- Home

- »

- Food Safety & Processing

- »

-

Food Processing Equipment Market Size, Share Report, 2030GVR Report cover

![Food Processing Equipment Market Size, Share, & Trends Report]()

Food Processing Equipment Market Size, Share, & Trends Analysis Report , By Mode of Operation (Automatic), By Type (Processing), By Application (Beverages), By Region, And Segment Forecasts, 2023 - 2030

- Report ID: GVR-2-68038-491-8

- Number of Pages: 214

- Format: Electronic (PDF)

- Historical Range: 2018 - 2021

- Industry: Consumer Goods

Report Overview

The global food processing equipment market size was valued at USD 50.80 billion in 2022 and is expected to grow at a compound annual growth rate (CAGR) of 4.0% over the forecast period. Population expansion, coupled with the rising per capita disposable income, is expected to result in an increased demand for meat and poultry and greater consumption of processed products, thus boosting the market growth over the forecast period. These systems are widely utilized across numerous applications, such as bakery and confectionery, meat, seafood and poultry, dairy, and grains, owing to their inherent advantageous characteristics, such as quality control, durability, hygiene, and preservation. The product is increasingly being utilized in the end-use industries, specifically in Asia Pacific, where rising domestic manufacturing and consumer income levels are driving innovation in this sector.

The food and beverage market in developing regions, such as Asia Pacific, is expected to dominate over the coming years owing to a rise in population, increasing foreign direct investments, rising disposable income, and changing preferences. In addition, increasing demand for leisure food in China, India, Indonesia, Malaysia, Japan, and various other countries is anticipated to boost the growth of the industry, thereby stimulating the product demand over the coming years.

Population growth and rising disposable income, along with increasing urbanization, are expected to augment the product demand in Middle Eastern countries. Moreover, the governments of Middle Eastern countries are focusing on reducing their reliance on the petroleum sector and promoting investments in industries, such as construction, automotive, and food and beverage.

Farmed fish solutions for the marine industry had provided a convenient solution for the demand-supply imbalance. However, the industry witnessed a price hike for fresh and processed fish. The positive economic condition of the market and potential customers are some of the prominent factors that assure the prominent growth of the market over the forecast period.

Though the number of malnourished people in the world has decreased by a considerable percent, the global condition of undernourished people is still critical. Rising population, dietary shifts, and a rise in spending power influence the market growth, which exerts pressure on the industry to fulfill the ever-increasing demand of the world.

In order to improve the food security of the world, one must increase pollution control measures and reduce food losses. These solutions can be easily achieved by standard and advanced processing equipment. This, in turn, is expected to create opportunities for equipment manufacturers over the forecast period.

Mode of Operation Insights

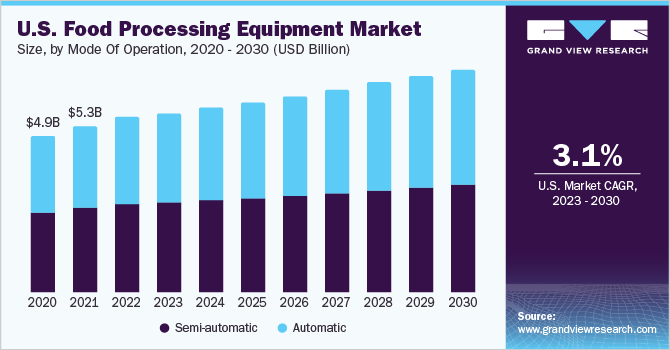

The semi-automatic segment held the largest revenue share of 49.9% in 2022. Automatic processing equipment is expected to expand at a significant CAGR from 2023 to 2030 owing to the high demand for technological development, growing use of automation, and strong research and development capabilities of market players.

Previously, manufacturers used to opt for semi-automated equipment owing to the availability of labor, low cost of the semi-automated product, and financial budget. As the demand for processed food had increased, the manufacturers preferred to have automated systems in the market.

On account of the need to offer precise, standard, and quality products and gain a competitive advantage over other players, the manufacturers provide automated operational systems for the manufacturing of food processing equipment. With the latest industrial trend, the market for automated food processing equipment is expected to witness considerable growth over the forecast period.

