- Home

- »

- Green Building Materials

- »

-

Environment Health And Safety Market Size Report, 2030GVR Report cover

![Environment Health & Safety Market Size, Share & Trends Report]()

Environment Health & Safety Market Size, Share & Trends Analysis Report By Product (Services, Software), By Deployment Mode (Cloud, On-premise), By End-use (Construction, Healthcare), By Region, And Segment Forecasts, 2024 - 2030

- Report ID: GVR-1-68038-339-3

- Number of Pages: 152

- Format: Electronic (PDF)

- Historical Range: 2018 - 2022

- Industry: Advanced Materials

Environment Health & Safety Market Trends

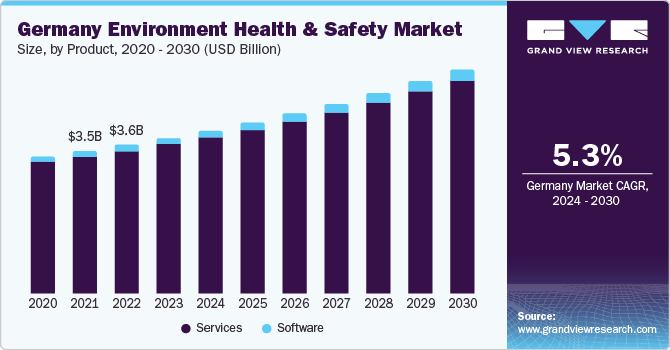

The global environment health & safety (EHS) market size was estimated at USD 49.3 billion in 2023 and is anticipated to grow at a compound annual growth rate (CAGR) of 6.6% from 2024 to 2030. Rising public concerns regarding environmental issues over the past few years have resulted in the development of environmental protection laws, which are expected to drive market growth. Companies in the U.S., Canada, the UK, and Australia are required to comply with strict wastewater treatment and industrial waste disposal norms, such as the toxics release inventory (TRI) in the U.S., National Pollutant Release Inventory (NPRI) in Canada, and National Pollutant Inventory (NPI) in Australia. The establishment of these stringent norms is projected to drive market growth over the forecast period. Chemical, automotive, mechanical engineering, and electrical are key industries in Germany.

The strong presence of key manufacturing and chemical industry players in the country, coupled with the presence of strict environmental, health & safety norms, is likely to augment the growth of the market in Germany over the forecast period. Moreover, factors, such as the presence of advanced research and development (R&D) centers, increasing investments to boost operational efficiency, and favorable growth policies, are likely to drive the demand for environment health & safety (EHS) services and software over the coming years. Many companies strive to conduct their operations with "Zero Incidents" or "Zero Harm" to people and the environment. Depending on how the organization defines it, this could mean zero incidents of harm to people or property or even zero environmental effects. It may even imply that there have been no close calls or risky actions. The new standard for excellence in health and safety management is “Zero Incidents.”

It enables companies to demonstrate their dedication to the welfare of their staff. These aforementioned factors are expected to drive the demand for EHS services over the forecast period. For instance, Trane Technologies strives for a safety-focused culture and works to achieve zero accidents and injuries across the whole organization. Government agencies, including the U.S. Environmental Protection Agency (EPA), Occupational Safety and Health Administration (OSHA), and the U.S. Department of Labor, lay down the EHS norms and regulations. In the U.S., among major market participants are Jacobs; AECOM; Enablon; Tetra Tech, Inc.; and VelocityEHS. These companies provide a wide range of EHS software and services, including ergonomics, engineering and construction, risk assessment, EHS software, and management consulting and compliance.

The high demand for EHS services in North America can also be attributed to the presence of a large number of oil & gas extraction industries in the region, which use these services to adhere to regulations & ensure the safety & health of their employees. Oil & gas spills can affect the environment and aquatic habitat to a huge extent, due to which, the governments in the region have implemented stringent disposal and risk assessment norms for oil & gas industries. Growth of oil & gas industries in this region, especially in the U.S., is expected to augment the demand for these services in the region. Companies can comply with the criteria set by environmental organizations such as CERCLA and RCRA with the help of EHS software and services. Demand is going to be complemented by growing social and political pressure on companies to operate sustainably as awareness of the harmful effects of pollution grows.

