- Home

- »

- Medical Devices

- »

-

DNA Sequencing Market Size, Share & Trends Report, 2030GVR Report cover

![DNA Sequencing Market Size, Share & Trends Report]()

DNA Sequencing Market Size, Share & Trends Analysis Report By Product & Services (Consumables, Instruments), By Application (Oncology, HLA Typing), By Technology, By Workflow, By End-use, By Region, And Segment Forecasts, 2023 - 2030

- Report ID: GVR-4-68039-070-4

- Number of Pages: 130

- Format: Electronic (PDF)

- Historical Range: 2018 - 2021

- Industry: Healthcare

Report Overview

The global DNA sequencing market size was estimated at USD 8.91 billion in 2022 and is anticipated to grow at a compound growth rate (CAGR) of 20.7% over the forecast period. Rapid advancements in sequencing technology and bioinformatics have enabled the identification of DNA variations. These advancements also determine variants associated with increased risk for disease. With the widespread application of next-generation sequencing (NGS) and whole-genome sequencing (WGS), a large range of genes can be tested in a single diagnostic platform simultaneously, which expands the utility of DNA sequencing in clinical diagnosis applications.

Personalized targeted sequencing of tumor accelerates the identification of mutations and further identifies cancer target or pathway for which pharmacological treatments are developed. The emergence of global-scale projects incorporating NGS protocols generates new foundational knowledge about oncology precision medicine.

Transform Oncology Care, a precision medicine program launched by CVS Health in December 2019, leverages genomics technology to plan personalized cancer treatment plans. An exponential rise in COVID-19 cases has driven the demand for these technologies on a large scale as well as rapid genomic sequencing projects in monitoring the viral spread and guide treatments in the future. The National Health Service of the UK, Genomics England, and Genetics of Mortality in Critical Care partnered with Illumina to generate whole-genome sequences of 35,000 COVID-19-affected UK citizens in May 2020.

DNA sequencing has brought a paradigm shift in proteomic and genomic research as it is a highly accurate and high-throughput technology used for various applications, such as de novo assembly, WGS, and DNA resequencing. This technology is readily adopted in several academic research institutes for research studies. Illumina installed NovaSeq 6000 Sequencing System at the Whitehead Institute for Biomedical Research, Massachusetts, U.S., in June 2020.

Efforts were undertaken by the Center for Medicare and Medicaid Services (CMS), the Association for Molecular Pathology, and commercial payers, such as Blue Cross Blue Shield and Aetna, to boost the clinical usage of sequencing technologies, which drives the market for DNA sequencing. For instance, in January 2020, CMS expanded the coverage of NGS-based diagnostic tests for ovarian and breast cancer patients, providing more opportunities for patients to personalize their cancer care.

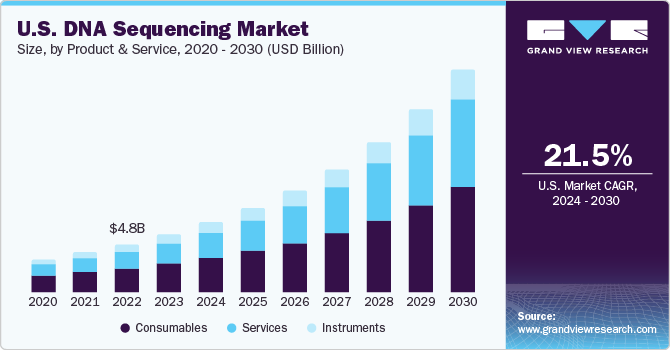

Product & Services Insights

In terms of products & services, the consumables segment dominated the market in 2022 with the largest revenue share. The wide availability of reagents and kits to cater to all library construction steps, such as DNA fragmentation, enrichment, adapter ligation, amplification, and quality control, contributes to a larger segment share. Most of these tools feature streamlined and simplified workflows, ready-to-use components, and compatibility with low-input and formalin-fixed specimens.

The continuous introduction of reagents and kits to make WGS more accessible and affordable also drives the segment in the market for DNA sequencing. For instance, in August 2020, Illumina Inc. launched the NovaSeq 6000 v1.5 Reagent Kit, which made the WGS technique more cost-effective and accessible for all laboratories and reduced the cost of sequencing a human genome to USD 600. These new kits can be used across WGS, single-cell genomics, and liquid biopsy techniques.

