- Home

- »

- Consumer F&B

- »

-

Food Colors Market Size, Share And Trends Report, 2030GVR Report cover

![Food Colors Market Size, Share & Trends Report]()

Food Colors Market Size, Share & Trends Analysis Report By Type (Natural, Synthetic, Nature-identical, Caramel), By Form (Powder, Liquid, Gel & Paste), By Source (Plant, Animal), By Application, By Region, And Segment Forecasts, 2023 - 2030

- Report ID: 978-1-68038-229-7

- Number of Pages: 180

- Format: Electronic (PDF)

- Historical Range: 2017 - 2021

- Industry: Consumer Goods

Food Colors Market Size & Trends

The global food colors market size was valued at USD 2.95 billion in 2022 and is expected to grow at a compound annual growth rate (CAGR) of 6.3% 2023 to 2030. Growth in the global population is expected to result in increased demand for food & beverage products, which is further likely to drive the demand for the product over the forecast period. The burgeoning food & beverage industry in BRICS in light of the increased domestic consumption is anticipated to be a major driving factor for the market over the forecast period. The increasing need for convenience foods due to the growing consumer knowledge about products with an exotic and traditional taste is predicted to further promote the growth of the market in the next few years.

Over the past few years, governments of Spain and Germany have launched and successfully implemented numerous campaigns to promote healthier lifestyles by introducing innovative health products to reduce obesity, cholesterol, and diabetes. This trend is expected to play a crucial role in the promotion of natural food colors in consumables.

The market is expected to exhibit a low threat of new entrants on account of extensive portfolio offered and distribution network operated by existing players, which results in a high entry barrier for the new entrants. Besides, the high switching cost for the buyers makes it difficult for new players to gain a significant market share, thereby lowering the threat of new entrants.

Concerns raised by consumers regarding the use of natural carmine extracted from cochineal insects are encouraging the manufacturers to seek other alternatives. With LycoRed producing its Lyc-O-Beta carotene orange color through the fermentation of the Blacksiea trispora fungus, Chr. Hansen is also trying to manufacture carmine through a similar process. Companies are also searching for alternatives owing to the fluctuating prices of carmine.

Type Insights

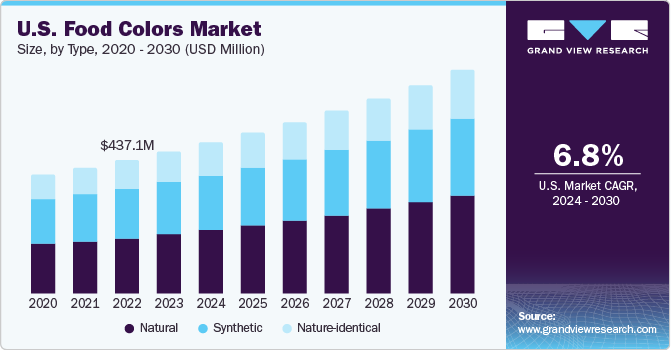

By type, the natural dominated the market and accounted for revenue share of more than 39%. The primary driver is the growing consumer preference for natural and clean-label products. Consumers are increasingly seeking out food products that are free from synthetic additives and artificial colors, as they are perceived as healthier and more wholesome. This shift in consumer behavior has prompted food manufacturers to reformulate their products using natural food colors derived from plant, fruit, and vegetable sources.

The synthetic segment is anticipated to exhibit CAGR of 5.6% during the forecast period (2023-2030) in terms of revenue. The market for synthetic food colors is expected to grow on account of growing product use by consumers across the developing economies. Besides, the demand for synthetic colors, such as green and blue, is expected to be driven primarily by their use in the beverage manufacturing industry. However, rising substitution by natural colors may hamper industry growth.

Form Insights

By form, the powder form dominated the food colors market and accounted for revenue share of 51.78% in 2022. The powder form offers convenience and ease of use. It can be easily stored, measured, and mixed into various food products, making it a versatile choice for both industrial and home cooking applications. Powdered food colors also tend to have a longer shelf life compared to liquid or gel forms, providing better stability and reducing the risk of spoilage.

The liquid form is anticipated to exhibit the highest revenue-based CAGR of 6.6% during the forecast period. They are highly concentrated and can achieve deep, rich hues with just a few drops. This is particularly important in the food industry, where appealing visual presentation plays a crucial role in consumer perception and purchasing decisions. Liquid food colors allow for precise color control, enabling chefs and food manufacturers to achieve the desired shade and tone in their products.

