- Home

- »

- Catalysts & Enzymes

- »

-

Enzymes Market Size, Share, Trends & Growth Report, 2030GVR Report cover

![Enzymes Market Size, Share & Trends Report]()

Enzymes Market Size, Share & Trends Analysis Report By Product (Carbohydrase, Proteases, Polymerases & Nucleases), By Type (Industrial, Specialty), By Source (Plants, Animals), By Region, And Segment Forecasts, 2023 - 2030

- Report ID: 978-1-68038-022-4

- Number of Pages: 140

- Format: Electronic (PDF)

- Historical Range: 2018 - 2021

- Industry: Specialty & Chemicals

Report Overview

The global enzymes market size was valued at USD 12.27 billion in 2022 and is expected to grow at a compound annual growth rate (CAGR) of 6.5% from 2023 to 2030. The rising demand for food & beverage products is attributable to the increasing consumer awareness related to one’s health and is expected to positively impact product demand over the forecast period. Enzymes are extracted from the different parts of animals including calf stomach, microorganisms, and plant materials, among others. with the emergence of advanced technologies, product manufacturers can choose their required host for production such as transgenic plants or microorganisms. The key companies are often using microorganisms as a host including fungi, enzyme-producing yeast, and bacteria at a commercial level.

The key players are now using eco-friendly technologies for different uses such as product modification and enhancement of product properties. The global enzymes market is likely to expand at a significant rate in the coming years. Technological advancements across the industry are considered one of the key driving factors.

The product growth across the world can be attributed to the growing demand for bakery and brewing applications. They are used in the formulation of fruit juices to enhance the quality and yield of fruits. In wine processing, they are used to maintain the clarity, color, and organoleptic attributes of wine. The rising level of urbanization and a global population largely contribute to the overall growth of the food & beverage industry. Thus, positively influencing the industry growth over the forecast period.

The growing demand for poultry and swine feed worldwide plays a key role in the market growth of the overall feed industry. Animal feed helps in improving the health and well-being of swine and poultry animals. The increasing animal feed market at a global level is anticipated to boost the overall industry growth over the forecast period.

Type Insights

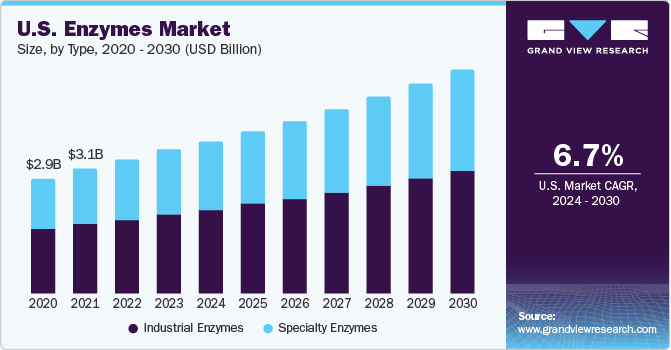

The industrial type dominated the market with a revenue share of over 56.7% in 2022. This is attributed to rising demand in various end-use industries such as food & beverage, detergent, animal feed, textile, paper & pulp, and wastewater among others. the growing use of detergents in industrial and household applications in the emerging economies of Brazil, China, and India are expected to drive the product inclusion in detergents.

They are used in the conversion of cellulosic for manufacturing cellulosic ethanol. The rate of fossil fuel depletion is rising, which is anticipated to boost the demand for biofuels, in turn, fueling the product demand. Moreover, the growing demand for green alternatives coupled with the increasing utilization of paper in the packaging sector owing to numerous environmental issues along with the lightweight and easy use is projected to trigger the demand for the product in the pulp & paper processing sector.

They find applications in research & biotechnology as they are extensively used in numerous end-use industries. Enzymes including anhydrase, catalase, dismutase, elastase, protease, and tyrosinase, are used in biotechnology due to their ability to carry out cells in chemical reactions. Increasing demand for medicinal drugs is further projected to boost industry growth in the coming years.

Product Insights

The carbohydrase segment dominated the market with a revenue share of over 47.5% in 2021. This is attributed to growing demand from various end-use applications including food & beverages, animal feed, and pharmaceuticals among others. Increasing demand for pectinases and amylases and pectinases in the processing of fruit juices for liquefaction, clarification, and maceration to improve the quantity and quality of the product is expected to fuel the product demand over the forecast period.

Protease is widely used for catalytic hydrolysis of protein peptides to amino acids, and breakdown in numerous applications including detergents, animal feed, food, chemicals, and pharmaceutical among others. The escalating growth of pharmaceutical, detergent, and chemical end-use industries in emerging economies such as China, India, and Brazil are expected to further promote market growth over the forecast period.

