- Home

- »

- Advanced Interior Materials

- »

-

Flat Flexible Cables Market Size And Share Report, 2030GVR Report cover

![Flat Flexible Cables Market Size, Share & Trends Report]()

Flat Flexible Cables Market Size, Share & Trends Analysis Report By Copper Wire Thickness (< 35 Micron, 35 To 50 Micron, 50 To 100 Micron), By Copper Wire Width, By Application, By Region, And Segment Forecasts, 2023 - 2030

- Report ID: GVR-4-68040-115-4

- Number of Pages: 110

- Format: Electronic (PDF)

- Historical Range: 2018 - 2021

- Industry: Advanced Materials

Report Overview

The global flat flexible cables market size was estimated at USD 1.35 billion in 2022 and is expected to grow at a compound annual growth rate (CAGR) of 10.8% from 2023 to 2030. The growth of the market can be attributed to the flourishing development of end-use industries such as automotive, aerospace, oil and gas, industrial displays, and telecommunications across the world, which are the primary consumers of these cables.

Flat flexible cables are increasingly used in the transportation industry owing to their significant advantages over their conventional counterparts such as round cables. The product is extensively used in electronic equipment of vehicles such as cameras, LCD panels, and navigation systems. The transportation industry is witnessing growth on account of the rising population as well as the increasing per capita income of people, which in turn, is fueling demand for vehicles.

The demand for niche and luxurious cars is also rising on account of changing consumer preferences and interests. Moreover, rising consumer preference for vehicles with variations in shape, body, and style has led to technological developments for the manufacturing of different types of vehicles, thus, acting as a growth driver for the transportation industry. Therefore, the rising production of vehicles in the transportation industry will enhance the demand for electronic equipment, thus driving the growth of the market for flat flexible cables.

The electronics industry is one of the key drivers for the demand for flat flexible cables. The product finds application in various electronics products such as smartphones, laptops, computers, printers, displays, and fax machines, among other high-density electronics. The product is highly preferred in various electronics items on account of its favorable properties, such as superior flexibility, reliable connection, low weight, and consumption of less space. Therefore, the rapidly increasing production in the electronic industry is anticipated to drive product demand.

Flat flexible cables are manufactured with flat copper strips laminated between two insulating foils. They are considered easy to use and efficient cables for PCB connections, offering advantages such as consumption of less space and low weight. Furthermore, the flat structure of the product makes it highly applicable for a wide range of applications, including several electronic equipment used in the aerospace, automotive, industrial, medical, and military sectors. Additionally, factors such as conductor quantity, length of cable, and connection can be customized as per requirements.

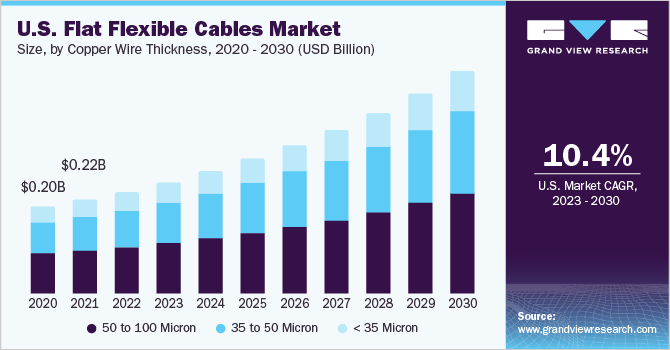

The market for flat flexible cables in the U.S. is projected to grow at a significant rate over the forecast period. The demand for flat flexible cables is increasing in the country owing to its flourishing aerospace, wind energy, and automotive industries. They are used for internal electric connections in these industries owing to their flexibility, durability, and lightweight. Manufacturers are involved in the production of various types of flat flexible cables as per their application in end-use areas such as aerospace, automotive, consumer goods, marine, etc. Additionally, companies also offer the option to build a product based on customer requirements. This helps companies cater to a wider audience, thus gaining significant market share as compared to other manufacturers.

