- Home

- »

- Clinical Diagnostics

- »

-

Endocrine Testing Market Size, Share Analysis Report, 2030GVR Report cover

![Endocrine Testing Market Size, Share & Trends Report]()

Endocrine Testing Market Size, Share & Trends Analysis Report By Test Type (FSH, Insulin), By Technology (Tandem Mass Spectrometry, Immunoassay), By End-use, By Region, And Segment Forecasts, 2023 - 2030

- Report ID: 978-1-68038-862-6

- Number of Pages: 180

- Format: Electronic (PDF)

- Historical Range: 2018 - 2021

- Industry: Healthcare

Report Overview

The global endocrine testing market size was estimated at USD 11.3 billion in 2022 and is expected to grow at a compound annual growth rate (CAGR) of 8.4% from 2023 to 2030. The prevalence of diabetes, thyroid, and obesity worldwide has resulted in government funding initiatives for increasing research activities, and rapid technological developments have caused the launch of multiple detection tests as well as novel products by life science companies. The increase in research and development (R&D) in the medical and clinical diagnostics field and the availability of advanced technologies such as biosensors and point-of-care to cater to the growing awareness of routine health monitoring are a few factors attributed to the growth of the market.

The market observed moderate growth at the beginning of the COVID-19 pandemic due to widespread testing for detection of the SARS-CoV2 and the research centered on the development of tools for detection. Therefore, there was a substantial decrease in endocrine testing and research activities. Furthermore, the closure of laboratories added to a reduction in testing. However, the aim of understanding the COVID-19 infection and the known role of thyroid hormone in immune response regulation led the researchers to study thyroid function in COVID-19 patients.

For instance, researchers from Indonesia published in an article in October 2021, that they conducted a meta-analysis study by including 31,339 patients from 21 studies. In their systemic review, the researchers concluded that the risk of COVID-19 increased in patients with age and thyroid abnormalities and even resulted in poor treatment outcomes. This understanding revived the routine endocrine testing over the last year due to the long-term effects of COVID-19 infection in the survivors and is even expected to advance the market growth during the forecast period.

The demand for endocrine testing is growing as there is increased health consciousness and a rising prevalence of lifestyle diseases among adult individuals. This upsurge in awareness has contributed to the increase of home healthcare and point-of-care (POC) devices with faster and more efficient outputs. The home-healthcare and POC devices are easy to operate and are cost-effective alternatives targeting the adult as well as the increasing geriatric population. According to the International Diabetes Federation, 537 million people were already living with diabetes in 2021, and this number is projected to shoot to 643 and 783 million by 2030 and 2045, respectively. These disease projections are likely to impact the market and result in significant growth during the forecast period.

With the growing diseased population, the number of tests employed for endocrinology has organically increased. This increase necessitated the need for many new technological advancements for faster and more reliable results. For instance, the coupling of mass spectroscopy with liquid chromatography (LC/MS) or tandem mass spectrometry (MS/MS) provides results with better precision and accuracy. Moreover, companies like Agilent Technologies, Inc. are also focusing on developing new alternative technologies for analysis, such as the use of LC-ICP-MS for more robust thyroid hormone testing. Such technological developments create huge opportunities for existing and emerging players and are expected to fuel market growth tremendously.

However, the lack of skilled & trained professionals limits accurate diagnosis and restricts market growth. As endocrine function testing requires sample handling & preparation stages, this necessitates skilled as well as technical expertise. The lack of technically strong personnel eventually limits the quality of endocrine testing and results in poor patient outcomes.

Test Type Insights

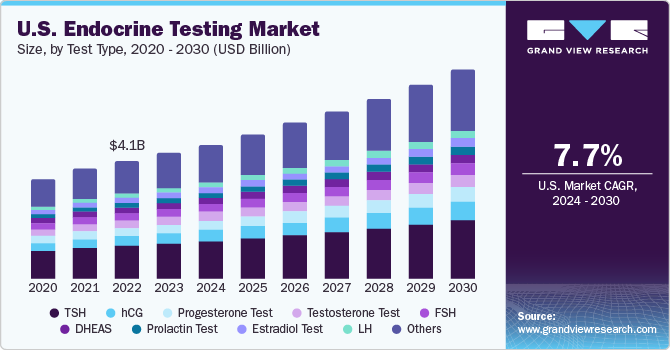

Based on test type, the thyroid stimulating hormone (TSH) testing segment dominated the market in 2022 with a revenue share of 28.0%. TSH is a key regulator in immune response and is also associated with maintaining multiple hormone levels such as progesterone and Human Chorionic Gonadotropin (hCG) among others within the human body. These aforementioned roles of TSH along with the prevalence of thyroid ailments such as cancer drives the TSH testing segment growth.

