- Home

- »

- Food Additives & Nutricosmetics

- »

-

Food Additives Market Size, Share & Growth Report, 2030GVR Report cover

![Food Additives Market Size, Share & Trends Report]()

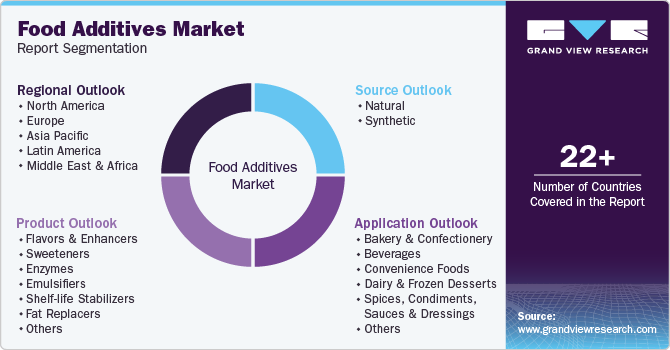

Food Additives Market Size, Share & Trends Analysis Report By Product (Flavors & Enhancers, Sweeteners, Enzymes, Emulsifiers), By Source (Natural, Synthetic), By Application, By Region, And Segment Forecasts, 2023 - 2030

- Report ID: 978-1-68038-187-0

- Number of Pages: 467

- Format: Electronic (PDF)

- Historical Range: 2018 - 2021

- Industry: Specialty & Chemicals

Food Additives Market Size & Trends

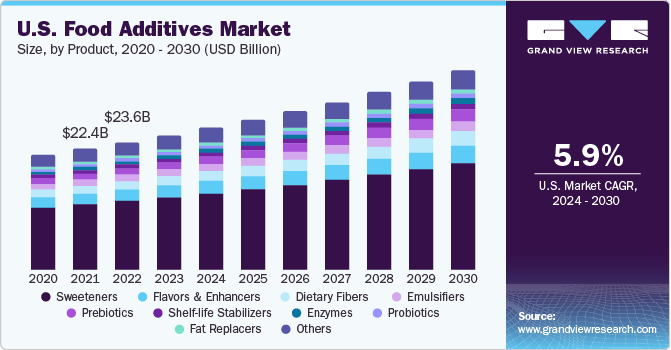

The global food additives market size was valued at USD 98.40 billion in 2022 and is expected to grow at a compound annual growth rate (CAGR) of 5.8% from 2023 to 2030. The requirement of improving taste, texture, mouthfeel, and overall appearance of food and beverages is expected to propel the demand for food additives. The growing food and beverages industry globally is the key factor driving the market. The consumption of packaged food products and beverages across the world is rising due to the changing dietary patterns of the population. This is expected to contribute to the surging demand for additives used during food processing to improve its quality and nutritional content.

The preference for a plant-based diet and the growing interest of consumers to pay more for clean-label products in the U.S. have surged the consumption of food and drinks infused with natural ingredients. In May 2021, Ventura Foods, LLC, a U.S.-based company, launched new plant-based and dairy-free salad dressings under Marie’s brand. The product is expected to attract vegan consumers in the U.S.

Food and beverage companies are focusing on reducing the sugar, fat, and overall calorie content in their products. Regulatory approvals for such low-calorie sweeteners and fat replacers are expected to offer an opportunity to produce low-sugar and low-fat food and beverage products.

In May 2021, the Malaysia Ministry of Health officially accepted SweeGen’s zero-calorie Bestevia sweeteners, Rebaudioside D, E, and M, for use as ingredients in food and beverage products. Similarly, in June 2020, the plant-based oil of Epogee, namely, Esterified Propoxy late Glycerol (EPG) fat replacer, received generally regarded as safe (GRAS) approval from the U.S. Food and Drug Administration (FDA) for use in various food applications. The prevailing trend of having low-calorie and low-sugar food and drinks among consumers is thus supporting the market growth.

Manufacturers are adopting new technologies to improve their production processes and offer high-quality ingredients. For instance, in June 2021, Firmenich SA launched Firgood Ingredients which are pure and made from 100% natural extracts. Extracts are obtained using the company’s patented water-based extraction technology without the use of toxic chemicals.

