- Home

- »

- Advanced Interior Materials

- »

-

Electrical Steel Market Size, Share & Growth Report, 2029GVR Report cover

![Electrical Steel Market Size, Share & Trends Report]()

Electrical Steel Market Size, Share & Trends Analysis Report By Product (GOES, NGOES), By Application (Transformer, Motor, Inductor), By Region (North America, Europe, APAC, CSA, MEA), And Segment Forecasts, 2022 - 2029

- Report ID: GVR-4-68038-029-3

- Number of Pages: 90

- Format: Electronic (PDF)

- Historical Range: 2017 - 2020

- Industry: Advanced Materials

Report Overview

The global electrical steel market size was evaluated at USD 24.59 billion in 2021 and is expected to grow at a compounded annual growth rate (CAGR) of 5.3% from 2022 to 2029. Increasing electricity generation worldwide is one of the key driving factors for market growth. As the name implies, electrical steel possesses enhanced electrical properties such as high permeability, high electrical resistivity, low hysteresis loss, and low magnetostriction. These properties make it highly desirable for applications related to electricity consumption, distribution, and generation.

Electrical steel finds application in generators, electric motors, relay, solenoid, and other electromagnetic devices, which are further used in power distribution systems and other related applications. The U.S. is the second-largest electricity generator in the world. In 2020, the country generated around 4,000 TWh of electricity from its utility-scale generators and reported an increase of 16.7% from 2019 in power generation by renewables.

The growth in the electric vehicles (EVs) industry is another growth driver for the market. Electrical steel contains specific magnetic properties, which makes it of vital use in rotors and stators in the motor of an EV. The product helps enhance motor efficiency by minimizing core energy losses and accelerating the vehicle’s range.

Despite the pandemic, which majorly affected the global economic growth, the plug-in vehicle sales were around 3.24 million in 2020, over 43% higher than in 2019. With an increase of 137% in EV sales from 2019 to 2020, Europe surpassed China and became the largest EV market in 2020. Rising EV production propels the use of electric motors, thus, boosting electrical steel consumption.

The rising demand for electrical steel has compelled manufacturers to expand their production. For instance, in May 2021, JSW Steel and JFE Steel Corporation signed an MoU to begin a feasibility study for establishing a joint venture company in India for manufacturing and sales of electrical steel sheets in the country.

Product Insights

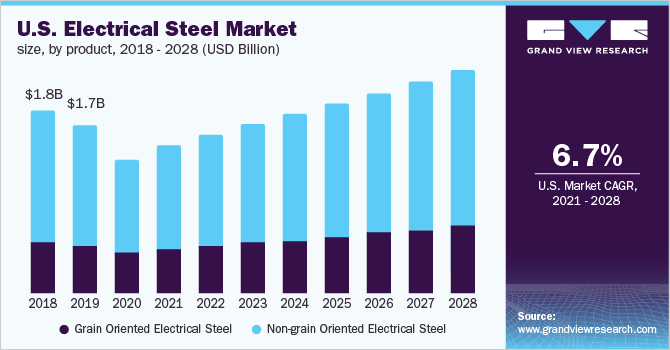

In terms of revenue, the Non-grain Oriented Electrical Steel (NGOES) dominated the market for electrical steel and accounted for the largest revenue share of more than 70.0% in 2020. NGOES finds application in the entire energy value chain from generators to electric motors and appliances. It is available in numerous grades depending upon properties, composition, and applications.

Grain-oriented Electrical Steel (GOES) mainly finds application in transformers and charging infrastructure of EVs. It has high magnetic induction and stacking factor enabling less usage of the material in the winding of the core. Its magnetic properties reduce core losses and provide economical and efficient solutions for transformers.

GOES is used in various types of transformers and is available in different grades. The grades are differed based on their thickness. The product segment is anticipated to register a higher growth rate compared to NGOES over the forecast period. Increasing production of transformers is propelling the segment growth. Its smaller market share can be attributed to its high cost compared to NGOES.

