- Home

- »

- Advanced Interior Materials

- »

-

Filters Market Size, Share & Trends Analysis Report, 2030GVR Report cover

![Filters Market Size, Share & Trends Report]()

Filters Market Size, Share & Trends Analysis Report By Product (ICE, Air, Fluid Filters), By Application (Motor Vehicles, Consumer Goods, Industrial & Manufacturing, Utilities), By Region, And Segment Forecasts, 2022 - 2030

- Report ID: 978-1-68038-195-5

- Number of Pages: 124

- Format: Electronic (PDF)

- Historical Range: 2017 - 2020

- Industry: Advanced Materials

Report Overview

The global filters market size was estimated at USD 72.33 billion in 2021 and is expected to grow at a compound annual growth rate (CAGR) of 5.1% from 2022 to 2030. Growing emphasis on the reduction of emissions from automotive and industrial applications is expected to drive market growth over the forecast period. An increase in product usage in several consumer goods, such as air and water purifiers, is expected to have a positive impact on the industry growth. The rapidly growing adoption of air purifiers in homes, hotels, restaurants, airplanes, and train compartments for killing harmful microbes, such as bacteria and viruses, is expected to open new opportunities for market growth.

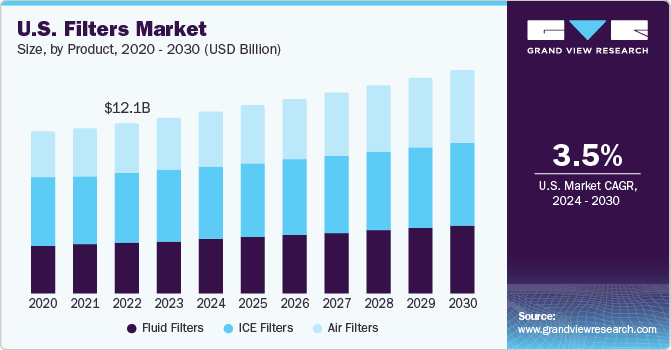

The market in the U.S. is expected to exhibit high growth on account of factors rising product demand from the automotive industries as per the environmental regulations laid down by the Environmental Protection Agency (EPA) for the installation of air emission control solutions in vehicles. In addition, economic revival and government initiatives to promote environmental protection are expected to drive market growth in the country. The global market growth is also credited to the increasing focus of the government on water treatment schemes for the construction of water treatment facilities due to factors, such as the scarcity of quality drinking water, growing population, and contamination of ground and surface water bodies.

The industry is significantly affected by the availability of raw materials, such as paper, cotton, synthetic textiles & fibers, metals like iron & steel, adhesives, rubber, chemicals, and plastics. Thus, the fluctuations in the raw material prices have a direct impact on the manufacturing costs that limits the industry growth to some extent. The market growth is also expected to be driven by the rise in the global automotive industry on account of the growing population and increasing disposable income levels, especially in the developing regions, such as Asia Pacific, Middle East & Africa, and Central & South America. Filters are used in several applications in the automotive industry, such as oil intake, cabin air filtration, and emission filtration.

Product Insights

The ICE filters product segment led the market in 2021 and accounted for the maximum revenue share of more than 42%. This high share was credited to the rapid growth in the automobile industry as ICE filters are widely used in automobiles to improve fuel efficiency. The implementation of environmental regulations, such as the Kyoto Protocol, Euro 5, and Euro 6 to control the release of harmful emissions, is expected to drive the segment further. The usage of ICE filters is expected to rise over the coming years owing to the high adoption of a start-stop system for automatic shutdown & restart of the internal combustion engines, to reduce the emissions & fuel consumption and idling time of engines. The advancements in the automotive industry, such as electric and hybrid vehicles, will also drive the segment growth.

The market growth for fluid filters is expected to be driven by the rising investments by governments in the construction of water treatment plants to provide safe water for various residential, commercial, and industrial applications. In addition, wide usage of fluid filters in a variety of other applications, such as cold sterilization of beverages & pharmaceuticals, petroleum refining, and dairy processing, is expected to support the segment growth. The air filters product segment is expected to witness the fastest CAGR from 2022 to 2030 owing to the rising focus of governments on the reduction of pollutants from vehicle emissions. In addition, the rising adoption of air purifiers in recent times is expected to fuel the demand for using cabin air filters that help in removing pollen & allergens from the air in homes, offices, aircraft, and train compartments.