Source Insights

The natural segment accounted for the largest revenue share of 82.6% in 2022 and is expected to grow at the fastest CAGR of 5.8% during the forecast period. Naturally sourced additives are safer for human consumption in comparison to their chemical counterparts. Chemically synthesized flavoring ingredients, sweeteners, and emulsifiers often result in health hazards such as allergies or diseases such as cancers.

Market players have been focusing on widening their portfolio based on plant-based ingredients due to rising consumer demand. In April 2021, ADM opened its new cutting-edge, plant-based innovation lab, located in ADM’s Biopolis research hub in Singapore. This was intended to strengthen ADM’s portfolio of plant-based products such as proteins and flavors.

In August 2021, Modern Plant-Based Foods Inc. partnered with Real Vision Foods, LLC, a natural food manufacturer, for the production of plant-based bars and meals for high-performance cognitive athletes. Thus, increased demand for natural additives from food and beverage manufacturers is expected to support the growth of the natural source segment.

However, the production cost of synthetic additives is lower than natural additives. Synthetic additives eliminate the need for procuring highly-priced natural raw materials and their expensive and time-consuming extraction processes. Thus, the production process and cost advantages of synthetic additives are expected to support the growth of the synthetic segment in the coming years.

Product Insights

The sweeteners segment accounted for the largest revenue share of 55.9% in 2022. Rising awareness regarding obesity and cardiovascular disease is expected to limit the demand for fatty foods and foodstuffs added with high fructose corn syrup (HFCS) and sucrose, which are considered high-calorie sweeteners. This factor is anticipated to positively support the growth of high-intensity sweeteners such as stevia, aspartame, and fat replacers such as whey protein and starch.

In July 2021, PepsiCo announced its goal to reduce the average level of added sugars in its beverages by 25% by 2025 and 50% by 2030. It is aiming to reformulate products using low-calorie sweeteners. Such initiatives by food and beverage manufacturers are expected to contribute to the rising demand for high-intensity sweeteners, flavors, enhancers, and fat replacers to improve taste without the addition of salt or sugar.

The flavors and enhancers segment accounted for a significant revenue share in 2022. Flavors and enhancers improve the taste of food and beverages. Food and beverage manufacturers have been focusing on reducing salt and sugar content in their products and hence, the demand for flavor enhancers is on the rise as they can boost the flavor without using salt or sugar. Bitterness suppressors are necessary to balance the taste of food and beverages to offer a better mouthfeel and eliminate unpleasant aftertaste.

Market players are focusing on offering specialized enzyme blends that can improve the quality of food products. For instance, Sabinsa offers a proprietary blend of five enzymes: α-amylase, protease, lipase, cellulose, and lactase. These enzymes are intended for use as functional ingredients to support the digestive system.

The prebiotics segment is expected to grow at the fastest CAGR of 7.5% during the forecast period. The importance of nutritional and fortified food products increased due to the COVID-19 outbreak; thus, food manufacturers are anticipated to incorporate ingredients such as prebiotics, and dietary fibers into their products to increase their nutritional value to attract consumers.

Consumers are actively seeking products that enhance immunity and improve digestive health. Increasing awareness regarding the benefits of prebiotics and probiotics on gut health and immunity is likely to increase the demand for prebiotic and probiotic-based functional food and beverage products in the coming years. For instance, in March 2020, BENEO announced to expansion of its chicory root manufacturing facility in Chile to meet the increasing demand for inulin, oligofructose, and chicory root fibers, which are used as dietary fibers.

The emulsifiers segment is expected to grow at a lucrative rate during the forecast period. Emulsifiers are used for blending two or more immiscible liquids and are thus widely used in bakeries, frozen desserts, and dressings. In March 2020, Ingredion developed a new emulsifier derived from chickpeas that can be used as a substitute for eggs added in sauces and dressings. Plant-based emulsifiers thus allow the preparation of vegan mayonnaise, aioli, or Alfredo sauce.

