- Home

- »

- Food Additives & Nutricosmetics

- »

-

Flavors And Fragrances Market Size & Share Report, 2030GVR Report cover

![Flavors And Fragrances Market Size, Share & Trends Report]()

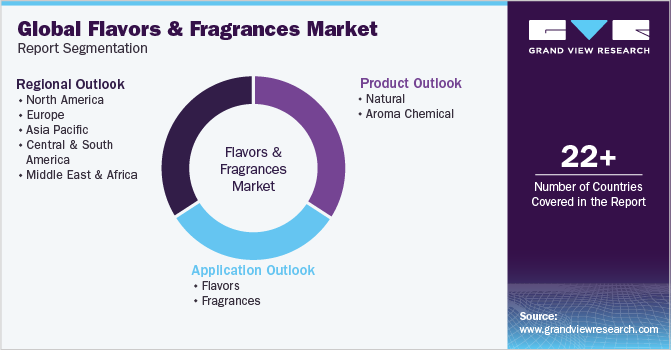

Flavors And Fragrances Market Size, Share & Trends Analysis Report By Product (Aroma Chemicals, Natural), By Application (Flavors, Fragrances), By Region (Asia Pacific, North America), And Segment Forecasts, 2023 - 2030

- Report ID: GVR-1-68038-697-4

- Number of Pages: 105

- Format: Electronic (PDF)

- Historical Range: 2018 - 2021

- Industry: Specialty & Chemicals

Report Overview

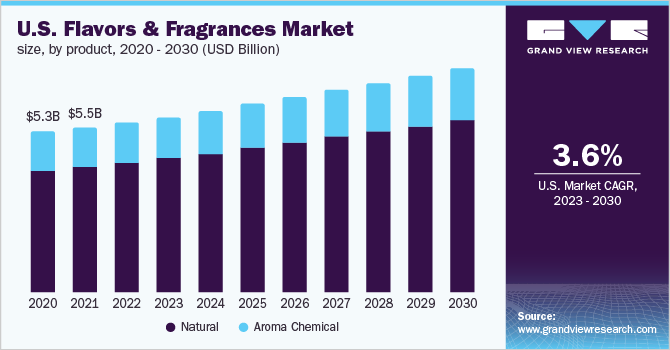

The global flavors and fragrances market size was valued at USD 29.15 billion in 2022 and is anticipated to grow at a compound annual growth rate (CAGR) of 5.4% from 2023 to 2030. The product demand is anticipated to be driven by the rising demand and consumption of processed food and personal care & cosmetic products globally. Rising disposable income in emerging economies like India and China coupled with population growth is expected to augment the demand for personal care and cosmetic products in the industry. In addition, the busy lifestyle pattern upheld in developing as well as developed countries are anticipated to augment the demand for processed foods & beverages, thereby increasing the demand for flavors.

Natural fragrances and flavors are costly due to their processing; and because of limited resources, industry players have developed cost-efficient synthetic alternatives. These products have the advantages of regular supply, steady pricing, and lower production costs. In the past years, there used to exist an arrangement in which dealers would have a multi-year contract with other dealers.

However, such an arrangement is no longer popular. Due to the increased awareness about the adverse effects of allopathic medicines, increasing concerns about the medicinal benefits, and therapeutic effects of herbal products are likely to fuel the demand for herbal products, dietary supplements, and herbal-based beauty aids derived from botanical extracts. These extracts are used in anti-aging cosmetic products to help reduce the radical damage caused by bioflavonoids in their composition.

Flavors and fragrances provide strong sensory impressions, often determined when applied via medical products, beverages, food, and other substances. These products enhance the aesthetic value and overall appeal of consumer goods. The increasing demand for health and wellness foods, Ready-to-Eat (RTE), and convenience meals, as well as rapid technological advancements, are expected to further augment the industry growth.

Product Type Insights

The natural chemicals segment dominated the industry in 2022 and accounted for the maximum share of more than 74.30% of the overall revenue. This is attributed to the ever-increasing product usage in various application industries like pharmaceuticals, aromatherapy, and natural cosmetics. Furthermore, increasing research spending for the development of natural fragrance compounds is expected to have a positive impact on the overall industry. Aroma chemicals are synthetic aromas, which are used in many applications, such as essential oils, food & beverages, and perfumes.

