, which makes it useful in a wide range of applications including foods, beverages, pharmaceuticals, and cosmetics among others.

The prices of gelatin vary depending on the prices of its raw materials. It also depends on the region or country where the product is being manufactured. The prices of raw materials are rising at a moderate rate on the account of the growing demand from end-use industries, especially food & beverage, and healthcare. In addition, the rise in demand is likely to be catered to by new production facilities in countries such as the U.S. and India. Furthermore, improvements in the supply chain and an increase in production levels may lead to stability in the prices of products in the coming years.

The key players in the global market comprise GELITA AG, Rousselot Weishardt Holding SA, Nitta Gelatin Inc., and STERLING GELATIN among others. These companies dominate the market with their strong product portfolio and regional presence. In addition, manufacturers are focusing on sustainable production, in-house R&D, customized product offerings, and technology licensing to attain a competitive edge in the market space. For example, in January 2021, Nitta Gelatin India Ltd. launched a premium gelatin product manufactured with Japanese technology of international standards for food application.

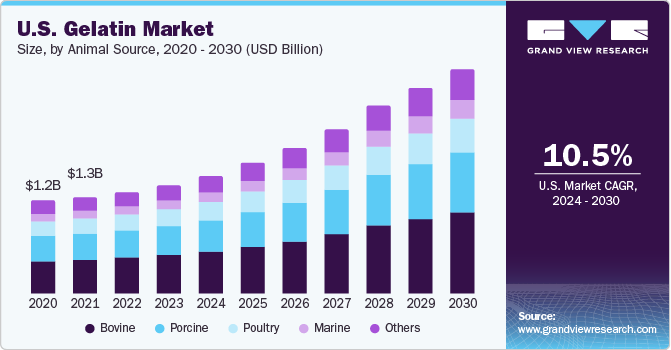

Source Insights

Bovine source dominated the market with the highest revenue share of 34.94% in 2022. This is attributed to the increasing usage of bovine based gelatin in various food & beverage applications. Moreover, the rise in demand for dietary supplements globally on the account of shifting inclination of consumers towards a healthy and protein-rich diet is expected to drive the market growth.

On the other hand, the increasing prevalence of vegan culture around the world coupled with the decrease in the slaughtering of animals like cows, buffalo, etc. is expected to hamper the growth of the market for bovine gelatin. According to the U.S. Department of Agriculture (USDA), commercial cow slaughtering in the year 2020 witnessed a decline of 2% in numbers compared to 2019. In addition, according to OECD-FAO, bovine meat output among major producing countries like Australia, New Zealand, and European Union) fell due to the limited availability of animals. Such factors can hamper the overall market growth.

Porcine based gelatin is among the traditionally used products. These products are sourced from pork skin and bones. According to National Health Service (NHS), the usage of porcine based products in various vaccines and capsules as a stabilizer to ensure effectiveness and safety, especially during and post storage, is expected to drive market growth in the coming years.

Function Insights

Stabilizer function dominated the market with the highest revenue share of more than 40% in 2022. This high share is attributed to the properties such as emulsifying effects. In addition, they help smoothen the food texture and provide the body with food. Moreover, they are responsible for giving a uniform nature or consistency to the product and retain the flavoring compounds in dispersions. Such properties of gelatin make it ideal for stabilizing ice creams, margarine, spreads, dairy products, salad dressings, and mayonnaise among others.

In addition, gelatin is also used as a thickener to increase the viscosity of a solution or mixture without altering its properties. Furthermore, it is often used as a food additive where the key attribute is taste. Additionally, it is used to improve the suspension of other ingredients that increase the stability of the product. Gelatin is added to various food types such as soups, salad dressings, sauces, and gravies. Moreover, the use of thickeners in cosmetics and personal care products is expected to fuel market growth over the coming years.

Other functions of gelatin include its use for texturing as well as a protective agent and emulsifier. Emulsifiers are substances that stabilize an emulsion. Increasing use of the product as an emulsifier in various food items such as bread, meat, chocolates, and ice creams is expected to fuel the market growth in the coming years.