Copper Wire Thickness Insights

The 50 to 100-micron copper wire thickness segment dominated the flat flexible cables market in 2022 by accounting for a revenue share of 47.2%. The growth of this market segment can be attributed to the surging use of copper cables with a thickness of 50 to 100 microns in automotive, aerospace, military, and industrial applications owing to their strength and durability.

The increasing adoption of electric vehicles across the world is further expected to positively impact the demand for flat flexible cables with a copper wire thickness of 50 to 100 microns, owing to their extensive use in these vehicles. Additionally, the growing defense budgets of countries due to rising geopolitical tensions and wars globally are fueling the demand for military aircraft that are incorporated with flat flexible cables with a copper thickness of 50 to 100 microns. The surging global adoption of industrial robots for achieving operational efficiency is also fueling the demand for these cables.

The < 35 microns copper wire thickness segment in the market for flat flexible cables is projected to expand at the fastest CAGR of 11.3% over the forecast period. The rising instances of innovations in miniaturized electronic products such as laptops, smartphones, and semiconductors that offer superior performance are driving the growth of this segment of the global market, as cables with this copper wire thickness are used in these products.

Ongoing technological advancements in the manufacturing industry are expected to contribute to the demand for high-strength cables that require less space. This is also anticipated to lead to the growth of the < 35 microns copper wire thickness segment in the flat flexible cables industry during the forecast period. Flat flexible cables with a thickness of < 35 microns are additionally used in medical devices and consumer goods (including smartphones, adaptors, tablets, etc.).

Copper Wire Width Insights

Copper wire with a width of <= 1 mm is most commonly used in flat flexible cables and the segment dominated the market with a revenue share of 63.2% in 2022. The product portfolio of several manufacturers such as Axon Cable majorly consists of flat flexible cables with copper wires having a width of <= 1 mm. The smaller product width makes it highly compact and lightweight. Hence, it finds applications in smartphones, laptops, medical devices, and telecommunication devices. The growth in the above-listed segments will lead to the rising demand for flat flexible cables with a copper wire width of <= 1 mm in the coming years.

The flat flexible cables segment concerning copper wire width equal to or greater than 3 mm is expected to advance at the fastest CAGR of 11.8% over the forecast period. Compared to cables with different copper wire widths, flat flexible cables with the above-mentioned width are used less owing to the rising production of compact consumer goods devices for comfort and the growing miniaturization trend in the electronic industry.

However, sectors such as automotive, aerospace, and industrial utilize this product, as machines used in these segments are heavy and big. Therefore, the width of the cable no longer creates a problem for the functioning of the equipment. Hence, the growth of the mentioned industries is expected to propel the demand for flat flexible cables with a copper wire width greater than or equal to 3 mm over the coming years.

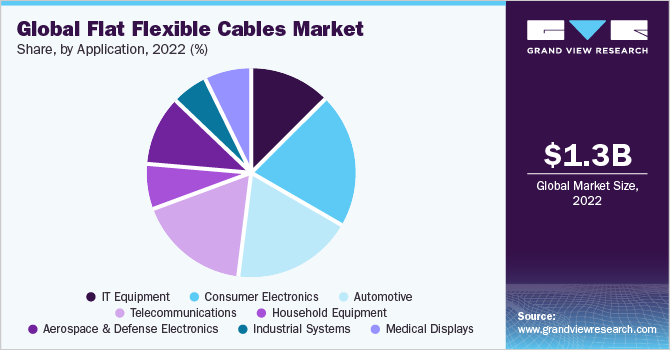

Application Insights

The aerospace & defense electronics segment emerged as a significant end-use sector and is anticipated to expand at the fastest CAGR of 11.3% over the forecast period. The application is expected to drive the overall demand for the product on account of the increasing demand for flat flexible cables for various electronic connections in aircraft due to their low weight and less space consumption. In addition, the rising demand for air travel, coupled with the increasing spending power of the general public with regard to luxury goods, is boosting the growth of the aerospace industry.

Various governments across the globe are investing in the defense sector owing to the rising geopolitical tensions between countries. This is expected to fuel the growth of the aerospace & defense industry, which, in turn, is expected to augment the demand for flat flexible cables in this segment over the forecast period.

