- Home

- »

- Food Safety & Processing

- »

-

Food Safety Testing Market Size, Share, Growth Report 2030GVR Report cover

![Food Safety Testing Market Size, Share & Trends Report]()

Food Safety Testing Market Size, Share & Trends Analysis Report By Test (Allergen Testing, Chemical & Nutritional Testing), By Application (Meat, Poultry, & Seafood Products), By Region, And Segment Forecasts, 2023 - 2030

- Report ID: GVR-3-68038-659-2

- Number of Pages: 152

- Format: Electronic (PDF)

- Historical Range: 2018 - 2021

- Industry: Consumer Goods

Food Safety Testing Market Size & Trends

The global food safety testing market size was estimated at USD 20,990.3 million in 2022 and is anticipated to grow at a compound annual growth rate (CAGR) of 7.8% from 2023 to 2030. One of the main factors propelling the growth of the market is the increase in cases of food-borne illnesses, increased consumer awareness of food safety, implementation of strict food safety regulations, and rising consumer desire for convenience and packaged food products. Furthermore, in the next years, major expansion potential for providers of food safety testing will be provided by technology developments in food safety testing methodologies. In order to guarantee the quality and safety of the food we eat, the food safety testing market is essential. This industry is crucial to safeguarding the public's health because of its capacity to identify and get rid of dangerous pollutants, food poisons, and viruses. The market is anticipated to increase significantly as a result of growing public concern about food contamination and food-borne illnesses as well as improvements in testing methodologies.

The Centers for Disease Control and Prevention (CDC) in the U.S. estimate that 1 in 6 Americans, or 48 million people, become ill from a foodborne illness each year. In addition, 3,000 people pass away from a foodborne illness each year, and 128,000 people are admitted to hospitals as a result of a foodborne illness. Hence, it is anticipated that the market for food safety testing would be driven by the rising number of cases of food-borne illness among Americans.

The main cause of food-borne sickness is consuming rotten, contaminated, or deteriorating food items that include numerous microorganisms, including bacteria, fungus, parasites, viruses, and others. In addition, a number of additional pollutants, including mycotoxins, heavy metals, and chemicals, are contributing to an increase in occurrences of food-borne disease. The demand for food testing kits, machinery, and systems in the area is dramatically rising as a result of these increasing incidents. Hence driving up demand for the market for food safety equipment. For instance, in May 2022, Reno, Nevada-based Bureau Veritas, a company that offers certification services, laboratory testing, and inspection announced the establishment of its third US microbiological laboratory. The facility is to do microbiology indicator analyses and quick pathogen testing for the agri-food industry.

Since the COVID-19 outbreak, a number of factors of food safety, including transportation and dining etiquette, have improved. With the use of information technology to locate consumer information and smartphone apps for food purchase and delivery, lockdown created a new business opportunity in the food sector. This crisis offers a chance to change the food system in ways that are less susceptible to upheaval. More than ever, consumers are concerned about food safety and the technology that upholds it. As a result, in the next years, the market acceptance of food safety testing is anticipated to be fueled by the expanding public consciousness regarding food safety.

Increasing demand for wholesome and nutritious food additives, growing awareness of various health benefits, rising food safety concerns, an ageing population, rising healthcare costs, shifting lifestyle habits, and the accessibility of different food safety testing techniques are a few of the major factors propelling the growth of the global food safety testing market. For instance, in April 2022 Mérieux NutriSciences acquired Hortec Pty Ltd (Hortec) in South Africa and Laboratorios Bromatológicos Araba SA (Aralab) in Spain. By making these new acquisitions, Mérieux NutriSciences is expanding its regional reach in Spain and entering the pesticide industry in South Africa, furthering its strategic objectives and enhancing its capabilities.

