- Home

- »

- Specialty Polymers

- »

-

Disposable Gloves Market Size & Share Analysis Report, 2030GVR Report cover

![Disposable Gloves Market Size, Share & Trends Report]()

Disposable Gloves Market Size, Share & Trends Analysis Report By Material (Natural Rubber, Nitrile, Vinyl, Neoprene, Polyethylene), By Product (Powdered, Powder-free), By End-use, And Segment Forecasts, 2023 - 2030

- Report ID: GVR-2-68038-574-8

- Number of Pages: 120

- Format: Electronic (PDF)

- Historical Range: 2018 - 2021

- Industry: Specialty & Chemicals

Report Overview

The global disposable gloves market size was estimated at USD 12,306.0 million in 2022 and is projected to grow at a compounded annual growth rate (CAGR) of 3.9% from 2023 to 2030. The growing demand for disposable gloves, especially from the healthcare industry amidst the ongoing COVID-19 pandemic, along with rising awareness about healthcare-associated infections, is expected to drive the market growth. The healthcare sector in major developing economies is anticipated to witness substantial growth on account of several factors, such as increasing investments in both private and public sectors along with rising population, the high influx of migrants, and the growing geriatric population. Furthermore, rising healthcare expenditure is projected to drive the growth of the healthcare sector, which, in turn, is estimated to augment the demand for disposable gloves.

The presence of sophisticated healthcare infrastructure, higher disposable income levels of patients, and a large base of geriatric population are some vital drivers of the disposable gloves industry in the U.S. Furthermore, the spread of the COVID-19 pandemic in the country has augmented the demand for disposable gloves, especially in the healthcare sector to reduce further transmission. Contact with harmful chemicals in the working environment of the industries has been one of the major factors associated with health issues among workers. Skin diseases, rashes, hand cuts, amputation, and bloodborne pathogens are the common risks experienced in various industries such as healthcare, medical, and mining. Safety regulations are likely to be the key factors anticipated to drive the market over the forecast period.

Rising awareness regarding the importance of raw materials in providing high heat resistance, comfort, elasticity, and lightweight properties is anticipated to boost the research & development activities of major players in the market. These initiatives aim to achieve the multi-functionality of disposable gloves and widen their application scope by adding innovative add-ons to the existing designs. The production of disposable gloves is highly capital-intensive on account of the high raw material costs and complex manufacturing methods. Major raw material suppliers in the market have integrated along the value chain to develop disposable gloves, which is expected to boost the competitiveness in the market.

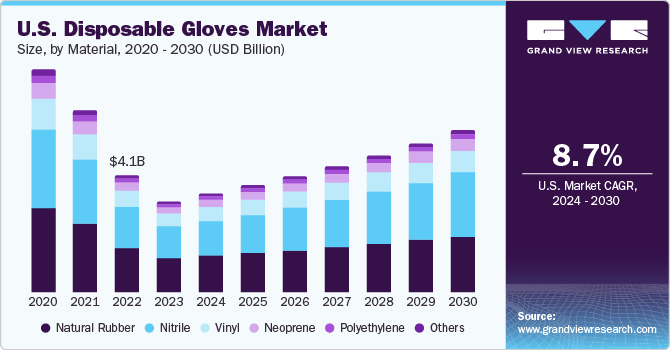

Material Insights

Natural rubber led the market and accounted for over 37.0% share of the global revenue in 2022. Natural rubber disposable gloves offer superior performance and protection in various applications such as medical and dental, food processing and service, janitorial and sanitation, pharmaceutical, and automotive. However, allergy caused by natural latex acts as a significant restraint, limiting the penetration of natural rubber gloves in the medical and food industries. Disposable nitrile gloves are anticipated to expand at the highest CAGR of 5.0% from 2023 to 2030 on account of their rising adoption in the medical, painting, chemical, laboratory, and dentistry sectors. Higher resistance of nitrile gloves towards puncture and chemicals than vinyl and natural rubber gloves is anticipated to boost the growth of nitrile gloves globally.

Vinyl disposable gloves are latex-free and are made from polyvinyl chloride and plasticizers. These gloves offer high comfort and tactile sensitivity as compared to neoprene gloves. Vinyl gloves are suitable in an environment where frequent change of gloves is required, such as food preparation. Vinyl gloves are used in manufacturing, food processing, print shops, assembly, and the medical industries. Polyethylene (PE) is the most cost-effective material for gloves. PE gloves offer a loose fit and are lightweight. These are particularly designed to come on and off rapidly and easily. Polyethylene gloves are also latex- and powder-free. PE gloves are used for light-duty applications that require frequent change of gloves, such as food processing and serving work, salad preparation, and other food applications.

Product Insights

The powder-free product segment led the market and accounted for over 74.0% share in 2022. Stringent regulations on the use of powdered gloves by several governments worldwide are expected to have a positive impact on the powder-free gloves market growth over the forecast period. Powder-free gloves are treated with chlorination, which makes them less form-fitting to eliminate the use of powder for easy donning and removal. Rising preference for powder-free gloves across several industries, including chemical, medical, and food processing, is projected to drive the market over the forecast period.

