- Home

- »

- Advanced Interior Materials

- »

-

Flooring Market Size, Share, Growth & Trends Report, 2030GVR Report cover

![Flooring Market Size, Share & Trends Report]()

Flooring Market Size, Share & Trends Analysis Report By Product (Ceramic Tiles, Porcelain Tiles, Carpet, Vinyl, Wood & Laminate), By Application (Residential, Industrial), By Region, And Segment Forecasts, 2023 - 2030

- Report ID: 978-1-68038-238-9

- Number of Pages: 108

- Format: Electronic (PDF)

- Historical Range: 2018 - 2021

- Industry: Advanced Materials

Report Overview

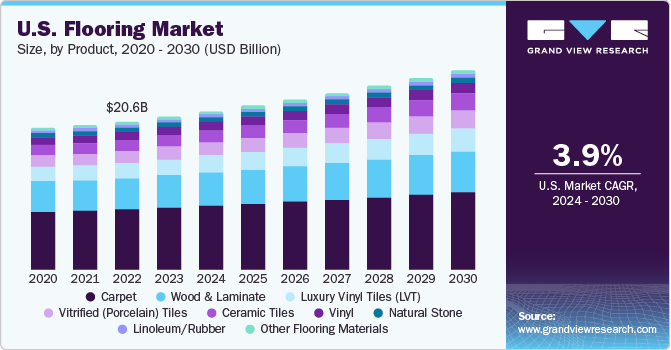

The global flooring market size was valued at USD 266.48 billion in 2022 and is expected to grow at a compound annual growth rate (CAGR) of 5.2% from 2023 to 2030. Increasing demand for aesthetic, superior, and durable floor covering solutions and changing consumer trends in floor design are aiding the growth of the flooring industry over the past few years. The expansion of offices & workspaces, improving consumer lifestyle, and rapid urbanization are factors that have also contributed to the market growth. The fast-paced infrastructural development owing to the rising population in developing countries further contributes to the growth of the flooring industry.

The growing disposable income has resulted in increased investments for comfort in residential buildings. Additionally, the continuous growth of high-end residential housing structures and the subsequent and growing preference for single-family housing structures are driving the demand for the market.

Domestic and foreign manufacturers are heavily investing in the U.S. regional market to meet the rising demand from various application industries. Several construction projects are underway in the U.S. For instance, in 2020, Amazon started the construction of its HQ2 building, which is estimated to be worth USD 2.5 billion. The mega project continues to make head turns in the construction industry as Amazon plans completion by 2023. The increasing large investments in such projects in the U.S. is expected to boost the demand for flooring.

The advancements in easy-to-install techniques, the availability of innovative construction solutions, and the rising demand for environmentally sustainable products are expected to drive the industry’s growth. The stringent regulatory framework during the production, usage, implementation, and recycling stages is also expected to boost market growth.

Furthermore, consumer preferences for aesthetically improved designs, textures, and colors, as well as low-maintenance and easy-to-install floorings, are expected to drive market growth. The growing desire for comfort and privacy as a result of noisier surroundings has increased the demand for insulation in the market, as well-insulated floors create a better acoustic environment. As a result, demand for floor insulation has increased, supporting market growth.

Product Insights

The vitrified (Porcelain) tile segment led the market and accounted for 27.7% of revenue share in 2022. This is owing to the properties of porcelain tiles such as additional strength, and more durability as compared to general ceramic tiles. These tiles can withstand extreme temperatures and are made from ultrafine and denser clays.

Their durability also shines with features such as mold and bacteria resistance offered by impervious porcelain tiles substantially increasing the long-term value of floor covering. In addition, this flooring product does not fade and is easy to maintain.

The ceramic tiles segment accounted for 22.4% of the total revenue share in 2022. Ceramic tiles are primarily of three types, namely glazed tiles, unglazed tiles, and scratch-resistant tiles. Scratch-resistant tiles are primarily utilized for high footfall areas, such as landscapes, pathways, parking, and shop floors, to cater to the enormous stress of its application.

The wood & laminate segment was estimated at USD 51.8 million in 2022 and is further estimated to grow at a substantial CAGR over the coming years. This growth is attributed to the rising significance of wood in luxury construction in residential as well as commercial areas. It offers numerous advantages including strength, durability, easy maintenance, aesthetics, the high monetary value of the house, steady appearance, the option of refinishing, improved acoustics, and improved air quality.