The hCG testing segment held a significant portion of revenue share in 2022. A high number of easy-to-use self-test pregnancy kits and the need for quantitative estimation of hCG at hospitals or laboratories are contributing to the hCG test’s growth. Moreover, the determination of hCG levels to detect abnormalities during different stages of pregnancy along with the growing fertile female population is also propelling the revenue generation of this segment. Furthermore, the role of hCG in the treatment of infertility in both men & women is expected to drive the market growth.

The insulin testing segment held the second-largest revenue share of 19.5% in 2022 and is expected to demonstrate the fastest CAGR of 9.5% in the forecast period. Studies from scientists have also demonstrated the fact that thyroid dysfunction and diabetes are the most frequently occurring endocrine disorders, which have a large effect on cardiovascular health. As per a scientific article published in December 2021 by researchers from Qatar University, it was observed that the occurrence of thyroid disorders is more prevalent in diabetic patients ranging from 9% to 48%. In addition, the researchers concluded that this prevalence was even higher for women (approximately 32%) than for men in a diabetic population. Such statistics are expected to determine and fuel the insulin testing segment growth during the forecast period.

Technology Insights

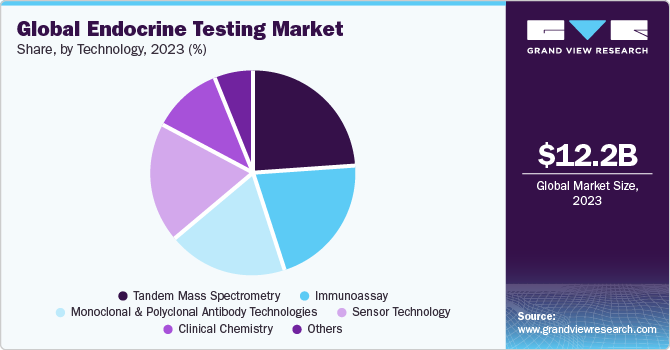

In terms of technology, the tandem mass spectrometry segment held the largest revenue share of 24.5% in 2022 owing to its high use along with liquid chromatography, which helps in generating results with greater accuracy. Mass spectrometry imaging (MSI) also provides crucial information with long imaging times to achieve a high spatial resolution and it has become an important tool in bioanalytical chemistry research due to the improvements in fragmentation techniques along with the introduction of soft ionization. According to an article published in the Journal of the American Society for Mass Spectrometry in September 2022, researchers revealed a novel segmented linear ion trap for multiple-stage tandem mass spectrometry.

The clinical chemistry segment held a significant revenue share in 2022 due to the usage of the products for liquid samples such as plasma, blood, and urine for the presence of any harmful drugs or drug-related chemicals. In addition, tests such as general tests, diagnostic tests, urinalysis & toxicological tests are also included in this segment. They are frequently used to detect chronic disorders including cancer and diabetes, which is expected to fuel the market further. The rise in demand for speedier diagnosis, scientific research & technical developments is anticipated to increase the use of automated clinical chemistry among healthcare and medical professionals.

The sensor technology segment is estimated to register the fastest CAGR of 9.6% over the forecast period due to the increasing use of biosensors in glucose monitoring for diabetes and it is frequently used by individuals for monitoring blood sugar levels in undiluted blood samples. Various organizations are emphasizing designing innovative products to cater to the needs of end-users. For instance, in June 2023, a wearable sensor device U-RHYTHM was developed by endocrine researchers at the University of Bristol, UK that enables the prior detection of diseases related to imbalanced stress hormone levels. The research is expected to completely transform the diagnosis of the stress hormone system. U-RHYTHM automatically extracts blood samples from under the skin every 20 minutes, which further eliminates the need for a blood sample to be taken. It also allows taking blood samples while sleeping, working, and doing other daily activities for up to 72 hours in one session.

In 2022, immunoassay-based detection techniques generated significant revenue in the market. This is due to multiple instruments and analyzers that use different types of immunoassay technologies for detection. In addition, the presence of immunoassay-based test panels for endocrine and reproductive functions offered by many key players further contributes to the highest revenue generation of the segment.