The rise in demand for fast and packaged food is expected to compel manufacturers to expand their production capabilities, which is likely to trigger product demand over the forecast period. Consumers owing to various economic and environmental factors tend to opt for processed products, which, in turn, is expected to boost the product demand over the coming years.

Application Insights

Bakery and confectionaries held the largest revenue share of 21.6% in 2022. Meat, poultry, and seafood products are expected to witness the fastest growth over the forecast period. The changing lifestyle of people, increasing inclination toward nutritious food, and awareness about the health benefits of marine products have triggered the demand for meat, poultry, and seafood products. In addition, the rising demand for equipment in which a single unit can operate multiple operations, such as cleaning, skinning, and weighing, is expected to create opportunities for product manufacturers over the coming years.

The moderate growth of the grains application segment is the result of dynamic regulatory changes and taxes imposed. In recent times, the imposed tariffs of China on the shipments from the U.S. depict lower imports of grain in China. Moreover, adverse weather conditions in Canada affect grain production, which eventually affects the product demand in the region.

Rising demand for nutritional enrichment, along with the EU’s support to regulate the application of food additives at the domestic level, is expected to augment market growth in the region. The presence of functional food manufacturers, along with the increasing R&D expenditure to develop innovatively formulated additives in Europe, is anticipated to boost the product demand over the coming years.

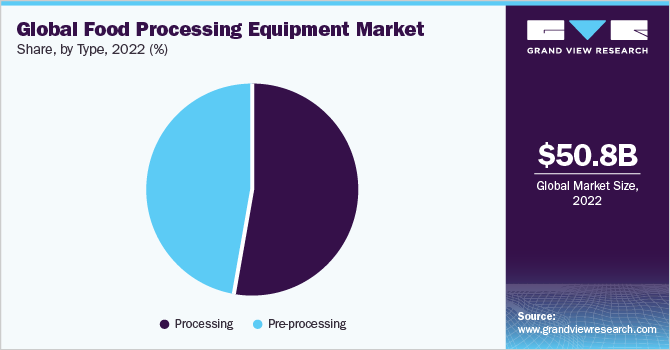

Type Insights

The processing equipment segment held the largest share of over 52.8% in 2022. The segment is expected to witness the fastest growth over the forecast period owing to the high demand for processed products and the increasing popularity of healthy and packaged food.

Pre-processing equipment deals with mixing, killing, and filleting, which are used in a wide range of application industries. The demand for these systems is expected to emerge from the Middle Eastern and Central and South American nations owing to the growing urbanization, industrialization, and changing consumer eating patterns.

Currently, over 80% of the people live in urban areas where consumers tend to opt for processed foods, such as frozen, bakery and confectionery, flavored dairy, and other allied products. In addition, advancements in processing and packaging technologies are anticipated to surge the product demand over the coming years.

The shelf arrangement in the supermarkets or hypermarkets or online sales altogether affects the buying behavior of the customers, which triggers the product sales. The constant rise in the demand for processed products is expected to create opportunities for food processing equipment manufacturers over the forecast period.

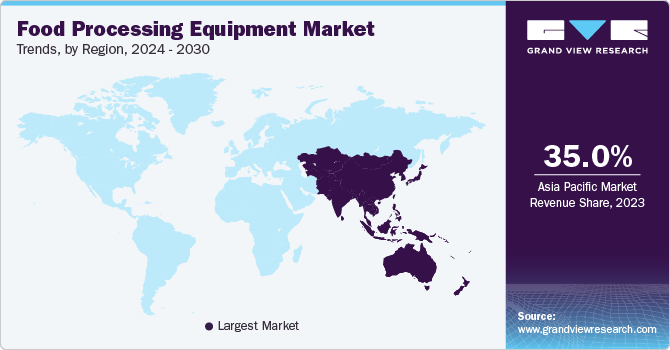

Regional Insights

Asia Pacific held the largest revenue share of 34.9% in 2022 and is expected to witness the fastest growth over the forecast period. The Chinese market has a significant number of players, and thus product innovation and strategic alliance are the success factors for the Chinese players. New product innovations, developments, and the introduction of advanced technologies offer favorable opportunities for food manufacturers, thereby surging the market growth in recent years.

The U.S. is one of the most urbanized countries with around 80% of its population living in urban areas. This has influenced food preferences, which, in turn, has favored the growth of the food processing industry. However, being a mature market, the product demand is expected to witness sluggish growth over the forecast period.

