- Home

- »

- Nutraceuticals & Functional Foods

- »

-

Functional Mushroom Market Size & Trends Report, 2030GVR Report cover

![Functional Mushroom Market Size, Share & Trends Report]()

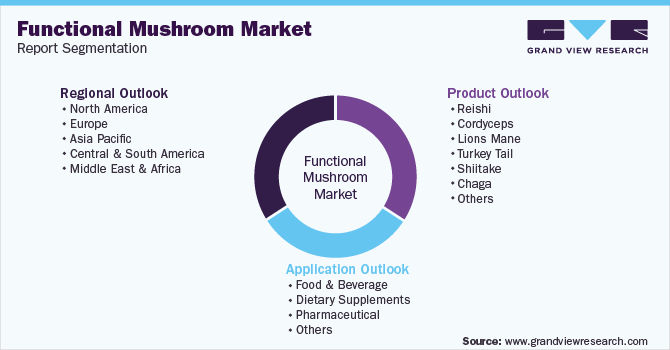

Functional Mushroom Market Size, Share & Trends Analysis Report By Product Type (Reishi, Shiitake), By Application (Food & Beverage, Pharmaceutical), By Region (EU, APAC, North America), And Segment Forecasts, 2022 - 2030

- Report ID: GVR-4-68039-932-0

- Number of Pages: 120

- Format: Electronic (PDF)

- Historical Range: 2017 - 2020

- Industry: Consumer Goods

Report Overview

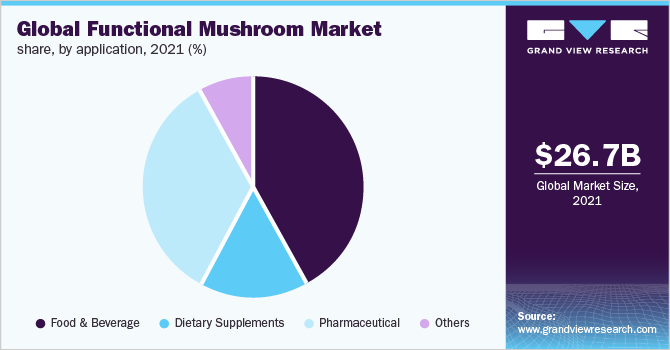

The global functional mushroom market size was valued at USD 26.7 billion in 2021 and is expected to expand at a compound annual growth rate (CAGR) of 10.8% from 2022 to 2030. This can be attributed to the growing popularity of functional mushrooms as superfoods due to their numerous health advantages. Functional mushrooms can be found in a variety of healthcare and pharmaceutical products. As a result, their demand is likely to grow over the forecast period. In addition, increasing product application scope in the pharmaceutical industry as a health supplement is further driving industry growth. Increasing cases of COVID-19 had led governments of different countries to impose lockdowns in 2020 to contain the spread of the infection.

This created a disturbance in the supply chain of the industry. Food manufacturing and processing plants were shut down for a brief period to safeguard the health of workers, which, in turn, affected the production capacity. Moreover, due to the global lockdown, the procurement of raw materials was difficult owing to restrictions on international trade activities. Delays in shipments due to restrictions on the movement of people also caused a shortage of raw materials, thereby increasing their prices that eventually raising the costs of functional mushrooms. However, the demand for functional mushrooms increased during the pandemic due to their health benefits, such as immunity-boosting properties, which had a positive impact on the global industry.

A diet high in protein has become increasingly popular over the past few years with the growing consumer awareness about maintaining overall health. Rising consumption of packaged food products due to hectic lifestyles will also support industry growth. To appeal to a customer base that is health-conscious, packaged food manufacturers are enhancing food products with nutritive ingredients, such as functional mushroom extracts or powders. The present production of protein through livestock is negatively impacting our planetary life-support systems. To fulfill the protein needs, livestock production is also growing, which is leading to a significant increase in the emission of Greenhouse Gases (GHG), creating sustainability issues.

Thus, a major focus is being laid on alternative protein sources. This trend is expected to boost industry growth in the coming years. Eating a plant-based diet has become popular, particularly among young people who care about animal welfare and the environment. As per the Alliance for Science and a study by Kansas State University, as of January 2022, about 10% of Americans over the age of 18 years were vegetarian or vegan. Functional mushrooms are anticipated to be used in a variety of medicinal and health products in the long run. This broadens the range of product applications in the food and beverage industries. Moreover, the industry is expanding as a result of the growing use of such mushrooms as functional ingredients in the pharmaceutical and nutraceutical sectors.

