- Home

- »

- Catalysts & Enzymes

- »

-

Europe Homogeneous Precious Metal Catalyst Market Report, 2028GVR Report cover

![Europe Homogeneous Precious Metal Catalyst Market Size, Share & Trends Report]()

Europe Homogeneous Precious Metal Catalyst Market Size, Share & Trends Analysis Report By Product (Palladium, Ruthenium), By End-use (Refineries, Pharmaceutical & Biomedical), And Segment Forecasts, 2021 - 2028

- Report ID: GVR-4-68039-296-6

- Number of Pages: 114

- Format: Electronic (PDF)

- Historical Range: 2017 - 2019

- Industry: Specialty & Chemicals

Report Overview

The Europe homogeneous precious metal catalyst market size to be valued at USD 2.4 billion by 2028 and is expected to grow at a compound annual growth rate (CAGR) of 18.9% during the forecast period. Increasing preference for homogeneous catalysts over heterogeneous ones owing to their specific features, especially associated with selectivity, augment the market growth. The market is also expected to witness a significant hike in demand amid the Covid-19 pandemic as PGM catalysts are utilized in the formulation of several APIs, such as a few antibiotics used for Covid-19 treatment. Homogeneous precious metal catalysts, the directed synthesis of a composite organic intermediate, can be completed catalytically to deliver a product that could not be obtained by other means.

A homogeneous catalytic way can enhance the product superiority as well as the complete economics of a present process. Several proven homogeneous catalysts are appropriate for laboratory preparations. Market players are involved in continuous innovation to increase the user base and target greater market growth in the future.

The research and development have been evident through the investments and efforts to come up with new ‘greener’ and cost-effective catalyst technologies to complement or replace the existing, costlier catalytic processes.

For example, American Elements came up with a new catalytic process involving rhodium of alumina spheres to replace the costlier pure rhodium/iridium catalysts. Such measures are taken by the market players to increase their revenue share by attracting new end-users and enhance the rapport with the existing customers through better technological solutions.

Europe Homogeneous Precious Metal Catalyst Market Trends

The market is anticipated to be driven by the increased benefits it has gained from high-value product groups. Catalysts, for example, are used in automobiles to reduce carbon pollution, which is hazardous to the environment. As a result, governments are encouraging their use. Furthermore, rising energy demand in nations such as Belgium France, Hungary, Slovakia, and Sweden are expected to propel the market.

The existence of substantial oil reserves in nations such as Russia, Norway, the United Kingdom, and Italy is projected to augment the region's growth even more. Key players in the region are focused on innovation to develop enhanced products that function better during the procedure. Such elements have aided the region's expansion.

Market participants in the region are aiming at innovation in order to develop enhanced products that function better during the procedure. Such elements have aided the region's expansion. However, the COVID-19 pandemic has hampered overall growth in several major economies, including Germany and Italy.

Refiners are compelled to curtail production immediately, perhaps resulting in high costs after the crisis calms. Moreover, certain refiners are predicted to lose market share to competitors, posing a short-term threat to total product demand.

Product Insights

The palladium product segment led the overall market in 2020 and accounted for the largest revenue share of over 50%. The segment is estimated to retain its dominant position throughout the forecast period owing to extensive product usage in applications requiring hydroesterification reactions. A key example of its application includes Lucite International, which uses the catalyst for MMA production from ethylene, carbon monoxide, and methanol. The demand for palladium witnessed robust growth in Europe as a result of a rise in loadings of gasoline cars. Strict vehicle testing and emission control regulations are the prime growth drivers of the palladium metal in catalysts. However, a temporal decline in demand is expected to be witnessed during the pandemic.

The platinum-based product segment is estimated to witness significant growth in the coming years as these products have rising demand in hydrosilylation reaction applications due to their highly reactive nature. However, uncertainties in price and the Covid-19 impact on the supply chain and demand are likely to hinder the growth of this segment. The rhodium-based products are used in reactions that require to be carried out at lower temperatures and pressures, such as hydroformylation. The demand for these catalysts is expected to increase in the market on account of their increasing use in the automotive sector.