Application Insights

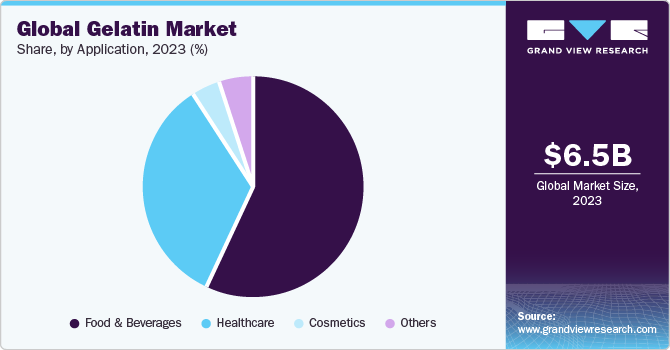

Food & beverages application dominated the market with the highest revenue share of 56.69% in 2022. Its high share is attributable to increasing demand for various food & beverage products such as desserts, functional food products, functional beverages, confectionery products, and meat products around the world.

Functional food products comprise additional enhanced nutritional properties that help in providing various health benefits like improved immunity and reduced fatigue. According to New Food Magazine, as a result of COVID-19, many people have evaluated their attitudes toward health, diet, and wellness during the past two years. More than ever, consumers are now making the connection between their eating habits and health. Furthermore, the demand for immunity booster products saw a sharp rise in the wake of the COVID-19 pandemic. This trend is expected to continue and thus likely to positively impact the market growth for functional food in the coming years.

In addition, gelatin is used in the pharmaceutical and healthcare industry for manufacturing capsules, emulsions, syrups, and tablets. It offers properties such as film forming, thermo-reversible gelling, and adhesiveness, which result in an increased preference among manufacturers for using gelatin in the manufacture of capsules. In addition, it is approved by the Food Drug Administration (FDA) for use in pharmaceutical and healthcare applications.

Regional Insights

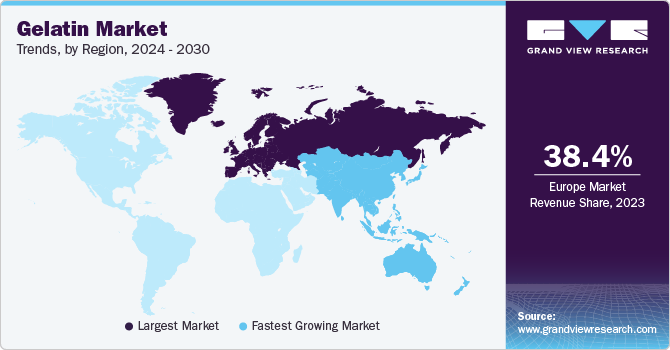

Europe dominated the market with the highest revenue share of 38.39% in 2022. This is attributed to the high demand from end-use industries such as cosmetics, food & beverages, and healthcare. In addition, the growth in the demand for the product market is characterized by the presence of numerous manufacturing companies like Biogel AG, Prowico, Gelita, among others.

Gelatin used in the U.K. is commonly sourced from bovine or porcine sources due to the high consumption levels of pork and beef in the region. In addition, the demand for the product in the country can be attributed to the rising sales of cosmetic products. Moreover, the presence of a well-defined and established meat processing industry proves to be favorable for raw material sourcing. The presence of well-established players coupled with abundant raw material supply is expected to fuel the production in the country over the forecast period.

Furthermore, Brazil is one of the prominent producers of gelatin globally. Most of the products produced in the country is sourced from bovine hides and bones owing to the abundant availability of raw materials. In addition, the presence of international players such as JBS SA, Minerva, and BRF involved in meat processing is expected to ensure consistent raw material supply for production. Thus, manufacturers are expected to open their production units in the country due to easy access to raw materials including bones and bovine hides at the domestic level.

