- Home

- »

- Display Technologies

- »

-

Digital Signage Market Size & Growth Report, 2030GVR Report cover

![Digital Signage Market Size, Share, & Trend Report]()

Digital Signage Market Size, Share, & Trend Analysis Report By Type, By Component, By Technology, By Application, By Location, By Content Category, By Size, By Region, And Segment Forecasts, 2023 - 2030

- Report ID: 978-1-68038-157-3

- Number of Pages: 215

- Format: Electronic (PDF)

- Historical Range: 2017 - 2021

- Industry: Semiconductors & Electronics

Report Overview

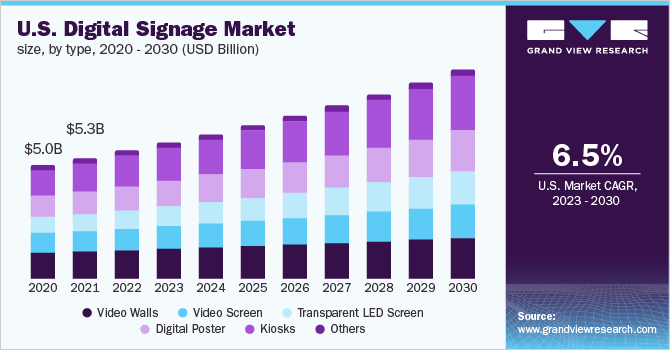

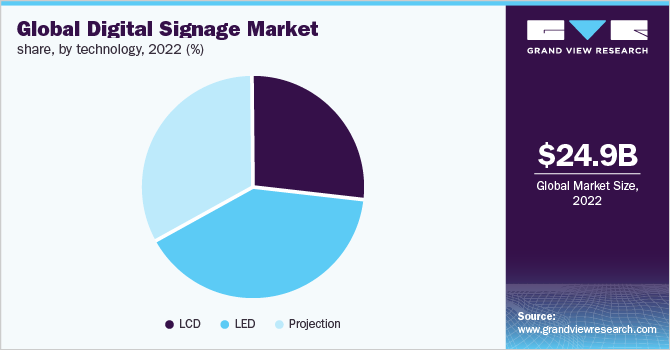

The global digital signage market size was estimated at USD 24.86 billion in 2022 and is expected to expand at a compound annual growth rate (CAGR) of 8.0% from 2023 to 2030. This market growth is accredited to the increasing demand for the digitized promotion of products and services to attract the attention of the target audience in an effective manner. Furthermore, the demand for 4K digitized sign displays with embedded software and media player is rising as it offers customers an affordable Ultra HD digital signage solution, which is also expected to drive the demand. The evolution of innovative products, such as home monitoring systems, leak detector systems, and so on, along with complicated monetary products, such as forex cards, that need informative and succinct advertisement content are some of the factors that are predicted to drive the product demand.

Moreover, there is a rising demand for adopting advanced products that require digitized information management and guidance that can be accessed from remote locations. This is one of the key drivers anticipated to drive the global industry during the forecast period. Digitized signs offer the necessary quality information to a large number of viewers by utilizing large display screens across the location with a concentrated target audience. With digitized display technology, information is provided in a digitized format that includes motion and pictures to attract customers with more impact as compared to the traditional modes of reaching out to customers. In addition, the integration of biometric technology with modern digitized signs has developed products, such as track heat paths and gaze tracking.

Gaze tracking technology helps in locating the area, which is crowded with a greater number of consumers, thereby helping the companies to track consumer behavior for effective marketing of products. Thus, the growing use of the aforementioned technology is expected to strengthen the demand in the next few years. Eventually, the growing awareness among consumers regarding the drawbacks and complexity of traditional advertising, such as short-lived print marketing and so on, is instigating digitized advertisement adoption. Furthermore, display designers, researchers, and advertisement companies are spending more on the improvement of the product’s display technology.

