- Home

- »

- Food Safety & Processing

- »

-

Food Emulsifiers Market Size, Share, Growth, Industry Report, 2025GVR Report cover

![Food Emulsifiers Market Size, Share & Trends Report]()

Food Emulsifiers Market Size, Share & Trends Analysis Report By Product (Mono-, Di-glycerides & Derivatives, Lecithin, Stearoyl Lactylates), By Application (Bakery & Confectionery, Convenience Foods, Meat Products), By Region, And Segment Forecasts, 2018 - 2025

- Report ID: 978-1-68038-372-0

- Number of Pages: 100

- Format: Electronic (PDF)

- Historical Range: 2014 - 2015

- Industry: Consumer Goods

Industry Insights

The global food emulsifiers market size was valued at USD 4.36 billion in 2015. The global demand for these colloidal products is considered to be mainly driven by the bakery & confectionery industry, owing to their multifunctional utility in this application.

Emulsifiers or colloids are extensively used as additives during the processing of victuals. These products have a broad application spectrum ranging from bakery to meat processing. Furthermore, rapid industrialization of the food & beverage sector in Asia Pacific region is another factor driving demand. Changing consumer preferences regarding the quality, texture, taste, and nutrition value of victuals in the region are likely to impact the dynamics of the emulsifiers industry over the forecast period.

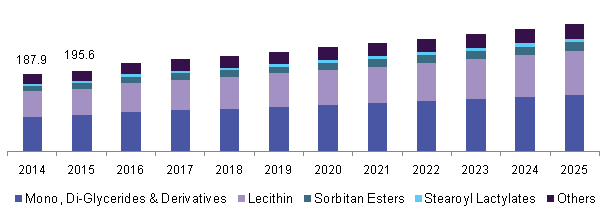

U.S. food emulsifiers market volume, by product, 2014 - 2025 (Kilo Tons)

The U.S. is one of the key consumers of emulsifying products. Currently, on-going clean label trend regarding ingredients and additives incorporated during the processing of victuals in the country is expected to boost the requirement of natural and biobased ingredients in the future. This scenario is likely to provide scope for the consumption of natural emulsifying materials to a considerable extent over the coming years.

Stepan Company is one of the key players offering emulsifying agents to various food & beverage application sectors. The company provides mono- and di-glycerides under the name DREWMULSE, which helps in stabilization and emulsification of nutrition and food systems.

Product Insights

Mono-, di-glycerides & derivatives held the highest revenue share of the total industry in 2015. These products are glycerin-based fatty acid esters that help in improving the surface activity required for proper stabilization and homogenization of processed victuals.

Mono-, di-glycerides & derivatives are extensively consumed for manufacturing dairy and bakery items, including cakes, ice creams, margarine, and bread. In terms of revenue, this category is projected to expand at a CAGR of 4.3% from 2016 to 2025, due to their large consumption in the bakery sector.

Stearoyl lactylates are anticipated to offer lucrative opportunities in the global industry. The use of these emulsifying agents is likely to increase in the next couple of years, owing to their extensive consumption for the production of pancakes, snacks, sauces, cream-based alcoholic beverages, and dietary products. This product is rendered safe by the U.S. FDA and the demand for the same is likely to increase at the highest rate over the coming years.

Application Insights

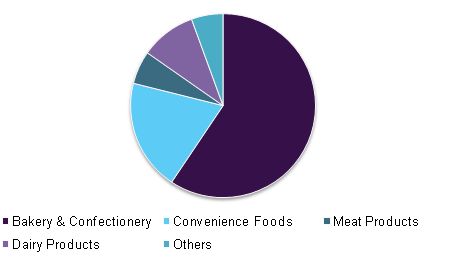

Bakery & confectionery, meat products, dairy products, and convenience foods are the major application segments. In terms of revenue, bakery & confectionery held the highest share, constituting 59.4% of the overall industry in 2015.

The demand for innovative baked products, especially those that are gluten-free and exhibit longer shelf life, is one of the major trends driving the growth of the bakery sector. Furthermore, rising consumer requirements for nutritious and fibrous biscuits is another trending aspect of the food emulsifiers market. These scenarios are likely to upsurge the consumption of natural ingredients, including emulsifiers, in the next couple of years.