End-use Insights

Based on end-use, the hospitals segment held the largest revenue share of 69.3% in 2022, which can be attributed to the well-equipped diagnostic rooms, higher purchasing power, existence of highly skilled healthcare professionals, and improvised health coverage in hospital-based healthcare services from various private and group insurance plans. Hospitals are the centers for disease identification as well as further treatment.In addition, patients suffering from various diseases are advised to stay longer in hospitals, thereby boosting the hospital segment. For instance, according to a study published in the Journal of Clinical Endocrinology and Metabolism in May 2022, people with untreated hypothyroidism are at greater risk for longer hospital stays and higher rates of readmission.

Furthermore, the commercial laboratories segment is expected to observe the fastest CAGR of 9.4% over the forecast period. The availability of a variety of test panels and the feasibility of at-home collection services are boosting the revenue generation of this segment. This can be attributed to the growing health consciousness among individuals and the continuous endocrine testing to monitor existing diseases and control predisposed hereditary conditions. In addition, the availability of reports over digital platforms by these commercial settings furthers their growth trajectory. For example, Laboratory Corporation of America Holdings or LabCorp, a U.S.-based diagnostics company in February 2022 launched a digital portal allowing online orderings of tests, and subsequently in April 2022, the company also launched a diagnostic test collection service at home.

Regional Insights

North America dominated the market in 2022 with the largest revenue share of 41.1%. This can be attributed to factors such as the high number of diabetic and obese population, affordable & accessible options due to the presence of reimbursing bodies, government funding initiatives for the betterment of healthcare settings, as well as the availability of multiple diagnostic companies. For example, the American Thyroid Association, an organization dedicated to supporting research for the treatment of thyroid diseases has funded over USD 2.8 million across 105 grants since the inception of its funding program. In addition, key players in this region drive the competition, resulting in multiple product offerings in the market.

Asia Pacific is expected to grow at the fastest CAGR of 9.8% during the forecast period owing to factors such as the developing medical & diagnostics industry, better healthcare systems, prevalence of diseases among the geriatric population, and growing personal healthcare expenditures that have resulted in fueling the demand for routine endocrine testing in the Asia Pacific. According to Korea Biomedical Review, the number of people over 60 years of age is expected to grow over 25% of the population in the region by 2050 making it the fastest-growing region for healthcare investment. In addition, the region is also observing growing research activities toward understanding diseases leading to better disease diagnosis & treatment.

Key Companies & Market Share Insights

The market witnessed increasing competition due to various new product launches such as instruments, kits, and test panels as well as the development of new technologies for the detection of hormone levels. For instance, in November 2021, Bloom Diagnostics, a Swiss innovative medtech company that develops smart testing systems for various medical conditions launched a Bloom Thyroid Test to detect hypothyroidism. The self-testing, single-use kit is used to test thyroid-stimulating hormone (TSH) to detect thyroid dysfunction in adults.

In addition, in August 2020, DiaSorin S.p.A announced that it has launched, the LIAISON Testosterone xt test with CE marking. This test is compatible with the company’s instrument, LIAISON XL for endocrine assay development to detect hypogonadism as well as hyperandrogenism. This launch also furthered DiaSorin’s existing endocrine and fertility panel of tests. Such initiatives are expected to drive the market growth and increase market competition. Some prominent players in the global endocrine testing market include:

-

Abbott Laboratories

-

AB Sciex

-

Agilent Technologies Inc.

-

bioMerieux SA

-

Bio-Rad Laboratories Inc.

-

DiaSorin S.p.A.

-

F. Hoffmann-La Roche Ltd.

-

Laboratory Corporation of America Holdings

-

Quest Diagnostics Incorporated

-

Ortho Clinical Diagnostics

Endocrine Testing Market Report Scope

Report Attribute

Details

Market size value in 2023

USD 12.20 billion

Revenue forecast in 2030

USD 21.42 billion

Growth rate

CAGR of 8.4% from 2023 to 2030

Base year for estimation

2022

Historical data

2018 - 2021

Forecast period

2023 - 2030

Quantitative units

Revenue in USD million/billion and CAGR from 2023 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Test type, technology, end-use, region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; UK; Germany; France; Italy; Spain; Denmark; Sweden; Norway; China; Japan; India; Australia; South Korea; Thailand; Brazil; Mexico; Argentina; Saudi Arabia; South Africa; UAE; Kuwait