All these factors are expected to catalyze the overall industry growth. With the advancement in display technologies, the evolution of LCD, LED, UHD, OLED, and Super AMOLED is further strengthening the industry growth. These technologies have led to the enhancement of the quality of advertisement content, thus creating a favorable impact on the target audience. The adoption of such technologies by digital poster providers is anticipated to boost overall industry growth. However, factors, such as software & hardware compatibility, electrical interface, and connectivity, are some prevailing issues that may hinder the market growth. Moreover, the complex taxations levied upon the erection of digitized signs and screens, coupled with the regulatory processes, such as licensing, are projected to hamper the growth.

COVID-19 Impact Analysis

The outbreak of COVID-19 pandemic has impacted a number of companies including their operations and made it difficult for businesses to continue. In such difficult scenarios, the adoption of cloud computing has increased for business continuity. The number of providers operating in the digital signage market have offered cloud-based digital signage platforms and solutions that are highly reliable and flexible. These cloud-based digital signage solutions are easier to use and are highly scalable and have lower total cost of ownership as this type of deployment mode does not require purchasing and maintaining an on-premise server.

Type Insights

The video walls segment accounted for the largest market share of more than 26% in 2022 and this trend is expected to continue during the forecast period. The video walls and kiosks segments gained a high share in 2022 followed by the video screens segment. Video walls and screens have captured a major market share across shopping malls and other public places. However, the kiosks segment is estimated to account for the maximum revenue share by 2030 becoming the largest type segment in the global market. Kiosks are generally used to provide information and for advertising in institutes and retail verticals.

However, the transparent LED screens segment is expected to emerge as the fastest-growing segment expanding at a CAGR of over 10.5% over the forecast period. Transparent LED screens are capable of offering a transparency level beyond 80% coupled with high resolution. In addition, they are adequately efficient, in terms of energy, thus, reducing energy consumption and optimizing the overhead expenditure of users. All these factors are anticipated to catapult the demand for transparent LED screens in the next six years, thereby supporting the growth of the segment.

Component Insights

The hardware components segment accounted for the largest market share of more than 57% in 2022 and is anticipated to maintain its position during the forecast period. Hardware components consist of displays, components required to manufacture a digital panel, banners, and so on. Compared to software, the hardware requirement is huge, and thus, the segment accounts for a large share in the industry. The growing number of innovative display technologies, such as 1080p, 4K, and 8K display, is expected to propel the demand for hardware components in the coming years. Advancement in 3D technology has developed glasses-free 3D displays. Such displays are used in the product.

Furthermore, the graphics design agencies are shifting their focus towards 3D holographic display cases. HYPERVSN, a European provider of holographic technology, is providing them for numerous applications, from advertising in malls to showpieces at trade shows. The services segment registers a comparatively lower demand owing to fewer maintenance and service issues occurring in the product. The services offered in the industry include integration & installation, maintenance, and consulting. The installation of a digital display and internet connectivity are the major services involved here. Therefore, the service offerings are quite cheaper compared to the hardware and software requirements. This leads to a lesser market share.

Application Insights

The retail sector accounted for the largest market share of more than 19% in 2022. The retail sector is the most prominent sector demanding digitized advertisements for marketing and promoting products and services. The competition among retailers owing to the variety of product offerings in the industry has led to the growing awareness of effective marketing strategies. Thus, digital posters are adopted largely in the retail sector as digitized advertising is an effective way of marketing a product, which attracts the attention of target consumers.

The transportation segment is expected to emerge as the fastest-growing segment expanding at a CAGR of over 9.8% over the forecast period. The transportation sector includes the application of digitized promotions & posters at airports, railway stations, metro stations, and bus stands. In addition, the digital display is also extensively used on the roads by cabs, public transport buses, and other vehicles that advertise products and services. Owing to the rapid urbanization and the development of the transportation sector in emerging countries, the advertisement industry is expected to grow, ultimately boosting the growth of the market for digital signage.

Location Insights

The in-store location segment accounted for the largest market share of over 71% in 2022. The in-store locations include the deployment of digital posters within closed premises, such as malls, corporate offices, retail shops, banks, and healthcare centers. The high share of this segment can be attributed to the heavy demand from retail stores as the retail sector is the most promising application sector for digital displays for advertisement purposes. The segment is also predicted to maintain its position in the global market and exhibit a steady growth rate over the forecast period due to consistent demand.