Natural stone is a little expensive compared to other flooring products. These products include marble, granite, limestone, sandstone, quartzite, and others. Natural stone flooring is widely used for durability, beauty, and lasting value. These stones are excellent for bathrooms, hallways, living, and outdoor areas. Owing to the surge in demand for natural stone products, companies are investing to strengthen their position in the market.

Application Insights

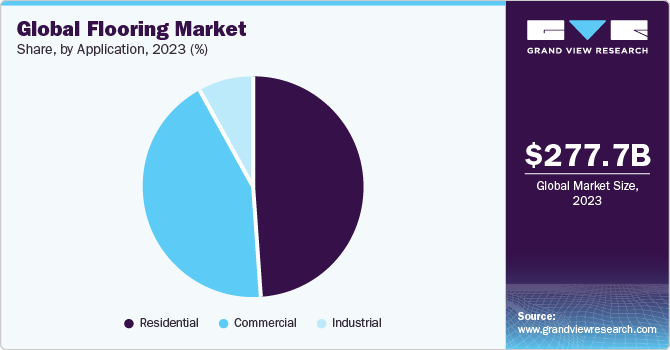

The residential application segment dominated the market and accounted for 49.4% of the revenue share in 2022 in the market. The residential end-use segment includes residential buildings, apartments, complexes, and small houses. Subsidies from governments for first-time homebuyers in developing and developed economies have positively affected the growth of the residential sector.

The developing countries in the Asia Pacific region have announced various schemes to support the development of the real estate sector. These schemes are partially or fully funded by governments in these countries, which ultimately benefits the demand side of the construction sector. This is likely to propel the growth of the flooring industry over the coming years.

The commercial application segment accounted for 43.0% of the revenue share in 2022. Commercial applications often involve high-traffic areas and therefore require durable flooring such as resilient and wooden. Flooring products are used in numerous commercial building applications including offices, convenience stores, shopping malls, and the construction of other retail stores.

Increasing construction of commercial buildings, such as drugstores, grocery, and big-box stores, over the past few years, is expected to benefit the segment growth over the coming years. Moreover, robust demand for office spaces, especially in urban areas of emerging economies, is also propelling demand for high-quality flooring products.

Regional Insights

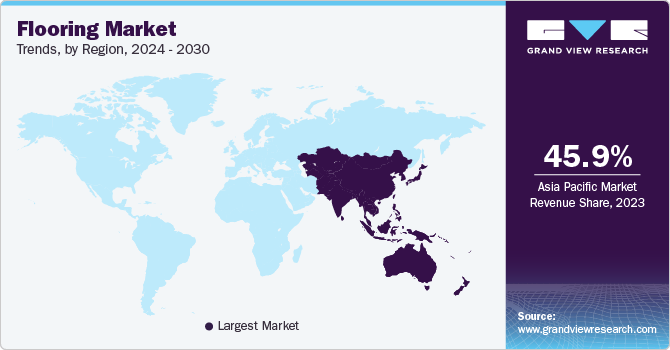

The Asia Pacific region dominated the market and accounted for 45.5% of the total revenue share in 2022. The regional market is expected to grow more at a CAGR of 5.7% over the forecast period. Factors such as increasing investment in affordable housing, smart city construction, upgradation & construction of infrastructure, and investment in the tourism sector are expected to boost the demand for flooring products over the forecast period.

The construction industry in the Asia Pacific is expected to grow on account of the rising per capita income, rapid urbanization, and expanding population. The expansion of residential, commercial, and industrial sectors on account of sustainable economic growth in the region is expected to boost construction activities, thereby, driving the market for flooring over the forecast period.

The Central & South American regional market is anticipated to witness sluggish growth compared to other regions worldwide over the coming years. Construction spending in the region witnessed a steep decline in 2020 owing to the pandemic. Although the spending surged in 2021, its pace is anticipated to decelerate in 2022.

The flooring industry in the Middle East and Africa accounted for 11.5% of revenue share in 2022. Improved funding by the Middle East and African governments, owing to the availability of financing options such as public-private partnerships, domestic capital markets, and private investment funds, is expected to boost the growth of the construction industry, thereby, driving the flooring industry in the region.

Key Companies & Market Share Insights

Manufacturers holding a major share in the flooring industry have established channels of distribution across various countries. For instance, Mohawk Industries, Inc. has its operations across 15 countries and sales across over 140 countries including the U.S., Russia, Mexico, Malaysia, India, Europe, China, Canada, Brazil, and Australia. This has helped manufacturers in gaining a major share of the market.