The advantages of using powdered gloves compared to powder-free gloves include their ability to fit tightly and offer protection against hazardous chemicals or physical contaminants. Cornstarch powder used in latex gloves is likely to contribute towards allergies or sensitivity, although it is not a concern in the case of vinyl or nitrile gloves. On January 19, 2017, the U.S. Food and Drug Administration (FDA) banned the manufacturing, sales, and distribution of all powdered patient examination gloves, powdered surgeon gloves, and absorbable powder used to lubricate surgeon's gloves, which, in turn, is anticipated to hamper the growth of the powdered gloves market over the forecast period.

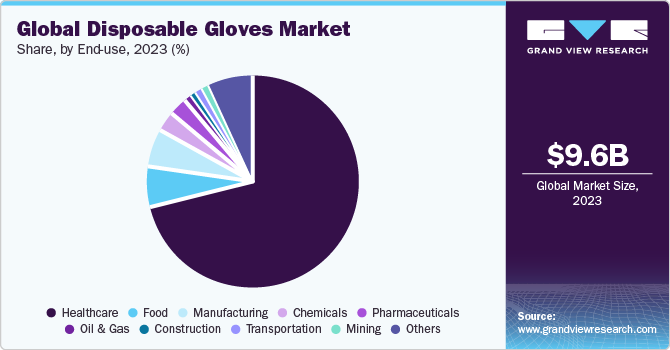

End-Use Insights

The medical and healthcare segment led the market and accounted for over 79.9% share of the global revenue in 2022. The spread of the COVID-19 pandemic across the world is anticipated to boost the demand for gloves used by healthcare professionals across the globe for examination and testing and to limit contact with infected patients. Disposable gloves are often classified based on application as surgical gloves and examination gloves. Disposable examination gloves have witnessed substantial growth in the medical sector on account of higher demand in hospital, veterinary, and dental applications. Surgical disposable gloves have high-quality standards compared to examination gloves and are commonly used by surgeons and operating room nurses.

Disposable gloves are essential to protect employees against hand injuries that are common across numerous industries, including food processing, construction, automotive, oil and gas, and metal fabrication. These gloves protect hands from hot objects, splinters, bodily fluids, sharp edges, excessive vibrations, electricity, and extreme cold. The chemical and petrochemical segment is anticipated to expand at a CAGR of 8.4% from 2023 to 2030 owing to the rising adoption of the product for handling volatile chemicals in laboratories and the chemical industries. Furthermore, rising concerns pertaining to employee safety and initiatives to reduce injury rates in manufacturing facilities are anticipated to augment the demand for protective gloves over the forecast period.

Regional Insights

North America led the market and accounted for over 37.4% share of the global revenue in 2022. The COVID-19 outbreak has resulted in augmenting the demand for disposable gloves significantly across the region. Increasing healthcare expenditure, coupled with the growing elderly population and rising awareness pertaining to healthcare-acquired infections, is projected to have a positive impact on the market growth in the region. The upgrading of the public healthcare system and infrastructure and investments in new facilities are a part of the reform plan. These developments are expected to drive the demand for medical equipment and devices. The demand for hand protection equipment such as disposable and durable gloves is anticipated to witness growth owing to the expanding medical sector in the country.

The Asia Pacific market is characterized by the increased demand for disposable gloves in medical, food and beverages, and industrial applications. Furthermore, the rapid spread of the COVID-19 pandemic across numerous countries such as India, Indonesia, and the Philippines is further projected to augment the demand for disposable gloves. The market in Central & South America is anticipated to register a CAGR of 3.5% over the forecast period. Factors such as increasing public-private partnerships in the healthcare industry, improving healthcare infrastructure, and expanding the healthcare industry are expected to benefit the market in the region over the forecast period.

Key Companies & Market Share Insights

The market is fragmented, with major manufacturers striving for market leadership. Key players have integrated along the value chain to further strengthen their market position. The global market has been witnessing mergers & acquisitions along with strategic alliances such as technology licensing in order to obtain an edge over competitors. The market is marked by the presence of top exporters in Southeast Asia, such as Top Glove Corporation Bhd and Kossan Rubber Industries Bhd, which are integrated across manufacturing rubber and glove production processes. The processed natural latex and nitrile rubbers are supplied to glove companies in the region through a diverse distribution channel. Some prominent players in the global disposable gloves market include:

-

Ansell Ltd

-

Top Glove Corporation Bhd

-

Hartalega Holdings Berhad

-

Supermax Corporation Berhad

-

Kossan Rubber Industries Bhd

-

Ammex Corporation

-

Kimberly-Clark Corporation

-

Sempermed USA, Inc

-

MCR Safety

Recent Developments

-

In April 2023, AMMEX Corp. launched a new product line of disposable gloves called Invisi-Gloves™ which disappears once they are worn by the user.

