- Home

- »

- Advanced Interior Materials

- »

-

Fire Suppression System Market Size & Share Report, 2030GVR Report cover

![Fire Suppression System Market Size, Share & Trends Report]()

Fire Suppression System Market Size, Share & Trends Analysis Report By Product, By Fire Extinguisher Type, By Application (Commercial, Residential), By Region, And Segment Forecasts, 2023 - 2030

- Report ID: GVR-4-68039-483-5

- Number of Pages: 100

- Format: Electronic (PDF)

- Historical Range: 2018 - 2021

- Industry: Advanced Materials

Report Overview

The global fire suppression system market was valued at USD 20.27 billion in 2022 and is expected to expand at a compound annual growth rate (CAGR) of 4.8% over the forecast period. The market growth is estimated to be driven by the growing importance of fire safety compliance in high-rise buildings, industrial spaces, and commercial sectors. The COVID-19 pandemic has changed the overall business scenario for 2020 as well as for the next few years across various verticals. However, with rising fire incidents and safety concerns among individuals, the industry is expected to witness significant growth during the forecast period.

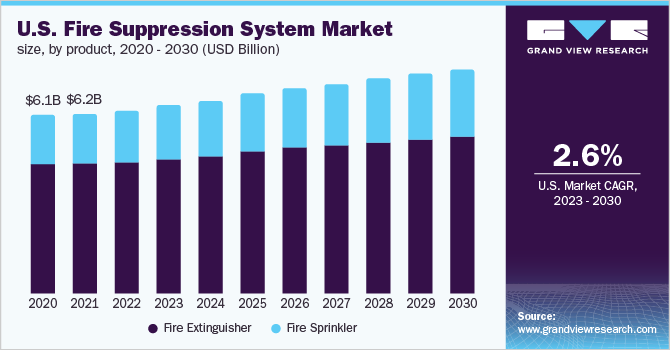

The surge in fire incidents has created lucrative growth opportunities for the adoption of these systems in commercial and residential spaces. In the U.S., the demand for fire suppression equipment, such as fire sprinklers, across industrial verticals is projected to increase as industrial sectors, such as energy & power, manufacturing, and oil & gas, involve a high risk of fire; this is because materials, such as crude oil, coal, petroleum, and flammable gases, are widely used. Growing consumer purchasing power and an increased emphasis by the government and regulatory agencies on improving the overall fire safety standard of the region’s buildings are likely to fuel product demand.

This, in turn, is estimated to propel the growth of the regional market over the forecast period. Furthermore, rising construction activity in the U.S., as well as a significant emphasis on modernizing sprinkler systems, are likely to drive market expansion. For instance, according to the estimates by Construct Connect, total construction growth in the U.S. was 8.8% and residential construction growth was 6.7% in 2021, which will further drive the product demand. The codes established by the National Fire Protection Association, generally known as the NFPA, control fire suppression systems.

This organization develops codes, regulations, and recommendations for the installation and maintenance of fire suppression systems. Similarly, the NFPA specifies regulations that must be satisfied for specific types of fire suppression systems. An increasing number of large-scale infrastructure investment projects, such as hospitals and hotels, in the U.S., is expected to propel the construction industry, thus driving product demand. The increased spending capacity of consumers coupled with the growing demand for single-family housing is anticipated to promote product utilization in the construction industry.

Product Insights

The fire extinguisher product segment led the market in 2022 and accounted for the largest share of more than 57.95% of the global revenue. Fire extinguishers are used to extinguish or control small fires with the help of a fire-extinguishing agent. The fire extinguisher systems can offer protection in the case of fire breakouts without harming or damaging valuable assets, documents, or equipment. The stringent safety rules and the implementation of fire safety regulations across the world are expected to augment the segment growth over the forecast period. The implementation of new or revised regulations is likely to increase the installation of fixed or portable fire extinguishing systems.

