- Home

- »

- Advanced Interior Materials

- »

-

Food Service Equipment Size, Share & Growth Report, 2030GVR Report cover

![Food Service Equipment Market Size, Share & Trends Report]()

Food Service Equipment Market Size, Share & Trends Analysis Report By Product (Kitchen Purpose Equipment, Refrigeration Equipment, Ware Washing Equipment, Food Holding & Storing Equipment), By End-user, And Segment Forecasts, 2023 - 2030

- Report ID: 978-1-68038-841-1

- Number of Pages: 130

- Format: Electronic (PDF)

- Historical Range: 2018 - 2021

- Industry: Advanced Materials

Report Overview

The global food service equipment market size was valued at USD 34.88 billion in 2022 and is expected to grow at a compound annual growth rate (CAGR)and is expected to register a CAGR of 6.3% from 2023 to 2030. Changing food consumption patterns, increased demand for takeaways and the expanding hospitality sector are some of the key factors driving the market. Furthermore, factors such as increasing digitalization, the need for sustainable & eco-friendly equipment, and stringent consumer safety norms are expected to create promising growth opportunities for the market in the near future.The market has rapidly evolved following the changing needs of clients for outfitting their kitchen spaces. Changing social customs coupled with technological progressions, have created a dynamic marketplace for the equipment used in the end-use sector.

The market has rapidly evolved following the changing needs of clients for outfitting their kitchen spaces. Changing social customs coupled with technological progressions, have created a dynamic marketplace for the equipment used in the end-use sector. From the discovery of equipment for preparing and storing food, such as cooking stoves, ranges, and electrical refrigerators, to the availability of custom foodservice appliances to cook different cuisines, the range of technologically-advanced and innovative products has entered the market over the years and is expected to favor the market growth in the longer run. Furthermore, rapid technological advancements achieved with the help of continual Research & Development (R&D) activities have helped appliance manufacturers to offer technology-driven efficiencies to their clients.

The market demand has significantly increased in response to the emergence of several casual restaurant chains in North America and Europe. Companies are mandated to sell certified and tested commercial kitchen appliances according to the safety rules laid by several regulatory bodies worldwide. These safety standards aim to create a guarded environment for both the restaurant operators and consumers. National Sanitation Foundation (NSF), an American product testing, inspection, and certification non-profit organization, has developed equipment safety standards to ensure food safety requirements and sanitation protocols are maintained by the end-use sector. With food safety being the utmost priority, standards have been set for the material used, design, and equipment architecture.

The growing awareness about energy consumption and eco-friendly initiatives facilitates consumers to adopt energy-efficient appliances, thereby creating opportunities for this market. Energy consumption norms across the globe emphasize reducing the Green House Gas (GHG) emissions to mitigate the rising impact of climate change. End customers are increasingly preferring appliances holding the ENERGY STAR symbol, a mark of energy efficiency of the equipment, which helps restaurants, institutional kitchens, and cafes save energy while also reducing maintenance and utility costs. As reported in 2018 by the Energy Star program of the U.S, Environmental Protection Agency (EPA), food service equipment with the ENERGY STAR symbol helps the end-use operators to save USD 5,300 or around 340 MMBTU per year.

The COVID-19 pandemic resulted in the temporary shutdown of food service operations owing to stringent social distancing and shelter-in-place norms imposed by governments worldwide. This resulted in negative growth of the industry as both production and sales were negligible during 2020. Nevertheless, as governments announce relaxations to lockdowns and the first vaccines arrive, the food service industry is expected to bounce back over the forecast period. While the dine-in restaurant traffic is expected to take longer to come to normalcy, end customers are expected to recover through off-premise, takeaways, and online delivery services. On account of the subsequent rise in footfall in food service restaurants and institutional kitchens, the beleaguered market is expected to flourish over the years to come.