Key Companies & Market Share Insights

The global gelatin market is concentrated in nature with the top four companies accounting for more than 65.0% of the total market share in 2022. Compared to other industry participants, these major companies have a higher penetration of their products in various end-use markets such as food & beverage, health & nutrition, and pharmaceuticals among others due to their exceptional distribution network and goodwill worldwide. Global expansion, production capacity expansion, and mergers & acquisitions are some of the key strategies adopted by manufacturing companies throughout the world. For instance, in July 2022, Perfect Day, U.S. alt-dairy startup acquired Sterling Biotech, an Indian manufacturer of Gelatin to expand its network in the domestic market.

An extensive range of product portfolios for end-use markets has contributed to high sales of gelatin for the above-mentioned companies. One of the major factors influencing the company's market share is a high level of integration in the value chain. Some prominent players in the gelatin market include:

-

GELITA AG

-

Rousselot

-

PB Leiner

-

STERLING GELATIN

-

Weishardt Holding SA

-

Junca Gelatines SL

-

Nitta Gelatin, Inc.

-

PAN Biotech GmbH

-

Shanghai Al-Amin Biotechnology Co., Ltd.

-

Tessenderlo Group

Recent Developments

-

In November 2022, Nitta Gelatin, Inc. introduced freshwater fish collagen peptide ingredients that are clinically tested, and responsibly sourced. The gelatin derived from this peptide comprise anti-aging properties, and is beneficial for skin health as well

-

In November 2022, PB Leiner entered into a joint venture with Hainan Xiangtai to commercialize, and produce fish collagen peptides. The combined strength of these organizations enabled a long-term sustainable provision of a product range of beef hide gelatin on the basis of PB Leiner’s technology

-

In November 2022, TEXTURA gelatin, one of texturizing solutions of PB Leiner, launched TEXTURATM Tempo Ready. It is a texturizing gelatin solution, especially designed for culinary professionals

-

In May 2022, Rousselot Biomedical launched Quali-Pure HGP 2000, a latest pharmaceutical-based gelatin, designed for wound healing and vaccine applications. This hydrolyzed gelatin is expected to increase the scope of biomedical applications of the organization

-

In November 2022, a partnership between Rousselot Biomedical and Gelomic resulted in the creation of a ready to use 3D cell culture kit that is based on X-Pure GelMA. This benefitted Rousselot to gain expertise in biomedical gelatins to make advancement in the development of latest medical devices and medicines

Global Gelatin Market Report Scope

Report Attribute

Details

Market size value in 2023

USD 6.51 billion

Revenue forecast in 2030

USD 13.14 billion

Growth Rate

CAGR of 10.1% from 2023 to 2030

Base year for estimation

2022

Historical data

2018 – 2021

Forecast period

2023- 2030

Quantitative units

Volume in kilotons, revenue in USD million and CAGR from 2023 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Source, function, application, region

Regional scope

North America; Europe; Asia Pacific; Latin America; Middle East & Africa

Country scope

U.S.; Canada; Germany; U.K.; France; Italy; Spain; Russia; Portugal; Netherlands; Switzerland; Poland; China; Japan; India; Indonesia; Vietnam; Thailand; Philippines; Brazil; Mexico; Ecuador; Peru; Bolivia; Chile; Argentina; South Africa; Saudi Arabia; Turkey; UAE; Qatar; Israel

Key companies profiled

GELITA AG; Rousselot; PB Leiner; STERLING GELATIN; Weishardt Holding SA; Junca Gelatines SL; Nitta Gelatin, Inc.; PAN Biotech GmbH; Shanghai Al-Amin Biotechnology Co., Ltd.; Tessenderlo Group

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Gelatin Market Report Segmentation