Europe is one of the prominent regions in the food and drink industry. The industry accounts for a majority of the share in Europe’s economy as countries like Germany, Italy, and the U.K. play a vital role in shaping the economy. The increasing demand and supply of these systems in these areas, along with a strong and distributed network, is expected to create opportunities for product manufacturers over the coming years.

In Brazil, processed products are expected to witness a positive performance over the forecast period. Macroeconomic factors such as GDP growth and steady economic conditions have favored the growth of the food industry, and thus the processing equipment market. The market in Brazil is expected to expand at a CAGR of 4.2% from 2030 to 2030 owing to the untapped opportunities and customer base

Key Companies & Market Share Insights

Mergers & acquisitions, new product launches, and licensing agreements are a few of the strategies adopted by the market players to strengthen their positions. Various government regulatory frameworks, taxes, and standards affect the trading of equipment. Various companies thus tend to opt for innovative and competitive strategies in the market in order to withstand the competition and maintain the position in the market. Some prominent players in the global food processing equipment market include:

-

BAADER Group

-

Marel

-

Bühler AG

-

GEA Group Aktiengesellschaft

-

The Middleby Corporation

-

Tetra Laval International S.A.

-

Alfa Laval

-

Krones AG

-

JBT Corporation

-

SPX Flow Inc.

-

LEHUI

-

Equipamientos Cárnicos, S.L. (MAINCA)

-

FENCO Food Machinery s.r.l.

-

Bigtem Makine A.S.

-

TNA Australia Pty Limited

Recent Developments

-

In February 2023, Middleby Corporation disclosed its acquisition of Flavor Burst, enhancing its portfolio in the beverage group. The addition of Flavor Burst's cutting-edge beverage flavoring technology reaffirms Middleby's prominent standing in the food processing and food service sector as a leading innovator and major player.

-

In February 2023, Middleby Corporation announced the strategic acquisition of Escher Mixers, a renowned provider of automated and robotic solutions for dough handling and mixing processes in the bakery industry. This further strengthens Middleby's position in the market, allowing the company to offer comprehensive and efficient integrated solutions, leading to improved production capabilities, cost savings, and enhanced quality for bakery products.

-

In April 2023, Krones signed a definitive agreement to purchase 90% ownership of Ampco Pumps Company LLC. This strategic acquisition represents a significant milestone in the expansion of Krones Processing's components business, as it complements their existing portfolio, which now includes Ampco Pumps and Evoguard Valve Technology, covering all essential components for the processing technology market.

-

In April 2023, Marel unveiled its acquisition of the operating assets of E+V Technology, a prominent player in food processing equipment. This strategic move reinforces Marel's market position, particularly in the meat and poultry sectors, as it incorporates cutting-edge vision technology into its existing portfolio of solutions, enhancing its offerings in the food processing equipment industry.

-

In May 2022, GEA will unveil the highly anticipated CutMaster Generation 3, a state-of-the-art food processing equipment optimized for a wide range of products including sausage, poultry, fish, plant-based, vegan, and vegetarian items, as well as processed cheese. This new generation is distinguished by its standard integrated AC technology, setting a new industry standard and solidifying GEA's position as a leading provider of cutting-edge cutting technology for food processing.

-

In June 2022, Tetra Pak partnered with Mycorena to build a greenfield production facility for fungi fermentation, aiming to develop alternative protein-based food applications. The facility will produce a meat replacement product from fungi, aligning with Tetra Pak's commitment to innovative and sustainable food sources.

-

In July 2022, Middleby Corporation disclosed its acquisition of Colussi Ermes. Colussi Ermes' technology, known for its efficiency in reducing labor requirements, conserving water and energy, minimizing chemical usage, and utilizing a compact footprint, perfectly complements Middleby's current range of food processing solutions.

