- Home

- »

- Medical Devices

- »

-

Endoscopy Devices Market Size, Share, Growth Report 2030GVR Report cover

![Endoscopy Devices Market Size, Share & Trends Report]()

Endoscopy Devices Market Size, Share & Trends Analysis Report By Product (Endoscopes, Flexible Endoscopes), By End-use (Hospitals, Outpatient Facilities), By Region, And Segment Forecasts, 2023 - 2030

- Report ID: GVR-3-68038-468-0

- Number of Pages: 118

- Format: Electronic (PDF)

- Historical Range: 2016 - 2021

- Industry: Healthcare

Report Overview

The global endoscopy devices market size was estimated at USD 50.8 billion in 2022 and is projected to grow at a compound annual growth rate (CAGR) of 7.5% from 2023 to 2030. The less invasive properties and affordable post and pre-procedure cost of endoscopy devices are the major factors anticipated to boost the market growth over the forecast period. Furthermore, a shift in the trend to use disposable endoscopic components to minimize the procedure cost as well as the chance of cross-contamination is also expected to accelerate market growth over the years.

In addition, the growing chronic disease burden and increasing geriatric population globally are also anticipated to fuel the adoption of endoscopic devices during the coming years. Moreover, growing medical conditions due to the increasing geriatric population often require endoscopic intervention such as liver abscesses, gallstones, endometriosis, and intestinal perforation, which in turn anticipated to drive the market growth for endoscopy devices over the forecast years. For instance, as per the Administration on Aging (AoA) of the U.S. Department of Health and Human Services report, about 16% of the population was aged above 65 years in 2019. This number is expected to increase to 21.6% by 2040.

In addition, increasing preference by medical professionals to use technologically advanced endoscopy devices equipped with high-definition camera and light sources to help physicians analyze internal organs of interest also drives the market growth. The shift of preference towards minimally invasive surgical procedures than traditional surgeries to reduce hospital stay and minimize post-procedure complications are the major factors anticipated to fuel the demand for endoscopy devices. Hence, factors such as higher patient satisfaction, increased economic viability, and lesser hospital stays are expected to increase the demand for minimally invasive endoscopic interventions in the coming years, thereby accelerating market growth.

Furthermore, the growing burden of cancer all over the world also fuels the adoption of endoscopy devices for the early diagnosis and treatment of the disease. For instance, GLOBOCAN 2020 estimated 19.3 million new cancer cases worldwide and almost 10 million deaths occurred in 2020 due to cancer. In addition, the increasing preference for biopsies for diagnosis and detection of cancer in recent years is also likely to increase the adoption of endoscopic devices, which in turn is anticipated to drive the market for endoscopy devices over the years.

Technological advancement to develop innovative endoscopic devices is also anticipated to accelerate market growth during forecast periods. The key manufacturers are continuously looking forward to innovating advanced endoscopic solutions for better treatment and diagnosis of several chronic disorders. For instance, in August 2021, Fujifilm Holdings Corporation announced the commercial launch of the ELUXEO 7000X Endoscopic Imaging System. This advanced imaging system enables real-time visualization of hemoglobin oxygen saturation (StO2) levels in tissue during laparoscopic and/or endoluminal imaging procedures.

COVID19 Endoscopy devices market estimates impact: 3.4% decrease in revenue growth from 2019 to 2020

Pandemic Impact

Post COVID Outlook

The Global endoscopy devices market estimates decreased by 3.4% from 2019 to 2020

The market is estimated to witness a y-o-y growth of approximately 6.9% to 7.4% in the next 5 years

The decrease in the market growth is due to the decrease in a number of endoscopic procedures during 2020 due to the COVID-19 pandemic as compared to 2019. In addition, the canceled or postponed semi-urgent and elective endoscopic procedures by the healthcare centers due to the fear of COVID-19 infection also restrained market growth.

The growing number of functional gastrointestinal disorders and cancer cases and the increase in the preference for cost-effective minimally invasive endoscopic procedures for the early diagnosis and detection of chronic diseases are anticipated to propel the adoption of endoscopic devices over the forecast years.

Furthermore, supply chain disruption, the shortage of healthcare professionals due to the COVID-19 infection, and changing regulations to curtail the infection in major geographic regions resulted in a significant impact on the global market growth in 2020.

High preference for disposable endoscopic equipment to minimize the chances of cross-contamination coupled with the technological advancement to develop cost-effective products helps in shortening the procedure time and these are the factors expected to accelerate market growth over the forecast years.