For instance, CGE Risk Management Solutions B.V., a supplier of risk management software that offers the industry-recognized BowTieXP solution, was acquired by Wolters Kluwer Legal & Regulatory in January 2020. The Environmental, Health & safety, and Operational Risk Management (EHS/ORM) software business of Wolters Kluwer, which already comprises Enablon and eVision, will now incorporate CGE. Customers will be able to conduct more accountable, successful, and safe operations owing to the combined services' improved EHS, ORM, and risk performance. The EHS market is characterized by extensive research for the development of solutions and software for more complex applications related to several end-use industries. However, lack of awareness among companies, primarily in developing economies, is expected to hamper market growth.

Rising government regulations for environmental protection, especially in the U.S. and Europe, are expected to augment the growth of the environmental health and safety market over the forecast period. Increasing focus on environmental impact can be seen from the rising international environmental bilateral and multilateral agreements across the globe.

Countries including China, India, and Mexico have implemented stringent regulations for environmental protection and energy consumption. In developing countries such as India, stringent regulations concerning emissions are being enforced and old regulations are being revised to meet the global environmental standards, which has created opportunities for EHS service provided in recent years.

Product Insights

Based on product, the services segment led the market and accounted for a revenue share of 96.3% in 2023. Donesafe complements HIS’s current workplace safety training, chemical management, and emergency care training products by encompassing health and safety, supplier management, quality management, and environmental activities. EHS services includes services, such as EHS compliance program development & implementation, EHS management information systems design, process safety evaluations & management, implementation & support, water quality, and EHS consulting services. For instance, EHS services assist mining companies by providing technical & regulatory advice and site auditing during exploration & drilling. EHS service providers also assist clients by identifying & reporting the required improvements for a better output with less environmental impact.

EHS software providers offer custom software to clients to meet their unique requirements. EHS software is primarily used in chemicals, manufacturing, pharmaceuticals, and oil & gas industries, thereby driving market expansion. Environment Health & Safety (EHS) software offers a broad range of functionalities, including audit & inspection, incident management, compliance management, management change, chemical management, performance metrics, risk analysis, training management, air emission measurement, water quality, ergonomics, safety meetings, and corrective actions. In February 2020, Health & Safety Institute, a pioneer in EHS software, training, and compliance solutions, acquired Donesafe.

Deployment Mode Insights

Based on deployment, the cloud segment accounted for a revenue share of 28% in 2023. Cloud segment is anticipated to have become a widely favored delivery mechanism among big businesses and SMEs due to its low cost and simplicity of implementation. Owing to the low cost and round-the-clock support and maintenance offered by software suppliers, SMEs are more likely to use cloud-based solutions than on-premises ones. Software that runs in the cloud is kept on a server owned by a different provider. The program and data are both accessible to end users online. SaaS and cloud-based software are closely related. For instance, cloud software consists of Dropbox, Office 365, and Google Documents.

The infrastructure is also owned and maintained by cloud software providers, who also host the data. Due to the fact that audits and inspections may be carried out remotely rather than visiting each facility, this is very advantageous for Environment Health & Safety (EHS) departments. The above-mentioned factors are anticipated to propel market demand over the projected timeframe. In January 2020, Cority acquired Enviance, a pioneer in environmental, chemical, sustainability, & ergonomics software, which uses a SaaS strategy to provide its EHS platform across the globe, at any time. Around 400 firms across 30 industries use Enviance's software.

On-site servers streamline the process due to advantages like complete control over upgrades and maintenance. On-premise packages are deployed directly onto the server at the user's place of business. However, they are expensive to install, run, & update and require a significant amount of time, effort, & resources from the company's IT staff. Numerous on-premise solutions can function without an internet connection. However, they cannot support a mobile workforce. Moreover, an increasing number of businesses are moving toward satellite offices and remote workers, who require access to applications while on the job. In addition, data loss is another drawback of on-premise software that businesses must take into account. These factors may hamper segment's growth in the years to come.

