- Home

- »

- Medical Devices

- »

-

Endoscopes Market Size, Share And Trends Report, 2030GVR Report cover

![Endoscopes Market Size, Share & Trends Report]()

Endoscopes Market Size, Share & Trends Analysis Report By Product (Flexible, Rigid, Disposable), By End-use (Hospitals, Outpatient Facilities), By Region, And Segment Forecasts, 2023 - 2030

- Report ID: GVR-2-68038-550-2

- Number of Pages: 118

- Format: Electronic (PDF)

- Historical Range: 2016 - 2021

- Industry: Healthcare

Report Overview

The global endoscopes market size was estimated at USD 18.8 billion in 2022 and is expected to grow at a compound annual growth rate (CAGR) of 9.0% from 2023 to 2030. The rise in the prevalence of chronic disorders and growing awareness about early detection of diseases through minimally invasive surgical procedures are some of the major factors anticipated to drive market growth over the forecast years. In addition, favorable reimbursement policies, and increasing FDA approvals for endoscopic devices are also expected to boost the growth of the market over the forecast years. For instance, in 2021, the United States Food and Drug Administration granted 510(k) clearance to EndoFresh’s disposable digestive endoscopy system, a device developed to reduce the chance of contamination in gastrointestinal procedures.

Furthermore, endoscopic procedures have been largely adopted to diagnose and treat functional gastrointestinal disorders. Functional gastrointestinal disorders can affect any part of the gastrointestinal tract, including the stomach, esophagus, and intestines. The growing prevalence of functional gastrointestinal disorders, such as Irritable Bowel Syndrome (IBS), functional constipation, or functional dyspepsia, is also expected to accelerate product adoption and boost market growth over the forecast years. For instance, in 2021, a multinational study published in the Gastroenterology journal on 33 countries reported that, globally, over 40% of persons have functional gastrointestinal disorders.

In addition, obesity is a growing serious health problem globally due to unhealthy lifestyles and diets. It is associated with several gastrointestinal disorders, such as esophageal adenocarcinoma, erosive esophagitis, gastroesophageal reflux disease, colorectal polyps, and cancer. As per the Organization for Economic Co-operation and Development (OECD) data, the obesity rate is expected to grow at a significant rate by 2030. Nearly 47%, 39%, and 35% of the population in the U.S., Mexico, and England respectively are expected to be obese by 2030. Bariatric surgery is the most effective treatment option resulting in significant weight loss. However, the emergence of minimally invasive endoscopic sleeve gastroplasty procedures significantly reduces stomach volume.

It is performed through patients’ mouths unlike traditional bariatric surgery using a flexible endoscope. Hence, the increase in demand for minimally invasive endoscopic bariatric procedures is further anticipated to drive market growth over the years.Furthermore, the growing global burden of cancer all over the world is driving the product demand for early diagnosis and treatment. For instance, according to the Globocan 2020 report, the estimated number of new cancer cases was 19.3 million in 2020 and the number of deaths that occurred due to cancer was about 10 million. Thus, increasing demand for endoscopic biopsy to diagnose cancer is anticipated to drive the market growth during forecast years.

A decrease in the number of endoscopic procedures during the COVID-19 pandemic hampered the market growth in 2020. Due to the risk of cross-contamination and the chance of SARS-CoV-2 transmission, several endoscopic facilities have canceled or postponed the elective, and semi-urgent procedures, which is restraining the market growth. Furthermore, supply chain disruption and changing regulations to curtail the infection are also some of the major factors that hindered the market growth in 2020. For instance, a study on the endoscopy unit of the Cancer Institute of the State of São Paulo (ICESP), published in Clinics (Sao Paulo) journal in 2021, stated that there was a 55% reduction in the endoscopic procedure during the pandemic and the colonoscopy is the most affected modality (-79%).

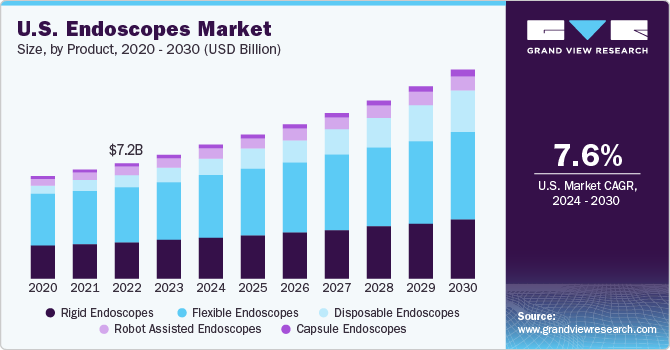

Product Insights

The product segment comprises of rigid endoscopes, flexible endoscopes, disposable endoscopes, robot-asssited endoscopes, and capsule endoscopes. The flexible endoscopes dominated the market and accounted for the largest revenue share of 47.2% in 2022. This is attributed to its increasing preference by healthcare professionals for the first-line therapeutic option as it can be performed under sedation.The cost-effectiveness, safety, and high-efficiency properties of flexible endoscopes also boost their adoption. In addition, flexible endoscopes are used in several surgical applications, such as gastrointestinal endoscopy, laparoscopy, arthroscopy, urology endoscopy, obstetrics/gynecological endoscopy, bronchoscopy, otoscopy, mediastinoscopy, and laryngoscopy.