Application Insights

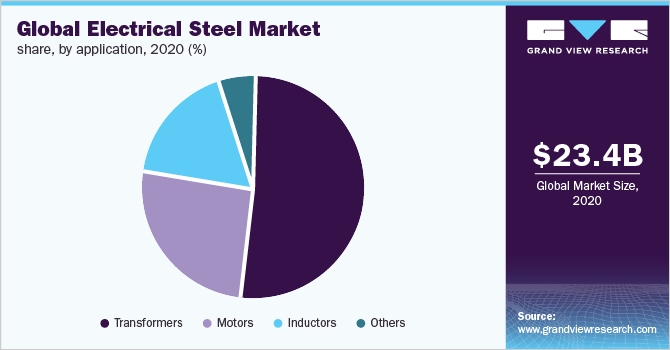

In 2020, the transformer segment held the largest revenue share of more than 52.0% of the overall market. Increasing complexity in electrical grids, penetration of EVs, rise in digital loads, and growth in decentralized generation have augmented the need for transformers.

The rising need for transformers has compelled companies to expand their production capacities. For instance, in February 2021, a new power transformer plant was commissioned in Kerala, India. The new plant was set up with an investment worth ₹12.5 crores (~USD 1.7 million). The annual production capacity of the plant for manufacturing power transformers up to 25 MVA, 132kV class is expected to be 1,500 MVA.

The motor segment is anticipated to register the fastest growth rate across the forecast period. The high frequency, high permeability, and excellent magnetic properties of electrical steel make it preferable in electric motors. Increasing emphasis on EV production is propelling the need for electric motors, which is eventually expected to benefit market growth.

Compared to motors used in industrial machinery, electric motors provide four times higher speed. High speed can cause the generation of significant heat, which can impact a vehicle’s performance by increasing core losses and putting extreme mechanical stress on motor components. Electrical steel overcomes this situation owing to its properties making it reliable and increasing the durability of the motor.

Regional Insights

Asia Pacific dominated the electrical steel market and accounted for the largest revenue share of more than 71.0% in 2020. Based on region, North America held a revenue share of more than 8.0% of the global market in 2020. Growing emphasis on power generation and EV production in the region has propelled the need for electric motors and charging stations, which in turn is driving the market for electrical steel. For instance, in March 2021, Foxconn announced to build EVs in North America by 2023. The company plans to invest NTD 10 billion (~USD 354 million) for the next three years for EV-related and other operations.

With increasing investments in the EV industry, companies are emphasizing electric motors as well. For instance, in April 2021, Exro Technologies Inc. announced its plan to open a 37,000 square foot manufacturing facility in Calgary, Canada. The company has developed a new class of power electronics with its patented coil driver technology for enhancing the performance of electric motors and batteries. With this new facility, the company aims to cater to the growing consumer EV market.

Europe was the second-largest regional segment of the market for electrical steel in 2020. The EV market is the key growth driver for the consumption of electrical steel in the region. With 1.4 million EVs sold, Europe held a 45% share of global EV sales in 2020. The growing EV market attracted foreign companies to invest in the region.

For instance, in November 2020, Nidec announced to build an EV factory in Serbia with an investment of JPY 200 billion (~USD 1.9 billion) to expand its foothold in Europe and compete against Chinese players. The facility is expected to have an annual production capacity of 300,000 motors by 2023.

Key Companies & Market Share Insights

The market for electrical steel is highly competitive in nature owing to the presence of several major players. The key players have a competitive edge such as advanced technology, significant research activities, and a strong foothold in regional markets. The COVID-19 pandemic had major repercussions on supply-chain activities and sales, which even caused several manufacturers to face losses. To compete in the market and overcome the losses, the market players of the industry are adopting numerous strategies, such as upgrading plants to cater high-quality products to customers. For instance, in April 2020, Shougang Qian’an Electric Vehicle Electrical Steel Co., Ltd. ordered a New 6-stand Hyper Universal Crown Control mill for the production of high-grade electrical steels from Primetals Technologies. Some of the prominent players in the electrical steel market include:

-

ArcelorMittal

-

Cleveland-Cliffs Corporation

-

JFE Steel Corporation

-

Nippon Steel Corporation

-

POSCO

-

Tata Steel

-

thyssenkrupp AG

Recent Development

-

In May 2023, JFE Steel announced the expansion of its initial electric steel sheet capacity and the addition of a second phase expansion at its West Works’ Kurashiki steel plant. This expansion will upgrade to top-class technologies and advanced steel products, reducing CO2 emissions and playing a part in making the planet more sustainable.

