- Home

- »

- Healthcare IT

- »

-

Europe Digital Health Market Size And Share Report, 2030GVR Report cover

![Europe Digital Health Market Size, Share & Trends Report]()

Europe Digital Health Market Size, Share & Trends Analysis Report By Technology (Tele-healthcare, mHealth, Healthcare Analytics, Digital Health Systems), By Component, By Region, And Segment Forecasts, 2023 - 2030

- Report ID: GVR-4-68039-941-1

- Number of Pages: 150

- Format: Electronic (PDF)

- Historical Range: 2016 - 2021

- Industry: Healthcare

Report Overview

The Europe digital health market size was valued at USD 45.3 billion in 2022 and is expected to grow at a compound annual growth rate (CAGR) of 16.0% from 2023 to 2030. The growing challenges such as the increasing prevalence of chronic diseases, rising aging population, and shortage of medical professionals in Europe are anticipated to drive the market growth. Advancement of digital technologies, improved internet connectivity and growing demand for virtual healthcare services also are among the major factors anticipated to accelerate the growth. In addition, the ongoing crisis of the COVID-19 pandemic is acting as a catalyst for the adoption of telehealth services and digital health technologies and in turn, is anticipated to drive the market growth.

Growing smartphone penetration and rising demand for remote patient monitoring is expected to boost the adoption of digital health platforms. For instance, according to Eurostat, in the EU-27 countries, 92% of young people used mobile phones to access the internet and 94% of the young ones have used the internet daily in 2019. The high penetration of the internet and smartphones in Europe has also broadened the scope of using medical, health & fitness apps which in turn supports market growth.

The availability of a large volume of data in the healthcare sector and the growing need for fast and efficient healthcare information technology (HCIT) solutions to efficiently process patient data accessibility are also one of the major factors anticipated to drive the growth of the market over the forecast period.

The rapid increase in the number of patients suffering from several chronic diseases such as cancer, diabetes, Alzheimer's diseases, and cardiovascular diseases requires long-term patient monitoring services. The shortage of medical professionals and growing preference for remote healthcare management of chronic conditions such as telehealth services is further anticipated to propel the market growth. For instance, according to the WHO, each year the number of new cancer cases in Europe is over 3.7 million which is around one-quarter of total cancer cases in the world, whereas the population of Europe is one-eighth of the total world's population.

In addition, telehealth services enhance patient engagement activities and bridge the gap between patients & healthcare providers. This kind of service reduces the hassles of scheduling appointments, eliminates the need for an in-person consultation, and thereby, reduces the care expenses and unnecessary costs which in turn is expected to drive the growth of the Europe digital health market in the forthcoming years.

Moreover, increasing government initiatives to promote digital health solutions and the growing adoption of advanced technology for remote health management are also anticipated to accelerate the market growth in Europe. For instance, in 2020, The European Programme of Work (EPW) was developed by the WHO, called "United Action for Better Health" which sets priorities for the future of healthcare and promotes digital healthcare technologies across Europe to improve the interface between service providers and people.

In addition, increasing preference for advanced software solutions such as Electronic Medical Records (EMRs), telehealth platforms, and remote patient monitoring for long-term care services, which in turn supports the market growth. For instance, according to Pharmaceutical Services Negotiating Committee report, about 26 million people in England have at least one long-term condition and 10 million have 2 or more such conditions.

The ongoing COVID-19 pandemic has made the digital healthcare platform an immediate necessity in Europe. The digital health platform holds the potential to enhance remote communications, surveillance, monitoring, provision of quality healthcare management, and vaccine rollout. The pandemic has created a supportive environment for digital health platforms and made it a necessity. The fear of coronavirus infection, the government-imposed shutdown, and lockdowns in Europe during the COVID-19 pandemic also enhance the adoption of telecommunication platforms and health consultation.

COVID-19 Europe digital health market impact: an increase of 18.9% market growth between 2020 and 2021

Pandemic Impact

Post COVID Outlook

The European digital health market grew at a CAGR of 18.9% from 2020 to 2021.