Additionally, manufacturers are also establishing a strong online presence for the sake of gaining a competitive edge. The development of innovative products and proper display & distribution systems, which includes online catalogs and virtual assistants, help the consumers choose the ideal product for the intended application. Thereby, the customers intend to visit online websites before visiting stores for collecting information regarding the products and the company. This has given an edge to manufacturers with a strong foothold in the virtual world. Some prominent players in the global flooring market include:

-

Mohawk Industries, Inc.

-

Tarkett, S.A.

-

AFI Licensing

-

Burke Flooring Products, Inc.

-

Firbo Flooring

-

Shaw Industries, Inc.

-

Interface, Inc

-

Gerflor

-

Mannington Mills, Inc.

-

Polyflor

-

RAK Ceramics

-

Crossville Inc.

-

Atlas Concorde S.P.A.

-

Porcelanosa Group

-

Kajaria Ceramics Limited

Recent Devlopments

-

In July 2023, Shaw Industries announced that its EcoWorx carpet tile product range had obtained the ‘Works with WELL’ mark, demonstrating that the product adheres to health strategies in the WELL Building Standard. EcoWorx, developed in the late 1990s, was the first carpet tile that was PVC-free, and has been Cradle to Cradle Certified, meaning that it is safe, circular, and made responsibly

-

In June 2023, Crossville, Inc. introduced the ‘Sahara Noir’ porcelain tile panel, which has been made by Laminam in Italy. The porcelain panels are wider than conventional ones, and have been designed for exterior and interior walls, flooring, and counters

-

In May 2023, Mannington Commercial introduced the Crafted Collection, which features high durability, making it ideal for use in interior spaces that witness high foot-traffic. The range features 2 styles – Frost and Foam – having textural patterns; the collection is made of type 6 nylon and leverages the patented Infinity 2 Modular backing to withstand strong wet cleanings

-

In September 2022, Tarkett North America introduced the Discovery collection that are aimed towards educational institutions. The company claims that the flooring design is based in research focused on helping neurodiverse or neurotypical students in having a comfortable learning environment

-

In July 2022, Atlas Concorde announced an investment of more than 60 million Euros for boosting large ceramic slab production in Italy. The investment, made in the Finale Emilia plant, is based on focus towards environment sustainability, and the large-sized porcelain slabs will be sold in over 120 global markets

-

In June 2022, Mohawk Industries announced an agreement regarding the purchase of Grupo Industrial Saltillo’s Vitromex ceramic tile business. Vitromex, found in 1967, has 4 manufacturing facilities located in Mexico, and the deal is expected to help Mohawk expand its customer base, along with its logistical and manufacturing capabilities

-

In February 2022, Polyflor launched its Camaro Rigid Core collection that is available in 3 formats – tile, plank, and herringbone – and features 18 designs. It features a rigid SPC core construction that helps in installation over existing subfloors without the requirement of a mallet. Camaro Rigid Core additionally has an inbuilt acoustic underlay with 18dB impact sound reduction and is completely waterproof

-

In February 2022, Diverzify combined with Spectra Contract Flooring and ProSpectra Contract Flooring, divisions of Shaw Industries, forming the biggest independent commercial installation business globally

Flooring Market Report Scope

Report Attribute

Details

Market size value in 2023

USD 277.67 billion

Revenue forecast in 2030

USD 398.27 billion

Growth Rate

CAGR of 5.2% from 2023 to 2030

Base year for estimation

2022

Actual estimates/Historical data

2018 - 2021

Forecast period

2023 - 2030

Quantitative units

Volume in million square meters, revenue in USD million, CAGR from 2023 to 2030

Report coverage

Volume forecast, Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, application, region

Regional scope

North America; Europe; Asia Pacific; Central & South America; Middle East & Africa

Country scope

U.S.; Canada; Mexico; Germany; U.K.; France; Italy; Spain; Russia; Romania; Czech Republic; Portugal; Ukraine; Slovakia; Hungary; China; India; Japan; Indonesia; South Korea; Australia; Philippines; Vietnam; Saudi Arabia; UAE; Israel; Qatar; South Africa; Morocco; Brazil; Argentina; Peru; Colombia; Chile

