- Home

- »

- Food Safety & Processing

- »

-

Flavors Market Size, Share & Growth Analysis Report, 2030GVR Report cover

![Flavors Market Size, Share & Trends Report]()

Flavors Market Size, Share & Trends Analysis Report By Nature (Natural, Synthetic), By Form (Powder, Liquid/Gel), By Application (Food, Beverages), By Region, And Segment Forecasts, 2023 - 2030

- Report ID: GVR-4-68040-131-6

- Number of Pages: 180

- Format: Electronic (PDF)

- Historical Range: 2017 - 2021

- Industry: Consumer Goods

Flavors Market Size & Trends

The global flavors market size was estimated at USD 18.27 billion in 2022 and is projected to grow at a compound annual growth rate (CAGR) of 5.7% from 2023 to 2030. Consumer preferences in the food industry have significantly changed in recent years, particularly with reference to the growing acceptance of unique and exotic flavors. This shift toward diverse and unconventional flavor profiles has strongly influenced the market, giving rise to the emergence of natural flavor enhancers made from botanical and fruit extracts.

Consumers are increasingly conscious of their health and wellness, preferring flavors derived from natural sources. Companies have been investing heavily in research and development to cater to this growing demand. Manufacturers have been launching new products to cater to these consumer preferences. For instance, in October 2022, International Flavors & Fragrances Inc., a renowned solution provider for the food, beverage, health, biosciences, and fragrance industries, introduced a groundbreaking innovation called IFF NEO. This innovative portfolio of natural flavors is designed to deliver an exceptional citrus taste experience without relying on citrus oil or any of its derivatives. IFF NEO encompasses a wide range of complete citrus flavors, including orange, lemon, lime, grapefruit, and mandarin. This offering provides beverage manufacturers with a more reliable supply and helps mitigate price fluctuations and reduces the environmental impact associated with traditional citrus sourcing.

Natural fragrances and flavors are costly due to their processing; and because of limited resources, industry players have developed cost-efficient synthetic alternatives. These products have the advantages of regular supply, steady pricing, and lower production costs. In the past years, there used to exist an arrangement in which dealers would have a multi-year contract with other dealers.

Aroma chemicals play a crucial role in the manufacturing of flavors that are used in the food industry to enhance the appeal and flavor of the product. These chemicals are classified as phenols, aldehydes, alcohols, esters, and other chemicals. The use of natural products is on the rise due to the high demand for exotic essential oils to be used in pharmaceuticals, aromatherapy, and natural cosmetics.

The e-commerce sector's rapid expansion is creating new opportunities for flavor manufacturers. Consumers can now conveniently purchase flavors and fragrances online, offering a hassle-free shopping experience. This accessibility is particularly appealing to consumers who may want to explore a wide range of flavor and fragrance options for their culinary or product development needs.

Nature Insights

Based on nature, the synthetic flavors segment dominated the market in 2022 with a revenue share of 67.2%. Synthetic flavor compounds are artificially created in a laboratory through chemical synthesis. Scientists and flavorists carefully design these compounds to replicate the taste and aroma of natural ingredients. The main purpose of synthetic flavor compounds is to mimic specific flavor profiles found in natural ingredients. They are used to reproduce flavors such as fruit, spices, and vanilla.

Technological advancements including the use of artificial intelligence (AI) and machine learning, are aiding the development of more unique and precise synthetic flavor profiles. For instance, in October 2020, Firmenich, a leading flavor and fragrance company, developed an AI-generated flavor. This flavor, designed to mimic the taste of lightly grilled beef, is intended for use in plant-based meat alternatives. AI empowers flavor manufacturers by providing precise formula starting points and optimizing ingredient combinations, enhancing their capability to meet specific product parameters, such as 100% natural ingredients. Changing consumer preferences and demand to replicate flavors in vegan food products have led to this technological innovation, contributing to the synthetic flavors segment growth.

The natural flavor segment is anticipated to register the fastest CAGR of 7.3% over the forecast period. The natural flavors segment is experiencing robust growth, primarily driven by increasing consumer demand for healthier and natural food products perceived as safer and more authentic alternatives to artificial flavors. There is a growing consumer interest in botanical flavors, especially those derived from flowers. The unique and fragrant profiles of flowers have captured the attention of flavor innovators, who are using them to create distinct and appealing taste experiences in a variety of food products. As consumers seek more natural and plant-based options, manufacturers are leveraging the opportunity to create unique botanical flavors, especially in the sweet, packaged foods segment.

In June 2023, Marquis, a Los Angeles-based beverage brand, introduced its first botanical-inspired flavor, Lemon Lavender. This plant-based, caffeinated, ready-to-drink beverage incorporates unique botanical elements and vitamins, aligning with the increasing consumer preference for natural flavors. The addition of lavender to the product line caters to the demand for botanical flavors linked with self-care and well-being.