The Shelf-life stabilizers is anticipated to grow at a notable rate during the forecast period. On-the-go food products are largely in demand from consumers with a preference for conveniently packaged food items. This factor is prompting food processing companies to add shelf-life stabilizers or food preservatives to products to extend their shelf life without compromising on quality. Rising import-export activities of food and beverages worldwide have further led to the increased need for maintaining the shelf-life of food and beverages for a longer time, thus boosting demand for shelf-life stabilizers such as natamycin, rosemary extract, and potassium sorbate.

Application Insights

The bakery and confectionery segment accounted for the largest revenue share of 30.4% in 2022. Several additives including enzymes, sweeteners, emulsifiers, and dietary fibers are used to improve the quality of bakery and confectionery products. In February 2020, DuPont’s Nutrition & Biosciences division (now known as International Flavors & Fragrances Inc.) launched DuPont POWERBake 6000 and 7000 enzymes for bakery products, such as white bread and buns.

The company offers a wide range of bakery enzymes, including POWERBake, POWERSoft Cake, POWERFlex, and POWERFresh enzymes, such as lipase and xylanase, used for extending dough stability, dough strengthening, and offering tolerance and robustness to flour quality.

The convenience foods segment is expected to grow at the fastest CAGR of 6.1% during the forecast period. Convenience foods include ready-meals, savory snacks, instant noodles, infant formula, and soups, among others. As per Stats NZ, in New Zealand, restaurant meals and ready-to-eat food held a share of 27.23% of the total food expenditure in 2020, which increased from 25.55% in September 2017. Factors such as longer working hours, and thus getting less time for cooking food are expected to shift consumer preferences towards convenience food options that save time in food preparation and cleanup.

The beverages segment is expected to grow at a significant rate during the forecast period. Beverages such as sports drinks, flavored water, flavored milk, and other ready-to-drink (RTD) beverages can be easily consumed on the go while commuting and are thus, anticipated to witness surged demand from the young generation. New developments in fermented beverages, such as kombucha and other fermented teas, have gained increased popularity, which is supporting the growth of the market.

The rising demand for various alcoholic and non-alcoholic drinks with varied flavor options is expected to fuel the growth of the beverage segment globally. In November 2020, BLUE CALIFORNIA launched the Destination Flavors Collection for ready-to-drink (RTD) alcoholic beverages comprising a lower sugar content. The flavors offered are inspired by regional flavors such as Catalan Crush, Arctic Gem, Pacific Blossom, Thai Treat, and California Dreamin.

The dairy & frozen desserts segment is anticipated to grow at a notable rate during the forecast period Consumption of dairy products is rising worldwide owing to the high nutritional content of milk. As per the Food & Agricultural Organization, the per capita consumption of processed dairy products in milk solids increased from 23.6 kg in 2018-20 to 25.2 kg by 2030. New dairy product developments by dairy product manufacturers, such as Nestlé and Danone, are expected to boost the growth of the dairy and frozen desserts segment.

The spices, condiments, sauces & dressings segment is expected to register steady growth during the forecast period. New product launches from the manufacturers of sauces and dressings are further expected to boost the demand for spicy flavors and additives that provide a creamy texture. In May 2020, Conagra Brands, Inc. launched a Power Dressings line including products such as Creamy Ranch and Creamy Italian under its Healthy Choice brand. These products can be used as dips, marinades, and dressings for salads and vegetables. New launches of various spices, condiments, sauces, and dressings are thus expected to fuel the growth of the segment.

Other applications include meat, poultry, seafood products, and fats and oils. Processed pork, poultry meat, and seafood products are prone to microbial contamination owing to higher nutrient content. Thus, preservatives and antimicrobial agents are needed in these products to protect them from microbial growth. Hydrocolloids, emulsifiers, whey protein concentrate, food starch, and cellulose are commonly added to meat and poultry products to enhance their taste and improve their texture.