The consumer electronics segment accounted for the highest revenue share of 20.8% of the overall market in 2022 and is expected to expand at a CAGR of 10.2% over the forecast period. Growing purchasing power, the improving living standards of consumers, and rapid urbanization in several developed as well as developing countries are factors expected to drive the consumer electronics sector, thereby driving the demand for flat flexible cables in the coming years.

Flat flexible cables are used in various consumer electronics items such as CD & DVD players, TVs, LCDs, hi-fi systems, and satellite receivers and decoders for internal connections. The product is flat, which helps it fit in less space, and is also lightweight, which helps reduce the overall weight of the end products. The rising demand for such electronics products in countries including India, China, Vietnam, the Philippines, and Thailand is expected to further boost the demand for flat flexible cables over the forecast period.

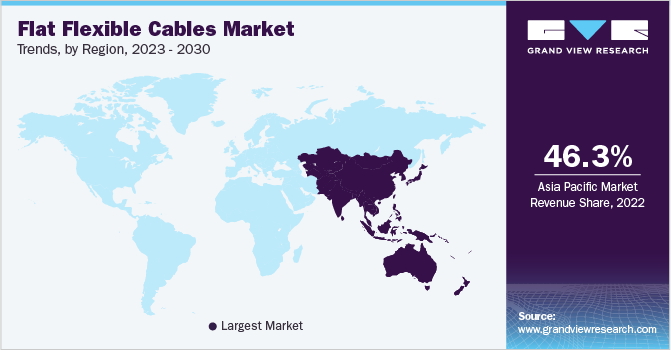

Regional Insights

Asia Pacific dominated the market for flat flexible cables with a revenue share of 46.3% in 2022. The regional market is further expected to expand at a significant rate over the forecast period, on account of the growth being observed in various end-use industries such as IT equipment, consumer electronics, automotive, telecommunications, aerospace, and medical displays.

North America accounted for a notable revenue share of 21.7% in 2022. The markets studied for flat flexible cables in this region include the U.S., Canada, and Mexico. The economy is extremely favorable for aircraft manufacturing, owing to the increasing number of aging aircraft in the region. These aging aircraft are required to be replaced with new ones owing to their low operating efficiency and reduced revenue generation for airlines. Therefore, the increasing production of aircraft is poised to result in the growing demand for flat flexible cables in the aerospace industry.

The U.S. is one of the prominent markets in North America. The demand for flat flexible cables is increasing in the country owing to its flourishing wind energy, automotive, and aerospace industries. These cables are used for internal electric connections in these industries owing to their flexibility, durability, and lightweight.

The demand for flat flexible cables is anticipated to expand at the fastest CAGR of 11.9% over the forecast period in the Middle East & Africa. The oil & gas industry in this region is a significant contributor to its economy. Flat flexible cables are used in this industry in sensors, transmitters, transducers, etc. As the Middle Eastern countries are focusing on the industrialization and diversification of their economies to reduce their reliance on the oil & gas industry, it is expected to drive the growth of the manufacturing, electronics, and automotive sectors. Surging demand for electronic equipment in these industries is expected to fuel the regional consumption of flat flexible cables during the forecast period.

Key Companies & Market Share Insights

The market is considered highly competitive, on account of the presence of many large-scale manufacturers, such as Johnson Electric Holdings Limited, Quadrangle Products, Samtec, Würth Elektronik, SUMIDA CORPORATION, NICOMATIC, and Molex, functioning at a regional or global level. To have a competitive advantage over each other, these companies are continuously investing in various strategies such as expansions, product launches, collaborations, mergers & acquisitions, and research & development. Some of the prominent players in the global flat flexible cables market include:

-

Johnson Electric Holdings Limited.

-

Proterial Cable America, Inc.

