- Home

- »

- Sensors & Controls

- »

-

Distributed Fiber Optic Sensor Market Share Report, 2030GVR Report cover

![Distributed Fiber Optic Sensor (DFOS) Market Size, Share & Trends Report]()

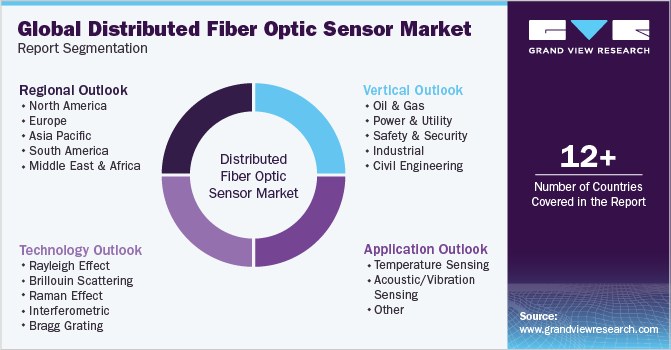

Distributed Fiber Optic Sensor (DFOS) Market Size, Share & Trends Analysis Report By Vertical (Oil & Gas, Industrial), By Technology (Rayleigh Effect, Raman Effect), By Application, And Segment Forecasts, 2023 - 2030

- Report ID: GVR-1-68038-462-8

- Number of Pages: 154

- Format: Electronic (PDF)

- Historical Range: 2017 - 2021

- Industry: Semiconductors & Electronics

Report Overview

The global DFOS market size was valued at USD 1.44 billion in 2022 and is expected to grow at a compound annual growth rate (CAGR) of 6.8% from 2023 to 2030. Rising need among enterprises and corporations to engage in effective sensing operations of their machine systems is offering growth opportunities to the market. Application of optic sensing has increased substantially across various business sectors, including automotive, aerospace, civil, energy, and others. Other types of sensing technologies, such as Raman Effect-based and Rayleigh’s effect-based sensing, also have distinct operational capabilities.

High functionality of Distributed Fiber Optic Sensors (DFOS) is encouraging more enterprises to invest in the technology and engage in R&D practices. This results in development of new products, thereby offering companies opportunity to capture a larger industry share. Corporations aim to optimize their production practices and regulate the efficiency to overtake all other substitutes of fiber optics technology. High cost of deployment and installation of DFOS products further promotes companies to develop competitively-priced optic inspection products that are more reliable.

Technologies, such as Optical Time Domain Reflectometry (OTDR) and Optical Frequency Domain Reflectometry (OFDR), characterize fiber optics by carrying out a quality inspection of accuracy, range, and resolution of key trends observed in the industry. Integration of advanced technologies, such as Real-Time Thermal Rating (RTTR) and intelligent Distributed Acoustic Sensor (iDAS) technologies, are other prominent trends. An increasing number of investments to carry out R&D activities to introduce innovative fiber cables and provide reliable connectivity at high speed.

The virtue of the technology to offer optimum performance in challenging end-uses is one of the significant market drivers. Optical fibers enable professionals to monitor and control heavy operations used in pipelines, border security, and civil engineering. Deployment of fiber optic cables offers companies better cost-saving opportunities than metal wires due to their high transmission capacity. The high efficiency and high speed of transmission capabilities in remote and inaccessible places promote corporations to deploy the technology.

COVID-19 Impact Insights

COVID-19 pandemic has impacted the industry significantly. Implementation of lockdowns in several geographies resulted in a temporary shutdown of industries or working with downsized teams. This has resulted in lesser production activities and reduced product development, thereby lowering the adoption of fiber optics in industrial and civil engineering industries. However, changing manufacturing practices and the need to deploy fiber optics in mission-critical scenarios offer growth opportunities to the market. Furthermore, use of fiber optics facilitates faster testing of novel coronavirus SARS-CoV-2, which can aid in simplifying and improving the testing process. The development of plasmonic fiber-optic absorbance biosensors is expected to help healthcare workers to follow faster and more reliable testing.