The services segment is expected to grow at the fastest CAGR during the forecast period as it offers rapid turnaround time, outstanding customer service, and technical support. Sequencing services unravel several sequencing challenges, such as uneven base distributions and multiple hairpin loops. The service provider’s proprietary reagents and streamlined technology platforms ensure highly accurate performance, and their highly experienced team assists with customers’ special requirements.

Technology Insights

In terms of technology, the NGS segment dominated the market in 2022 for DNA sequencing and held the largest revenue share. The radical advances in these technologies, and the declining cost of sequencing, have made genome sequencing faster, more affordable, and more accurate. In addition, NGS technology is gaining popularity as a routine clinical diagnostic test, particularly with the COVID-19 pandemic, which positively impacts the segment’s revenue share.

In June 2020, Illumina recently received Emergency Use Authorization (EUA) from the FDA for its COVIDSeq Test, which is used to sequence the full genome of the novel SARS-CoV-2 virus. This test along with high-throughput NovaSeq 6000 hardware of Illumina, is capable of processing more than 3,000 samples and offers results within 24 hours. Similarly, in April 2020, Helix OpCo LLC received EUA for its Helix COVID-19 NGS Test for detecting SARS-CoV-2 infection.

The third-generation sequencing methods, such as nanopore and single-molecule real-time sequencing, are projected to witness a considerable CAGR during the forecast period. This technology overcomes the issues of second-generation techniques as it includes easy sample preparation without the need for PCR amplification with faster speed. Moreover, it generates long reads exceeding numerous kilobases to detect repetitive sites of complex genomes.

Workflow Insights

In terms of workflow, the sequencing segment held the largest revenue share in 2022. Is Sequencing is a major step in the entire workflow. This step enables the sequence profiling of the genome and DNA-protein interactions. It is an integral part of the entire DNA sequencing workflow in research and discovery studies, accounting for a larger share. The ability of sequencers to generate a large amount of data in a relatively short period accelerates understanding of human health and disease treatments.

In addition, the advent of Paired-End (PE) sequencing results in the advancement of this workflow, further contributing to segment growth. PE sequencing allows the DNA fragments to sequence from both ends, which produces twice the number of reads in a similar time.

Data analysis workflow segment is projected to witness a significant CAGR during the forecast period. In recent years, commercial cloud computing solutions have matured rapidly. This segment creates new data centers, adds services, reduces prices, and generates notable profits to run existing genomics software. These platforms have resulted in technological advancements in data integration tools, which help analyze and process massive, sequenced data.

Application Insights

In terms of revenue, the oncology segment dominated the market in 2022 with the largest revenue share. The technology holds great potential in clinical research and cancer diagnostics and therapeutics development. The value of these technologies in companion diagnostics and precision medicine is widely recognized by clinicians and companies. For instance, in August 2020, the FDA approved the first liquid biopsy companion diagnostic that leverages NGS technology to guide cancer treatment. The Guardant360 CDx assay promotes less invasive testing and the simultaneous mapping of several biomarkers of genomic alterations in the tumor.

The consumer genomics segment is anticipated to witness the fastest CAGR during the forecast period. This is attributed to the rapid proliferation of paternity testing, genealogy, ancestry, and personal health awareness. Biotechnology companies, such as AncestryDNA, Helix Opto LLC, and 23andMe, are involved in providing the “Personal Genome Service”, along with the emergence of other small-mid-sized companies operating in the consumer genomics sector.

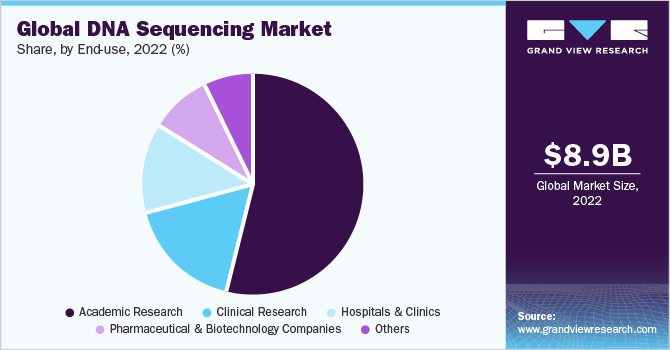

End-use Insights

In terms of end-use, the academic research segment dominated the market in 2022 with a revenue share of 53.9%, owing to the wide acceptability of Sanger technology and NGS in academic and institutional research projects. In addition, a rise in funding and investment programs augment the demand of these entities for DNA sequencing products, resulting in a larger revenue share.