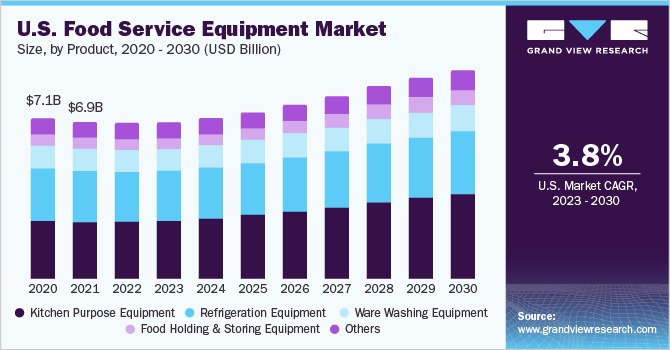

Product Insights

The kitchen purpose equipment segment accounts for the largest revenue share of over 38.8% of the overall market in 2022 and is estimated to witness the fastest growth from 2023 to 2030. The procurement of appropriate kitchen appliances is a must while establishing a new business or refurbishing an existing place to ensure smooth operations. The growth of the kitchen purpose equipment segment is highly subject to the use of innovative products in commercial kitchens depending on the space and budget of the kitchen. The increasing demand for meal preparation appliances in the open food service kitchens has encouraged manufacturers to increase their focus on elements including the latest technology solutions and appliance exterior designs. The trend of embedding sensors in kitchen purpose equipment, such as fryers, ovens, and cooktops, has led to real-time monitoring of meal preparations.

Furthermore, restaurants are shifting to smaller kitchens owing to the increasing rent of commercial spaces. This is compelling the food service equipment manufacturers to upgrade their product designs and make them compact, multipurpose, and faster in functionality. The refrigeration equipment segment constituted a significant market share in 2022. The rising popularity of take-away and ready-to-eat items has compelled restaurant chains to equip themselves with modern refrigerators. This has necessitated manufacturers to incorporate bidirectional Internet of Things (IoT) connectivity in commercial refrigerators to remotely monitor food inventory and temperature.

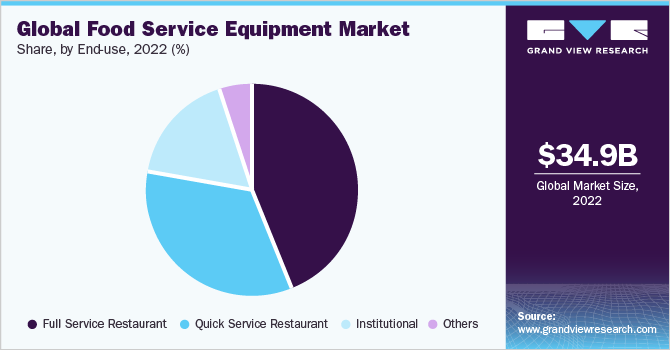

End-user Insights

The Fullfull-Service service Restaurant restaurant (FSR) segment accounted for the dominant revenue share of over 44.13% of the market in 2022. The high market share of FSRs can be attributed to the advent of digital dining trends, which has compelled food service operators to deploy modern equipment to speed up the preparation process and reduce delivery uptime. The subsequent shift in the dine-out culture for formal events as well as informal gatherings during travel & tourism activities has increased the footfall in full-service restaurants over the past few years. As a result, the FSR segment is likely to retain its dominance over the forecast period.

The Quick quick Service service Restaurants restaurants (QSRs) segment is expected to register the fastest growth over the forecast period. This can be attributed to the rising working population and globalization of prominent restaurant chains by establishing franchisee joints. QSRs are emphasizing on menu innovation, convenience, and competitive pricing. Furthermore, the continual product innovations in food service equipment market have been acknowledged as an added stimulus enabling time-constrained consumers to have quicker access to good-quality cooked items.

