- Home

- »

- Consumer F&B

- »

-

Frozen Food Market Size, Growth & Trends Report, 2022-2030GVR Report cover

![Frozen Food Market Size, Share & Trends Report]()

Frozen Food Market Size, Share & Trends Analysis Report By Product (Fruits & Vegetables, Potatoes, Ready Meals), By Distribution Channel (Offline, Online), By Region, And Segment Forecasts, 2022 - 2030

- Report ID: 978-1-68038-280-8

- Number of Pages: 100

- Format: Electronic (PDF)

- Historical Range: 2017 - 2020

- Industry: Consumer Goods

Report Overview

The global frozen food market size was valued at USD 177.07 billion in 2021 and is expected to expand at a compound annual growth rate (CAGR) of 5.2% from 2022 to 2030. The increasing popularity of shelf-stable foods among consumers on a global level is expected to expand the industry size over the next few years. According to an article published in Progressive Grocer in August 2021, the popularity of these foods including breakfast meals rose by 10.9%, and dinners/entrees were up by 4.9%. frozen meat, up 2.7%, and processed chicken (up 10.4%). Moreover, the utilization of these products by numerous end users such as full-service restaurants, hotels & resorts, and quick-service restaurants will further support the growth of this market.

The recent spread of COVID-19 infections, affecting food manufacturing plants has raised the possibility of mass closures of these plants, causing significant risk to a value chain with limited excess capacity. To comply, companies are offering a blend of incentives and incremental safety investments to maximize worker attendance to keep the food supply chain running and are increasing their e-commerce presence by going direct to consumers.

According to Organization for Economic Co-operation and Development (OECD) October 2020, in Korea, food services via online platforms increased by 66.3%. Hence, initiatives like these, given the spike in infections are likely to bode well for the growth of the industry over the forecast period.

The rising prevalence of gluten-free dietary lifestyles among consumers owing to various health benefits offered by these products will further boost the market for gluten-free ready meals. For instance, in March 2022, Halo Top, an ice-cream brand from Wells Enterprises, Inc. launched a line of fruity frozen desserts with new sorbet pints.

These products are available in three juicy flavors including raspberry, mango, and strawberry. In addition, these products are made up of real fruits, with less sugar & calories and vegan certified, and gluten-free. The rise in the trend of healthy eating among buyers will further integrate well for the expansion of the industry.

Growing penetration of companies on e-commerce websites with the ongoing trend of consumers opting for online distribution channels to directly get their food delivered at home will drive the market in the forecast period. For instance, in March 2022, GoodPop frozen pops launched a United States Department of Agriculture (USDA) certified organic pops that are 100% fruit juice-based and made with no added sugar.

The pops will be available in packs of six flavors: orange, cherry, and grape. These products will be available at GoodPop’s online shop across the U.S. beginning in April. Hence, initiatives like these will propel market growth in the coming years.

Increasing women’s employment rate has been witnessed globally in recent years. According to the U.S. Bureau of Labor Statistics April 2021, the employment rate was 68% for women in January 2020. Similarly, in China, the women’s employment rate was around 61.8% in 2020.

With the increase in the number of employed women, it becomes significantly difficult for them to cook meals, which results in consuming frozen ready meals. All these factors collectively drive the industry’s growth. Popular products in the segment include chicken pies, mini cottage pie, smoked haddock kedgeree, and broccoli & cheddar bake.

Moreover, the rising trend of stay-at-home across the globe due to the COVID-19 pandemic is shifting consumers’ preferences toward ready-to-eat (RTE) food products as they can be stored for a longer duration. For instance, in October 2021, Amul, the Indian food retailer expanded its frozen and ready-to-eat food offerings including food such as frozen potatoes, paneer, cheese parathas, and patties.

The initiative was taken to broaden the product portfolio range by the company and increase diversification for these foods. Hence, owing to safety and hygiene concerns, consumers are taking shorter trips to stores which has propelled the demand for frozen products.