The immune system efficiency can be increased by consuming functional mushrooms and products derived from mushrooms, according to numerous scientific studies, which has further led to the expansion of this market. Functional mushrooms have a short shelf life of one to three days because of the high water content in them. As a result, post-harvest transportation and storage are essential for a functional mushroom value chain. Even when high-quality mushrooms are grown, poor transportation practices can cause quality to decline, which lowers the product’s final cost. The majority of mushrooms, including paddy straw mushrooms, have a very short shelf life of only a few hours; as a result, they must be processed, preserved, or refrigerated as soon as they are harvested to reduce post-harvest losses. This is anticipated to be a market restraint.

Product Insights

The shiitake product segment dominated the industry in 2021 and accounted for the maximum share of more than 34.0% of the overall revenue. This was owing to the product’s rising demand for its nutritional and medicinal benefits. These mushrooms help strengthen the immune system, promote cardiovascular health, help with weight loss, and boost energy levels. Furthermore, shiitake mushrooms are used in the food industry as well as the dietary supplements industry. As shiitake mushrooms have an umami flavor, dried shiitake mushrooms are highly popular among consumers across the globe. Moreover, both fresh & dried shiitake mushrooms are used in stir-fries, soups, stews, and other Asian cuisines.

The reishi segment is estimated to register the fastest CAGR during the forecast period. Reishi mushrooms are beneficial for strengthening the immune system as the consumption of reishi mushrooms impacts white blood cells and improves the immune function of the human body. Moreover, along with the immune system benefits, it also reduces fatigue and depression. Reishi mushrooms also have other potential health benefits that include improved heart health and blood sugar control and can act as an antioxidant in food & dietary supplement applications. These factors are expected to boost segment growth in the coming years.

Application Insights

On the basis of applications, the industry has been categorized into food & beverage, dietary supplements, pharmaceuticals, and others. The food and beverage application segment dominated the global industry in 2021 and accounted for the maximum share of more than 42.10% of the overall revenue. The changing lifestyle of consumers, the increasing urban population, and growing disposable income levels are some of the key factors influencing consumers to opt for healthy eating habits. Thus, consumers across the globe are adopting functional mushroom-infused foods and beverages in their diets.

Therefore, the global food processing industry has been capitalizing on this trend, and it is expected that this trend is likely to boost the demand for functional mushrooms over the forecast period. The pharmaceutical application segment is expected to witness the fastest CAGR from 2022 to 2030. Functional mushrooms are rich in various bioactive compounds, including antioxidants, such as flavonoids, quercetin, baicalein, polyphenols, polysaccharides, triterpenes, proteins, amino acids, and organic germanium. Thus, functional mushroom extracts are used as an ingredient in formulating medicinal or supplement products for diabetes, hypertension, sleeplessness, vitality, cancer, and hypercholesterolemia. This is expected to fuel the segment growth during the forecast period.

Regional Insights

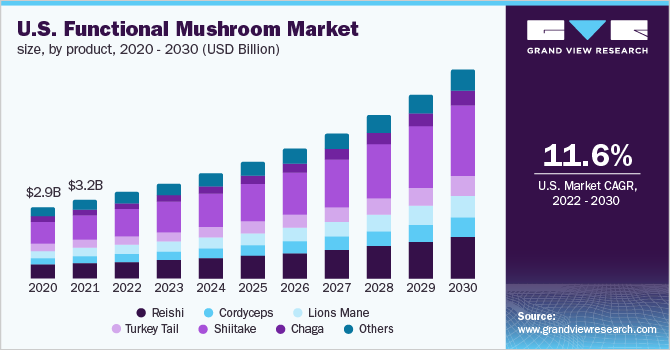

On the basis of geographies, the global industry has been further categorized into North America, Asia Pacific, Europe, Middle East & Africa, and Central & South America. North America is projected to register the fastest growth rate of more than 11.5% during the projected timeframe. This is attributed to a rise in the popularity of these mushrooms as superfoods. Functional mushrooms are becoming more popular in developed areas because they are a superior alternative to numerous other nutritious foods. Furthermore, increased consumer awareness about maintaining overall health and well-being will support the region’s growth.