This increases their adoption, thereby fueling the segment's growth. On the other hand, the disposable endoscopes segment is anticipated to register the fastest CAGR of 15.5% during the forecast period. This growth can be attributed to the increasing preference for these devices over conventional endoscopes to reduce the risk of cross-contamination. In addition, the adoption of disposable deviceswas higher during the COVID-19 pandemic as these devices reduce the risk of nosocomial disease spread.

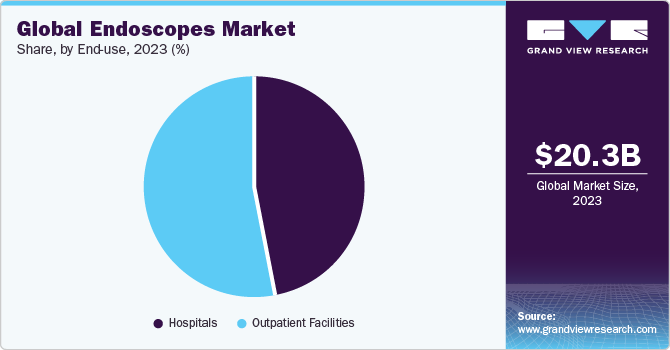

End-use Insights

On the basis of end-use, the global market has been further categorized into hospitals and outpatient facilities. In 2022, the outpatient facilities segment dominated the market and accounted for the largest share of 52.9% of the overall revenue. The segment is projected to expand furtherat the fastest growth rate of 9.7% over the forecast period. Increasing adoption of endoscopes across outpatient facilities, such as ambulatory surgery centers (ASCs) and diagnostic clinics, for the early diagnosis and detection of several life-threatening diseases is supporting the growth of the segment.

In addition, the introduction of keyhole endoscopic surgeries with minimal discomfort and faster recovery time also boosts the growth of this segment. Moreover, lower cost of procedures, due to shorter stays, is anticipated to augment the segment growth over the forecast years.

Regional Insights

North America led the market in 2022 and accounted for the highest share of more than 40.9% of the global revenue. The regional market is estimated to retain the dominant position throughout the forecast period owing to the increasing adoption of elective endoscopic procedures, improved healthcare expenditure, and the high geriatric population. In addition, the high burden of cancer and functional gastrointestinal disorders in the U.S.is anticipated to further drive the market over the forecast period. For instance, according to the American Cancer Society, about 1.9 million new cancer cases are estimated to be diagnosed in 2021 in the U.S.

On the other hand, Middle East & Africa is projected to be the fastest-growing regional market with a CAGR of 12.0% over the forecast period. This growth is owing to the presence of a growing patient population pool suffering from functional gastrointestinal disorders and other chronic lifestyle disorders. Advancements in healthcare infrastructure, growing healthcare expenditure, and increasing awareness about available diagnostic & therapeutic solutions are driving the regional market growth. Some of the other factors contributing to the regional market growth include the rising geriatric population,rapid economic development, and increasing government healthcare investments thathelp attract foreign investments in this region. Moreover, the presence of key players in the region is fueling product adoption, which, in turn, supports the regional market growth.

Key Companies & Market Share Insights

Key manufacturers are looking forward to investing more in the development of technologically advanced devices. The growing demand for different types of endoscopes increases the competition among market players to expand their product portfolio and global presence. Moreover, key industrial strategies, such as collaboration, merger, and acquisition, have also been undertaken by top players to increase their market share. For instance, in January 2021, Olympus Corp. acquired Quest Photonic Devices to strengthen its presence in the surgical endoscopy market.Some of the prominent players in the global endoscopes market include:

-

Olympus Corp.

-

PENTAX Medical

-

Ethicon US, LLC

-

FUJIFILM Holdings Corp.

-

Stryker

-

Boston Scientific Corp.

-

CONMED Corp.