However, the demand from the out-store location segment is expected to exhibit the fastest CAGR over the forecast years. The demand at out-store locations is expected to rise owing to the growing transportation sector, especially in developing countries. In addition, the rising need of promoting products effectively and on a large scale and emerging popular trends, such as election campaigns, introductory offers on products & services, and the increasing number of live concerts & shows, are likely to boost the adoption of digital posters in open premises, thereby augmenting the out-store segment growth.

Content Category Insights

Broadcast content category is expected to emerge as the fastest-growing segment expanding at a CAGR of over 8.8% over the forecast period. The broadcast content category is further segregated into the news, weather, sports, and others. The sports segment dominated the market in 2022 and accounted for a market share of over 35%. The increasing adoption of digital signage for displaying sports-related content across the stadium and sports ground during the tournaments is driving segment growth.

The news category is likely to account for a considerable share as well, followed by the sports content category. These segments are anticipated to witness significant growth in the forthcoming years owing to the rapidly increasing demand from the corporate sectors where digital signage is used extensively for communication purposes. In addition, the weather forecast is displayed majorly on external premises, such as roads and transport facilities along with offices. The market for weather content is projected to maintain its share and generate stable revenue over the coming years.

Technology Insights

LED segment accounted for the largest market share of over 47% in 2022. LCD technology is one of the most extensively adopted technologies in the advertisement & marketing industry. The ease of producing LCDs and their lower manufacturing costs are a few factors behind the significant adoption of LCD technology in digital posters. However, LEDs have successfully made a mark as a standard product with their high-quality display. Manufacturers remain aspirant in the designing of flat-paneled, larger, brighter, and slimmer displays.

LEDs are one of the achievements in display technology. Further advancements in LEDs have led to the evolution of OLED displays that are anticipated to propel the overall adoption of LEDs in displays. Superior picture quality offered by OLEDs is predicted to be a prominent factor for the increasing demand. However, the production costs and complicated manufacturing process, coupled with a shorter lifespan of LED displays could hamper the growth of this segment to some extent.

Screen Size Insights

Below 32 inches display segment accounted for the largest market share of over 40% in 2022. The high share is attributed to the greater adoption of this type of signage in the retail sector. Shop dimensions are one of the most important reasons for concern in retail shops. Due to the limitations of the area, the adoption of smaller-sized digital advertisements is greater. Thus, the segment accounted for a high market share and is anticipated to dominate the industry over the forecast period.

However, the industry is changing considerably, in terms of size specifications and demands, due to the necessity of enhanced and enlarged advertisement content to have an impact on customers. The market for 32 to 52 inches digital posters is anticipated to witness the fastest CAGR over the forecast period owing to the increasing demand from the healthcare, corporate, and retail sectors. The demand for posters sized more than 52 inches is also expected to grow notably on account of the significantly expanding transportation sector and flourishing advertisement industry. In addition, the increasing demand across out-store locations is fuelling the above 52 inches screen size segment growth and is expected to exhibit steady growth over the forecast period.

Regional Insights

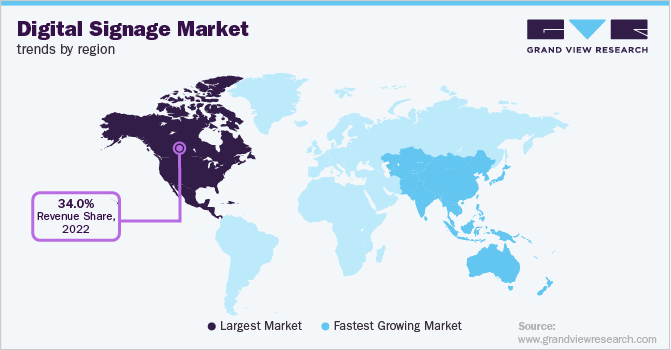

North America emerged as the dominant segment in 2022 with a revenue share exceeding 34%, followed by Europe. The high share is attributed to the growing presence of dedicated suppliers of the product along with rising demand for signage in the retail industry. The U.K., Germany, and the U.S., in particular, are projected to exhibit considerable growth primarily due to the rising R&D activities by companies to enhance product quality and increasing government initiatives to install digital signage at various offices for maintaining continuous information flow systems. Asia Pacific is expected to emerge as the fastest-growing regional market over the forecast period.