Application Insights

Based on application, the flavors in the food segment dominated the market in 2022 with the largest revenue share of 65.1%. The food industry is witnessing a growing demand for fruit and botanical flavors. Some of the trending flavors include grapefruit, tangerine, yuzu, mango, passion fruit, and guava, each preferred for their unique chemical characteristics that can serve various functions, from reducing bitterness to masking protein off-notes in sports nutrition products. In addition, consumers are increasingly drawn to premium taste experiences and health benefits offered by florals and botanicals, with flavors such as ylang-ylang, vetiver, cherry blossom, hibiscus, and elderflower gaining popularity, according to Tastewise’s 2023 top flavor & ingredient trends report. The appealing colors associated with these flavors also play a role in attracting consumers.

The flavor beverage market is poised to grow at the fastest CAGR of 6.1% during the forecast period. The growing interest of consumers in mood-boosting and wellness-oriented products has led to increasing demand for flavors in functional beverages. As consumers seek ways to manage stress, balance their moods, and improve their overall mental and emotional well-being, flavor becomes a crucial component of these functional beverages. Flavors are selected to align with different mood-related claims, such as happiness, relaxation, indulgence, and energy. For example, flavors like turmeric, ginger, and lemongrass are associated with happiness claims, while floral, herbal, and citrus flavors like chamomile, lavender, and hibiscus are popular in products positioned as calming or relaxing.

Further, manufacturers are capitalizing on the opportunities presented by the growing synergy between flavor innovation and the demand for functional beverages that promote mood enhancement and overall well-being. As consumer preferences continue to evolve in the case of mood-boosting products, flavor choices and their alignment with specific mood-related claims play a significant role in driving the flavor industry's growth in the functional beverage sector.

Form Insights

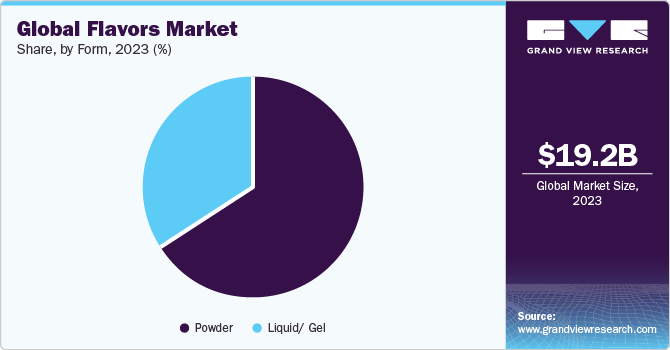

Based on form, the powder segment dominated the market in 2022 with the largest revenue share of 66.0%. The use of powdered flavors in the food industry is driven by their versatility and ability to enhance the flavor of various food and beverage products. Powdered flavors are dry, easy to store, convenient, have high heat stability, and have a longer shelf life compared to fresh ingredients, making them particularly suitable for baking applications and beverages. Flavors in powdered form can be combined with other ingredients such as salt, sugar, and spices to create a burst of flavors.

The liquid/gel segment is anticipated to exhibit a significant CAGR during the forecast period. Liquid/gel forms are concentrated forms of flavors used in food, beverage, and nutrition products. Concentrated flavors are particularly advantageous as they offer a potent flavor impact in small quantities. The concentrated form enables easy amplification of flavor into food products. Manufacturers are likely to use liquid forms of flavor in applications that require a higher level of flavor usage to achieve desired taste profiles.Moreover, the clean-label trend has driven the preference for liquid flavors, as these often contain fewer additives compared to powdered flavors and align with the demand for transparent and wholesome ingredient lists.

Regional Insights

Asia Pacific dominated the market in 2022 with a revenue share of 35.5%. The region is also projected to grow at a CAGR of 6.6% during the forecast period. The demand for natural flavors in the Asia Pacific market has been boosted by consumers' growing interest in products that are naturally nutrient-rich and delicious. Natural herbs and spices have been traditionally used in household cooking across the region.

In February 2021, Tonino Lamborghini formed a licensing agreement with NEW AWAKEN LIMITED, and later in April, the company launched the Tonino Lamborghini Energy Drink in the Chinese market. The Tonino Lamborghini Energy Drink Sugar-Free was the first product launched in China; subsequent releases were slated to include a regular canned version and a non-carbonated variant. The product was launched in a uniquely designed can tailored to align with Chinese preferences and consumption habits.

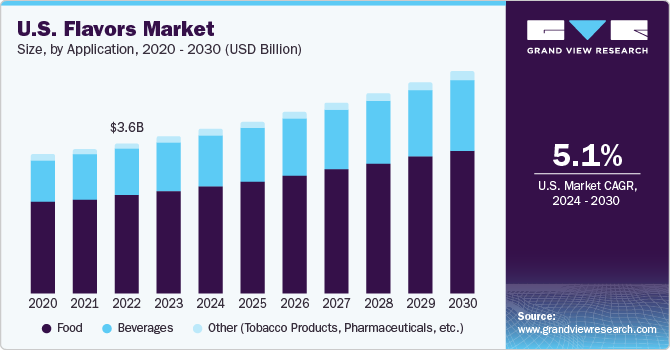

Demand for flavors in North America accounted for a market share of over 25.0% in 2022 and is expected to witness substantial growth over the forecast period. The demand for more exciting and adventurous flavors drives innovation in the snack industry. Snack brands are increasingly reinventing classic flavor profiles and offering bold and inventive taste experiences. Textures, uncommon flavor pairings, and extreme flavor profiles can help firms improve their product ranges and (re)engage consumers. Snack brands would benefit from launching traditional items with a twist, as even adventurous consumers find comfort in traditional products. For instance, according to the 2022 Food and Beverage Flavor Trends Report by T. Hasegawa Co., Ltd., 41% of consumers in the U.S. are open to sampling new flavors that are like their favorites.