For instance, in May 2022, the U.K. government introduced new duties under the Fire Safety Order for building owners or managers to improve the fire protection of apartment blocks in cost-effective and practical ways for individual owners and leaseholders. The installation of fire sprinkler systems is increasing rapidly across the world owing to the stringent safety protocols for high-rise buildings. For instance, the 2021 edition of NFPA 101, Life Safety Code, (the National Fire Protection Association of the U.S.), states that all new high-rise buildings must have sprinklers and already constructed high-rise buildings must install sprinkler systems within 12 years of the adoption of the code.

This is expected to augment the market growth over the forecast period. The fire sprinkler product segment is expected to grow at a steady CAGR over the forecast period. A fire sprinkler system is an automatic and active system consisting of a sprinkler, a distribution system, and a water supply. These systems have been recognized as effective systems for protecting lives as well as property and are increasingly being installed in commercial, industrial, and residential buildings. Thus, in turn, is likely to assist segment growth.

Fire Extinguisher Type Insights

The dry chemical powder segment led the industry in 2022 and accounted for the largest share of more than 37.15% of the global revenue. The growth of the dry chemical powder fire extinguisher is driven by the rising awareness among end-users about the benefits of the product. Its ability to handle different kinds of fires and easy storage without the need for pressurized equipment has resulted in its rising popularity. A gas fire extinguisher system consists of pressurized CO2 gas in a sealed container. The released CO2 suffocates the fire by restricting oxygen contact. The use of CO2 does not leave any residues as well as it does not cause any damage to electrical devices or equipment. Most of the time CO2 fire extinguishers are used to contain the fire involving burning liquids and electrical fires.

This type of extinguisher is most useful in commercial office buildings, industrial places, or data storage facilities. The water segment is expected to grow at a steady CAGR over the forecast period. The technological developments in water extinguishers are expected to facilitate segment growth over the forecast period. One such system is the water mist system, which optimizes water usage and distributes water in mist form. Other segments of fire extinguishers consist of wet chemical and foam extinguishers. Foam fire extinguisher works by covering the flame with a thick layer of foam that disconnects the supply of oxygen for burning and extinguishes the fire. Commonly used chemicals in the foam fire extinguisher include sodium bicarbonate, potassium bicarbonate, monoammonium phosphate, and potassium chloride.

Application Insights

The industrial segment led the market and accounted for 49.10% of the global revenue share in 2022. The industrial segment consists of fire suppression systems used in manufacturing facilities, warehouses & storage buildings, data hosting centers, etc. The expansion of industrial facilities and the continuous updates in fire safety regulations across the world are expected to contribute significantly to the global demand for fire suppression systems. For instance, the Government of the U.S. introduced America Creating Opportunities for Manufacturing, PreEminence in Technology, and Economic Strength (COMPETES) Act in February 2022, which focuses on funding domestic small- and medium-sized manufacturing companies and revitalizing the manufacturing industry in the country.

The residential segment is expected to expand at a steady CAGR during the forecast period. The rising awareness related to fire safety protocols meant for residential applications among end-users across the world is expected to fuel the demand for fire suppression systems that are installed in residential buildings. The growing importance of fire safety protocols and regulatory compliances in commercial premises is anticipated to augment the growth of the commercial segment. For instance, in March 2019, various construction bodies, such as the Chartered Institute of Building (CIOB), the Royal Institute of British Architects (RIBA), and the Royal Institute of Chartered Surveyors (RICS), urged the Government of the U.K. to make the installation of sprinklers mandatory in hotels, hospitals, care homes, and school buildings.