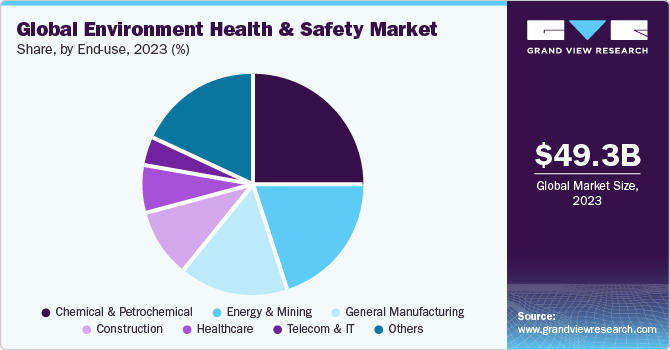

End-use Insights

Based on end-use, the chemicals & petrochemicals segment accounted for the largest revenue share of 24.5% in 2023. A rapid increase in the production of shale across the globe has led to an increased demand for petrochemicals and their derivatives. For instance, shale oil & gas output in the U.S. is rising at a startlingly rapid rate. The crude oil production in the U.S. rose from 700,000 b/d to 900,000 b/d in 2022, according to the Energy Information Administration. EHS service providers offer responsive and innovative support services during all stages of development and operation cycles in the chemical & petrochemical end-use segment, thereby driving market expansion.

EHS services for the mining & energy end-use segment include feasibility checks, regulatory and social studies, strategic environmental approvals and design, engineering for mining infrastructure, mining operations, procurement & construction management, reclamation and rehabilitation, project evaluation, and planning. The healthcare segment is likely to grow at a CAGR of 7.3% over the forecast period. The healthcare industry involves the use of these services to manage facilities, laboratories, & pharmacies; stay updated with changing regulatory landscape; improve operational efficiency; and ensure safety of their workers from biohazards.

Management professionals in the construction segment focus on providing green and efficient practices for project management, subcontractor management, construction techniques, quality assurance, health & safety, and quality control, and other issues impacting the construction projects. These aforementioned factors are anticipated to drive the demand for EHS in the construction end-use segment in coming years. For instance, L&T is committed to giving its employees a safe & healthy work environment. By seeking to become a “Zero Harm” corporation, the conglomerate has been going ahead on this pledge. It indicates that L&T is taking every precaution to avoid workplace mishaps and injuries. This entails putting in place strict safety policies & training programs, monitoring & upgrading workplace safety standards, and utilizing cutting-edge technology for SMART applications.

Regional Insights

North America accounted for a revenue share of 37.6% in 2023 due to the presence of a large number of oil & gas extraction industries in the region, which use EHS services to adhere to regulations and ensure the health & safety of their employees. In addition, increasing investments from industries in EHS IT software to comply with OSHA and EPA regulations are expected to boost the demand for EHS in North America. To phase out the current take-make-dispose model and maximize the utilization of raw resources, the use of EHS services and software is growing quickly in the European market. The regulations pertaining to health, safety, consumer protection, and environmental protection were developed by EU-OSHA and the EEA.

The demand for EHS software & services is projected to increase over the coming years, due to Europe's strict environmental standards. For instance, The Waste Framework Directive or Directive 2008/98/EC lays down measures to protect the environment and human health by reducing or preventing the adverse impacts of generation and management of waste. The European Commission has also increased waste reduction targets, which can be achieved by recycling municipal and packaging waste. The rising pressure from the European Commission encourages key players to adopt recycling technologies by adopting EHS services and software.

In December 2021, Ideagen Plc, an international provider of information management software, received USD 124.07 million to accelerate product investment and extend global operations through additional acquisitions, which would further propel market expansion. Asia Pacific is facing an environmental crisis due to rapid industrialization in the region. Environmental issues, such as deforestation and air, water, & soil pollution, are major concerns for regional governments. EHS services offer efficient methods and techniques to overcome these issues. Various initiatives undertaken by the governments to improve environmental sustainability in the region have driven EHS market growth in developing countries.

The increasing pressure due to public and economic development is anticipated to augment market growth in this region over the forecast period. Many national authorities in the Middle East have privatized state-owned businesses to allow more foreign investment & trade opportunities while ensuring that EHS standards and management policies are integrated to support a sustainable environment and long-term economic growth. This is anticipated to be a key factor driving the market growth in the Middle East & Africa over the forecast period. Implementation of stringent reporting and safety norms across many countries in the Middle East & Africa is likely to provide high growth opportunities for EHS service and software providers in this region.

Key Companies & Market Share Insights

To increase market penetration and meet shifts in technological demands from various applications, including chemicals & petrochemicals, telecom & IT, energy & mining, healthcare, construction, and manufacturing, manufacturers use a variety of strategies, including acquisitions, mergers, joint ventures, new product developments, and geographic expansions. For instance, in February 2023, AECOM and its Office of Air and Radiation (OAR) collaborated in 2023.