The endoscopy devices industry has been significantly impacted by the COVID-19 pandemic. The reduction and postponement of elective surgeries due to the fear of COVID-19 infection have negatively impacted the growth of the market for endoscopy devices. In addition, supply chain disruptions, changing regulations for surgical procedures, are some of the factors that also hampered market growth in 2020. For instance, according to an international study published in the Arab Journal of Gastroenterology, Elsevier in 2020, the endoscopic procedure volume was reduced by over 50% of the 85% of the global respondent countries during the COVID-19 pandemic.

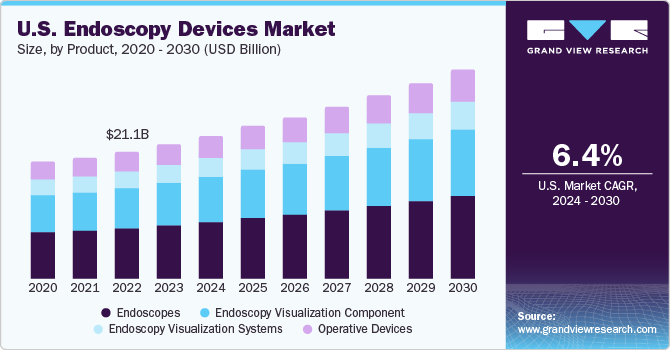

Product Insights

The product segment comprises endoscopes, endoscopy visualization systems, endoscopy visualization components, and operative devices segments. The endoscopes segment dominated the market in 2022 with the largest revenue share of 36.9% and is also anticipated to register the fastest CAGR of 9.0% over the forecast period. Growing awareness and rising adoption rate of endoscopes across various diagnostic and therapeutic procedures are driving the market growth of endoscopes. In addition, endoscopes aid in diagnosis of complex disease conditions such as cancer, GI disorders, urinary disorders, and lung disorders. This high growth rate is attributed to the increasing number of endoscopic procedures coupled with the high adoption of endoscopes to perform surgeries and biopsies for better diagnosis and treatment.

The flexible endoscopes segment dominated the endoscopes segment and held the largest revenue share in 2022, owing to its high use by medical professionals and its advantages such as safety, increased efficiency, and enhanced ergonomics as compared to rigid endoscopes.

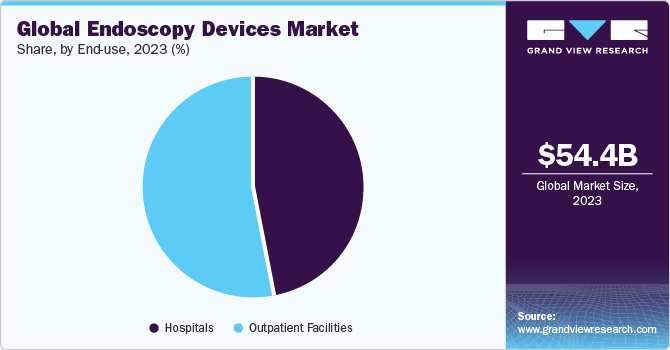

End-use Insights

The end-use segment comprises hospitals and outpatient facilities segments. The outpatient facilities’ segment dominated the market in 2022 with the largest revenue share of 52.9%. The outpatient facilities segment is also anticipated to register the fastest CAGR of 8.2% over the forecast period. Outpatient facilities such as ambulatory surgery centers and diagnostic clinics are expected to witness lucrative growth owing to the growing preference for minimally invasive procedures to lower overall cost and reduce the number of days of hospital stays which in turn is expected to drive the growth of the segment.

In addition, faster recovery time, and minimal discomfort due to the use of less invasive keyhole endoscopic procedures also accelerate the adoption of endoscopy devices in outpatient facilities, which in turn is anticipated to propel segment growth over the forecast period.

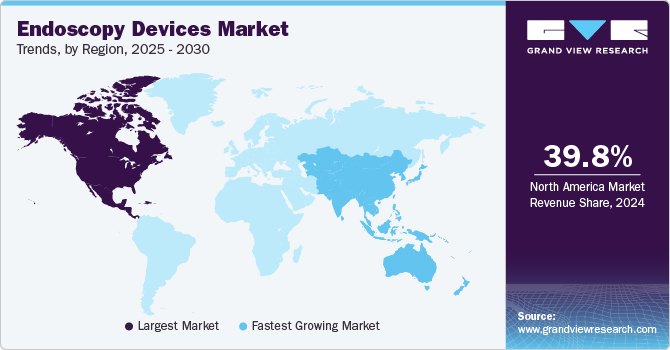

Regional Insights

Based on region, North America held the largest revenue share of 41.5% in 2022. This is attributed due to the growing prevalence of several chronic diseases such as cancer, diabetes, cardiovascular diseases along with functional gastrointestinal disorders. In addition, the increasing geriatric population, those who are prone to several chronic disorders also propelling the adoption of endoscopic procedures in this region. Moreover, growing awareness for early disease diagnosis using minimally invasive procedures and improved healthcare infrastructure are further boosting the market growth in this region.