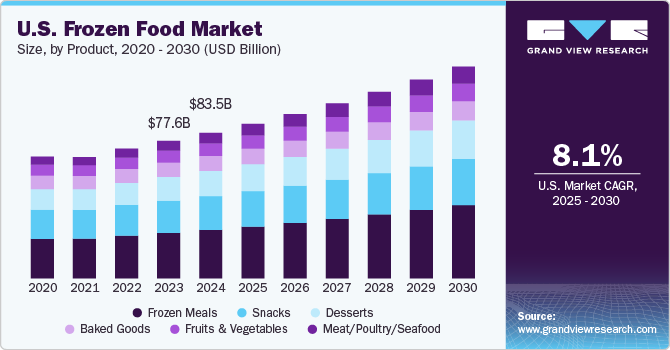

Product Insights

The ready meals segment held the largest revenue share of 43.0% in 2021 and is expected to maintain dominance over the forecast period on account of pre-dominant consumption of ready meals among working-class people around the globe. According to an article published in BioMed Central (BMC) in February 2020, nearly 36% of adults in the U.S. reported consumption of ready-to-eat meals.

Further, the segment is expected to grow on account of new product launches. For instance, in September 2021, China’s HEROTEIN launched sixteen ready-to-eat plant-based meat meals including various types of chicken and beef. The entire range is fully plant-based and will be distributed across China.

The fruits & vegetable segment is projected to register the fastest CAGR of 6.0% from 2022 to 2030. Owing to the increasing prevalence of lifestyle diseases, consumers are shifting to these products as they do not need to be washed, peeled, or chopped. Diseases such as bloated stomach and diarrhea are caused by eating infected or unclean food.

In line with this, manufacturers are launching unique product variants, incorporating herbs and spices from local produce, to widen their portfolio and attract a large consumer base. For instance, in January 2021, Mother Dairy launched two new frozen vegetables under the Safal brand including Drumsticks and Cut Okra. This initiative was taken in wake of health-conscious consumers which will further aid the segmental growth.

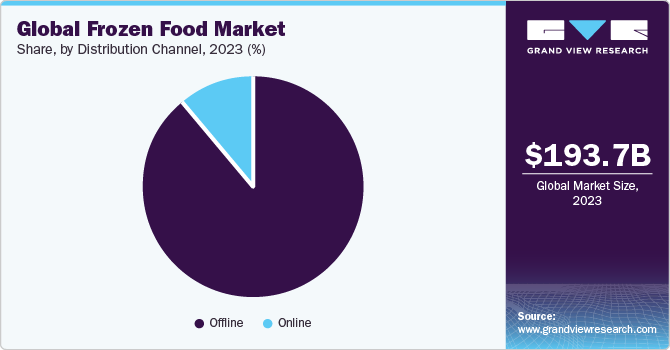

Distribution Channel Insights

The offline segment held the largest revenue share of around 89.2% in 2021. Offline channels include supermarkets/hypermarkets, convenience stores, grocery stores, and local shops. An increasing number of these stores across various regions have experienced a surge in the distribution of frozen food.

According to an article published by Talking Retail, in April 2021, the sales of frozen food via the grocery market, increased by 14.4% in value and 11.5% in volume in 2020. Moreover, easy access to such products in brick-and-mortar stores on a global level is expected to keep the momentum of the segment over the next few years.

The online distribution channel is anticipated to register a rapid CAGR of 5.4% from 2022 to 2030. The segment is poised to emerge as a steady source of revenue over the forecast period. Promising growth exhibited by e-commerce platforms in emerging as well as developed countries is compelling manufacturers to reorient their retail strategies in these countries.

For instance, in April 2021, Amazon launched Aplenty, a private label food and snack brand with hundreds of products including frozen foods, pita chips, crackers, mini cookies, and condiments. These foods will be available online and in-store at Amazon Fresh which will further increase product visibility among consumers.

Regional Insights

North America made the largest contribution to the global market with a share of 33.2% in 2021. Growing affinity towards frozen food among consumers especially millennials due to single serving options and ease in preparation is expected to drive the market in the forecast period. For instance, in October 2019, Bell & Evans launched a line of uncooked, frozen chicken meatballs.

Flavors include parmesan breaded with mozzarella, buffalo seasoned, and a traditional, savory chicken meatball. All three varieties are made from a blend of dark meat chicken and skin for full flavor and are uncooked and nitrogen chocked to lock in freshness and natural juices. Further, opening opportunities for developing country suppliers in Brazil, Canada, and Mexico will surpass the market growth trend in the future.

Asia Pacific is the fastest-growing market and is expected to witness a CAGR of 5.6% from 2022 to 2030. The increasing availability of frozen products that are high in protein, low in calories, and low in fat that addresses specific dietary requirements such as dairy-free, vegan, sugar-free, gluten-free, and plant-based products, will drive the regional growth.