In January 2020, the Intelligence Advanced Research Projects Activity provided USD 23.0 million to the Broad Institute and Harvard University, and DNA Script. The entities have been working together to explore the possibility of combining the enzymatic DNA synthesis technology and NGS into a single instrument for more than four years. This consortium further plans to partner with Illumina to utilize its sequencing-by-synthesis technology.

The clinical research segment is expected to grow at the fastest CAGR of 22.4% during the forecast period owing to an increase in the incorporation of NGS products and services in several clinical laboratories due to several strategic alliances among the clinical laboratories and companies. As of July 2020, a high throughput NGS clinical laboratory, Optogenetics Corporation, signed an agreement to supply Swift 2S Turbo DNA Library Kits from Swift Biosciences, Inc. to ramp up its NGS-based clinical services.

Regional Insights

North America dominated the market in 2022 with the largest revenue share of 49.2% due to high investment in R&D, technological developments by key players, and advanced healthcare infrastructure. Several government initiatives in the U.S. and Canada support research in drug development and treatment of cancer.

For instance, the Personalized Onco-Genomics program of the British Columbia (BC) Cancer Foundation, a part of the Provincial Health Services Authority in BC, Canada, utilizes transcriptome and whole-genome analysis to determine cancer genes and identify corresponding drugs. These drugs can inhibit the relevant pathways in cancer-affected patients. Such public programs are expected to boost the application of these technologies in the region.

In Asia Pacific, the regional market for DNA sequencing is projected to witness a lucrative CAGR of 22.9% over the forecast period. Strategic initiatives undertaken by international firms to expand their presence due to the high customer base are expected to create numerous opportunities for regional growth.

Key Companies & Market Share Insights

The market is highly competitive and key players are undertaking strategies such as mergers & acquisitions, product launches, and collaborations to expand their global reach. In September 2022, Illumina Inc. announced the launch of production-scale sequencers, NovaSeq X Series. It is expected to push the limits of genomic medicine, enabling more powerful, sustainable, and faster sequencing. Some prominent players in the global DNA sequencing market include:

-

Agilent Technologies, Inc.

-

Thermo Fisher Scientific, Inc.

-

Illumina, Inc.

-

QIAGEN

-

F. Hoffmann-La Roche Ltd.

-

Oxford Nanopore Technologies plc.

-

Macrogen, Inc.

-

PerkinElmer U.S. LLC.

-

PacBio

-

BGI

-

Bio-Rad Laboratories, Inc.

-

Myriad Genetics, Inc.

-

PierianDx

-

Intrexon Bioinformatics Germany GmbH

-

Eurofins Scientific

DNA Sequencing Market Report Scope

Report Attribute

Details

Market size value in 2023

USD 10.66 billion

Revenue forecast in 2030

USD 39.71 billion

Growth rate

CAGR of 20.7% from 2023 to 2030

Base year for estimation

2022

Historical data

2018 - 2021

Forecast period

2023 - 2030

Report updated

September 2023

Quantitative units

Revenue in USD million/billion and CAGR from 2023 to 2030

Report coverage

Revenue forecast, company share, competitive landscape, growth factors, and trends

Segments covered

Product & services, technology, workflow, application, end-use, region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; UK; Germany; France; Italy; Spain; Denmark; Sweden; Norway; China; Japan; India; Australia; South Korea; Thailand; Brazil; Mexico; Argentina; Saudi Arabia; South Africa; UAE; Kuwait