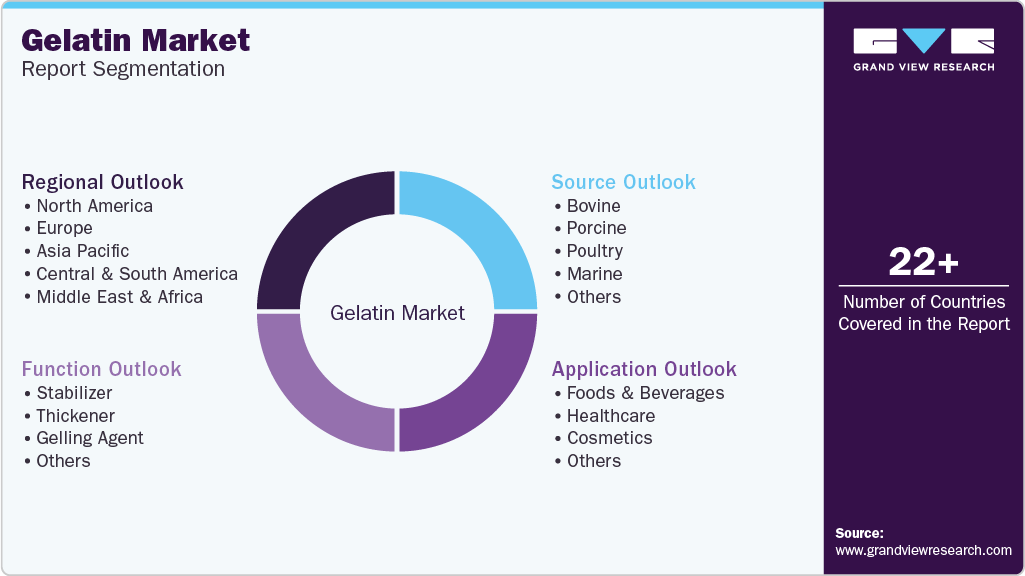

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global gelatin market report based on source, function, application, and region:

-

Source Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2030)

-

Bovine

-

Porcine

-

Poultry

-

Marine

-

Others

-

-

Function Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2030)

-

Stabilizer

-

Thickener

-

Gelling Agent

-

Others

-

-

Application Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2030)

-

Food & Beverages

-

Functional Foods

-

Meat Processing

-

Functional Beverages

-

Dietary Supplements

-

Confectionery

-

Desserts

-

-

Healthcare

-

Cosmetics

-

Others

-

-

Regional Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

-

Europe

-

Germany

-

U.K.

-

France

-

Italy

-

Spain

-

Russia

-

Portugal

-

Netherlands

-

Switzerland

-

Poland

-

-

Asia Pacific

-

China

-

Japan

-

India

-

Indonesia

-

Vietnam

-

Thailand

-

Philippines

-

-

Latin America

-

Brazil

-

Mexico

-

Ecuador

-

Peru

-

Bolivia

-

Chile

-

Argentina

-

-

Middle East & Africa

-

South Africa

-

Saudi Arabia

-

Turkey

-

UAE

-

Qatar

-

Israel

-

-

Frequently Asked Questions About This Report

b. The global gelatin market size was estimated at USD 6.08 billion in 2022 and is expected to reach USD 6.51 billion in 2023.

b. The global gelatin market is expected to grow at a compound annual growth rate of 9.5% from 2023 to 2030 to reach USD 13.14 billion by 2030.

b. Bovine dominated the gelatin market with a share of over 34% in 2022. This is attributable to cheaper prices of bovine than the other raw materials.

b. Some key players operating in the gelatin market include Gelita AG; Darling Ingredients Inc.; Nitta Gelatin Inc.; Sterling Gelatin; and Tessenderlo Group. Gelita AG and Nitta Gelatin Inc.

b. Key factors that are driving the gelatin market growth include increasing demand for convenience and functional food and beverage products, coupled with its augmented use in the pharmaceutical application.

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![ESOMAR Certified Member]()

![Great Place to Work Certified]()

ESOMAR & Great Work to Place Certified

![ISO 9001:2015 & 27001:2022 Certified]()

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."

Important: Covid19 pandemic market impact

Demand across the organic chemicals sector shall register a slump in growth albeit increasing demand for certain chemicals that find end applications in healthcare and food. Furthermore, China, a major supplier of chemicals to the world, registered a considerable decline in manufacturing in the first quarter of 2020, following the trajectory unfolded by COVID-19's escalation to a pandemic. This has led to an imbalance in supply-demand dynamics, forcing manufacturers and customers alike to renegotiate supply agreements. The report will account for Covid19 as a key market contributor.