The market is estimated to witness a year-on-year growth of ranged from 21.0% to 30.3% in the next 5 years

The COVID-19 pandemic has created a supportive environment for digital platforms and made it a necessity for healthcare management. The widespread infection rate of COVID-19 imposed lockdowns and travel restrictions which in turn supported the adoption of online platforms for disease management.

The surge in demand for remote patient monitoring, teleconsultation, mHealth applications, electronic medical records, virtual fitness platforms, healthcare analytics, and remote medication management to tackle the crumbling healthcare systems is also anticipated to boost the market over the coming years.

Increasing government initiatives to develop mobile health applications and promote online platforms to manage the pandemic also drive the market growth during COVID-19

Furthermore, technological advancements in cybersecurity protocols and improvements in mHealth, telemedicine, telehealth, and telecare platforms by the manufacturers are also expected to boost the market growth during the post-COVID years.

The technological advancement of cybersecurity protocols and digital health platforms such as mHealth, telemedicine, telehealth, telecare, advanced diagnostics, and digital integration of health systems have also boosted the market growth during the COVID-19 pandemic. In addition, several government initiatives on virtual healthcare services are also supporting the market growth over the forecast years. For instance, in March 2020, Welsh Government implemented TEC (Technology Enabled Care) Cymru online platform for video consulting services to support the COVID-19 response in Wales.

Technology Insights

The mHealth segment held the highest revenue share of 33.6% in 2022, attributable to the increase in the number of mHealth apps for medical, health, and wellness applications and the growing number of smartphone users. In addition, high adoption of mobile healthcare applications and constant mobile app improvements with better functionality by the manufacturers also drive the growth. Increasing adoption of mobile healthcare applications for disease management, remote patient monitoring, medication management, patient tracking, women's health, fitness and wellness, and personal health record management among others is also expected to drive the segment growth.

The healthcare analytics segment is anticipated to register the fastest CAGR during the forecast period. The growing benefit of telehealthcare technology especially in non-emergency and where direct or face-to-face interaction of patient and provider interactions are not required also anticipated to drive the segment growth. Increasing preference for telehealthcare services among the medical professionals and patients to improve access to care in remote locations and reduce the risk of direct transmission of infectious pathogens are also anticipated to support the growth.

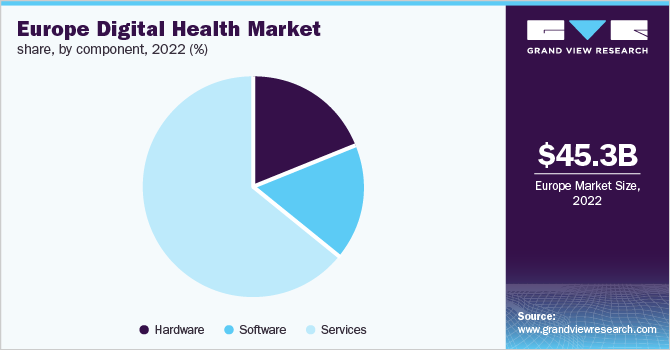

Component Insights

The services segment accounted for the highest revenue share of 63.5% in 2022, owing to the growing demand for maintenance, training, staffing, resource allocation & optimization services of telehealthcare components. The market players are increasingly focusing on providing these kinds of services to hold their strong position in the market, which in turn is anticipated to drive the segment growth. The advancement of electronic health platforms and increasing expectations by the consumers for better services are also expected to boost the market share of the segment. The wide array of pre-installation and post-installation services offered by the key players are also anticipated to accelerate the segment growth.

The software segment is anticipated to register the fastest CAGR over the forthcoming years. This growth is attributable to the rapid adoption of software or applications among healthcare institutions, patients, providers, and insurance payers. A growing number of software for health management is also anticipated to drive the segment growth. The growing trend of healthcare digitalization due to the pandemic is also anticipated to fuel the segment growth. Improved healthcare IT infrastructure, and increased smartphone, and internet users in Europe are also expected to support the high growth of the segment.