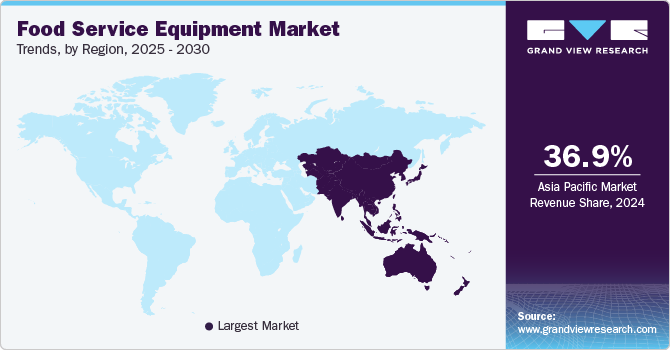

Regional Insights

The Asia Pacific market accounted for the highest revenue share of close to 35.9% in 2022 and is expected to retain its dominance in the market over the forecast period. Rapidly westernizing dining customs and expansion of the tourism sector, particularly in Singapore, Malaysia, Indonesia, and Australia, are driving the demand for food service equipment in the region. Furthermore, restaurants are incorporating multiple cuisines into their menus owing to an increasing number of customers experimenting with new foods and developing a taste for different cuisines. Additionally, the rising consumption of processed foods is expected to create a soaring demand for these appliances in the Asia Pacific region.

The U.S. has emerged as the dominant market in the food service equipment industry, owing chiefly to the presence of well-established brands such as McDonald's, Burger King Corporation, KFC Corporation, and Starbucks Coffee Company among others. Moreover, government initiatives influencing the tourism sector and immigration in the country are projected to uplift the restaurant industry in the near future, which could work well for these appliances' deployment rates in the region. The Central & South America market is anticipated to foresee significant growth owing to the rising demand for off-premise or home delivery services.

Key Companies & Market Share Insights

The rising deployment of sustainable technology equipment has compelled key players to focus on business strategies such as collaborations, mergers, and acquisitions beneficial for their businesses. Key manufacturers are collaborating with solution providers to build customer-centric equipment addressing food wastage by grocery stores, hypermarkets, and supermarkets. For instance, in 2018, AB Electrolux collaborated with Karmalicious AB, a Sweden-based startup that builds food rescue applications. This collaboration was aimed at introducing a new technologically-advanced refrigerator for grocery stores to minimize food wastage. In 2019, Daikin Industries, Ltd. acquired AHT GROUP GmbH, one of Germany's leading food service manufacturers. This acquisition helped the company to expand its business presence in the European region. Additionally, strategies such as new product launch targeted marketing are being adopted to gain a competitive edge in the market. Some of the prominent players operating in the global food service equipment market include:

-

AB Electrolux

-

Ali Group S.r.l. a Socio Unico

-

Dover Corporation

-

Duke Manufacturing

-

Haier Group

-

SMEG S.p.A.

-

The Middleby Corporation

Recent Development

-

In July 2023, Hoshizaki America announced the expansion of its sales team in the country with three new manufacturers’ representative groups to represent their refrigeration lines. Gabriel Group, Preferred Source, and Elevate Foodservice Group would act as agents in the Midwest, the Northern Texas, and the Northeast territories respectively

-

In February 2023, The Middleby Corporation announced the acquisition of Marco Beverage Systems, a Dublin, Ireland-based designer and manufacturer of energy-efficient beverage dispense solutions. The acquisition would help expand Middleby’s offerings in cold brew dispense and coffee brewers, along with various types of hot, cold, and sparkling water dispensers

-

In February 2023, Vollrath Company announced the revamping of its countertop equipment line, aimed at improving the performance, functionality, and ease of use for customers. New features or updates have been added to hot food merchandizers; fryers; gas equipment such as charbroilers, hot plates, and griddles; and half-size long warmers. Additionally, the company has also updated the visual designing of their models

-

In January 2023, Rancilio Group announced that the Rancilio Specialty RS1 had obtained the Premium Certification from the Italian Espresso Institute (IEI), making it one of the first espresso machines to attain this certification. The RS1 features a multi-boiler system and Advanced Temperature Profiling technology and was tested on the constancy of the extraction temperature, pre-infusion, and steam production

-

In November 2022, Fujimak Corporation announced the establishment of its new subsidiary in Santa Ana, California, to promote the company’s sales in North America. This makes it the company’s first subsidiary to be established in this region

-

In July 2022, Ali Group announced that it had completed the acquisition of Welbilt, Inc., allowing the former to expand its geographical footprint as well as its portfolio of advanced and innovative foodservice solutions

-

In July 2022, the Middleby Corporation announced the acquisition of Colussi Ermes, a Pordenone, Italy-based global manufacturer of automated washing solutions for the food processing business. Colussi Ermes provides washing solutions in many segments, including confectionary, bakery, protein, and fruits & vegetables, and they are known for minimizing water, chemical, and energy use, as well as reducing labor requirements