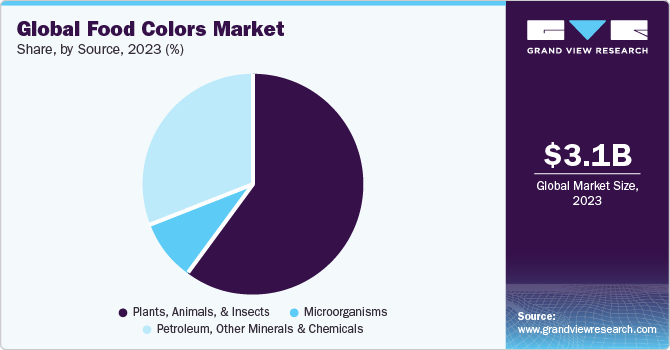

Source Insights

By source, the plant, animal and insect segment dominated the market and accounted for revenue share of 59.48% in 2022 and is projected to maintain its lead over the forecast period. The driving forces behind the growth of plant, animal, and insect source in the food color market include consumer demand for natural and clean label products, concerns over synthetic color additives, the emphasis on sustainability, and cultural preferences for traditional ingredients. These factors are shaping the industry and encouraging manufacturers to explore and incorporate natural sources into their food color formulations.

The microbes source is poised to expand at the CAGR of 5.8% by revenue from 2023-2030. Microbes offer a wide range of vibrant and diverse color options, enabling manufacturers to create visually appealing food products. These natural colors derived from microbes can be used to replace synthetic colorants, which have raised concerns regarding their safety and potential health risks.

Application Insights

By application, the bakery and confectionery dominated the market in 2022 with 29.66% share of the overall revenue. The bakery and confectionery application is driving the food color market by offering opportunities for creativity, visual appeal, and customization. As consumers increasingly prioritize the visual aspect of food products, the demand for food colors in the bakery and confectionery industry is expected to continue to grow.

The beverage application is poised to expand at the highest CAGR of 7.0% by revenue from 2023-2030. Beverages, including soft drinks, energy drinks, juices, and alcoholic beverages, have become an integral part of modern lifestyles, with increasing consumption worldwide. As consumers seek more visually appealing and aesthetically pleasing beverages, the demand for food colors to enhance the appearance of these drinks has significantly risen.

Regional Insights

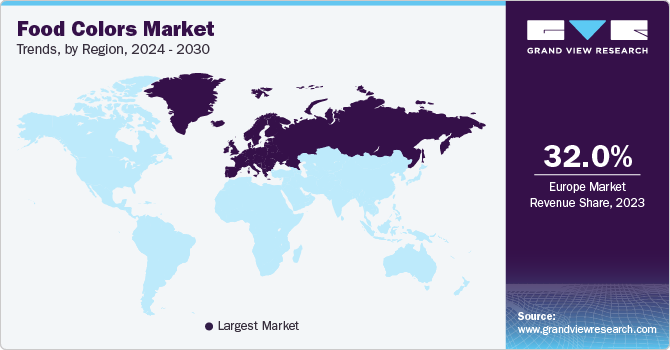

Europe dominated the market in 2022 with 32.13% share of the overall revenue along with the CAGR of 5.8% during the forecast period 2023-2030. Robust bakery and confectionary industry in Europe coupled with growing consumer demand is expected to have a positive impact on the market growth in the region over the forecast period. Also, stringent regulations concerning the use of artificial food colors are expected to strengthen the natural food colors market in Europe.

Demand for food colors in North America accounted for a market share of over 28.63% in 2022 and is expected to witness substantial growth over the forecast period. The increasing popularity of processed and packaged food products in North America has also contributed to the growth of the food color market. Processed foods often require the addition of food colors to enhance their appearance, as they may lose color during processing or lack visual appeal. As consumers continue to seek convenience and a wide variety of food options, the demand for food colors to improve the visual appeal of processed foods remains high.

The market in Asia Pacific is poised to witness substantial growth over the forecast period, registering a CAGR of 7.2% in terms of revenue. The Asia Pacific exhibits high adoption of nature-identical products driven by superior product properties such as uniform color and comparatively lower cost than natural food colors. Also, the high adoption of the product in the production of alcoholic and non-alcoholic beverages is expected to drive the market growth.

Key Companies & Market Share Insights

The industry players focus on research and development of new products to improve characteristics such as thermal and pH stability. These companies mostly compete based on product quality and price, as the pure form of each source is derived from the same source. For example, a pure source of natural carmine is a cochineal insect.