Key companies profiled

Mohawk Industries, Inc.; Tarkett, S.A.; AFI Licensing; Burke Flooring Products, Inc.; Firbo Flooring; Shaw Industries, Inc.; Interface, Inc.; Gerflor; Mannington Mills, Inc.; Polyflor; RAK Ceramics; Crossville Inc.; Atlas Concorde S.P.A.; Porcelanosa Group; Kajaria Ceramics Limited

Customization scope

Free report customization (equivalent up to 8 analysts' working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Flooring Market Report Segmentation

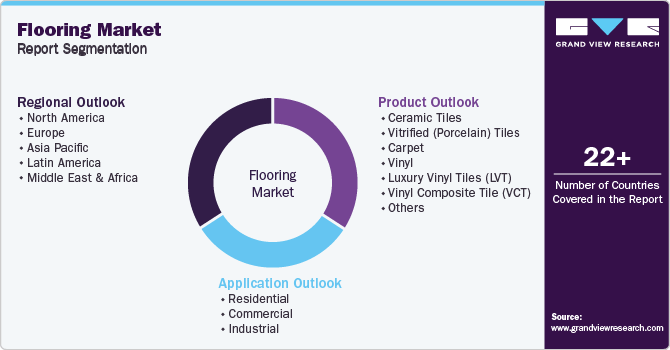

This report forecasts volume & revenue growth at global, regional & country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2022 to 2030. For the purpose of this study, Grand View Research has segmented the global flooring market report based on product, application, and region:

-

Product Outlook (Volume, Million Square Meters; Revenue, USD Million, 2018 - 2030)

-

Ceramic Tiles

-

Vitrified (Porcelain) Tiles

-

Carpet

-

Vinyl

-

Luxury Vinyl Tiles (LVT)

-

Linoleum/Rubber

-

Wood & Laminate

-

Natural Stone

-

Other Flooring Materials

-

-

Application Outlook (Volume, Million Square Meters; Revenue, USD Million, 2018 - 2030)

-

Residential

-

Commercial

-

Industrial

-

-

Regional Outlook (Volume, Million Square Meters; Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

U.K.

-

France

-

Italy

-

Spain

-

Russia

-

Romania

-

Czech Republic

-

Portugal

-

Ukraine

-

Slovakia

-

Hungary

-

-

Asia Pacific

-

China

-

India

-

Japan

-

South Korea

-

Australia

-

Indonesia

-

Philippines

-

Vietnam

-

-

Middle East & Africa

-

Saudi Arabia

-

UAE

-

Israel

-

Egypt

-

Qatar

-

South Africa

-

Morocco

-

-

Central & South America

-

Brazil

-

Argentina

-

Peru

-

Colombia

-

Chile

-

-

Frequently Asked Questions About This Report

b. The global flooring market size was estimated at USD 266.48 billion in 2022 and is expected to reach USD 277.67 billion in 2023.

b. The flooring market is expected to grow at a compound annual growth rate of 5.6% from 2023 to 2030 to reach USD 398.27 billion by 2030.

b. Residential construction dominated the flooring market with a share of 49.4% in 2022. This is attributed to growing population and increased spending in residential structures enhancements.

b. Some of the key players operating in the flooring market include Mohawk Industries, Inc., Tarkett, S.A., AFI Licensing, Burke Flooring Products, Inc., Firbo Flooring, Shaw Industries, Inc., Interface, Inc., Gerflor, Mannington Mills, Inc., Polyflor, RAK Creamics, Crossville Inc., Atlas Concorde S.P.A., Porcelanosa Group, Kajaria Ceramics Limited

b. The key factors that are driving the flooring market include rapidly rising construction activities in developing countries around the globe. In addition, investments in several developing countries such as India, Brazil, and South Korea towards development of the non-residential construction industry, is expected to drive the market growth over the forecast period.

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![ESOMAR Certified Member]()

![Great Place to Work Certified]()

ESOMAR & Great Work to Place Certified

![ISO 9001:2015 & 27001:2022 Certified]()

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."

Important: Covid19 pandemic market impact

The global construction industry once booming due to the residential and commercial construction in China and the U.S., has been affected by the suspension of the construction activities across the impacted economies. The construction industry in the U.S. is expected to take a major hit due to labor shortages and the lockdown imposed by the government during COVID-19, which is expected to be aggravated by the resulting supply chain issues and financing pressures due to the non-adherence to the completion times. The report will account for COVID-19 as a key market contributor.