Application Insights

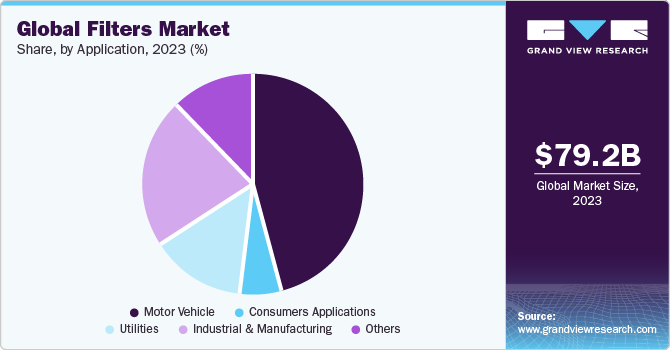

The motor vehicles segment led the market in 2021 and accounted for more than 45% of the global revenue share. The increasing automotive production, primarily in countries, such as China, Indonesia, South Korea, Japan, Malaysia, and Taiwan, supports the segment growth. In addition, stringent regulations for the reduction of automotive pollution levels by agencies, such as the U.S. EPA and the Department of Energy, are expected to increase the usage of filters, thus driving the product demand in motor vehicles applications. The usage of filtration equipment in several consumer goods, such as water filters, air purifiers, and air conditioners, is expected to drive the growth of the market over the coming years.

The manufacturing of portable air purifiers by several companies, such as Dyson and Philips, is expected to drive the consumer goods segment. The demand for filters in the industrial & manufacturing segment is expected to be driven by the well-established industrial setup in Europe and North America coupled with stringent regulations in these regions regarding emission from these facilities. Moreover, rapid industrialization in developing countries, such as India, South Africa, Brazil, Thailand, and Indonesia, is expected to drive the market. Other major application industries include pharmaceutical manufacturing and wine production. Microfiltration equipment is widely used in wine industries for the removal of contaminants, such as bacteria, particulates, crystals, and yeasts, to improve the quality of wine and provide stabilization.

Regional Insights

Asia Pacific dominated the market in 2021 and accounted for over 42% share of the global revenue in 2020 owing to the rapid industrialization coupled with stringent regulations by local governments to maintain the environmental quality. Increasing atmospheric pollution levels and growing environmental concerns are anticipated to promote the usage of air filtration and water filtration processes, thereby propelling market growth. The product demand in Europe is driven by the rising adoption of air filtration equipment in several industries, such as cement, chemicals, and metallurgy, to lower their emission levels, as per the directives laid down by several agencies, such as the International Plant Protection Convention (IPPC) by the European Commission.

A rise in the adoption of air purifiers in several countries, such as Germany, France, Italy, and Spain, will also drive the regional market. North America is expected to grow at a steady CAGR from 2022 to 2030 due to the high automobile production levels as a result of the presence of major manufacturers, such as Ford, General Motors, and BMW. In addition, technological advancements, such as the implementation of nanotechnology in the filtration process are anticipated to boost the product demand in the region. The demand for filters in Central & South America is likely to witness significant growth over the projected period.

This is owing to the rising construction activities of several wastewater treatment facilities in the region on account of growing water pollution levels in countries, such as Brazil, Argentina, and Uruguay. In addition, the usage of filters in the growing mining industry in Brazil for the reduction of emission levels is expected to drive the regional market.

Key Companies & Market Share Insights

The companies are involved in the development of new sustainable products and solutions offering improved efficiency and better value to the customers. The companies are also trying to increase their sales through acquisitions, investments, and innovation. They are expanding their production capacities to facilitate the respective markets. The market is competitive due to the presence of several major companies and is characterized by the presence of a significant consumer base across the globe with the companies operating their businesses through dedicated distribution networks. Some prominent players in the global filters market include:

-

3M

-

Airex Filter Corp.

-

Koch Filter

-

Freudenberg Filtration Technologies SE & Co. KG

-

Donaldson Company, Inc.

-

Camfil AB

-

Parker Hannifin Corp.

-

DENSO Corp.

-

Clark Air Systems

-

Spectrum Filtration Pvt. Ltd.

Recent Developments

-

In May 2023, 3M announced the expansion of its facilities in Europe for supporting its biotech manufacturing capabilities. The investment would allow for greater focus on speeding up the company’s development and delivery of critical filtration equipment, required in areas including bioprocessing and small molecule pharmaceutical manufacturing. The company has its own ‘Zeta Plus’ depth filtration technology for clarifying cell-derived protein therapeutic products

-

In May 2023, 3M collaborated with Svante Technologies for the development of a material to trap and permanently remove carbon dioxide in the atmosphere. 3M’s venture capital division had participated in the Series E fundraising round of Svante earlier to accelerate its carbon capture and removal technology manufacturing. Svante has developed a process to coat solid sorbents onto laminate sheets and stacking into high-performance filters for both direct air capture and industrial point-source capture

-

In March 2023, Donaldson Company released the Alpha-Web filtration media, a hydraulic filtration technology for significantly improving hydraulic fluid cleanliness to extend the life and decrease downtime of hydraulic components. The filtration technology uses a unique fine-fiber layer to trap and lock particles during frequent flow-rate changes, thus bringing a substantial improvement in the protection of hydraulic equipment

-

In February 2023, Camfil launched its CamPure 8 media in the U.S. for the efficient removal of gaseous contaminants and odors, including sulfur dioxide, hydrogen sulfide, formaldehyde, and ethylene. The molecular filtration media can be utilized extensively in industries such as pulp & paper, oil & gas, wastewater treatment, and mining & metal refining, while also preserving fruits, flowers, and vegetables by removing odors and contaminants