Food Processing Equipment Market Report Scope

Report Attribute

Details

Market size value in 2023

USD 52.69 billion

Revenue forecast in 2030

USD 69.30 billion

Growth Rate

CAGR of 4.0% from 2023 - 2030

Base year for estimation

2022

Historical data

2018 - 2021

Forecast period

2023 - 2030

Quantitative units

Revenue in USD billion and CAGR from 2023 to 2030

Report coverage

Revenue forecast, company market position analysis, competitive landscape, growth factors, and trends

Segments covered

Mode of Operation, type, application, region

Regional scope

North America; Europe; Asia Pacific; Central & South America; Middle East & Africa

Country Scope

U.S.; Canada; Mexico; Germany; UK; Italy; Russia; China; Japan; India; South Korea; Australia; Brazil; South Africa

Key companies profiled

BAADER Group; Marel; Bühler AG; GEA Group Aktiengesellschaft; The Middleby Corporation; Tetra Laval International S.A.; Alfa Laval; Krones AG; JBT Corporation; SPX Flow Inc.; LEHUI; Equipamientos Cárnicos; S.L. (MAINCA); FENCO Food Machinery s.r.l.; Bigtem Makine A.S.; TNA Australia Pty Limited

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Food Processing Equipment Market Reort Segmentation

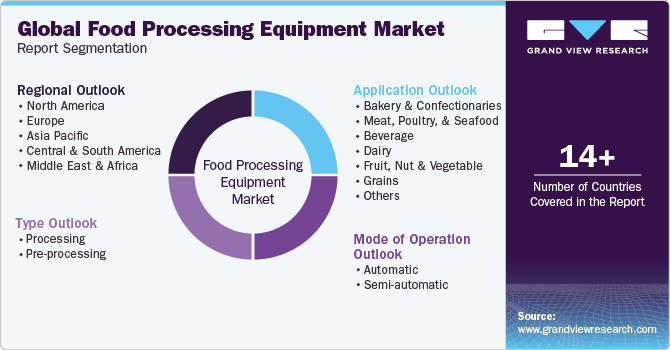

This report forecasts revenue growth at global, regional & country levels and provides an analysis of the industry trends in each of the sub-segments from 2018 to 2030. For the purpose of this study, Grand View Research has segmented the food processing equipment market on the basis of mode of operation, type, application, and region:

-

Mode of Operation Outlook (Revenue, USD Billion, 2018 - 2030)

-

Automatic

-

Semi-automatic

-

-

Type Outlook (Revenue, USD Billion, 2018 - 2030)

-

Processing

-

Pre-processing

-

-

Application Outlook (Revenue, USD Billion, 2018 - 2030)

-

Bakery & Confectionaries

-

Meat, Poultry, & Seafood

-

Beverage

-

Dairy

-

Fruit, Nut, & Vegetable

-

Grains

-

Other

-

-

Regional Outlook (Revenue, USD Billion, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

Russia

-

Italy

-

UK

-

-

Asia Pacific

-

China

-

India

-

Japan

-

South Korea

-

Australia

-

-

Central & South America

-

Brazil

-

-

Middle East & Africa

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global food processing equipment market size was estimated at USD 50.80 Billion in 2022 and is expected to reach USD 52.69 Billion in 2023.

b. The food processing equipment market, in terms of revenue, is expected to grow at a compound annual growth rate of 4.0% from 2023 to 2030 to reach USD 69.30 Billion by 2030.

b. Asia Pacific dominated the food processing equipment market with a revenue share of 34.9% in 2021, on account of several factors including a surge in domestic food production and growing beverage contract manufacturing in India.

b. Some of the key players operating in the food processing equipment market include Krones AG, KHS Group, OPTIMA packaging group GmbH, ProMach, Sacmi Imola S.C., Coesia S.p.A., Syntegon Technology GmbH, Hiemens Bottling Machines.

b. The key factors that are driving the food processing equipment market include the rising food & beverage industry, stringent regulations pertaining to food processing & safety, and increasing demand for packaged and processed foods.

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![ESOMAR Certified Member]()

![Great Place to Work Certified]()

ESOMAR & Great Work to Place Certified

![ISO 9001:2015 & 27001:2022 Certified]()

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."

Important: Covid19 pandemic market impact

FDA, in particular, has relaxed the nutrition labeling of products which is expected to aid in increasing the distribution of packaged foods by restaurant operators leading to the optimum supply chain of products to consumers. Furthermore, food safety testing and processing industries are expected to function at full capacity owing to consumers stock-piling goods during the COVID-19 lockdown. The report will account for Covid19 as a key market contributor.