Furthermore, in Asia Pacific, the market for endoscopy devices is expected to witness the fastest CAGR of 8.7% over the forecast years owing to the large population and an increasing number of functional gastrointestinal disorder patients. In addition, growing demand for the minimally invasive endoscopic procedure and improving healthcare infrastructure are the factors also anticipated to accelerate the region's growth in the market. Moreover, increasing government initiatives to modernize healthcare facilities and constantly develop a start-up landscape are among the major factors further promoting the growth of the market in the region.

Key Companies & Market Share Insights

The high demand for technologically advanced endoscopic products for diagnosis and treatment of several chronic disorders makes the competition intense among the existing players. In addition, the growing preference for the minimally invasive procedure with low costs, more safety, and reduced risks of contaminating the devices further increase the competition. Moreover, the top market players are also adopting business strategies such as new product launches, collaboration, mergers and acquisitions to increase their product portfolio and market share in the area of endoscopic devices. For instance, in September 2020, PENTAX Medical announced to launch new Ultrasound Video Gastroscopes J10 Series in the U.S. These advanced gastroscopes enable better image quality, increase diagnostic capabilities, and help in effective disease management of the patient. Some prominent players in the global endoscopy devices market include:

-

Olympus Corporation

-

Ethicon Endo-surgery, LLC.

-

FUJIFILM Holdings Corporation

-

Stryker Corporation

-

Boston Scientific Corporation

-

Karl Storz GmbH & Co. KG

-

Smith & Nephew Inc.

-

Richard Wolf GmbH

-

Medtronic Plc (Covidien)

-

PENTAX Medical

-

Machida Endoscope Co., Ltd.

Endoscopy Devices Market Report Scope

Report Attribute

Details

Market size value in 2023

USD 54.4 billion

Revenue forecast in 2030

USD 90.2 billion

Growth rate

CAGR of 7.5% from 2023 to 2030

Base year for estimation

2022

Historical data

2016 - 2021

Forecast period

2023 - 2030

Report updated

October 2023

Quantitative units

Revenue in USD million/billion and CAGR from 2023 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, end-use, region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; UK; Germany; Spain; France; Italy; Norway; Sweden; Denmark; China; Japan; India; Australia; South Korea; Thailand; Mexico; Brazil; Argentina; South Africa; Saudi Arabia; UAE; Kuwait

Key companies profiled

Olympus Corporation; Ethicon Endo-surgery LLC.; FUJIFILM Holdings Corporation; Stryker Corporation; Boston Scientific Corporation; Karl Storz GmbH & Co. KG.; Smith & Nephew Inc.; Richard Wolf GmbH; Medtronic Plc (Covidien); PENTAX Medical; Machida Endoscope Co., Ltd.

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional, and segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

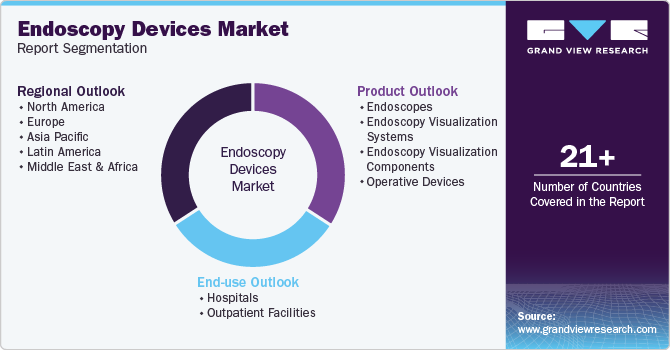

Global Endoscopy Devices Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2016 to 2030. For this study, Grand View Research, Inc. has segmented the global endoscopy devices market report based on product, end-use, and region:

-

Product Outlook (Revenue, USD Million, 2016 - 2030)