-

In June 2022, Hoshizaki announced the release of the company’s new refrigerated Pizza Prep models that help maintain ideal temperatures for products, while reducing maintenance and labor. Some of the features include a night/day mode, a one-piece pan rail design to protect the cabinet, optimal airflow in rail for precise and consistent cooling of products, and removable air filters. Eleven models had been launched in 46-inch and 60-inch configurations

Food Service Equipment Market Report Scope

Report Attribute

Details

Market size value in 2023

USD 35.97 billion

Revenue forecast in 2030

USD 56.90 billion

Growth rate

CAGR of 6.3% from 2023 to 2030

Base year for estimation

2022

Historical data

2018 - 2021

Forecast period

2023 - 2030

Quantitative units

Revenue in USD million/billion and CAGR from 2023 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, end-use, & region

Regional scope

North America; Europe; Asia Pacific; Central & South America, Middle East & Africa

Country scope

U.S.; Canada; Mexico; U.K.; Germany; China; India; Japan; Brazil

Key companies profiled

AB Electrolux; Ali Group S.r.l. a Socio Unico; Dover Corporation; Duke Manufacturing; Haier Group; SMEG S.p.A.; The Middleby Corporation

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Food Service Equipment Market Report Segmentation

This report forecasts revenue growth at regional and country levels and provides an analysis on the industry trends in each of the sub-segments from 2018 to 2030. For the purpose of this study, Grand View Research has segmented the food service equipment market based on product, end-user, and region.

-

Food Service Equipment Product Outlook (Revenue, USD Billion, 2018 - 2030)

-

Kitchen Purpose Equipment

-

Cooking Equipment

-

Food & Beverage Preparation Equipment

-

-

Refrigeration Equipment

-

Ware Washing Equipment

-

Food Holding & Storing Equipment

-

Others

-

-

Food Service Equipment End-user Outlook (Revenue, USD Billion, 2018 - 2030)

-

Full Service Restaurant (FSR)

-

Quick Service Restaurant (QSR)

-

Institutional

-

Others

-

-

Food Service Equipment Regional Outlook (Revenue, USD Billion; 2018 - 2030)

-

North America

-

U.S

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

U.K.

-

-

Asia Pacific

-

China

-

India

-

Japan

-

-

Central & South America

-

Brazil

-

-

Middle East & Africa

-

Frequently Asked Questions About This Report

b. The global food service equipment market size was estimated at USD 34.88 billion in 2022 and is expected to be USD 35.97 billion in 2023.

b. The food service equipment market, in terms of revenue, is expected to grow at a compound annual growth rate of 6.3% from 2023 to 2030 to reach USD 56.90 billion by 2030.

b. Asia Pacific dominated the food service equipment market with a revenue share of 35.87% in 2022 on the account of the rapidly westernizing dining customs and expansion of the tourism sector, particularly in Singapore, Malaysia, Indonesia, and Australia, are driving the demand for food service equipment in the region.

b. Some of the key players operating in the food service equipment market include: AB Electrolux; Ali Group S.r.l. a Socio Unico; Dover Corporation; Duke Manufacturing; Haier Group; SMEG S.p.A.; The Middleby Corporation.

b. Key factors that are driving the food service equipment market growth include changing food consumption patterns, increased demand for takeaways and the expanding hospitality sector.

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![ESOMAR Certified Member]()

![Great Place to Work Certified]()

ESOMAR & Great Work to Place Certified

![ISO 9001:2015 & 27001:2022 Certified]()

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."

Important: Covid19 pandemic market impact

The global electronics devices market (including consumer electronics and industrial electronics devices) is expected to be impacted significantly by COVID-19 as China is one of the major suppliers for the raw materials (used to manufacture devices) as well as the finished products. The industry is on the brink of facing a reduction in production, disruption in supply, and price fluctuations. While this can vastly encourage local manufacturers to step up and address the growing demand, the scarcity of raw material can still pose a challenge to this industry. The sales of prominent electronic companies is expected to be affected in the near future. The report will account for COVID-19 as a key market contributor.