Key companies profiled

Agilent Technologies, Inc.;Thermo Fisher Scientific, Inc.; Illumina, Inc.; QIAGEN; F. Hoffmann-La Roche Ltd.; Oxford Nanopore Technologies plc; Macrogen, Inc.; PerkinElmer U.S. LLC.; PacBio; BGI;Bio-Rad Laboratories, Inc.; Myriad Genetics, Inc.; PierianDx; Intrexon Bioinformatics Germany GmbH; Eurofins Scientific

Customization scope

Free report customization (equivalent up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global DNA Sequencing Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global DNA sequencing market report based on product and services, technology, workflow, application, end-user, and region:

-

Product & Services Outlook (Revenue, USD Million, 2018 - 2030)

-

Consumables

-

Instruments

-

Services

-

-

Technology Outlook (Revenue, USD Million, 2018 - 2030)

-

Sanger Sequencing

-

Next-Generation Sequencing

-

Whole Genome Sequencing (WGS)

-

Whole Exome Sequencing (WES)

-

Targeted Sequencing & Resequencing

-

-

Third Generation DNA Sequencing

-

Single-Molecule Real-Time Sequencing (SMRT)

-

Nanopore Sequencing

-

-

-

Workflow Outlook (Revenue, USD Million, 2018 - 2030)

-

Pre-sequencing

-

Sequencing

-

Data Analysis

-

-

Application Outlook (Revenue, USD Million, 2018 - 2030)

-

Oncology

-

Reproductive Health

-

Clinical Investigation

-

Agrigenomics & Forensics

-

HLA Typing/Immune System Monitoring

-

Metagenomics, Epidemiology & Drug Development

-

Consumer Genomics

-

Others

-

-

End-use Outlook (Revenue, USD Million, 2018 - 2030)

-

Academic Research

-

Clinical Research

-

Hospitals & Clinics

-

Pharmaceutical & Biotechnology Companies

-

Other Users

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

Sweden

-

Norway

-

Denmark

-

-

Asia Pacific

-

China

-

Japan

-

India

-

Australia

-

Thailand

-

South Korea

-

-

Latin America

-

Brazil

-

Mexico

-

Argentina

-

-

Middle East and Africa

-

Saudi Arabia

-

South Africa

-

UAE

-

Kuwait

-

-

Frequently Asked Questions About This Report

b. The global DNA sequencing market size was estimated at USD 8.91 billion in 2022 and is expected to reach USD 10.66 billion in 2023.

b. The global DNA sequencing market is expected to grow at a compound annual growth rate of 20.6% from 2023 to 2030 to reach USD 39.71 billion by 2030.

b. North America dominated the DNA sequencing market with a share of 49.3% in 2022. Continuous technological developments by key players, high investment in R&D, and availability of technologically advanced healthcare infrastructure have resulted in North America’s leading share in the global market.

b. Some key players operating in the DNA sequencing market include Agilent Technologies, Inc.; Thermo Fisher Scientific, Inc.; Illumina, Inc.; QIAGEN; F. Hoffmann-La Roche Ltd.; Oxford Nanopore Technologies Ltd.; Macrogen, Inc.; Perkin Elmer, Inc.; Pacific Biosciences of California, Inc.; BGI; Bio-Rad Laboratories, Inc.; Myriad Genetics; PierianDx; Eurofins Scientific; and Intrexon Bioinformatics Germany GmbH.

b. Key factors driving the DNA sequencing market include a rise in the incidence of genetic disorders and cancer, declining cost of genetic sequencing, technological advancements in sequencing techniques, and data integration, and an increase in the penetration rate of companion diagnostics and personalized medicine.

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![ESOMAR Certified Member]()

![Great Place to Work Certified]()

ESOMAR & Great Work to Place Certified

![ISO 9001:2015 & 27001:2022 Certified]()

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."

Important: Covid19 pandemic market impact

Biopharmaceutical innovators are at the forefront of the human response to the coronavirus pandemic. A significant number of major biotech firms are in the midst of a race to investigate the Sars-Cov-2 genome and prepare a viable vaccine for the same. As compared to the speed of response to SARS/MERs etc, the biotech entities are investigating SARs-Cov-2 at an unprecedented rate and a considerable amount of funds are being put into the R&D. With multiple candidates in trial, the public and private sectors are anticipated to work in unison for the foreseeable period, until a vaccine is developed for Covid-19. The report will account for Covid19 as a key market contributor.