-

Quadrangle Products

-

Samtec

-

Würth Elektronik

-

Adam Tech

-

SUMIDA CORPORATION

-

NICOMATIC

-

Molex

-

Axon Cable

-

GCT (Global Connector Technology)

-

AUK

-

Alysium-Tech GmbH

Flat Flexible Cables Market Report Scope

Report Attribute

Details

Market size value in 2023

USD 1.49 billion

Revenue forecast in 2030

USD 3.06 billion

Growth rate

CAGR of 10.8% from 2023 to 2030

Base year for estimation

2022

Historical data

2018 - 2021

Forecast period

2023 - 2030

Quantitative units

Volume in tons, revenue in USD billion, and CAGR from 2023 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Copper wire thickness, copper wire width, application, region

Regional scope

North America; Europe; Asia Pacific; Central & South America; Middle East & Africa

Country scope

U.S.; Canada; Mexico; Germany; UK; France; Spain; Italy; China; India; Japan

Key companies profiled

Johnson Electric Holdings Limited.; Proterial Cable America, Inc.; Quadrangle Products; Samtec; Würth Elektronik; Adam Tech; SUMIDA CORPORATION; NICOMATIC; Molex; Axon Cable; GCT (Global Connector Technology); AUK; Alysium-Tech GmbH

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

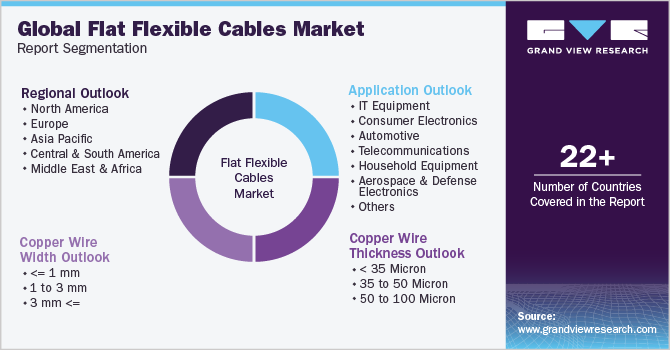

Global Flat Flexible Cables Market Report Segmentation

This report forecasts revenue and volume growth at the global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For the purpose of this study, Grand View Research has segmented the global flat flexible cables market report on the basis of copper wire thickness, copper wire width, application, and region:

-

Copper Wire Thickness Outlook (Volume, Tons; Revenue, USD Million, 2018 - 2030)

-

< 35 Micron

-

35 to 50 Micron

-

50 to 100 Micron

-

-

Copper Wire Width Outlook (Volume, Tons; Revenue, USD Million, 2018 - 2030)

-

<= 1 mm

-

1 to 3 mm

-

3 mm <=

-

-

Application Outlook (Volume, Tons; Revenue, USD Million, 2018 - 2030)

-

IT Equipment

-

Consumer Electronics

-

Automotive

-

Telecommunications

-

Household Equipment

-

Aerospace & Defense Electronics

-

Industrial Systems

-

Medical Displays

-

-

Regional Outlook (Volume, Tons; Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

Spain

-

Italy

-

-

Asia Pacific

-

China

-

India

-

Japan

-

-

Central & South America

-

Middle East & Africa

-

Frequently Asked Questions About This Report

b. The global flat flexible cables market size was estimated at USD 1.35 billion in 2022 and is expected to reach USD 1.49 billion in 2023.

b. The global flat flexible cables market is expected to grow at a compound annual growth rate of 10.8% from 2023 to 2030 to reach USD 3.06 billion by 2030.

b. <= 1 mm dominated flat flexible cables market in 2022 by accounting for a revenue share of 63.2% of the market in the same year. Increasing miniaturization of products in various industries is fueling the growth of this segment.

b. Some of the key players operating in the flat flexible cables market include Johnson Electric Holdings Limited., Quadrangle Products, Samtec, Wurth Elektronik, SUMIDA CORPORATION, NICOMATIC, and Molex.

b. The key factors that are driving the flat flexible cables market include the increasing demand for miniaturized electronic devices that offer superior performance.

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![ESOMAR Certified Member]()

![Great Place to Work Certified]()

ESOMAR & Great Work to Place Certified

![ISO 9001:2015 & 27001:2022 Certified]()

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."