Regional Insights

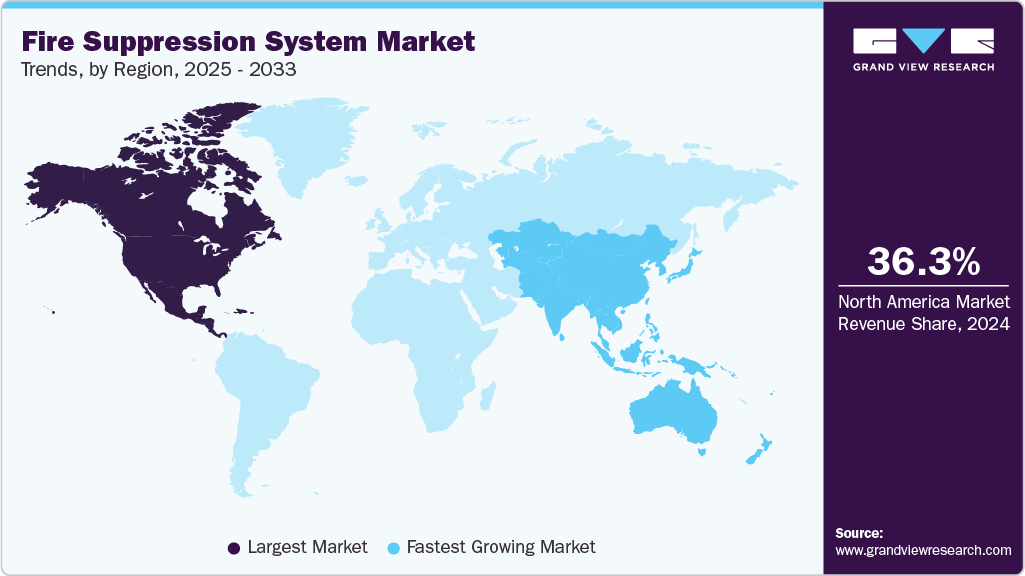

North America led the industry and accounted for 36.9% of the global revenue in 2022. Increasing production activities in offshore areas and exploration are anticipated to fuel the regional market over the forecast period. Furthermore, recent oil & gas projects in the region are expected to positively influence the market in the coming years. The European economy is projected to expand steadily on account of supportive initiatives, such as the European Green Deal and Horizon 2020 program by the government, growth in wages, and continuous job creation. Public spending, especially on digital infrastructure and transportation infrastructure, is estimated to have a positive influence on the overall economic development of the region. Private investments, especially in the construction sector, are also likely to drive economic growth.

Asia Pacific is estimated to witness the fastest CAGR from 2023 to 2030. The growth can be attributed to the rising awareness about fire safety among end-users and the increasing construction activities in developing economies, such as India and China. Furthermore, the growing demand for intelligent home automation systems and smart buildings, which deliver optimum security and safety, is likely to boost the product adoption. The increasing focus of the government of the Middle Eastern economies on reducing their reliance on the energy sector and growing initiatives to boost domestic production output in the petrochemicals, chemicals, and other industrial sectors are expected to augment product usage.

Key Companies & Market Share Insights

The global industry comprises both global as well as regional players. Manufacturers are undertaking various strategies, such as product development, partnerships, and M&A, to gain a higher industry share. For instance, in December 2022, Fike Corp. unveiled Fike Small Space Suppression. This innovative technique uses a flexible pneumatic tube that is strategically placed inside small applications to locate and put out fires using 3MTM NovecTM 1230 Fire Protection Fluid. Some of the prominent players in the global fire suppression system market include:

-

Gentex Corp.

-

Halma PLC

-

Hochiki America Corp.

-

Honeywell International Inc.

-

Robert Bosch GmbH

-

Siemens AG

-

Minimax USA LLC

-

Fike Corp.

Fire Suppression System Market Report Scope

Report Attribute

Details

Market size value in 2023

USD 21.11 billion

Revenue forecast in 2030

USD 29.54 billion

Growth rate

CAGR of 4.8% from 2023 to 2030

Base year for estimation

2022

Historical data

2018 - 2021

Forecast period

2023 - 2030

Quantitative units

Revenue in USD billion and CAGR from 2023 to 2030

Report coverage

Revenue forecast, company market position analysis, competitive landscape, growth factors, and trends

Segments covered

Product, fire extinguisher type, application, region

Regional scope

North America; Europe; Asia Pacific; Central & South America; Middle East & Africa

Country Scope

U.S.; Canada; Mexico; Germany; U.K.; France; Spain; Italy; China; India; Japan; South Korea; Australia; Brazil; Argentina; Saudi Arabia; South Africa

Key companies profiled

Fike Corp.; Minimax USA LLC; Gentex Corp.; Halma Plc; HOCHIKI America Corp.; Honeywell International Inc.; Johnson Controls; Robert Bosch GmbH; Siemens AG; Raytheon Technologies Corp.