Aroma chemicals play a crucial role in the manufacturing of fragrances and flavors that are used in the food industry to enhance the appeal and flavor of the product. These chemicals are classified as phenols, aldehydes, alcohols, esters, and other chemicals. The use of natural products is on the rise due to the high demand for the exotic essential oil to be used in pharmaceuticals, aromatherapy, and natural cosmetics. The demand for fragrances where the odor value of a fragrance is replaced with natural oils is high in developed countries. Thus, many exotic essential oils like, sandal, junipers, rosemary, lavender, geranium, etc. find applications in multiple new blends.

Application Insights

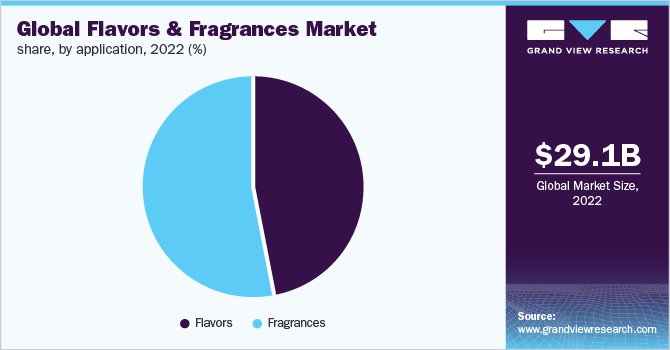

The fragrances application segment dominated the global industry in 2022 and accounted for the maximum share of more than 53.60% of the overall revenue. The high share of this segment can be attributed to the increased demand for various fragrances in toiletries, such as hand washes, detergents, soaps, personal care products, and cosmetics. Furthermore, fragrance plays an important role in aromatherapy applications, owing to which essential oils, materials, compounds, and aromatic oils demand is likely to be driven in aromatherapy applications.

In addition, the growing demand for aromatherapy diffusers is likely to fuel the industry's growth in the coming years. Flavors are the aromas used in food & beverage products. There is a rise in the application of flavors in several foods and beverages in commercial as well as domestic applications. In addition, feed and feed additive manufacturers are focusing more on providing palatability solutions to increase feed intake. This, in turn, is projected to propel the demand for flavors in animal feed applications supporting the overall market growth.

Regional Insights

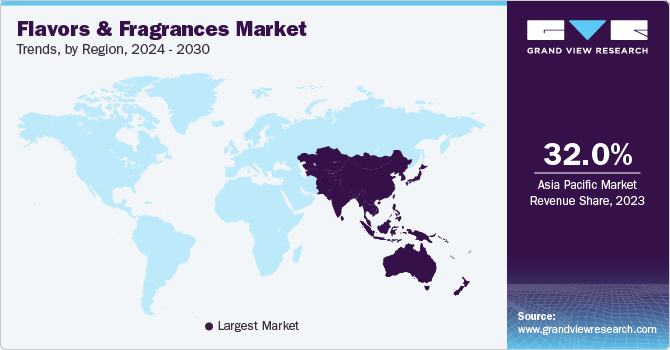

Asia Pacific dominated the global industry in 2022 and accounted for the highest share of more than 31.40% of the overall revenue. This is attributed to the shift in choices of consumers towards nutritional and healthy foods and beverages in most populated countries like India and China. Asian flavors and fragrances have also gained popularity in the major regions of Europe and North America. Indonesia, India, China, and Vietnam are among the prominent food flavor markets in the region of Asia Pacific. Multiple manufacturing companies are focusing on the expansion of their business and investments in R&D facilities in the Asia Pacific region.

Factors, such as government subsidies, tax benefits, and high per capita income, are attracting global companies to expand and start their operation in this region. The Comprehensive Economic & Trade Agreement (CETA) is predicted to remove the customs duty on food and agricultural products and several other industrial products. The trade agreement between Canada and the European Union is likely to enable it to participate in public bids in Canada. This is further intended to propel the trade of essential oils between Europe and North America, thereby providing a significant growth opportunity for the essential oils & floral extracts industry players in North America.