Market Dynamics

DFOS are flexible, transparent fibers that function on the principle of total internal reflection of light. They are made of high-quality glass, plastic, and silica. Intensive research & development in this field of optical technology has led to several innovations, enabling usage of optical fibers for a variety of purposes in oil & gas, medical, utilities, and defense sectors.

DFOS find novel applications across the security industry and are used for light conduction and illumination, flexible bundling, and laser delivery systems. Oil & gas is one of the core industries and plays an important role in influencing economic decisionmaking. Increasing population, industrialization, and growing economies, such as India and China, are expected to drive the oil & gas sector. Improving standards of living and rising income levels are estimated to increase sales of bikes and cars, subsequently leading to a surge in the oil & gas industry, as they are complementary markets.

Proper safety and preventive measures are required to be taken as oil and gas are highly inflammable and hazardous in nature. This concern can be addressed by fiber optic sensing. Optical fibers are able to detect fire, leakages in a pipeline, and third-party intrusion. Real-time monitoring of these concerns helps prevent disasters. Health supervision and safety in remote and hazardous workplaces, such as mines and tunnels, can be achieved using fiber optic sensor.

Application Insights

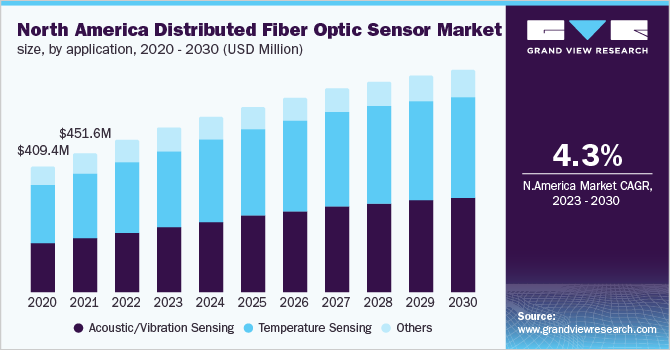

Temperature sensing application segment dominated the industry in 2022 and accounted for the largest share of more than 45.0% of the overall revenue. DFOS sensors help generate a continuous profile of strain, acoustics, temperature, or conditions along the entire length of the fiber. On the basis of applications, the market has been segmented into acoustic/vibration sensing, temperature sensing, and others. Vibration/acoustic segment is anticipated to witness significant growth from 2023 to 2030 owing to its increasing adoption across the security application segment.

Deploying Distributed Temperature Sensing (DTS) systems enable enterprises and organizations to engage in effective temperature measurement practices in challenging scenarios. High accuracy of the technology being used and the ability to be deployed in several industries, such as oil & gas, industrial, civil engineering, and power & utility, drive the market growth for the technology. Acoustic and vibration sensing also captured a significant revenue share in 2022, thus showcasing the importance of the technology and application for various uses. However, high cost of deployment and technological complexities act as refraining factors for segment growth.

Technology Insights

Raman Effect technology segment captured the highest share of more than 37.0% of the overall revenue in 2022. This can be credited to the use of this technology in critical situations, such as safety of large structures, coolant leak detection, and fire detection, with uses in advanced data processing practices. Furthermore, the immunity of the technology to electromagnetic interference helps in continuous monitoring and prevents structural problems in extensive infrastructures, such as rail tracks and bridges. Furthermore, Brillouin scattering, Raman Effect, Interferometric, and Bragg Grating technologies also significantly impact the market growth.

Rayleigh effect segment is expected to offer significant growth opportunities to the industry. It is due to the technology’s ability to measure almost all physical parameters, such as strain and temperature. In this method, the scattering principle of light is used to track and highlight propagating effects, which aids in sensing physical parameters. Moreover, distributed sensing using Rayleigh scattering of light helps turn optic fiber cable into an array of several virtual temperatures and strains, which can cover long distances.