Regional Insights

Asia Pacific dominated the market and accounted for the largest revenue share of 33.1% in 2022 and is expected to grow at the fastest CAGR of 6.6% during the forecast period, on account of the presence of a large consumer base and end-use industries. As per survey results published by the Journal of Ethnic Foods, in July 2021, about 79.67% of adult Chinese respondents consumed fast food. As per the same source, about 77.94% consumed baked food, whereas 22.06% preferred fried food. Expanding the food and beverage industry in highly populous countries such as China, India, and Indonesia is anticipated to positively impact the demand in the Asia Pacific.

The North American market is driven by the rising consumption of processed food products including ready meals and on-the-go breakfast products. This can be attributed to the busy lifestyle of the population in the region. As per a 2020 survey by the International Food Information Council, about 44.0% of women and 31.0% of men stated that they regularly/occasionally replaced meals with snacks in the U.S.

Europe held the second-largest revenue share in 2022. This is due to rising demand for cakes, pastries, bread-based products, and beverages. An increasing health-conscious population is expected to support sales of healthy food and beverages in Europe. According to the British Soft Drinks Association, low-/no-calorie drinks held a share of 68.6% of the total sales of soft drinks in the U.K. in 2020. Low-calorie food and beverages are gaining traction in the region, thus contributing to the growth of the high-intensity sweeteners, fat replacements, and flavor enhancers market.

Central & South America is anticipated to grow at a CAGR of 6.4% during the forecast period. The product demand in Central and South America is primarily driven by the growing food processing industry. As per the U.S. Department of Agriculture, the food processing industry in Brazil grew by 12.7% from 2019 and reached USD 152.00 billion in 2020. Improvements in sales channels of food and beverages with an increasing number of hypermarkets and supermarkets in the region are further expected to fuel the market growth.

Key Companies & Market Share Insights

Market players including Cargill, Incorporated; Ingredion; ADM; DuPont; and Tate & Lyle PLC are continuously involved in research and development to develop well-differentiated products and gain a competitive advantage. For instance, in June 2021, Kerry opened a new taste facility in Irapuato, Mexico. This is expected to strengthen the company’s position in the Mexican market and support the local customer base with advanced solutions of flavors and enhancers.

Players are adopting strategies such as mergers & acquisitions and capacity expansions for their business growth. For instance, in December 2020, Tate & Lyle acquired Sweet Green Fields, a stevia solutions business having its production and research & development facilities located in China. This move is expected to strengthen the company’s position in the clean-label sweetener market in China and the Asia Pacific region.

Key Food Additives Companies:

- ADM

- Chr. Hansen Holding A/S

- Ingredion Incorporated

- Novozymes A/S

- Tate & Lyle Plc

- DSM

- Ajinomoto Co., Inc

- Cargill, Incorporated

- BASF SE

- Givaudan

- International Flavors & Fragrances, Inc.

- Biospringer

- Palsgaard

- Lonza

- Sensient Technologies Corporation

- Kerry

- Corbion

- Fooding Group Limited

- DuPont

- The Kraft Heinz Company

Recent Developments

-

In January 2023, BASF SE and Cargill, Incorporated announced that they are strengthening their collaboration to provide advanced enzyme solutions to animal protein producers across the U.S. This enhanced partnership aims to deliver high-performance enzymes that meet the evolving needs of the industry.

-

In June 2023, ADM opened a new center for customer creation & innovation in the UK to strengthen its food innovation capabilities. ADM is developing new savory culinary innovations with the help of a modern kitchen, a chef's presentation theatre, and a flavor creation lab. ADM is also continuing to support the beverage, sweet products, and dairy industries.

-

In April 2022, Chr. Hansen Holding A/S developed new probiotics after 30 years of research & development. They ensured that the LGG strain would be used in the abrasive environment of fruit juice. The LGG & L. CASEI 431 strains of probiotics were made available for a variety of juices. The ability of both of these to boost immunological health is supported by scientific research.

-

In April 2022, Chr. Hansen Holding A/S expanded its VEGATM range with a fermentation-enabled solution to aid in maintaining the safety and freshness of plant-based meat substitutes. A new product line called VEGATM SAFEPRO is designed to keep plant-based alternative proteins fresh and safe for a longer period of time. The VEGATM SAFEPRO line includes three cultures that can be used singly or in combination to ferment, halting the growth of pollutants like listeria, yeast, and mould.