Lipases are used for digesting, transporting, and processing various dietary lipids including fats, oils, and triglycerides. The growing market demand for phospholipase as a biocatalyst from various end use applications such as agriculture, biodiesel, bioremediation, cosmetics, detergents, food, leather, nutraceuticals, and oil among others is anticipated to drive the overall industry growth.

Source Insights

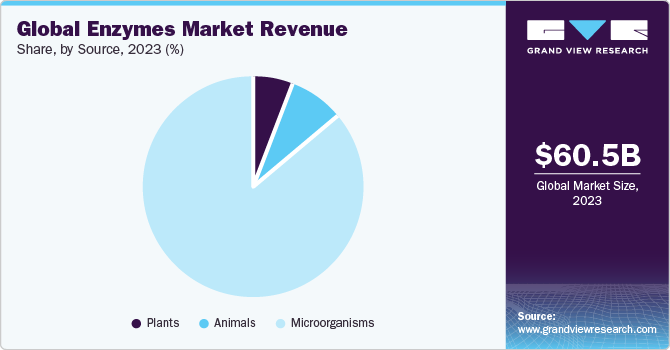

The microorganisms source segment dominated the market with a revenue share of over 85.6% in 2021. This is attributed to the growing demand for fungi-based enzymes from various end-use applications. Fungi-based enzymes are best suited for a vegetarian diet which in turn, is likely to positively impact the product demand.

The animal source segment is another large segment after microorganisms. Animal source segment accounting for 8.4% revenue share in 2022. Animal-based enzymes are extracted from the stomach and pancreas of swine and cattle. It is used for the treatment of pancreatic cancer, exocrine pancreatic insufficiency, and pancreatitis, which is anticipated to fuel its demand in the pharmaceutical sector.

Plant-based enzymes are extracted from plants. Bromelain is a plant-based enzyme, derived from pineapple. The major enzymes found in plants are lipase, protease, cellulase, and amylase among others. The demand for plant-based products is growing at a significant rate on account of their ability to lower acid indigestion, heartburn, acid reflux, and various other digestive disorders.

Regional Insights

The North America regional segment dominated the market with a revenue share of over 37.6% in 2022. This is attributed to the presence of various end-use manufacturers in the food & beverage, laundry detergent, personal care & cosmetics industries, and pharmaceuticals coupled with high scope for research & development activities in major countries of the region.

The Asia Pacific region is anticipated to grow at an exponential rate on the account of growing meat production, particularly in China. The demand for protease and carbohydrase is growing significantly across the country on account of rising demand from the pharmaceutical and food & beverage industries. The increasing use of nuclease and polymerase enzymes in biotechnology applications is further projected to propel the industry growth.

Expanding textile and food & beverage industries are anticipated to boost the market expansion owing to the growing population and rising income levels in emerging countries including Brazil and Columbia. In Middle East & Africa (MEA), pharmaceutical and cosmetic industries are anticipated to grow due to various factors such as increasing health awareness, and growing disposable income, and rising demand for high-end cosmetic products, which is anticipated to stimulate the demand in the above-mentioned industries.

Key Companies & Market Share Insights

The market is growing at a significant rate on the account of the rising consumption in various end-use applications including paper & pulp, detergents, research, biotechnology, pharmaceutical, food & beverage, and nutraceuticals among others. Key market players are focusing on various mergers & acquisitions and joint ventures for the expansion of business. Some prominent players in the global enzymes market include:

-

BASF SE

-

Novozymes

-

DuPont Danisco

-

DSM

-

Novus International

-

Adisseo

-

Associated British Foods Plc

-

Chr. Hansen Holding A/S

-

Advanced Enzyme Technologies

-

Lesaffre

-

Enzyme Development Corporation

Recent Developments

-

In May 2023 dsm-firmenich launched MaxilactNext – the quickest pure lactase enzyme in the industry for enhanced and lactose-free dairy production.

-

In January 2023, Novus International, Inc., an international animal health & nutrition company announced the acquisition of Agrivida Inc., a biotech company. With this acquisition, Novus took ownership of the flagship INTERIUS™ technology developed by Agrivida to implant feed additives in grain.

-

In December 2022, Adisseo announced its participation in the Chinese First Agri-food closing round. This investment focuses on activities emphasizing the modern agricultural & livestock revolution.

-

In November 2022 Chr. Hansen collaborated with CP Kelco for co-developing an ambient, breakthrough, plant-based ‘vegurts’.

-

In August 2022, BASF entered into a strategic binding agreement with Danstar Ferment AG (a subsidiary of Lallemand Inc.) for divesting the company’s baking enzymes portfolio and business – Nutrilife. Nutrilife assists food suppliers to produce healthy, cost-efficient, and appealing food products while supporting the optimum use of resources.