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Fire Suppression System Market Segmentation

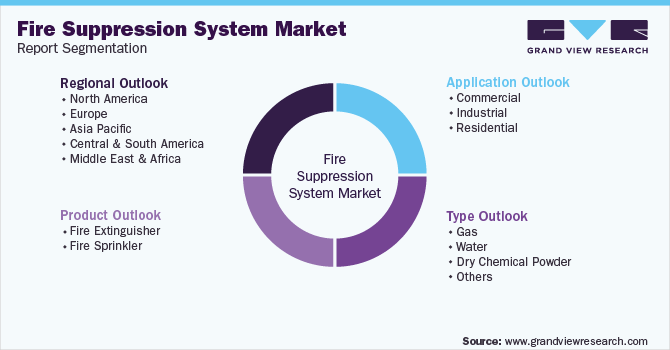

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global fire suppression system market report based on product, fire extinguisher type, application, and region:

-

Product Outlook (Revenue, USD Billion, 2018 - 2030)

-

Fire Extinguisher

-

Fire Sprinkler

-

-

Fire Extinguisher Type Outlook (Revenue, USD Billion, 2018 - 2030)

-

Gas

-

Water

-

Dry Chemical Powder

-

Others

-

-

Application Outlook (Revenue, USD Billion, 2018 - 2030)

-

Commercial

-

Industrial

-

Residential

-

-

Regional Outlook (Revenue, USD Billion, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

U.K.

-

France

-

Spain

-

Italy

-

-

Asia Pacific

-

China

-

Japan

-

India

-

South Korea

-

Australia

-

-

Central & South America

-

Brazil

-

Argentina

-

-

Middle East & Africa

-

Saudi Arabia

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global fire suppression system market size was estimated at USD 20.27 billion in 2022 and is expected to reach USD 21.11 billion in 2023.

b. The global fire suppression system market is expected to grow at a compound annual growth rate of 4.8% from 2023 to 2030 to reach USD 29.54 billion by 2030.

b. North America dominated the fire suppression system market with a share of 33.6% in 2022. Increasing production activities in offshore areas and exploration are expected to fuel the fire suppression system market over the forecast period. Furthermore, recent oil & gas projects in the region are expected to positively influence the market in the coming years.

b. Some of the key players operating in the fire suppression system market include Fike Corporation, Minimax USA LLC, Gentex Corporation, Halma Plc, HOCHIKI America Corporation, Honeywell International Inc., Johnson Controls, Robert Bosch GmbH, Siemens AG, Raytheon Technologies Corporation

b. The key factors that is driving the fire suppression system market includes the growing importance of fire safety compliance in high-rise buildings, industrial spaces, and commercial sectors

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![ESOMAR Certified Member]()

![Great Place to Work Certified]()

ESOMAR & Great Work to Place Certified

![ISO 9001:2015 & 27001:2022 Certified]()

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."

Important: Covid19 pandemic market impact

The global construction industry, once thriving with increased investments, has been severely affected by the suspension of the construction activities in the wake of the pandemic. Shortage of labors coupled with potential supply chain bottlenecks of materials and equipment caused project delays in the ongoing funded projects and may lead to reduced spending in the upcoming projects. On similar lines, the HVAC industry has been adversely affected by the COVID-19 outbreak due to the shutting down of several component manufacturing facilities across China, European countries, Japan, and the U.S. This has consequently led to a significant slowdown in the production of HVAC equipment. The report will account for COVID-19 as a key market contributor.