-

In April 2023, Posco and Honda partnered together to speed up their journey by utilizing each other's expertise to become carbon neutral. Moreover, this partnership aims for future cooperation in environmental and electric technology.

-

In July 2022, JFE Steel Corporation acquired EcoLeaf for the tinplate products, JFE Universal Brite, and tin-free steel through the SuMPO EPD program in Japan. The transparency of JFE goods’ environmental factors will be enhanced by the data visualization made possible by Ecoleaf.

Electrical Steel Market Report Scope

Report Attribute

Details

Market size value in 2021

USD 24.59 billion

Revenue forecast in 2029

USD 35.98 billion

Growth Rate

CAGR of 5.3% from 2022 to 2029

Base year for estimation

2021

Historical data

2017 - 2020

Forecast period

2022 - 2029

Quantitative units

Revenue in USD billion and CAGR from 2022 to 2029

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segment Scope

Product, application, region

Region scope

North America; Europe; Asia Pacific; Central & South America; MEA

Country scope

U.S.; Canada; Mexico; Germany; Russia; Turkey; France; Italy; Japan; China; India; South Korea; Brazil; Iran

Key companies profiled

ArcelorMittal; Cleveland-Cliffs Corporation; JFE Steel Corporation; Nippon Steel Corporation; POSCO; Tata Steel; thyssenkrupp AG

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Segments Covered in the ReportThis report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2017 to 2029. For this study, Grand View Research has segmented the global electrical steel market report based on product, application, and region:

-

Product Outlook (Volume, Kilotons; Revenue, USD Million, 2017 - 2029)

-

Grain oriented electrical steel

-

Non-grain oriented electrical steel

-

-

Application Outlook (Volume, Kilotons; Revenue, USD Million, 2017 - 2029)

-

Transformer

-

Motor

-

Inductor

-

Other

-

-

Regional Outlook (Volume, Kilotons; Revenue, USD Million, 2017 - 2029)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

Russia

-

Turkey

-

France

-

Italy

-

-

Asia Pacific

-

China

-

India

-

Japan

-

South Korea

-

-

Central & South America

-

Brazil

-

-

Middle East & Africa

-

Iran

-

-

Frequently Asked Questions About This Report

b. Increasing electricity generation and growth in EV production are key growth drivers of the electrical steel market.

b. The global electrical steel market size was estimated at USD 23.4 billion in 2020 and is expected to reach USD 25.12 billion in 2021.

b. The electrical steel market is expected to grow at a compound annual growth rate of 4.9% from 2020 to 2028 to reach USD 34.3 billion by 2028.

b. The transformer was the key application segment of the market with a revenue share of above 52.0% of the electrical steel market in 2020.

b. Some of the key players operating in the electrical steel market are ArcelorMittal, Tata Steel, JFE Steel Corporation, ThyssenKrupp AG, and POSCO

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![ESOMAR Certified Member]()

![Great Place to Work Certified]()

ESOMAR & Great Work to Place Certified

![ISO 9001:2015 & 27001:2022 Certified]()

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."

Important: Covid19 pandemic market impact

The mining industry accounts for a vital share of the global economy and is responsible for supplying key raw materials for several applications and end-use industries, thus being a key sector of focus amidst the ongoing pandemic outbreak. Mining industries in China are expected to return to normal operations by Q3 of 2020 as enterprises indicated towards the returning of their workers soon. Moreover, Iron ore producers are known to be the least impacted. Major players such as BHP and Vale reported experiencing no major influence on their operations due to the COVID-19 virus. The iron ore prices reached above USD 90 per ton amidst the pandemic situation which may negatively impact the end-use industries. The report will account for Covid19 as a key market contributor.