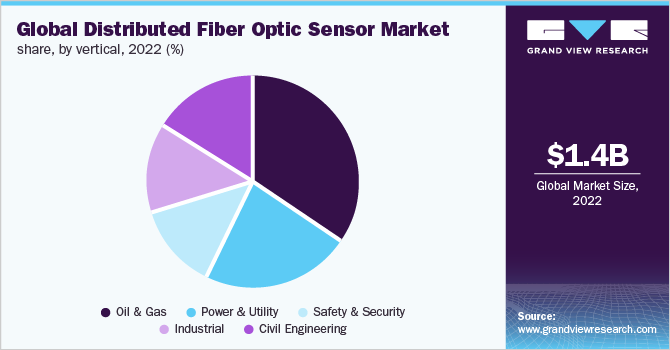

Vertical Insights

Oil & gas segment dominated the industry with a revenue share of more than 35.4% in 2022. Also, other verticals, including power and utility, safety and security, and industrial and civil engineering, have a major impact on the industry's growth. DFOS is essential in real-time and accurate downhole measurement for optimized performance, leading to real-time data-driven decision-making. The use of fiber optics for Distributed Temperature Sensing (DTS) and Distributed Acoustic Sensing (DAS) helps solve daily oil and gas field encounters, which is further offering an impetus to industry growth.

Industrial segment, however, is estimated to register fastest growth rate during the forecast period. Power & utility sector has gained significant revenue share due to increasing demand amongst electric utility companies for localization and hotspot detection, smart grid, and ampacity. The Brillouin scattering principle helps detect strains and stresses in machine system, which helps in monitoring and potentially mitigating risks. Primary reason behind use of distributed sensors in this vertical is to detect hotspots, leakages, and ground movement monitoring.

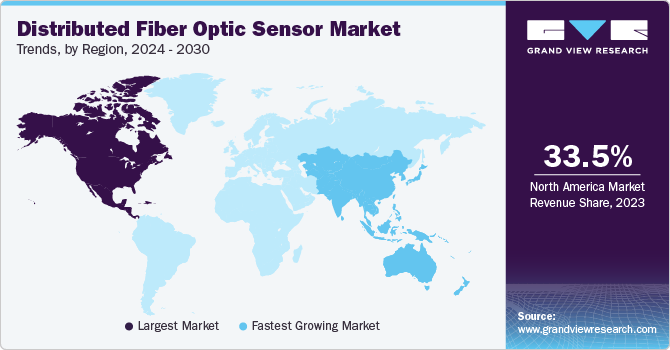

Regional Insights

North America dominated the global industry in 2022 and accounted for the largest share of more than 34.2% of overall revenue. This can be attributed to the significant presence of the oil and natural gas industry in the U.S., facilitating higher adoption rates for distributed fiber optic cables. The U.S. produced nearly 34.4 trillion cubic feet of natural gas in 2020 using hydraulic fracturing and horizontal drilling techniques, both of which use high-performance optical fibers. Additionally, rising price of crude oil worldwide promotes oil & gas companies to deploy more affordable and efficient supporting systems to improve profit generation capability, which further improves the growth opportunities for the industry.

Europe region captured a substantial revenue share in 2022 due to technological advancements in the region, fostering market growth for fiber optics. The pandemic also augmented the need to deploy faster internet services and better-connected infrastructure. This is promoting service providers to deploy fiber optics to meet the needs and requirements of people. Asia Pacific also offers significant growth opportunities to the industry, owing to rising construction and infrastructure activities in the region and the requirement for safety and security of processes.

Key Companies & Market Share Insights

Rising R&D activities and increasing investments made by service providers to accelerate innovation and provide better service offerings offer an impetus to industry growth. This has helped users engage in data-driven decision-making and closely administer machine systems to mitigate potential risks. Furthermore, service providers are also engaging in partnerships and collaborations to drive business practices and enhance revenue generation. For instance, in July 2020, Halliburton and TechnipFMC introduced Odassea, a distributed acoustic sensing solution for subsea wells, enabling operators to participate in intervention-less reservoir diagnostics seismic imaging to improve reservoir knowledge and reduce the total cost of ownership.

Companies have also started engaging in mergers and acquisitions to improve their product offerings and foster innovation. In December 2020, Luna Innovations acquired OptaSense to create a fiber optic sensing company, which has enabled Luna Innovations to penetrate the market more effectively. Companies are also developing new products to enhance their offerings and develop new revenue generation channels. In February 2020, OFS Fitel, LLC introduced its new product, the AcoustiSens wideband single-mode vibration sensor fiber, which is designed to improve distributed acoustic sensing (DAS) systems functionality. Some of the prominent players in the global distributed fiber optic sensor market include:

-

Halliburton

-

Schlumberger Ltd.