Development and implementation of national initiatives pertaining to acid rain, radon, stratospheric ozone depletion, automobile and engine pollution, climate change, radiation protection, and indoor & outdoor air quality are the main objectives of this collaboration. The partnership, which aims to protect the environment and public health across the country, is made possible by an environmental, analytical, research, technical, and hybrid (EARTH) contract.

Key Environment Health & Safety Companies:

- AECOM

- Jacobs

- Intelex Technologies

- Enablon

- Tetra Tech, Inc.

- SAP SE

- Golder Associates

- SGS SA.

- ERM Group, Inc.

- VelocityEHS

- John Wood Group PLC

- RPS Group

- ETQ

- Cority (Medgate)

- Sphera

Environment Health & Safety Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 52.3 billion

Revenue forecast in 2030

USD 77.0 billion

Growth rate

CAGR of 6.6% from 2024 to 2030

Base year for estimation

2023

Historical data

2018 - 2022

Forecast period

2024 - 2030

Report updated

November 2023

Quantitative units

Revenue in USD million/billion, and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company market position analysis, competitive landscape, growth factors, and trends

Segments covered

Product, deployment mode, end-use, region

Regional scope

North America; Europe; Asia Pacific; Central & South America; Middle East & Africa

Country Scope

U.S.; Canada; Mexico; Germany; France; UK; Germany; Italy; Spain; China; Japan; India; South Korea; Australia; Brazil; Argentina; South Africa; Saudi Arabia

Key companies profiled

AECOM; Jacobs; Intelex Technologies; Enablon; Tetra Tech, Inc.; SAP SE; Golder Associates; SGS SA; ERM Group, Inc.; VelocityEHS; John Wood Group PLC; RPS Group; ETQ; Cority (Medgate); Sphera

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Environment Health & Safety Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global environment health & safety market report based on of product, deployment mode, end-use, and region:

-

Product Outlook (Revenue, USD Billion, 2018 - 2030)

-

Software

-

Services

-

Analytics

-

Project Deployment & Implementation

-

Business Consulting & Advisory

-

Audit, Assessment, & Regulatory Compliance

-

Certification

-

Others

-

-

-

Deployment Mode Outlook (Revenue, USD Billion, 2018 - 2030)

-

Cloud

-

On-premises

-

-

End-use Outlook (Revenue, USD Billion, 2018 - 2030)

-

Chemical & Petrochemical

-

Energy & Mining

-

Healthcare

-

Telecom & IT

-

Construction

-

General Manufacturing

-

Others

-

-

Regional Outlook (Revenue, USD Billion,2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

Italy

-

Spain

-

-

Asia Pacific

-

China

-

India

-

Japan

-

Australia

-

South Korea

-

-

Central & South America

-

Brazil

-

Argentina

-

-

Middle East & Africa

-

South Africa

-

Saudi Arabia

-

-

Frequently Asked Questions About This Report

b. North America dominated the environment health & safety (EHS) market with a revenue share of 37.7% in 2022. The high demand for environment health & safety (EHS) services in North America can also be attributed to the presence of a large number of oil and gas extraction industries in the region, which use environment health & safety (EHS) services to adhere to the regulations and ensure the health & safety of their employees.

b. Some of the key players operating in the environment health & safety market include AECOM, Jacobs, Intelex Technologies, Enablon, Tetra Tech, Inc, SAP SE, Golder Associates, and among others.

b. The key factors that are driving the environment health & safety market include the increasing regulations by the government in various economies act as the primary growth driver. Industries, such as energy and chemicals deploy environment health & safety (EHS) services and software for the prevention of accidents at work as employees in these industries deal with hazardous materials.

b. The global environment health & safety market size was estimated at USD 46.62 billion in 2022 and is expected to reach USD 49.2 billion in 2023.

b. The global environment health & safety market, in terms of revenue, is expected to grow at a compound annual growth rate of 6.5% from 2023 to 2030 to reach USD 77.0 billion by 2030.

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![ESOMAR Certified Member]()

![Great Place to Work Certified]()

ESOMAR & Great Work to Place Certified

![ISO 9001:2015 & 27001:2022 Certified]()

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."

Important: Covid19 pandemic market impact

The global construction industry once booming due to the residential and commercial construction in China and the U.S., has been affected by the suspension of the construction activities across the impacted economies. The construction industry in the U.S. is expected to take a major hit due to labor shortages and the lockdown imposed by the government during COVID-19, which is expected to be aggravated by the resulting supply chain issues and financing pressures due to the non-adherence to the completion times. The report will account for Covid19 as a key market contributor.