Key Companies & Market Share Insights

The industry is fragmented and dominated by large-scale multinational companies. Smaller companies differentiate themselves by creating unique natural fragrances and flavors and as a result, make it difficult for their competitors to imitate and enter the domestic market. The manufacturers are experiencing profit margin problems, which have become worse due to the demands of retailers and processors and their private label brands. Safety considerations and environmental protection laws are becoming vital in most developed countries.

Operating costs and the cost of investments are also getting higher each year. Under these circumstances, the clearances for new projects are tough to obtain in developed countries. Furthermore, creativity and innovation are the most important factors for achieving a competitive edge. Thus, to achieve this, new ingredients are being searched for resulting in higher processing costs. These factors are expected to be a challenge for industry players. Some of the prominent players in the global flavors and fragrances market include:

-

Sensient Technologies Corp.

-

Mane SA

-

Takasago International Corp.

-

Manohar Botanical Extracts Pvt. Ltd.

-

Alpha Aromatics

-

Ozone Naturals

-

Elevance Renewable Sciences, Inc.

-

Firmenich SA

-

Symrise AG

-

Vigon International, Inc.

-

BASF SE

-

Indo World

-

Akay Flavors & Aromatics Pvt. Ltd.

-

Ungerer & Company

-

Synthite Industries Ltd.

-

Universal Oleoresins

-

Flavex Naturextrakte GmbH

-

Falcon Essential Oils

-

doTERRA International

-

Young Living Essential Oils

-

Biolandes SAS

-

International Flavors and Fragrances, Inc.

-

Givaudan

Recent Development

-

In July 2023, Young Living announced a new series of products and returning favorites. This series includes the Ignite Your Journey essential oil blend and Simplified by Jacob + Kait Tropical Tango Hand Cream, along with reformulated returning favorites including the Valor blend.

-

In June 2023, MANE commenced the company’s one of the largest production bases in Zhejiang, China. The objective of this new facility was to deliver a robust impetus for the development of the flavors market in the country and other regions nearby.

-

In June 2023, dōTERRA announced the inauguration of its rose-centric distillery in Bulgaria. The new facility was aimed at revitalizing the essential oils arena and facilitating diversified and sustainable development in the country.

-

In May 2023, Symrise announced the commencement of its new fine fragrance development hub – Little Red House in Shanghai. With the help of this development, the company planned to strengthen its market position in the Chinese fragrance market.

-

In May 2023, Firmenich announced the successful merger of Firmenich and DSM and established dsm-firmenich. With this initiative, dsm-firmenich planned on becoming a trendsetter in the manufacturing, reinvention, and blending of essential nutrients, flavors, and fragrances.

-

In May 2023, MANE KANCOR announced the opening of its largest manufacturing plant in Karnataka, India. The new facility supports the development of the company’s scientific manufacturing capabilities focusing on segments including organic colors, personal care ingredients, and natural antioxidants.

-

In March 2023, BASF announced the expansion of its aroma ingredients business with the launch of new facilities in Germany and China. The company planned to introduce a new citral plant in Zhanjiang, China, and linalool & menthol downstream plants in Ludwigshafen, Germany.

-

In March 2023, Firmenich announced the launch of Orange NextGen extenders and replacers, its organic substitute for FTNF (From The Named Fruit) orange oils. The solution is able to attain identical orange flavors at a striking economic benefit to consumers and enables sustained supply.

