- Home

- »

- Electronic Devices

- »

-

GCC Protective Relay Market Share, Industry Report, 2024GVR Report cover

![GCC Protective Relay Market Report]()

GCC Protective Relay Market Analysis By Voltage (Low, Medium, High), By Application (Feeder Protection, Generator Protection, Bus-Bar Protection, Capacitor Bank Protection, Breaker Protection, Transformer Protection), By End-Use (Infrastructure, Industrial, Government, Power) And Segment Forecasts To 2024

- Report ID: GVR-1-68038-263-1

- Number of Pages: 130

- Format: Electronic (PDF)

- Historical Data: 2013-2015

- Industry: Semiconductors & Electronics

"Rising investments in the T&D networks expected to drive GCC protective relay market"

The GCC protective relay market size was valued at USD 237.7 million in 2015 and is expected to witness growth at a CAGR of 5.4% over the forecast period.

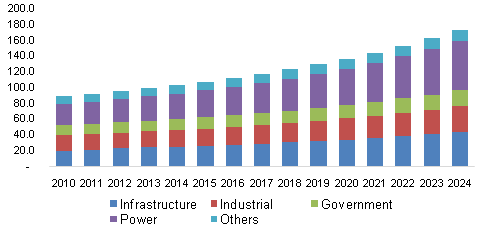

Saudi Arabia Protective Relay Market, By End-Use, 2010 - 2024 (USD Million)

The growth is primarily attributed to the growing investments in the transmission & distribution infrastructure in the GCC region.

"Surging power generation capacity in GCC is estimated to be a major driving force"

The power sector is anticipated to emerge as the largest end-use segment and is predicted to grow at a CAGR of over 6.0% from 2016 to 2024. The rapid industrialization coupled with the rise in power generation capacity in the GCC region is expected to act as a key driver fueling the GCC protective relay market growth. The growing population together with the increasing per capita electricity consumption in GCC are some vital factors backing the demand over the next eight years.

The infrastructure segment is also anticipated to emerge as a key application segment, which is expected to grow at a CAGR exceeding 5.0% over the forecast period. The increasing commercial and residential projects coupled with a rise in the set-up of several industrial plants in GCC are likely to drive the demand for the product over the next eight years.

"Medium voltage was the largest protective relays in 2015"

The medium voltage segment accounted for over 35% of the GCC market in 2015. The high share is attributed to an upsurge in the usage of medium voltage protective relays in medium voltage substations and power systems. The growing population in Saudi Arabia, UAE, Kuwait, and Qatar has led to a significant rate of population migration, thereby increasing the demand for residential infrastructure as well as electricity consumption. Thus, the rising demand for electricity in these countries is expected to spur the industry growth over the forecast period.

"High preference for feeder protection as compared to its counterparts"

The feeder protection segment accounted for over 20% of the total revenue share in 2015. The extensive usage of protective relays to safeguard electrical power transmission lines is anticipated to drive the industry growth over the next eight years.

The probability of fault occurrence in the electrical power transmission lines is much higher than the other power system components as these lines are usually long enough and run through an open atmosphere. Thus, the lines and cables forming the feeder system require maximum protection else they can cause harm to the surroundings. The growing demand for feeder protection across the power, infrastructure, and industrial sectors is anticipated to have a positive impact on the industry growth over the projected period.

"Saudi Arabia is expected to remain the largest segment"

In 2015, Saudi Arabia was the largest market accounting for over 40% of the total market share in the same year. The modernization of grid infrastructure coupled with huge investments in the renewable sector are a few factors significantly contributing towards the industry growth in this country. Infrastructure development in the residential, commercial, and industrial sectors is expected to further drive the Saudi Arabian industry over the forecast period.

Although Saudi Arabia remains the largest segment, UAE is projected to witness a healthy growth over the forecast period. The increase in transmission & distribution equipment exports, paired with the substation automation in this country, is expected to fuel the industry growth.

"Siemens, ABB, GE, and Schneider hold a significant market position"

The GCC protective relay industry is consolidated with few key players holding over 60% of the total market share. Key players such as ABB, Siemens, GE-Alstom, Schneider undertake the merger & acquisitions to withhold their strong market position. For instance, in August 2016, General Electric announced the acquisition of Alstom’s (France) energy business to strengthen its industry position with Alstom’s complementary global capability, technological capabilities, installed base, and talent.

GCC Protective Relay Market Report Scope

Report Attribute

Details

Market size value in 2020

USD 300.3 million

Revenue forecast in 2024

USD 377.4 million

Growth Rate

CAGR of 5.4% from 2016 to 2024

Base year for estimation

2015

Historical data

2013 - 2015

Forecast period

2016 - 2024

Quantitative units

Revenue in USD million and CAGR from 2016 to 2024

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Voltage and region.

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; Mexico; U.K.; Germany; China; India; Japan; Brazil

Key companies profiled

ABB Ltd.; Doble Engineering Company; Eaton Corporation Plc; Fanox Electronics; General Electric; Mitsubishi Electric Corp.; and Schneider Electric.

Customization scope

Free report customization (equivalent up to 8 analysts’ working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![ESOMAR Certified Member]()

![Great Place to Work Certified]()

ESOMAR & Great Work to Place Certified

![ISO 9001:2015 & 27001:2022 Certified]()

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."

Important: Covid19 pandemic market impact

The global electronics devices market (including consumer electronics and industrial electronics devices) is expected to be impacted significantly by COVID-19 as China is one of the major suppliers for the raw materials (used to manufacture devices) as well as the finished products. The industry is on the brink of facing a reduction in production, disruption in supply, and price fluctuations. While this can vastly encourage local manufacturers to step up and address the growing demand, the scarcity of raw material can still pose a challenge to this industry. The sales of prominent electronic companies is expected to be affected in the near future. The report will account for Covid19 as a key market contributor.