The growing preference for a vegan diet is also anticipated to drive demand for functional mushrooms in North America. Asia Pacific was the dominant region in 2021 owing to the majority of mushrooms being grown in China. Another key factor driving the regional market was the high demand for such mushrooms as a result of their potential as functional foods. There is also a high demand for functional mushrooms in the food and beverage industry of the Asia Pacific region owing to an increase in the usage of these mushrooms in regular diets as a nutritious food option.

Key Companies & Market Share Insights

Major players are investing heavily in R&D to focus on new product development while expanding their distribution network. For instance, in June 2021, The Marley, in partnership with Silo Wellness Inc., a major psychedelic company in Toronto, launched a new psychedelic and functional mushroom consumer brand, Marley One. The initial product offering includes a variety of functional mushroom tinctures, including lion’s mane, cordyceps, reishi, turkey tail, and Chaga, which provide benefits, such as boosting immunity, supporting gut health, sleep enhancement, and cognitive function. Some of the key companies operating in the global functional mushroom market are as follows:

-

Way of Will Inc.

-

M2 Ingredients

-

Nammex

-

Mitoku Company

-

Hokkaido Reishi Co. Ltd.

-

Lianfeng (Suizhou) Food Co. Ltd.

-

Monterey Mushrooms Inc.

-

Rebbl

-

Sotru

-

Monaghan Group

Functional Mushroom Market Report Scope

Report Attribute

Details

Market size value in 2022

USD 29.05 billion

Revenue forecast in 2030

USD 65.8 billion

Growth rate (Revenue)

CAGR of 10.8% from 2022 to 2030

Base year for estimation

2021

Historical data

2017 - 2020

Forecast period

2022 - 2030

Quantitative units

Revenue in USD million/billion and CAGR from 2022 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, application, region

Regional scope

North America; Europe; Asia Pacific; Central & South America; Middle East & Africa

Country scope

U.S.; Canada; Germany; U.K.; Italy; The Netherlands; Poland, China; India; Japan; South Korea; Brazil; South Africa

Key companies profiled

Way of Will Inc, M2 Ingredients, Nammex, Mitoku Company, Hokkaido Reishi Co. Ltd, Lianfeng (Suizhou) Food Co. Ltd, Monterey Mushrooms Inc., Rebbl, Sotru, Monaghan Group

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Functional Mushroom Market Segmentation

This report forecasts revenue growth at the global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2017 to 2030. For the purpose of this study, Grand View Research has segmented the global functional mushroom market report on the basis of product, application, and region:

-

Product Outlook (Revenue, USD Million, 2017 - 2030)

-

Reishi

-

Cordyceps

-

Lions Mane

-

Turkey Tail

-

Shiitake

-

Chaga

-

Others

-

-

Application Outlook (Revenue, USD Million, 2017 - 2030)

-

Food and Beverage

-

Dietary Supplements

-

Pharmaceutical

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2017 - 2030)

-

North America

-

U.S.

-

Canada

-

-

Europe

-

Germany

-

U.K.

-

Italy

-

The Netherlands

-

Poland

-

-

Asia Pacific

-

China

-

India

-

Japan

-

-

Central & South America

-

Brazil

-

-

Middle East & Africa

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global functional mushroom market size was estimated at USD 26.7 billion in 2021 and is expected to reach USD 29.05 billion in 2022.

b. The global functional mushroom market is expected to grow at a compound annual growth rate of 10.8% from 2022 to 2030 to reach USD 65.8 billion by 2030.

b. The Asia Pacific dominated the functional mushroom market with a revenue share of 46.10% in 2021. This is attributable to the rising adoption of functional mushrooms as superfoods owing to its healthier benefits along with the increasing applicability of these mushrooms in the food and beverage sector

b. Some key players operating in the functional mushroom market include New Wave Holdings Corp, M2 Ingredients, Nammex, CNC Exotic Mushrooms, Mitoku Company, Hokkaido Reishi Co. Ltd., Shanghai Finc Bio-tech Inc., and Hirano Mushroom LLC

b. Key factors that are driving the functional mushroom market growth include rising demand for functional mushrooms from various end-use industries, anticipated growth in dietary supplements, along with the growing trend of functional food consumption.

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![ESOMAR Certified Member]()

![Great Place to Work Certified]()

ESOMAR & Great Work to Place Certified

![ISO 9001:2015 & 27001:2022 Certified]()

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."