Key Companies & Market Share Insights

The rising consumer concerns regarding the use of synthetic colors in edible products have prompted manufacturers to look for alternatives. For example, in March 2023, Firmenich SA launched the "Orange NextGen replacers and extenders" product line as a natural substitute for FTNF (From the Named Fruit) orange oils. It offers cost-effective and sustainable solutions to its customers while maintaining the desired flavor profile. Some prominent players in the global flavors market include:

-

Givaudan

-

Firmenich SA

-

Symrise AG

-

Sensient Technologies Corporation

-

International Flavors & Fragrances Inc.

-

Takasago International Corporation

-

Kerry Group plc

-

MANE

-

Robertet Group

-

Huabao Flavours & Fragrances Co., Ltd.

Flavors Market Report Scope

Report Attribute

Details

Market size value in 2023

USD 19.20 billion

Revenue forecast in 2030

USD 28.54 billion

Growth rate

CAGR of 5.7% from 2023 to 2030

Base year for estimation

2022

Historical data

2017 - 2021

Forecast period

2023 - 2030

Quantitative units

Revenue in USD million/billion, and CAGR from 2023 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Nature, form, application, region

Regional scope

North America; Europe; Asia Pacific; Central & South America; Middle East & Africa

Country scope

U.S.; Canada; Mexico; UK; Germany; France; Italy; Spain; China; India; Japan; Australia; New Zealand; Brazil; South Africa

Key companies profiled

Givaudan; Firmenich SA; Symrise AG; Sensient Technologies Corporation; International Flavors & Fragrances Inc.; Takasago International Corporation; Kerry Group plc; MANE; Robertet Group; Huabao Flavours & Fragrances Co., Ltd.

Customization scope

Free report customization (equivalent up to 8 analyst working days) with purchase. Addition or alteration to country, regional, and segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Flavors Market Report Segmentation

This report forecasts revenue growth at the global, regional, and country levels and provides an analysis of the latest industry trends from 2017 to 2030 in each of the sub-segments. For this study, Grand View Research has segmented the global flavors market report based on form, nature, application, and region:

-

Nature Outlook (Revenue, USD Million, 2017 - 2030)

-

Natural

-

Synthetic

-

-

Form Outlook (Revenue, USD Million, 2017 - 2030)

-

Powder

-

Liquid/Gel

-

-

Application Outlook (Revenue, USD Million, 2017 - 2030)

-

Food

-

Dairy Products

-

Bakery & Confectionery

-

Supplements & Nutrition Products

-

Meat & Seafood Products

-

Snacks

-

Pet Foods

-

Sauces, Dressings & Condiments

-

Others

-

-

Beverages

-

Juices & Juice Concentrates

-

Functional Beverages

-

Alcoholic Beverages

-

Carbonated Soft Drinks

-

Others

-

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2017 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

Italy

-

Spain

-

-

Asia Pacific

-

China

-

India

-

Japan

-

Australia And New Zealand

-

-

Central & South America

-

Brazil

-

-

Middle East & Africa

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global flavors market size was estimated at USD 18.27 billion in 2022 and is expected to reach USD 19.20 billion in 2023.

b. The flavors market is expected to grow at a compound annual growth rate of 5.7% from 2022 to 2030 to reach USD 28.54 billion by 2030.

b. Asia Pacific region held a dominant revenue share of 35.5% in 2022 owing to the rise in a number of health-conscious consumers coupled with high demand for organic foods.

b. Some of the major players in the market include Givaudan,Firmenich SA, Symrise AG, Sensient Technologies Corporation, International Flavors & Fragrances Inc., Takasago International Corporation, Kerry Group plc, MANE, Robertet Group, and Huabao Flavours & Fragrances Co., Ltd.

b. The rising popularity of plant-based diets coupled with popularity of clean label ingredients among all age groups is supporting the demand for the market.

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![ESOMAR Certified Member]()

![Great Place to Work Certified]()

ESOMAR & Great Work to Place Certified

![ISO 9001:2015 & 27001:2022 Certified]()

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."

Important: Covid19 pandemic market impact

The demand for packaged and processed foods is expected to increase owing to their longer shelf life. Furthermore, manufacturers are closely monitoring the product supply to major retailers through specialized communication channels in order to improve restocking. In addition, processed food manufacturers have urged the packaging raw material suppliers as well as contract packers to ensure a steady flow of goods during the lockdown related to COVID-19. The report will account for Covid19 as a key market contributor.