Key companies profiled

Abbott Laboratories; AB Sciex; Agilent Technologies Inc.; bioMerieux SA, Bio-Rad Laboratories; DiaSorin S.p.A.; F. Hoffmann-La Roche Ltd; Laboratory Corporation of America Holdings; Quest Diagnostics Incorporated; Ortho Clinical Diagnostics;

Customization scope

Free report customization (equivalent up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional & segment scope

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Endocrine Testing Market Report Segmentation

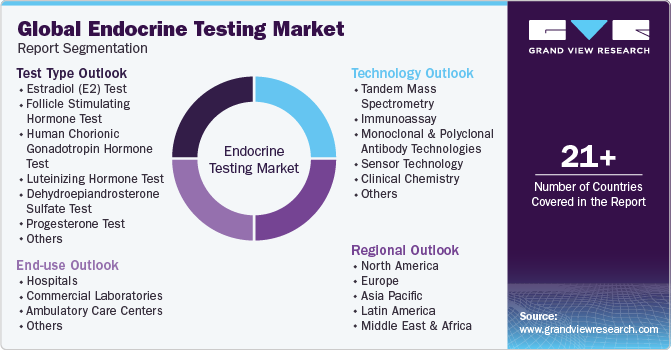

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global endocrine testing market report based on test type, technology, end-use, and region:

-

Test Type Outlook (Revenue, USD Million, 2018 - 2030)

-

Estradiol (E2) Test

-

Follicle Stimulating Hormone (FSH) Test

-

Human Chorionic Gonadotropin (hCG) Hormone Test

-

Luteinizing Hormone (LH) Test

-

Dehydroepiandrosterone Sulfate (DHEAS) Test

-

Progesterone Test

-

Testosterone Test

-

Thyroid Stimulating Hormone (TSH) Test

-

Prolactin Test

-

Cortisol Test

-

Insulin Test

-

Others

-

-

Technology Outlook (Revenue, USD Million, 2018 - 2030)

-

Tandem Mass Spectrometry

-

Immunoassay

-

Monoclonal & Polyclonal Antibody Technologies

-

Sensor Technology

-

Clinical Chemistry

-

Others

-

-

End-use Outlook (Revenue, USD Million, 2018 - 2030)

-

Hospitals

-

Commercial Laboratories

-

Ambulatory Care Centers

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

Sweden

-

Norway

-

Denmark

-

-

Asia Pacific

-

China

-

Japan

-

India

-

Australia

-

Thailand

-

South Korea

-

-

Latin America

-

Brazil

-

Mexico

-

Argentina

-

-

Middle East and Africa

-

Saudi Arabia

-

South Africa

-

UAE

-

Kuwait

-

-

Frequently Asked Questions About This Report

b. The global endocrine testing market size was estimated at USD 11.3 billion in 2022 and is expected to reach USD 12.20 billion in 2023.

b. The global endocrine testing market is expected to grow at a compound annual growth rate of 8.4% from 2023 to 2030 to reach USD 21.42 billion by 2030.

b. North America dominated the endocrine testing market with a share of 41.1% in 2022. This is attributable to the presence of well-established healthcare infrastructure, rising prevalence of diabetic & obese population and favorable healthcare reimbursement scenarios in the North American region.

b. Some key players operating in the global endocrine testing market include Abbott Laboratories; AB Sciex; Agilent Technologies, Inc.; bioMerieux SA, Bio-Rad Laboratories, Inc.; DiaSorin S.p.A; F. Hoffmann-La Roche Ltd.; Ortho Clinical Diagnostics; Laboratory Corporation of America Holdings (LabCorp); and Quest Diagnostics Incorporated.

b. Key factors that are driving the global endocrine testing market growth include growing incidences of life style diseases, endocrine disorders & awareness of reproductive functions such as obesity, hyperthyroidism, diabetes, infertility and adrenal insufficiency.

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![ESOMAR Certified Member]()

![Great Place to Work Certified]()

ESOMAR & Great Work to Place Certified

![ISO 9001:2015 & 27001:2022 Certified]()

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."

Important: Covid19 pandemic market impact

The most common concern for the governments of all Covid-19 hit nations is the excruciating need to screen for and test large numbers of patients for possible Sars-Cov-2 infection. As a result, most of them are facing major shortages in the supply for diagnostic kits to test for the virus. Diagnostics virology entities are under immense pressure to provide reliable testing kits, and there is a surge in demand for in-vitro or point-of-care testing capacities by labs across a large number of countries. The report will account for Covid19 as a key market contributor.