-

In March 2022, BASF SE strengthened their collaboration with Brenntag Specialties and announced it as the exclusive distribution partner for its Baxxodur amine-based curing agents.

Food Additives Market Report Scope

Report Attribute

Details

Market size value in 2023

USD 103.62 billion

Revenue forecast in 2030

USD 153.46 billion

Growth rate

CAGR of 5.8% from 2023 to 2030

Base year for estimation

2022

Historical data

2018 - 2021

Forecast period

2023 - 2030

Report updated

October 2023

Quantitative units

Revenue in USD million/billion and CAGR from 2023 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, source, application, region

Regional scope

North America; Europe; Asia Pacific; Central & South America; Middle East & Africa

Country scope

U.S.; Canada; Mexico; U.K.; Germany; France; Italy; Spain; Belgium; Russia; China; Japan; India; South Korea; South-east Asia; Argentina; Brazil; South Africa; Saudi Arabia

Key companies profiled

ADM; Chr. Hansen Holding A/S; Ingredion Incorporated; Novozymes A/S; Tate & Lyle Plc; DSM; Ajinomoto Co., Inc; Cargill Incorporated; BASF SE; Givaudan; International Flavors & Fragrances, Inc.; Biospringer; Palsgaard; Lonza; Sensient Technologies Corporation; Kerry; Corbion; Fooding Group Limited; DuPont; The Kraft Heinz Company

Customization scope

Free report customization (equivalent up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional & segment scope

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Food Additives Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global food additives market report based on product, source, application, and region:

-

Product Outlook (Revenue in USD Million, 2018 - 2030)

-

Flavors & Enhancers

-

Sweeteners

-

HIS

-

HFCS

-

Sucrose

-

Other

-

-

Enzymes

-

Emulsifiers

-

Mono, Di-Glycerides & Derivatives

-

Lecithin

-

Stearoyl Lactylates

-

Sorbitan Esters

-

Others

-

-

Shelf- life Stabilizers

-

Fat Replacers

-

Protein

-

Starch

-

Fats

-

-

Prebiotics

-

Probiotics

-

Dietary Fibers

-

Others

-

-

Source Outlook (Revenue in USD Million, 2018 - 2030)

-

Natural

-

Synthetic

-

-

Application Outlook (Revenue in USD Million, 2018 - 2030)

-

Bakery & Confectionery

-

Beverages

-

Convenience Foods

-

Dairy & Frozen Desserts

-

Spices, Condiments, Sauces & Dressings

-

Others

-

-

Regional Outlook (Revenue in USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

U.K.

-

Germany

-

France

-

Italy

-

Spain

-

Belgium

-

Russia

-

-

Asia Pacific

-

China

-

Japan

-

India

-

South Korea

-

South-east Asia

-

-

Central & South America

-

Argentina

-

Brazil

-

-

Middle East & Africa

-

South Africa

-

Saudi Arabia

-

-

Frequently Asked Questions About This Report

b. The global food additives market size was estimated at USD 98.4 billion in 2022 and is expected to reach USD 103.6 billion in 2023.

b. The global food additives market is expected to grow at a compound annual growth rate of 5.8% from 2023 to 2030 to reach USD 153.5 billion by 2030

b. The sweeteners segment dominated the food additives market with a share of nearly 55.9% in 2022 owing to its widespread usage in several food & beverage applications

b. Some of the key players operating in the global food additives market include ADM; Chr. Hansen Holding A/S; Ingredion Incorporated; Novozymes A/S; Tate & Lyle Plc; DSM; Ajinomoto Co., Inc.; Cargill, Incorporated; BASF SE; Givaudan; International Flavors & Fragrances, Inc.; and others.

b. The key factors that are driving the global food additives market include the requirement to improve taste, texture, mouthfeel, and overall appearance of food and beverages. The growing food and beverages industry globally is the key factor driving the market.

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![ESOMAR Certified Member]()

![Great Place to Work Certified]()

ESOMAR & Great Work to Place Certified

![ISO 9001:2015 & 27001:2022 Certified]()

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."