-

Yokogawa Electric Corp.

-

OFS Fitel, LLC

-

Qinetiq Group PLC

-

Omnisens SA

-

Brugg Kable AG

-

Luna Innovations Inc.

-

AP Sensing GmbH

Distributed Fiber Optic Sensor Market Report Scope

Report Attribute

Details

Market size value in 2023

USD 1.59 billion

Revenue forecast in 2030

USD 2.53 billion

Growth rate

CAGR of 6.8% from 2023 to 2030

Base year for estimation

2022

Historical data

2017 - 2021

Forecast period

2023 - 2030

Quantitative units

Revenue in USD million/billion and CAGR from 2023 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Application, technology, vertical, region

Regional scope

North America; Europe; Asia Pacific; South America; MEA

Country scope

U.S.; Canada; Mexico; Germany; U.K.; China; India; Japan; Brazil

Key companies profiled

Halliburton; Schlumberger Ltd.; Yokogawa Electric Corp.; OFS Fitel, LLC; Qinetiq Group PLC; Omnisens SA; Brugg Kable AG; Luna Innovations Inc.; AP Sensing GmbH

Customization scope

Free report customization (equivalent up to 8 analyst working days) with purchase. Addition or alteration to country, regional, and segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Distributed Fiber Optic Sensor Market Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2017 to 2030. For the purpose of this study, Grand View Research has segmented the global distributed fiber optic sensor market report based on application, technology, vertical, and region:

-

Application Outlook (Revenue, USD Million, 2017 - 2030)

-

Temperature Sensing

-

Acoustic/Vibration Sensing

-

Other

-

-

Technology Outlook (Revenue, USD Million, 2017 - 2030)

-

Rayleigh Effect

-

Brillouin Scattering

-

Raman Effect

-

Interferometric

-

Bragg Grating

-

-

Vertical Outlook (Revenue, USD Million, 2017 - 2030)

-

Oil & Gas

-

Power and Utility

-

Safety & Security

-

Industrial

-

Civil Engineering

-

-

Regional Outlook (Revenue, USD Million, 2017 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

U.K.

-

-

Asia Pacific

-

China

-

India

-

Japan

-

-

South America

-

Brazil

-

-

MEA

-

Frequently Asked Questions About This Report

b. The global distributed fiber optic sensor market size was estimated at USD 1.44 billion in 2022 and is expected to reach USD 1.59 billion in 2023.

b. The global distributed fiber optic sensor market is expected to grow at a compound annual growth rate of 6.8% from 2023 to 2030 to reach USD 2.53 billion by 2030.

b. North America dominated the global distributed fiber optic sensor market in 2022 with a revenue share of 34.2%.

b. Some key players operating in the distributed fiber optic sensor market include Halliburton; Schlumberger Limited; Yokogawa Electric Corporation; OFS Fitel, LLC; Qinetiq Group PLC; Omnisens SA; Brugg Kable AG; Luna Innovations Incorporated; and AP Sensing GmbH.

b. Key factors that are driving the DFOS market growth include significant demand from the civil engineering vertical and rising adoption in the oil & gas sector.

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![ESOMAR Certified Member]()

![Great Place to Work Certified]()

ESOMAR & Great Work to Place Certified

![ISO 9001:2015 & 27001:2022 Certified]()

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."

Important: Covid19 pandemic market impact

The recent COVID-19 pandemic that has been ravaging numerous countries across the globe has adversely affected the overall sensor, control, and automation industry. While the capital investments in the automation sector have been lethargic before the pandemic, they are expected to be put on hold or postponed for at least a year. However, the recent standstill in industrial manufacturing and production is anticipated to act as a wake-up call for the manufacturing sector on its reliance on human labor. This, in turn, is expected to highlight the advantages of robotics and automation helping a greater adoption in the post-pandemic period. As IoT, industrial automation, and digitalization are expected to become increasingly relevant to post-pandemic Tier 1 manufacturers, it may eventually turn into an opportunity especially in evolving supply chains. The report will account for COVID-19 as a key market contributor.