-

In September 2021, Novozymes unveiled the launch of Pristine the organic and biodegradable detergent ingredient for catering to some of the significant and unaddressed challenges of consumers. This exceptional enzyme manages discoloration and malodor at the source, setting a new benchmark for detergent capabilities.

-

In February 2021, IFF announced the completion of its merger with DuPont’s Nutrition & Biosciences business. The merged company was planned to continue its operations with the name IFF, which will structure itself as a leading ingredients & solutions provider for IFF’s customers across a diverse range of end-use sectors.

Enzymes Market Report Scope

Report Attribute

Details

Market size value in 2022

USD 13.11 billion

Revenue forecast in 2030

USD 20.31 billion

Growth rate

CAGR of 6.5% from 2023 to 2030

Base year for estimation

2022

Historical data

2018 - 2021

Forecast period

2023 - 2030

Report updated

May 2023

Quantitative units

Revenue in USD million and CAGR from 2023 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Type, product, source, region

Regional scope

North America; Europe; Asia Pacific; Central & South America; Middle East & Africa

Country scope

U.S.; Canada; Mexico; Germany; UK; Italy; Spain; France; China; India; Japan; South Korea; Indonesia; Australia; Brazil; Argentina; Turkey; Saudi Arabia

Key companies profiled

BASF SE; Novozymes; DuPont Danisco; DSM; Novus International; Adisseo; Associated British Foods Plc; Chr. Hansen Holding A/S; Advanced Enzyme Technologies; Lesaffre; Enzyme Development Corporation

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Enzymes Market Report Segmentation

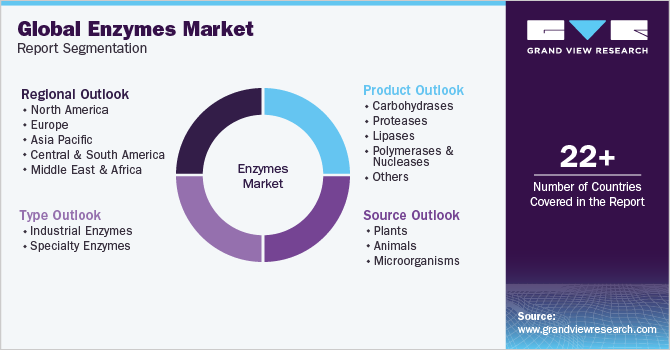

This report forecasts revenue growth at global, regional, and country levels and provides an analysis on the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global enzymes market report on the basis of type, product, source, and region:

-

Type Outlook (Revenue, USD Million, 2018 - 2030)

-

Industrial Enzymes

-

Food & Beverages

-

Detergents

-

Animal Feed

-

Biofuels

-

Textiles

-

Pulp & Paper

-

Nutraceutical

-

Personal Care & Cosmetics

-

Wastewater

-

Others

-

-

Specialty Enzymes

-

Pharmaceutical

-

Research & Biotechnology

-

Diagnostics

-

Biocatalyst

-

-

-

Product Outlook (Revenue, USD Million, 2018 - 2030)

-

Carbohydrases

-

Proteases

-

Lipases

-

Polymerases & Nucleases

-

Others

-

-

Source Outlook (Revenue, USD Million, 2018 - 2030)

-

Plants

-

Animals

-

Microorganisms

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

Spain

-

Italy

-

-

Asia Pacific

-

China

-

Japan

-

India

-

South Korea

-

Indonesia

-

Australia

-

-

Central & South America

-

Brazil

-

Argentina

-

-

Middle East & Africa

-

Saudi Arabia

-

Turkey

-

-

Frequently Asked Questions About This Report

b. The global enzymes market size was estimated at USD 12.27 billion in 2022 and is expected to reach USD 13.11 billion in 2023.

b. The global enzymes market is expected to grow at a compound annual growth rate of 6.5% from 2023 to 2030 to reach USD 20.31 billion by 2030.

b. North America dominated the enzymes market with a share of 37.6% in 2022. This is attributable to increasing demand from the pharmaceutical and biotechnology sector in the U.S.

b. Some key players operating in the enzymes market include Novozymes, DuPont, DSM; Amano Enzyme Inc., and Lonza Group among others

b. Key factors that are driving the enzymes market growth include increasing demand for industrial and specialty enzymes from the food & beverage pharmaceutical and animal feed sector.

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![ESOMAR Certified Member]()

![Great Place to Work Certified]()

ESOMAR & Great Work to Place Certified

![ISO 9001:2015 & 27001:2022 Certified]()

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."

Important: Covid19 pandemic market impact

In the wake of COVID-19 and the measures taken by government authorities, some of the applications of enzymes including pharmaceutical, detergents are expected to witness a rise in demand. The surge in medical testing and diagnostics has been a major reason for the upshift in enzymes' demand as enzymes are frequently used in medicine and pharma engineering. The updated report will account for COVID-19 as a key market contributor.