End-use Insights

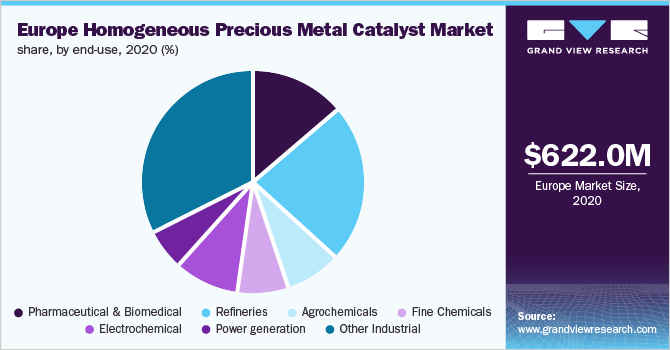

The refinery end-use segment led the overall market in 2020 and accounted for a revenue share of more than 20%. The segment is expected to grow further at a steady CAGR of over 18% from 2021 to 2028 as precious metal catalysts help in optimized and economic oil production. The presence of several mainstream refineries in Europe project significant potential for market growth over the forecast period. However, the sudden outbreak of the Covid-19 has adversely affected the refinery sector owing to lockdowns imposed in the region, which, in turn, affected the oil consumption by the transportation sector. On the other hand, the product demand is expected to increase once this situation subsides.

The others end-use segment includes the paper and construction sectors. In the paper end-use segment, these catalysts are used in the coating process of packaging. In the construction segment, they are used in transparent roofing, sanitary field shower walls, and noise protection walls. In addition, the catalysts can be used in applications involving hydrosilation, telomerization, hydroesterification, hydroformylation, hydrogenation, hydroformylation, and metathesis reactions.

Country Insights

The overall market is anticipated to witness significant growth over the forecast period on account of increasing energy demand from economies, such as France, Slovakia, Hungary, Belgium, Sweden, and Bulgaria. In addition, the presence of adequate oil reserves in countries including Russia, Norway, the U.K., and Italy, is expected to complement the market growth. Major market participants are shifting their focus toward increasing capacities to cater to the growing demand across the region.

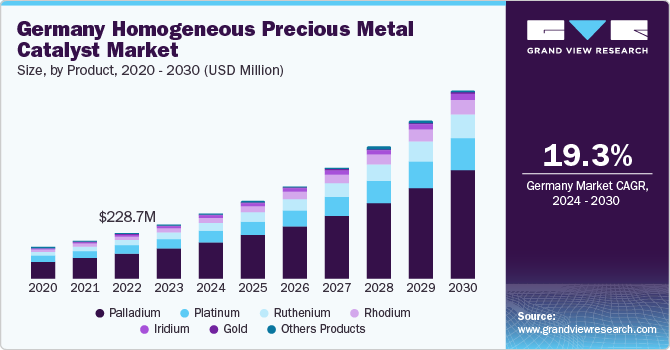

Companies are also focusing on innovation for the development of advanced products to exhibit better performance during the process. Such factors will also boost the market growth in the region. The global pandemic has severely affected many key economies in the region, which restricted all forms of movement, resulting in declined oil consumption in the transportation sector. In 2020, Germany emerged as the largest market with a share of over 23% and will maintain its dominance over the forecast period.

The growth in this country can be attributed to a strong presence of key end-use industries, such as pharmaceuticals, chemicals, and power generation. The growing investments for the establishment of new refineries as well as for the expansion of existing refineries, despite the lack of natural resources, are further expected to fuel the market growth in the country.

Key Companies & Market Share Insights

The market is highly concentrated with the presence of major producers of various grades of the product catering to a wide array of end-use industries. The innovation in the market also gets driven by customized demands by the end-users, which invest directly with the catalyst formulator companies like BASF SE and Clariant Inc. to come up with customized products to suit their specific needs. Demonstration of technical capability by the key players can further expand their product portfolio and help them secure a better market position. Companies are also focusing on mergers and acquisitions to increase their customer base and acquire new markets.

Recent Developments

-

In June 2022, BASF announced the construction of a large-scale battery recycling black matter facility in Schwarzheide, Germany. Indicating the prevalence of several EV car manufacturers and cell makers in Central Europe, the site is a perfect location for the expansion of battery recycling activities. This investment will result in the creation of around 30 new production positions, with a start date of early 2024

-

In June 2022, Evonik invests $220 million in a new triglyceride manufacturing plant for mRNA-based medicines in the United States, in collaboration with the US government. The new factory will position the company for future expansion in revolutionary mRNA-based therapeutics beyond COVID-19 vaccines, reinforcing its reputation as a leading strategic ally for creative pharmaceutical firms throughout the world

-

In May 2022, Argor-Heraeus announced its complete acquisition of Erbas, a renowned Ticino-based watchmaker and jewelry manufacturer. The mutual decision broadens the scope of Argor-Heraeus' service offerings. The agreement constitutes a substantial step forward in terms of end-product tracking, which is critical in a supply chain simplification sector

Some of the key companies in the Europe homogeneous precious metal catalyst market are:

-

Alfa Aesar

-

Heraeus Holding

-

BASF SE

-

Evonik Industries AG

-

Johnson Matthey

-

Clariant AG

-

Haldor Topsoe

-

Umicore

-

American Elements

-

Chimet S.p.A.