For instance, in June 2021, First pride, a food brand in Asia-Pacific rolled out frozen bites, nuggets, and strips made with plants to consumers in Malaysia. And will also make them available in other regional markets in the coming months, further increasing the sales of these products.

Key Companies & Market Share Insights

The market is highly fragmented with the presence of a large number of global players. The market players face intense competition, especially from the top manufacturers of this market as they have a large consumer base, strong brand recognition, and vast distribution networks. Companies have been implementing various expansion strategies, such as partnerships and new product launches, to stay ahead in the game.

-

For instance, in March 2021, Nomad Foods acquired Fortenova’s frozen food business. The deal for the divestment of the business mentioned above covers Ledo Plus, Ledo Citluk, Frikom, and several smaller affiliated companies

-

In June 2020, GOELD, a frozen food business by the Goel Group was launched. The brand offers fifteen products in four categories, including Indian bread, snacks, desserts, and vegan treats

-

In January 2021, Imperial Tobacco Company of India Limited (ITC) expanded its frozen snacks business three times during the COVID-19 pandemic with the conglomerate adding 10 new products during the period

Some prominent players in the global frozen food market include:

-

Unilever PLC

-

Nestlé S.A.

-

General Mills, Inc

-

Nomad Foods Ltd.

-

Tyson Foods Inc.

-

Conagra Brands Inc.

-

Wawona Frozen Foods

-

Bellisio Parent, LLC

-

The Kellogg Company

-

The Kraft Heinz Company

Frozen Food Market Report Scope

Report Attribute

Details

Market size value in 2022

USD 185.07 billion

Revenue forecast in 2030

USD 278.47 billion

Growth rate

CAGR of 5.2% from 2022 to 2030

Base year for estimation

2021

Historical data

2017 - 2020

Forecast period

2022 - 2030

Quantitative units

Revenue in USD million/billion and CAGR from 2022 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, distribution channel, region

Regional scope

North America; Europe; Asia Pacific; Central & South America; Middle East & Africa

Country scope

U.S.; U.K.; Germany; France; China; India; Japan

Key companies profiled

Unilever PLC; Nestlé S.A.; General Mills, Inc; Nomad Foods Ltd.; Tyson Foods Inc.; Conagra Brands Inc.; Wawona Frozen Foods; Bellisio Parent, LLC; The Kellogg Company; The Kraft Heinz Company

Customization scope

Free report customization (equivalent to up to 8 analysts' working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Frozen Food Market Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends and opportunities in each of the sub-segments from 2017 to 2030. For this study, Grand View Research has segmented the global frozen food market report based on product, distribution channel, and region:

-

Product Outlook (Revenue, USD Million, 2017 - 2030)

-

Fruits & Vegetables

-

Potatoes

-

Ready Meals

-

Meat

-

Fish/Seafood

-

Others

-

-

Distribution Channel Outlook (Revenue, USD Million, 2017 - 2030)

-

Offline

-

Online

-

-

Regional Outlook (Revenue, USD Million, 2017 - 2030)

-

North America

-

U.S.

-

-

Europe

-

U.K.

-

Germany

-

France

-

-

Asia Pacific

-

China

-

India

-

Japan

-

-

Central & South America

-

Middle East & Africa

-

Frequently Asked Questions About This Report

b. The global frozen food market size was estimated at USD 177.07 billion in 2021 and is expected to reach USD 185.07 billion in 2022

b. The global frozen food market is expected to grow at a compound annual growth rate of 5.2% from 2022 to 2030 to reach USD 278.47 billion by 2030

b. North America dominated the frozen food market with a share of 33.29% in 2021. This is attributable to increasing spending on shelf-stable foods among consumers.

b. Some key players operating in the frozen food market include Wawona Frozen Foods; Bellisio Foods; McCain Foods; ConAgra Foods, Inc.; General Mills, Inc.; and Nestle S.A.

b. Key factors that are driving the market growth include growing importance of Ready-to-Eat (RTE) food products as a result of hectic lifestyles among working-class individuals.

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![ESOMAR Certified Member]()

![Great Place to Work Certified]()

ESOMAR & Great Work to Place Certified

![ISO 9001:2015 & 27001:2022 Certified]()

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."

Important: Covid19 pandemic market impact

The frozen food market is witnessing a significant rise in demand globally. Will the limited consumer knowledge regarding the possible end to this crisis play an integral role in shaping the near future of the industry? Our team is working to account for the rapid surge in our estimates. The report will account for Covid19 as a key market contributor.