Regional Insights

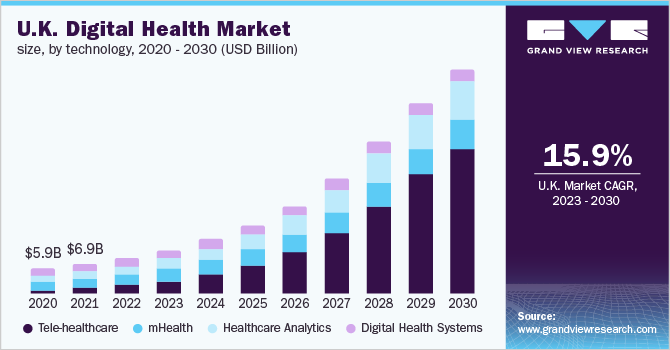

Countries, such as the U.K, Germany, Spain, France, Italy, and Russia accounted for 77.2% of the market share in 2022. However, the Germany held the largest revenue share of 17.5% in 2022, owing to the growing penetration of the internet and smartphone and an increasing number of consumers using remote digital health services. In addition, the growing geriatric population, changing lifestyles, increasing number of chronic disease cases, and growing adoption of remote health care services are among the major factors driving the adoption of digital health solutions in the U.K.

Spain is expected to be the fastest-growing country over the forecast period. The increase in the number of digital health startups in Italy and the strong government initiatives to promote remote health care services are some of the major factors driving the regional market growth. Increasing collaboration by the manufacturers with the government for investments in the development of patient engagement solutions, remote monitoring solutions, and medical video conferencing platforms to connect patients with providers to increase access, convenience, and continuity of care also supporting to the high growth of the regional market.

Key Companies & Market Share Insights

Growing demand for digital platforms for better remote healthcare services is driving the key players to focus on technical improved and cost-effective product development. The product innovation strategies and increasing industry consolidation activities such as collaboration & partnership by the key players to expand product portfolio are also anticipated to drive the market growth.

The emergence of startups and growing acquisition activities by the leading market players to increase their service portfolio and market share are also some of the major factors anticipated to drive the market growth. For instance, Zava, a European digital healthcare provider acquired Medlanes, an online medicine platform in December 2020 and Sprechstunde. Online, a video consultation platform in January 2021 to expand its telemedicine service in Germany. Some prominent players in the Europe digital health market include:

-

Cerner Corporation

-

Allscripts

-

Apple, Inc.

-

Telefonica S.A.

-

McKesson Corporation

-

Epic Systems Corporation

-

QSI Management, LLC

-

AT&T

-

Vodafone Group

-

Airstrip Technologies

-

Google, Inc.

-

Samsung Electronics Co. Ltd

-

HiMS

-

Orange

-

Softserve

-

Qualcomm Technologies, Inc.

-

MQure

-

Computer Programs and Systems, Inc.

-

Vocera Communications

-

IBM Corporation

-

Cisco Systems Inc.

Recent Developments

-

In June 2023, Apple announced new health features in iOS 17, watchOS 10, and iPadOS 17 to provide innovative tools, and empower users to take care of their health. The two new mental health and vision health features provide users with data to better understand their health

-

In April 2023, Telefónica Tech and 3M launched a pioneering technological solution with predictive capabilities to optimize the management of the Hospital Emergency Department (HED), and ultimately improve patient satisfaction. This solution helps healthcare professionals in providing areas of improvement for better decision-making

-

In April 2023, Samsung Electronics launched Samsung Health Stack 1.0, a breakthrough project in digital health research to create a healthcare R&D ecosystem. The Samsung Health Stack aids researchers with digital health research to easily build apps, backend servers, and analysis tools on Android and Wear OS operating systems

-

In March 2023, Cleveland Clinic and IBM unveiled the first IBM-managed quantum computer in the United States. The IBM Quantum System One is the world's first quantum computer uniquely designed for healthcare research to accelerate biomedical discoveries for Cleveland Clinic

-

In November 2022, McKesson Canada's Biopharma and Provider Solutions launched McKesson's EvolveHealth Digital Ecosystem to enhance and simplify specialty patient outcomes. EvolveHealth is a digital solution that offers innovative solutions to help create a more accessible personalized care journey