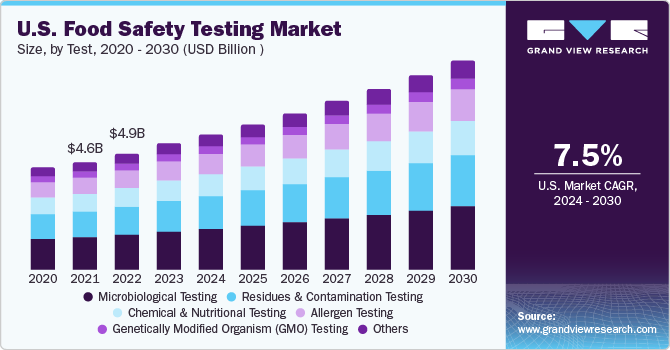

Test Insights

Allergen testing segment accounted for 12.8% of the global revenue share in 2022. Increasing prevalence of food allergies in consumers increases the consciousness about health that increases the development in food allergen testing methods and are rising the growth of the segment. For instance, according to CDC/National Center for Health Statistics 2023, nearly 1 in 3 U.S. adults and more than 1 in 4 U.S. children reported having a food allergy. In addition, almost 6% of U.S. adults and children have a food allergy, thereby, driving the segment growth over the projected year.

Microbiological testing segment accounted for 28.7% of the global revenue share in 2022. The market is anticipated to grow as it assistances in the detection of microorganisms in food items using chemical, biological, molecular, and biochemical methods, offering very exact results on their makeup. For instance, SGS opened a new food analysis facility in Mexico in July 2022. Businesses will benefit from the new Naucalpan laboratory's assistance with quality control and regulatory compliance, which will benefit the Mexican food industry.

The residues & contamination testing segment is likely to grow at a CAGR of 7.5% over the forecast period on account of extensive safety and quality checks done to detect the overuse of chemicals such as pesticides and herbicides and growth in the utilization of antimicrobial drugs and additives. A rise in the demand for contamination checks for meat, poultry, and meat products is expected to drive the segment growth.

Genetically modified organism (GMO) testing segment accounted for 13.2% of the global revenue share in 2022. The segment is primarily driven by rising awareness among consumers regarding the presence of harmful GMOs in edible products. Also, growth in the production of GMO edible products is expected to drive the demand for such safety tests to ensure optimum food quality

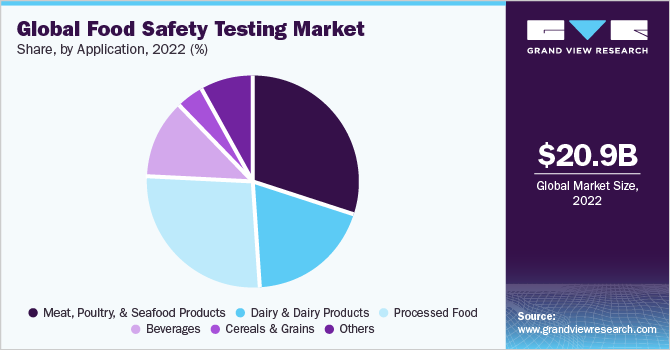

Application Insights

Meat, poultry, & seafood products application segment accounted for 30.1% of the global revenue share in 2022. Globally more individuals are consuming processed poultry and meat products at home, in restaurants, fast food restaurants, and other locations. For instance, the worldwide meat consumption is estimated to reach 460 to 570 million tons by the year 2050, according to The World Counts. Therefore, it is essential to ensure optimum product quality during meat processing to minimize the perils of foodborne microorganisms. Meat quality testing requirements are always changing to make sure that food producers only release the highest-grade goods onto the market. For instance, Tyson Foods recalled more than 8.9 million pounds of ready-to-eat chicken products in July of this year because of possible Listeria monocytogenes contamination. The significant recall quantity itself represents the scope of pathogen testing requirements in processed meat sector, thereby driving up the market for food safety testing over the forecast period.

Processed food application segment accounted for 26.8% of the global revenue share in 2022. The ongoing investigation of the processed food product line is caused by the inclining consumer need for variety in food goods. In order to ensure that every ingredient maintains its quality and safety across all processing stages and that completed products are packaged and kept properly, more advanced quality control techniques are required. Consequently, it is projected that the adoption of food safety testing will fuel market expansion as a result of the aforementioned factors. For instance, the FSSAI regulates processed foods as a group of products, with guidelines for testing that include nutritional information, pollutants, and microbiological safety.