Global food emulsifiers market revenue share, by application, 2015 (%)

Convenience products are projected to witness the fastest growth by the end of the forecast period at a CAGR of 5% in terms of volume. The increasingly busy lifestyle of consumers in both developed and developing countries coupled with rising consumer spending on packed items is one of the key socio-economic factors supporting their consumption. This, in turn, is anticipated to leverage the usage of emulsifiers in the near future.

Regional Insights

Europe captured the largest chunk of the industry, constituting 29.5% of the volume share in 2015, closely followed by North America and Asia Pacific. Germany, France, and Eastern European countries are anticipated to influence the industry expansion over the coming years positively. Regional demand for emulsifying agents, including stearoyl lactylates and sorbitan esters for bakery and dairy applications, is estimated to increase at a steady CAGR over the years ahead.

Countries in the eastern part of Europe, including Russia, are expected to illustrate the fastest industry expansion, owing to rising foreign investments in alcoholic beverages manufacturing sector. This development is estimated to offer lucrative prospects for emulsifiers. Asia Pacific food emulsifiers industry is projected to witness the fastest growth, owing to key socio-economic factors including drastically developing the food & beverage industry and broad consumer base. This scenario is likely to reflect in China, India, and other countries in Southeast Asia over the next few years.

Food Emulsifiers Market Share Insights

The key industry participants include Danisco A/S, BASF SE, Cargill, Inc., Beldem, Lonza Group, Riken Vitamin Co., Ltd., Palsgaard A/S, Adani Wilmar Ltd., Archer Daniels Midland Company, Solvay S.A., Lubrizol Corporation, and Stepan Company.

Companies such as Palsgaard and Riken Vitamin are significantly investing in research & development for enhancing the functional attributes of their existing product portfolio. Danisco A/S offers manufactured goods that possess enhanced taste, texture, nutritional value, and extended shelf life. Cargill’s synthetic emulsifiers find application in bakery, chocolate, and snacks, thereby offering superior dispersion systems as compared to soy lecithin.

Report Scope

Attribute

Details

Base year for estimation

2015

Actual estimates/Historical data

2014 - 2015

Forecast period

2016 - 2025

Market representation

Volume in Kilo Tons, revenue in USD Million, & CAGR from 2016 to 2025

Regional scope

North America, Europe, Asia Pacific, Central & South America & MEA

Country scope

The U.S., Germany, France, China, India, and Brazil

Report coverage

Volume & revenue forecast, company share, competitive landscape, growth factors, and trends

15% free customization scope (equivalent to 5 analyst working days)

If you need specific market information, which is not currently within the scope of the report, we will provide it to you as a part of customization

Segments Covered in the ReportThis report forecasts volume & revenue growth at the global, regional, & country levels and provides an analysis of the latest trends in each of the sub-segments from 2014 to 2025. For the purpose of this study, Grand View Research has segmented Food Emulsifiers Market on the basis of product, application, and region:

-

Product Outlook (Volume, Kilo Tons; Revenue, USD Million, 2014 - 2025)

-

Mono-, di-glycerides & Derivatives

-

Lecithin

-

Stearoyl Lactylates

-

Sorbitan Esters

-

Others

-

-

Application Outlook (Volume, Kilo Tons; Revenue, USD Million, 2014 - 2025)

-

Bakery & Confectionery

-

Convenience Foods

-

Meat Products

-

Dairy Products

-

Others

-

-

Regional Outlook (Volume, Kilo Tons; Revenue, USD Million, 2014 - 2025)

-

North America

-

The U.S.

-

-

Europe

-

Germany

-

France

-

-

Asia Pacific

-

China

-

India

-

-

Central & South America

-

Brazil

-

-

Middle East & Africa

-

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![ESOMAR Certified Member]()

![Great Place to Work Certified]()

ESOMAR & Great Work to Place Certified

![ISO 9001:2015 & 27001:2022 Certified]()

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."

Important: Covid19 pandemic market impact

FDA, in particular, has relaxed the nutrition labeling of products which is expected to aid in increasing the distribution of packaged foods by restaurant operators leading to the optimum supply chain of products to consumers. Furthermore, food safety testing and processing industries are expected to function at full capacity owing to consumers stock-piling goods during the COVID-19 lockdown. The report will account for Covid19 as a key market contributor.