-

In January 2023, Donaldson Company launched a connected solution for industrial filtration customers, called ‘Managed Filtration Services’, which leverages the company’s proprietary ‘iCue’ connected technology to offer condition-based repair and maintenance services for proper operation of industrial filtration equipment. The iCue Connected Filtration Service was launched by the company in 2019 to provide dust collector insights to customers through a web-based dashboard

-

In April 2022, Parker Hannifin’s Industrial Gas Filtration and Generation Division launched a pleated baghouse filter, called the ‘BHA® Wicked™ High Temp Pleated Filters’, which collects dust in extreme heat applications. The product has been stated to function efficiently at 500°F (260°C) and avoids the requirement of cages, thus saving money and time in filter installation and removal costs

-

In February 2022, Camfil announced its investment in Malaysia for the purpose of a new plant expansion in Ipoh. The plant was made operational in 2022 and has the capacity to address the rising demand for air filter services and products in the region. The expansion includes an innovative R&D facility along with advanced HEPA filter, turbomachinery, and molecular filter manufacturing

-

In December 2021, Freudenberg announced that its Filtration Technologies business unit had completed the acquisition of RPS Products, a filter manufacturer and seller for commercial and residential buildings. This came after the company had acquired Protect Plus Air Holding, Inc. in September 2021, thus ensuring significant expansion of the company’s business in North America

Filters Market Report Scope

Report Attribute

Details

Market size value in 2022

USD 75.5 billion

Revenue forecast in 2030

USD 112.87 billion

Growth rate

CAGR of 5.1% from 2021 to 2028

Base year for estimation

2021

Historical data

2017 - 2020

Forecast period

2022 - 2030

Quantitative units

Revenue in USD million/billion and CAGR from 2021 to 2028

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, application, region

Regional scope

North America; Europe; Asia Pacific; Central & South America; Middle East & Africa

Country scope

U.S.; Canada; Mexico; Germany; U.K.; France; Italy; Spain; Russia; China; India; Japan; Australia; Thailand; Malaysia; Brazil; South Africa

Key companies profiled

3M; Airex Filter Corp.; Koch Filter; Freudenberg Filtration Technologies SE & Co. KG; Donaldson Company, Inc.; Camfil AB; Parker Hannifin Corp.; DENSO Corp.; Clark Air Systems; Spectrum Filtration Pvt. Ltd.

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Segments Covered in the Report

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2017 to 2028. For the purpose of this study, Grand View Research has segmented the global filters market report on the basis of product, application, and region:

-

Product Outlook (Revenue, USD Million, 2017 - 2030)

-

Fluid Filters

-

ICE Filters

-

Air Filters

-

-

Application Outlook (USD Million, 2017 - 2030)

-

Motor Vehicle

-

Consumers Goods

-

Utilities

-

Industrial & Manufacturing

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2017 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

U.K.

-

France

-

Italy

-

Spain

-

Russia

-

-

Asia Pacific

-

China

-

India

-

Japan

-

Australia

-

Thailand

-

Malaysia

-

-

Central & South America

-

Brazil

-

-

Middle East & Africa

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global filters market size was estimated at USD 72.33 billion in 2021 and is expected to reach USD 75.5 billion in 2022.

b. The filters market is expected to grow at a compound annual growth rate of 5.1% from 2022 to 2030 to reach USD 112.87 billion by 2030.

b. ICE filters led the filters market and accounted for more than 41% share of the global revenue in 2021, owing to growth in the automobile industry, primarily in Asia Pacific, Europe, and North America regions.

b. Some of the key players operating in the filters market include 3M, Airex Filter Corporation, Koch Filter, Freudenberg Filtration Technologies SE & Co. KG, Donaldson Company, Inc., Camfil AB, and Parker Hannifin Corporation.

b. The key factors that are driving the filters market include growing product demand in the automobile industry for the reduction of fuel consumption and emission levels, growing demand for fluid filters in water treatment plants, and growth in the global air filtration industry.

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![ESOMAR Certified Member]()

![Great Place to Work Certified]()

ESOMAR & Great Work to Place Certified

![ISO 9001:2015 & 27001:2022 Certified]()

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."

Important: Covid19 pandemic market impact

The mining industry accounts for a vital share of the global economy and is responsible for supplying key raw materials for several applications and end-use industries, thus being a key sector of focus amidst the ongoing pandemic outbreak. Mining industries in China are expected to return to normal operations by Q3 of 2020 as enterprises indicated towards the returning of their workers soon. Moreover, Iron ore producers are known to be the least impacted. Major players such as BHP and Vale reported experiencing no major influence on their operations due to the COVID-19 virus. The iron ore prices reached above USD 90 per ton amidst the pandemic situation which may negatively impact the end-use industries. The report will account for Covid19 as a key market contributor.