Flavors And Fragrances Market Report Scope

Report Attribute

Details

Market size value in 2023

USD 30.61 billion

Revenue forecast in 2030

USD 44.6 billion

Growth rate

CAGR of 5.4% from 2023 to 2030

Base year for estimation

2022

Historical data

2018 - 2021

Forecast period

2023 - 2030

Quantitative units

Revenue in USD million and CAGR from 2023 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, application, region

Regional scope

North America; Europe; Asia Pacific; Central & South America; Middle East & Africa

Country scope

U.S.; Canada; Mexico; Germany; U.K.; France; Spain; Portugal; Turkey, China, India, Japan, South-East Asia, Indonesia, Brazil, Colombia, Saudi Arabia, Africa Continent

Key companies profiled

Sensient Technologies Corp.; Mane SA; Takasago International Corp.; Manohar Botanical Extracts Pvt. Ltd.; Alpha Aromatics; Ozone Naturals; Elevance Renewable Sciences, Inc.; Firmenich SA; Symrise AG; Vigon International, Inc.; BASF SE; Indo World; Akay Flavors & Aromatics Pvt. Ltd.; Ungerer & Company; Synthite Industries Ltd.; Universal Oleoresins; Flavex Naturextrakte GmbH; Falcon Essential Oils; doTERRA International; Young Living Essential Oils; Biolandes SAS; International Flavors and Fragrances, Inc.; Givaudan

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope. Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Flavors And Fragrances Market Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For the purpose of this study, Grand View Research has segmented the global flavors and fragrances market report on the basis of product, application, and region:

-

Product Outlook (Revenue, USD Million, 2018 - 2030)

-

Natural

-

Essential Oils

-

Orange Essential Oils

-

Corn mint Essential Oils

-

Eucalyptus Essential Oils

-

Pepper Mint Essential Oils

-

Lemon Essential Oils

-

Citronella Essential Oils

-

Patchouli Essential Oils

-

Clove Essential Oils

-

Ylang Ylang/Canaga Essential Oils

-

Lavender Essential Oils

-

-

Oleoresins

-

Paprika Oleoresins

-

Black Pepper Oleoresins

-

Turmeric Oleoresins

-

Ginger Oleoresins

-

-

Others

-

-

Aroma Chemical

-

Esters

-

Alcohol

-

Aldehydes

-

Phenol

-

Terpenes

-

Others

-

-

-

Application Outlook (Revenue, USD Million, 2018 - 2030)

-

Flavors

-

Confectionery

-

Convenience Food

-

Bakery Food

-

Dairy Food

-

Beverages

-

Animal Feed

-

Others

-

-

Fragrances

-

Fine Fragrances

-

Cosmetics & Toiletries

-

Soaps & Detergents

-

Aromatherapy

-

Others

-

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

U.K.

-

France

-

Spain

-

Portugal

-

Turkey

-

-

Asia Pacific

-

China

-

India

-

Japan

-

SEA

-

Indonesia

-

-

Central & South America

-

Brazil

-

Colombia

-

-

Middle East & Africa

-

Saudi Arabia

-

Africa Continent

-

-

Frequently Asked Questions About This Report

b. The global flavors and fragrances market size was estimated at USD 29.15 billion in 2022 and is expected to reach USD 30.61 billion in 2023.

b. The global flavors and fragrances market is expected to grow at a compound annual growth rate of 5.4% from 2023 to 2030 to reach USD 44.6 billion by 2030.

b. Aroma Chemicals dominated the flavors and fragrances market with a share of more than 74% in 2022. This is attributable to rising concern about fitness and well-being by people of all ages which is likely to provide lucrative opportunities for aroma chemicals in fragrances.

b. Some key players operating in the flavors and fragrances market include IFF, Givaudan, Takasago, BASF SE; Symrise AG; Vigon International, In. and others

b. Key factors that are driving the flavors and fragrances market growth include increasing demand from application industries such as food, beverages, perfumery, cosmetics, and toiletries.

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![ESOMAR Certified Member]()

![Great Place to Work Certified]()

ESOMAR & Great Work to Place Certified

![ISO 9001:2015 & 27001:2022 Certified]()

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."

Important: Covid19 pandemic market impact

Weaker consumer demand for lifestyle and wellbeing products due to social restrictions and lockdown policies shall have a negative impact on the demand patterns of cosmetic ingredients and certain categories of food additives. However, easing restrictions and public discourse about restarting economic activities in the consumer goods marketspace indicates that, the recovery of demand is imminent. The report will account for Covid19 as a key market contributor.