-

In January 2023, Ansell launched plastic-free packaging in the industrial gloves range to minimize the environmental impact of their packaging.

-

In July 2022, Ansell started its $80m greenfield manufacturing plant operations, focused on manufacturing surgical and life sciences products, including Ansell’s disposable glove product line.

-

In December 2021, Supermax announced its plans to build a glove production facility in the United States. This expansion has enabled Supermax to strengthen its global foothold.

-

In January 2021, Ansell enters into a supply partnership and acquired Primus gloves and its life science business.

Disposable Gloves Market Report Scope

Report Attribute

Details

Market size value in 2023

USD 9,571.5 million

Revenue forecast in 2030

USD 16,772.4 million

Growth rate

CAGR of 3.9% from 2023 to 2030

Base year for estimation

2022

Historical data

2018 - 2021

Forecast period

2023 - 2030

Quantitative units

Revenue in USD million and CAGR from 2023 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Material, product, end-use, region

Regional scope

North America; Europe; Asia Pacific; Central & South America; Middle East and Africa

Country scope

U.S.; Canada; Mexico; Germany; France; Italy; Russia; Spain; UK; China; India; Japan; South Korea; Indonesia; Australia; Thailand; Malaysia; Brazil; Argentina; UAE; Saudi Arabia; South Africa

Key companies profiled

Ansell Ltd; Top Glove Corporation Bhd; Hartalega Holdings Berhad; Unigloves (UK) Limited; The Glove Company; Superior Gloves; MAPA Professional; Adenna LLC; MCR Safety

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Disposable Gloves Market Report Segmentation

This report forecasts revenue growth at global, regional & country levels and provides an analysis on the industry trends in each of the sub-segments from 2018 to 2030. For the purpose of this study, Grand View Research has segmented the global disposable gloves market report on the basis of material, product, end-use, and region:

-

Material Outlook (Revenue, USD Million; 2018 - 2030)

-

Natural Rubber

-

Nitrile

-

Vinyl

-

Neoprene

-

Polyethylene

-

Others

-

-

Product Outlook (Revenue, USD Million; 2018 - 2030)

-

Powdered

-

Powder-free

-

-

End-Use Outlook (Revenue, USD Million; 2018 - 2030)

-

Medical & Healthcare

-

Examination

-

Dental

-

Veterinary

-

Hospital

-

EMS

-

Others

-

-

Surgical

-

Dental

-

Veterinary

-

Hospital

-

EMS

-

Others

-

-

-

Automotive

-

Oil & Gas

-

Food & Beverage

-

Metal & Machinery

-

Chemical & Petrochemical

-

Pharmaceutical

-

Cleanroom

-

Others

-

-

Regional Outlook (Revenue, USD Million; 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

Russia

-

Italy

-

Spain

-

-

Asia Pacific

-

China

-

India

-

Japan

-

Australia

-

South Korea

-

Indonesia

-

Thailand

-

Malaysia

-

-

Central & South America

-

Brazil

-

Argentina

-

-

Middle East & Africa

-

Saudi Arabia

-

UAE

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global disposable gloves market size was estimated at USD 12,306.0 million in 2022 and is expected to be USD 9,571.5 million in 2023

b. The disposable gloves market, in terms of revenue, is expected to grow at a compound annual growth rate of 3.9% from 2023 to 2030 to reach USD 16,772.4 million by 2030

b. North America dominated the disposable gloves market with a revenue share of 37.4% in 2022. Increasing healthcare infrastructure, such as hospitals and clinics, as well as an increase in the number of people choosing for home care services and rising medical tourism in the region are factors are leading to the increased disposable medical gloves market demand.

b. Some of the key players operating in the disposable gloves market include Ansell Ltd., Top Glove Corporation Bhd, Hartalega Holdings Berhad, Supermax Corporation Berhad, Kossan Rubber Industries Bhd., Cardinal Health, Semperit AG Holding, Rubberex, Dynarex Corporation, B. Braun Melsungen AG.

b. Key factors that are driving the disposable gloves market growth include the increasing prevalence of infectious diseases and viral outbreaks coupled with increasing healthcare expenditure.

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![ESOMAR Certified Member]()

![Great Place to Work Certified]()

ESOMAR & Great Work to Place Certified

![ISO 9001:2015 & 27001:2022 Certified]()

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."

Important: Covid19 pandemic market impact

The outbreak of COVID-19 has positively impacted the PPE industry as the demand for masks, respirators, protective clothing, and disposable gloves have increased significantly. The manufacturing, aerospace, etc. sectors have supplied PPE to their employees to protect them from the sudden outbreak of the pandemic COVID-19. In addition, the manufacturers are working at 100% capacity to supply PPE across the regions owing to the increasing demand-supply gap. As a result, the demand for disposable gloves is expected to witness growth over the forecast period. The updated report will account for COVID-19 as a key market contributor.