The dairy & dairy product application segment is likely to grow at a CAGR of 7.7% over the forecast period. In the dairy business, food safety goes beyond disease control. For instance, between 2% and 3% of infants in affluent countries suffer from milk allergy, which is the most prevalent food allergy in early life. Furthermore, because to the vast range of ingredients used in dairy products, particularly ice cream, milk products are vulnerable to undisclosed allergy recalls. For instance, when it comes to such recalls in the United States, ice cream is second only to bakery products in terms of frequency. Hence, it is anticipated that the growing number of food recalls resulting from non-compliant dairy and dairy products will increase market demand.

Beverage application segment accounted for 12.0% of the global revenue share in 2022. With the development of new goods including sports drinks, vitamin-fortified water, anti-aging water, and energy drinks, the beverage sector expands yearly. To help track contamination, adulteration, product consistency, and to assure regulatory compliance from raw ingredients like fruits, additives, and water, to the finished product, for instance, the compositional quality, testing, and safety must be maintained. As a result, producers are putting more of an emphasis on meeting the customer's expanding needs in order to ensure the quality and longer shelf life of beverages including soft drinks, energy drinks, and fruit juices. In addition, an increase in safety testing processes due to the usage of preservatives and concentrates in milk and milk products is anticipated to fuel market expansion.

Regional Insights

North America accounted for a 31.3% share of global revenue in 2022. By offering specific product lines and higher-quality food safety testing services, players in the market have established a strong presence in North America. They also employ cutting-edge manufacturing and marketing techniques. The increase in disposable income in Canada is also expected to lead to additional growth in the market for food safety testing in the region. For instance, according to the Mississippi State Department of Health, shigellosis, salmonellosis, and campylobacteriosis are the three most prevalent foodborne diseases in Mississippi. As a result of the aforementioned considerations, many businesses are now providing high-quality services for food safety testing, which is driving up demand.

In order to prevent foodborne disease outbreaks and avoid consuming heavy metals and drug residues that are unsafe for human consumption, the Europe market is anticipated to have an increase in demand for microbiological testing, followed by chemical & residues contamination testing. Moreover, a significant contributor to the economy in Europe is the food and beverage sector. The sector continues to exhibit the traits of a strong, resilient, and stable industry. Over the course of the projected period, product makers' increased attention on ensuring the safety of food products is anticipated to fuel market expansion.

The Asia Pacific food safety testing market is anticipated to grow at a CAGR of 9.0% over the forecast period. The market is growing owing to the implementation of stringent rules and regulation regarding the food. Governments have put different regulations in place for regulators, consumers, producers. The market growth in this region is largely driven by rising demand for processed food in emerging and developing nations like china, India, Indonesia, and Thailand as well as an increase in poisoning outbreaks caused by the consumption of contaminated meat and rise in cases of food degradation like pesticides, contamination, and acritical flavoring. For instance, South Korean government has imposed a complete ban on food and beverage packaging made using recycled materials that are not in full compliance with national standards.

As numerous studies and polls demonstrate, consumers in the Middle East and Africa have a high level of trust in food and beverage firms, governments in these regions are taking action to reassure local customers about the safety of food products and supply chains. The Department of Trade & Industry, and the National Department of Health, other top food safety organisations have implemented strict laws during the past several years to prevent foodborne outbreaks, which has contributed to the expansion of the South African food safety testing sector. Hence, over the course of the study period, the market in the area has grown as a result of rising consumer worries about food safety.

Key Companies & Market Share Insights

The manufacturers adopt several strategies, including acquisitions geographical expansions, new joint ventures, product developments, and mergers to enhance market penetration and cater to the changing technological requirements from various applications such as dairy & dairy products, processed food, beverages, cereals, meat, poultry, & seafood products, and others.

For instance, site rationalizations and reorganizations have been moving steadily as of February 2022, following Eurofins' purchase of Test America in the U.S. in 2018. 2019 saw the purchase of a 7,950 m2 structure on an 18,000 m2 block of land in California, United States. Later, the structure was renovated to combine the laboratories for TestAmerica Eurofins and Calscience LLC and Irvine into a single location. Some prominent players in the global food safety testing market include:

-

SGS S.A.