-

In June 2022, Orange and DabaDoc launched a platform dedicated to e-health named "Orange Santé" aimed at both African patients and doctors. This platform offers users with online appointment booking, digitized medical records, and payment for remote consultants and teleconsultants

Europe Digital Health Market Report Scope

Report Attribute

Details

Market size value in 2023

USD 51.7 billion

Revenue forecast in 2030

USD 145.9 billion

Growth Rate

CAGR of 16% from 2023 to 2030

Base year for estimation

2022

Historical data

2016 - 2021

Forecast period

2023 - 2030

Quantitative units

Revenue in USD million, and CAGR from 2023 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Technology, component, region

Regional scope

Europe

Country scope

U.K.; Germany; France; Italy; Spain; Russia

Key companies profiled

Cerner Corporation; Allscripts; Apple Inc; Telefonica S.A.; McKesson Corporation; Epic Systems Corporation; QSI Management, LLC; AT&T; Vodafone Group; Airstrip Technologies; Google, Inc; Samsung Electronics Co. Ltd; HiMS; Orange; Qualcomm Technologies, Inc; Softserve; MQure; Computer Programs and Systems, Inc; Vocera Communications; IBM Corporation; CISCO Systems, Inc

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Segments Covered in the Report

This report forecasts revenue growth at regional and country levels and provides an analysis of the latest industry trends in each of the segments from 2016 to 2030. For this study, Grand View Research, Inc. has segmented the Europe digital health market report based on technology, component, and country:

-

Technology Outlook (Revenue, USD Million, 2016 - 2030)

-

Tele-healthcare

-

Tele-care

-

Activity Monitoring

-

Remote Medication Management

-

-

Telehealth

-

LTC Monitoring

-

Video Consultation

-

-

-

mHealth

-

Wearables

-

BP Monitors

-

Glucose Meters

-

Pulse Oximeters

-

Sleep Apnea Monitors

-

Neurological Monitors

-

Activity Trackers/ Actigraphs

-

-

mHealth Apps

-

Medical Apps

-

Fitness Apps

-

-

Services

-

mHealth Service, By Type

-

Monitoring Services

-

Independent Aging Solutions

-

Chronic Disease Management & Post-Acute Care Services

-

-

Diagnosis Services

-

Healthcare Systems Strengthening Services

-

Others

-

-

mHealth Services, By Participants

-

Mobile Operators

-

Device Vendors

-

Content Players

-

Healthcare Providers

-

-

-

-

Healthcare Analytics

-

Digital Health Systems

-

EHR

-

E-Prescribing Systems

-

-

-

Component Outlook (Revenue, USD Million, 2016 - 2030)

-

Software

-

Hardware

-

Services

-

-

Regional Outlook (Revenue, USD Million, 2016 - 2030)

-

Europe

-

U.K.

-

Germany

-

France

-

Italy

-

Spain

-

Russia

-

-

Frequently Asked Questions About This Report

b. mHealth segment dominated the Europe digital health market with a share of 33.6% in 2022. This is attributable to the increase in the number of mHealth apps for medical, health, and wellness applications and the growing number of smartphone users.

b. Some key players operating in the Europe digital health market include Apple Inc.; AirStrip Technologies; Allscripts; Google Inc.; Orange; Qualcomm Technologies Inc.; Mqure; Samsung Electronics Co. Ltd.; Telefonica S.A.; Vodafone Group; Cerner Corporation; and McKesson Corporation.

b. Key factors that are driving the Europe digital health market growth include the advancement of digital technologies, improved internet connectivity, and growing demand for virtual healthcare services.

b. The Europe digital health market size was estimated at USD 45.3 billion in 2022 and is expected to reach USD 51.7 billion in 2023.

b. The Europe digital health market is expected to grow at a compound annual growth rate of 16.0% from 2023 to 2030 to reach USD 145.9 billion by 2030.

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![ESOMAR Certified Member]()

![Great Place to Work Certified]()

ESOMAR & Great Work to Place Certified

![ISO 9001:2015 & 27001:2022 Certified]()

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."