-

Endoscopes

-

Rigid Endoscopes

-

Laparoscopes

-

Arthroscopes

-

Ureteroscopes

-

Cystoscopes

-

Gynecology Endoscopes

-

Neuroendoscopes

-

Bronchoscopes

-

Hysteroscopes

-

Laryngoscopes

-

Sinuscopes

-

Otoscopes

-

Sigmoidoscopes

-

Pharyngoscopes

-

Duodenoscopes

-

Nasopharyngoscopes

-

Rhinoscopes

-

-

Flexible Endoscopes

-

Laparoscopes

-

Arthroscopes

-

Ureteroscopes

-

Cystoscopes

-

Gynecology Endoscopes

-

Neuroendoscopes

-

Bronchoscopes

-

Hysteroscopes

-

Laryngoscopes

-

Sinuscopes

-

Otoscopes

-

Sigmoidoscopes

-

Pharyngoscopes

-

Duodenoscopes

-

Nasopharyngoscopes

-

Rhinoscopes

-

Colonoscopes

-

-

Disposable Endoscopes

-

Laparoscopes

-

Arthroscopes

-

Ureteroscopes

-

Cystoscopes

-

Gynecology Endoscopes

-

Neuroendoscopes

-

Bronchoscopes

-

Hysteroscopes

-

Laryngoscopes

-

Sinuscopes

-

Otoscopes

-

Sigmoidoscopes

-

Pharyngoscopes

-

Duodenoscopes

-

Nasopharyngoscopes

-

Rhinoscopes

-

Colonoscopes

-

-

Capsule Endoscopes

-

Robot Assisted Endoscopes

-

-

Endoscopy Visualization Systems

-

Standard Definition (SD) Visualization Systems

-

2D Systems

-

3D Systems

-

-

High Definition (HD) Visualization Systems

-

2D Systems

-

3D Systems

-

-

-

Endoscopy Visualization Component

-

Camera Heads

-

Insufflators

-

Light Sources

-

High Definition Monitors

-

Suction Pumps

-

Video Processors

-

Operative Devices

-

Energy Systems

-

Access Devices

-

Suction & Irrigation Systems

-

Hand Instruments

-

Wound Retractors

-

Snares

-

-

-

End-use Outlook (Revenue, USD Million, 2016 - 2030)

-

Hospitals

-

Outpatient Facilities

-

-

Regional Outlook (Revenue, USD Million, 2016 - 2030)

-

North America

-

U.S.

-

Canada

-

-

Europe

-

UK

-

Germany

-

Italy

-

France

-

Spain

-

Norway

-

Sweden

-

Denmark

-

-

Asia Pacific

-

Australia

-

China

-

Japan

-

India

-

South Korea

-

Thailand

-

-

Latin America

-

Mexico

-

Brazil

-

Argentina

-

-

Middle East Africa

-

South Africa

-

Saudi Arabia

-

UAE

-

Kuwait

-

-

Frequently Asked Questions About This Report

b. The global endoscopy devices market size was estimated at USD 50.8 billion in 2022 and is expected to reach USD 54.4 billion in 2023.

b. The global endoscopy devices market is expected to grow at a compound annual growth rate of 7.5% from 2023 to 2030 to reach USD 90.2 billion by 2030.

b. Endoscopy visualization systems dominated the endoscopy devices market with a share of 36.6% in 2022. This is attributable to the increasing preference for HD visualization systems by medical professionals in the diagnosis & treatment of complex diseases.

b. Some key players operating in the endoscopy devices market include Olympus Corporation; Fujifilm Holdings Corporation; Ethicon Endo-Surgery, LLC; Stryker Corporation; Richard Wolf GmbH; Boston Scientific Corporation; and Karl Storz.

b. Key factors that are driving the endoscopy devices market growth include a significant increase in the prevalence of age-related diseases, a rise in demand for endoscopy devices in diagnostic & therapeutic procedures, and increasing adoption of minimally invasive surgeries.

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![ESOMAR Certified Member]()

![Great Place to Work Certified]()

ESOMAR & Great Work to Place Certified

![ISO 9001:2015 & 27001:2022 Certified]()

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."

Important: Covid19 pandemic market impact

With COVID-19 infections rising globally, the apprehension regarding a shortage of essential life-saving devices and other essential medical supplies in order to prevent the spread of this pandemic and provide optimum care to the infected also widens. In addition, till a pharmacological treatment is developed, ventilators act as a vital treatment preference for the COVID-19 patients, who may require critical care. Moreover, there is an urgent need for a rapid acceleration in the manufacturing process for a wide range of test-kits (antibody tests, self-administered, and others). The report will account for COVID-19 as a key market contributor.