-

Shaanxi Kai Da Chemical Engineering Co., Ltd.

-

Sabin Metal Corporation

Europe Homogeneous Precious Metal Catalyst Market Report Scope

Report Attribute

Details

Market size value in 2021

USD 760 Million

Revenue forecast in 2028

USD 2,486.4 Million

Growth rate

CAGR of 18.9% from 2021 to 2028

Base year for estimation

2020

Historical data

2017 - 2019

Forecast period

2021 - 2028

Quantitative units

Volume in tons, revenue in USD million/billion, and CAGR from 2021 to 2028

Report coverage

Revenue forecast, volume forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, end-use, country

Country scope

Germany; U.K.; France; Italy; Spain; Russia; Poland

Key companies profiled

Alfa Aesar; Heraeus Holding; BASF SE; Evonik Industries AG; Johnson Matthey; Clariant AG; Haldor Topsoe; Umicore; American Elements; Chimet S.p.A.; Shaanxi Kai Da Chemical Engineering Co., Ltd.; Sabin Metal Corp.

Customization scope

Free report customization (equivalent to up to 8 analyst working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

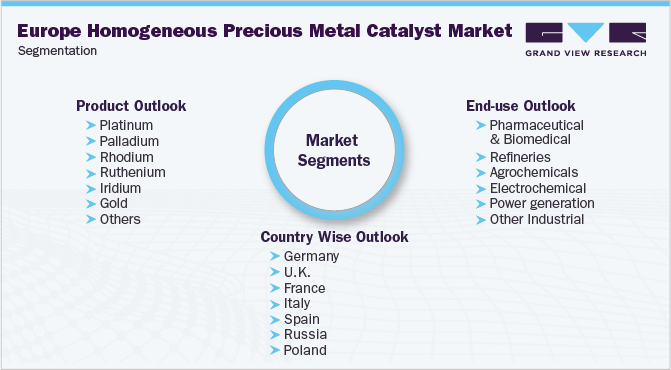

Europe Homogeneous Precious Metal Catalyst Market SegmentationThis report forecasts revenue growth at regional and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2017 to 2028. For the purpose of this report, Grand View Research has segmented the Europe homogeneous precious metal catalyst market report on the basis of product, end-use, and country:

-

Product Outlook (Volume, Tons; Revenue, USD Million, 2017 - 2028)

-

Platinum

-

Palladium

-

Rhodium

-

Ruthenium

-

Iridium

-

Gold

-

Others

-

-

End-use Outlook (Volume, Tons; Revenue, USD Million, 2017 - 2028)

-

Pharmaceutical & Biomedical

-

Refineries

-

Agrochemicals

-

Electrochemical

-

Power generation

-

Other Industrial

-

-

Country Wise Outlook (Volume, Tons; Revenue, USD Million, 2017 - 2028)

-

Germany

-

U.K.

-

France

-

Italy

-

Spain

-

Russia

-

Poland

-

Frequently Asked Questions About This Report

b. Europe's homogeneous precious metal catalyst market size was estimated at USD 622.0 million in 2020 and is expected to reach USD 760 million in 2021.

b. Europe's homogeneous precious metal catalyst market is expected to grow at a compound annual growth rate of 18.9% from 2021 to 2028 to reach USD 2,486.4 million by 2028.

b. Germany dominated the European homogeneous precious metal catalyst market with a share of 25% in 2019. This is attributable to the strong presence of key end-use industries, such as pharmaceuticals, chemicals, and power generation.

b. Some key players operating in the European homogeneous precious metal catalyst market include Alfa Aesar; Heraeus Holding; BASF SE; Evonik Industries AG; Johnson Matthey; Clariant AG; Haldor Topsoe; Umicore; American Elements; Chimet S.p.A.; Shaanxi Kai Da Chemical Engineering Co., Ltd.; Sabin Metal Corp.

b. Key factors that are driving the market growth include increasing preference for homogeneous catalysts over heterogeneous ones owing to their specific features, especially associated with selectivity, augment the market growth.

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![ESOMAR Certified Member]()

![Great Place to Work Certified]()

ESOMAR & Great Work to Place Certified

![ISO 9001:2015 & 27001:2022 Certified]()

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."