Rising consumer concerns regarding the use of synthetic colors in the edible products have prompted manufacturers to look for alternatives. For example, Nestle announced the rejection of synthetic colors in any of their products. This move by the manufacturers is expected to have a greater impact on the market which is anticipated to reduce the consumption of synthetic food colors. Some of the prominent players in the food colors market include:

-

BASF

-

Cargill

-

CHR Hansen

-

Danisco

-

DD Williamson

-

DSM

-

GNT Group

-

Lycored Ltd

-

Naturex

-

SAN-EI GEN F.F.I. INC

Food Colors Market Report Scope

Report Attribute

Details

Market size value in 2023

USD 3.13 billion

Revenue forecast in 2030

USD 4.83 billion

Growth rate

CAGR of 6.3% from 2023 to 2030

Base year for estimation

2022

Historical data

2017 - 2021

Forecast period

2023 - 2030

Report updated

2023 June

Quantitative units

Volume in metric tons, revenue in USD million, and CAGR from 2023 to 2030

Report coverage

Volume forecast, Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Type, source, form, application, region

Regional scope

North America; Europe; Asia Pacific; Central and South America; Middle East & Africa

Country scope

U.S.; Canada; Mexico; UK; Germany; France; Italy; Spain; China; India; Japan; Australia and New Zealand; South Korea; Brazil; Argentina; UAE; and South Africa

Key companies profiled

BASF; Cargill; CHR Hansen; Danisco; DD Williamson; DSM; GNT Group; Lycored Ltd; Naturex

Customization scope

Free report customization (equivalent up to 8 analyst working days) with purchase. Addition or alteration to country, regional, and segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Food Colors Market Report Segmentation

This report forecasts volume & revenue growth at the global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2017 to 2030. For the purpose of this study, Grand View Research has segmented the global food colors market report based on type, form, source, application, and region:

-

Type Outlook (Volume: Metric Tons; Revenue: USD Million, 2017 - 2030)

-

Natural

-

Carotenoids

-

Anthocyanin

-

Annatto

-

Others

-

-

Synthetic

-

Tartrazine-E102

-

Sunset yellow FCF-E110

-

Brilliant Blue FCF

-

Others

-

-

Nature-identical

-

Mixed carotenes

-

Canthaxanthin

-

Riboflavin

-

Others

-

-

Caramel

-

-

Form Outlook (Volume: Metric Tons; Revenue: USD Million, 2017 - 2030)

-

Powder

-

Liquid

-

Gel & paste

-

-

Source Outlook (Volume: Metric Tons; Revenue: USD Million, 2017 - 2030)

-

Plant, animal, & insect

-

Microbes

-

Petroleum, mineral & chemicals

-

-

Application Outlook (Volume: Metric Tons; Revenue: USD Million, 2017 - 2030)

-

Bakery & confectionery

-

Dairy & frozen treats

-

Breakfast cereals & snacks

-

Savory & plant-based meat

-

Beverages

-

Others

-

-

Regional Outlook (Volume: Metric Tons; Revenue: USD Million, 2017 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

-

Asia Pacific

-

China

-

India

-

Japan

-

Australia and New Zealand

-

South Korea

-

-

Latin America

-

Brazil

-

Argentina

-

-

Middle East & Africa

-

South Africa

-

U.A.E.

-

-

Frequently Asked Questions About This Report

b. The global food colors market size was estimated at USD 2.95 billion in 2022 and is expected to reach USD 3.13 billion in 2023.

b. The food colors market is expected to grow at a compound annual growth rate of 6.3% from 2023 to 2030 to reach USD 4.83 billion by 2030.

b. Europe dominated the market in 2022 with 32.13% share of the overall revenue along with the CAGR of 5.8%. Robust bakery and confectionary industry in Europe coupled with growing consumer demand is expected to have a positive impact on the market growth in the region over the forecast period.

b. Some of the key market players in the food colors market are BASF, Cargill, CHR Hansen, Danisco, DD Williamson, DSM, GNT Group, Lycored Ltd, Naturex.

b. The increasing need for convenience foods due to the growing consumer knowledge about products with an exotic and traditional taste is predicted to further promote the growth of the market in the next few years.

b. China is expected to account for the largest market share over the forecast period. The ability to improve bowel movements and regulate blood sugar levels, has gained recognition as a beneficial dietary supplement in China.

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![ESOMAR Certified Member]()

![Great Place to Work Certified]()

ESOMAR & Great Work to Place Certified

![ISO 9001:2015 & 27001:2022 Certified]()

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."

Important: Covid19 pandemic market impact

Weaker consumer demand for lifestyle and wellbeing products due to social restrictions and lockdown policies shall have a negative impact on the demand patterns of cosmetic ingredients and certain categories of food additives. However, easing restrictions and public discourse about restarting economic activities in the consumer goods marketspace indicates that, the recovery of demand is imminent. The report will account for Covid19 as a key market contributor.