-

Karl Storz GmbH & Co., KG

-

Richard Wolf Medical Instruments

-

Medtronic

Endoscopes Market Report Scope

Report Attribute

Details

Market size value in 2023

USD 20.3 billion

Revenue forecast in 2030

USD 37.1 billion

Growth rate

CAGR of 9.0% from 2023 to 2030

Base year for estimation

2022

Historical data

2016 - 2021

Forecast period

2023 - 2030

Report updated

October 2023

Quantitative units

Revenue in USD million/billion and CAGR from 2023 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, enduse, region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; UK; Germany; Spain; France; Italy; Norway; Sweden; Denmark; China; Japan; India; Australia; South Korea; Thailand; Mexico; Brazil; Argentina; South Africa; Saudi Arabia; UAE; Kuwait

Key companies profiled

Olympus Corp.; Ethicon US, LLC; Fujifilm Holdings Corp.; Boston Scientific Corp.; Karl Storz GmbH & Co., KG; Stryker; PENTAX Medical; Conmed Corp.; Richard Wolf Medical Instruments; Medtronic

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Endoscopes Market Report Segmentation

This report forecasts revenue growth at the global, regional, and country levels and provides an analysis of the latest trends in each of the sub-segments from 2016 to 2030. For this study, Grand View Research, Inc. has segmented the endoscopes market report on the basis of product, end-use, and region:

-

Product Outlook (Revenue, USD Million, 2016 - 2030)

-

Rigid Endoscopes

-

Laparoscopes

-

Arthroscopes

-

Ureteroscopes

-

Cystoscopes

-

Gynecology Endoscopes

-

Neuroendoscopes

-

Bronchoscopes

-

Hysteroscopes

-

Laryngoscopes

-

Sinuscopes

-

Otoscopes

-

Sigmoidoscopes

-

Pharyngoscopes

-

Duodenoscopes

-

Nasopharyngoscopes

-

Rhinoscopes

-

-

Flexible Endoscopes

-

Laparoscopes

-

Arthroscopes

-

Ureteroscopes

-

Cystoscopes

-

Gynecology Endoscopes

-

Neuroendoscopes

-

Bronchoscopes

-

Hysteroscopes

-

Laryngoscopes

-

Sinuscopes

-

Otoscopes

-

Sigmoidoscopes

-

Pharyngoscopes

-

Duodenoscopes

-

Nasopharyngoscopes

-

Rhinoscopes

-

Colonoscopes

-

-

Disposable Endoscopes

-

Laparoscopes

-

Arthroscopes

-

Ureteroscopes

-

Cystoscopes

-

Gynecology Endoscopes

-

Neuroendoscopes

-

Bronchoscopes

-

Hysteroscopes

-

Laryngoscopes

-

Sinuscopes

-

Otoscopes

-

Sigmoidoscopes

-

Pharyngoscopes

-

Duodenoscopes

-

Nasopharyngoscopes

-

Rhinoscopes

-

Colonoscopes

-

-

Capsule Endoscopes

-

Robot Assisted Endoscopes

-

-

End-use Outlook (Revenue, USD Million, 2016 - 2030)

-

Hospitals

-

Outpatient Facilities

-

-

Regional Outlook (Revenue, USD Million, 2016 - 2030)

-

North America

-

U.S.

-

Canada

-

-

Europe

-

UK

-

Germany

-

Italy

-

France

-

Spain

-

Norway

-

Sweden

-

Denmark

-

-

Asia Pacific

-

Australia

-

China

-

Japan

-

India

-

South Korea

-

Thailand

-

-

Latin America

-

Mexico

-

Brazil

-

Argentina

-

-

Middle East Africa

-

South Africa

-

Saudi Arabia

-

UAE

-

Kuwait

-

-

Frequently Asked Questions About This Report

b. The global endoscopes market size was estimated at USD 18.8 billion in 2022 and is expected to reach USD 20.3 billion in 2023.

b. The global endoscopes market is expected to grow at a compound annual growth rate of 9.0% from 2023 to 2030 to reach USD 37.1 billion by 2030.

b. Flexible endoscopes dominated the endoscopes market with a share of 47.2% in 2022. This is attributable to their ergonomics features, increased safety, efficiency, and advancements in medical-optics technology thus driving the demand and consumption of flexible endoscopes.

b. Some key players operating in the endoscopes market include Fujifilm Holdings Corporation; Olympus Corporation LLC; Stryker Corporation; Ethicon Endo-Surgery; Richard Wolf GmbH; Karl Storz; and Boston Scientific Corporation.

b. Key factors that are driving the endoscopes market growth include an increasing geriatric population; a growing preference for minimally invasive surgeries; and a rise in incidences of cancer, gastrointestinal diseases, and other chronic diseases.

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![ESOMAR Certified Member]()

![Great Place to Work Certified]()

ESOMAR & Great Work to Place Certified

![ISO 9001:2015 & 27001:2022 Certified]()

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."