-

NSF International

-

Bureau Veritas

-

Eurofins Scientific SE

-

Intertek Group PLC

-

Merieux Nutrisciences

-

Merieux Nutrisciences

-

TUV SUD

-

UL LLC

-

Asurequality Limited

Food Safety Testing Market Report Scope

Report Attribute

Details

Market size value in 2023

USD 22,611.2 million

Revenue forecast in 2030

USD 38.25 billion

Growth Rate

CAGR of 7.8% from 2023 to 2030

Base year for estimation

2022

Historical data

2018 - 2021

Forecast period

2023 - 2030

Quantitative units

Revenue in USD million and CAGR from 2023 to 2030

Report coverage

Revenue forecast, company market position analysis, competitive landscape, growth factors, and trends

Segments covered

Test, application, region

Regional scope

North America; Europe; Asia Pacific; Central & South America; Middle East & Africa

Country Scope

U.S.; Canada; Mexico; Germany; France; U.K.; China; Japan; India; Brazil; Peru; Ecuador; Bolivia; Colombia; Paraguay; Costa Rica; Guatemala; South Africa

Key companies profiled

SGS S.A.; NSF International; Bureau Veritas; Eurofins Scientific SE; Intertek Group PLC; Merieux Nutrisciences; Merieux Nutrisciences; TUV SUD; UL LLC; Asurequality Limited

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Food Safety Testing Market Report Segmentation

This report forecasts revenue growth at global, regional & country levels and provides an analysis on the industry trends in each of the sub-segments from 2018 to 2030. For the purpose of this study, Grand View Research has segmented the global food safety testing market report on the basis of test, application, and region:

-

Test Outlook (Revenue, USD Million; 2018 - 2030)

-

Allergen Testing

-

Chemical & Nutritional Testing

-

Genetically Modified Organism (GMO) Testing

-

Microbiological Testing

-

Residues & Contamination Testing

-

Others

-

-

Application Outlook (Revenue, USD Million; 2018 - 2030)

-

Meat, Poultry, & Seafood Products

-

Dairy & Dairy Products

-

Processed Food

-

Beverages

-

Cereals & Grains

-

Others

-

-

Regional Outlook (Revenue, USD Million; 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

Europe

-

Germany

-

U.K.

-

France

-

Asia Pacific

-

China

-

India

-

Japan

-

Central & South America

-

Brazil

-

Peru

-

Ecuador

-

Bolivia

-

Colombia

-

Paraguay

-

Costa Rica

-

Guatemala

-

Middle East & Africa

-

South Africa

-

Frequently Asked Questions About This Report

b. The global food safety testing market size was estimated at USD 20,990.3 million in 2022 and is expected to reach USD 22,611.2 million in 2023.

b. The food safety testing market, in terms of revenue, is expected to grow at a compound annual growth rate of 7.8% from 2023 to 2030 to reach USD 38,248.5 million by 2030.

b. Europe dominated the food safety testing market with a revenue share of 34.4% in 2022. The food & beverage industry in Europe is major contributor to the economy. The industry maintains the characteristics of a stable, resilient and robust sector. Increasing focus of product manufacturers to maintain the safety of food products is expected to drive the market growth over the forecast period.

b. Some of the key players operating in the food safety testing market include SGS S.A., NSF International, Bureau Veritas, Eurofins Scientific SE, Intertek Group PLC, and among others.

b. The key factors that are driving the food safety testing market includes the increase in cases of food-borne illnesses, increased consumer awareness of food safety, implementation of strict food safety regulations, and rising consumer desire for convenience and packaged food products.

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![ESOMAR Certified Member]()

![Great Place to Work Certified]()

ESOMAR & Great Work to Place Certified

![ISO 9001:2015 & 27001:2022 Certified]()

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."

Important: Covid19 pandemic market impact

The food safety testing market is expected to witness a moderate growth owing to relaxations provided by governments on the food label norms manufacturers have to comply with during the pandemic outbreak. This is necessarily done to ensure an ample supply of essential food products to the population particularly in economies affected by lockdown. We at GVR are trying to quantify the impact of this pandemic on the food safety testing market. Get your copy now to gain deeper insights on the same.