Asia Pacific is expected to emerge as the fastest-growing segment growing at a CAGR of over 9.5% over the forecast period. The growth can be attributed to the growing awareness regarding the benefits of digital signage. India and China are anticipated to witness significant growth primarily due to the rising application in retail stores, corporate offices, hospitals, and hotels. Increasing disposable income has surged the visitors to malls and multiplex stores in the emerging countries of Asia Pacific. Enterprise is therefore leveraging this opportunity to promote their offerings through large displays, which helps them attract the targeted audience in a better manner. With the rising number of shopping malls and multiplexes, the adoption of digital signage in the hospitality industry is expected to increase over the forecast period.

Key Companies & Market Share Insights

The introduction of innovative solutions is anticipated to propel the business in the coming years. For instance, Intel Corp. introduced Open Pluggable Specification (OPS), which has helped in standardizing the design of digitized marketing. In addition, Nippon Telegraph and Telephone (NTT) Corp., Japan, created digitized signs using aroma-emitting devices. The companies, through R&D efforts and continuous innovations, are also endeavoring to develop premium-quality and high-value products at an optimum cost to gain a competitive edge in the price-sensitive market. Some prominent players in the global digital signage market include:

-

ADFLOW Networks

-

BrightSign, LLC

-

Cisco Systems, Inc.

-

Intel Corp.

-

KeyWest Technology, Inc.

-

LG Electronics (LG Corp.)

-

Microsoft Corp.

-

NEC Display Solutions

-

Omnivex Corp.

-

Panasonic Corp.

-

SAMSUNG

-

Scala Digital Signage

-

Winmate Inc.

Digital Signage Market Report Scope

Report Attribute

Details

Market size value in 2023

USD 26.76 billion

Revenue forecast in 2030

USD 45.94 billion

Growth rate

CAGR of 8.0% from 2023 to 2030

Base year for estimation

2022

Historical data

2017 - 2021

Forecast period

2023 - 2030

Quantitative units

Revenue in USD million/billion and CAGR from 2023 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Type, component, technology, location, content category, screen size, application, and region

Regional scope

North America; Europe; Asia Pacific; South America; Middle East & Africa

Country scope

U.S.; Canada; Mexico; U.K.; Germany; France; China; India; Japan; Brazil

Key companies profiled

Omnivex Corp.; Microsoft Corp.; KeyWest Technology, Inc.; ADFlow Networks; NEC Display Solutions, Ltd.; LG Electronics

Customization scope

Free report customization (equivalent to up to 8 analysts' working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Digital Signage Market SegmentationThis report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2017 to 2030 For the purpose of this study, Grand View Research has segmented the global digital signage market report based on type, component, technology, location, content category, screen size, application, and region:

-

Type Outlook (Revenue, USD Million, 2017 - 2030)

-

Video Walls

-

Video Screen

-

Transparent LED Screen

-

Digital Poster

-

Kiosks

-

Others

-

-

Component Outlook (Revenue, USD Million, 2017 - 2030)

-

Hardware

-

Software

-

Service

-

-

Digital Signage Technology Outlook (Revenue, USD Million, 2017 - 2030)

-

LCD

-

LED

-

Projection

-

-

Location Outlook (Revenue, USD Million, 2017 - 2030)

-

In-store

-

Out-store

-

-

Content Category Outlook (Revenue, USD Million, 2017 - 2030)

-

Broadcast

-

News

-

Weather

-

Sports

-

Others

-

-

Non-Broadcast

-

-

Screen Size Outlook (Revenue, USD Million, 2017 - 2030)

-

Below 32 Inches

-

32 to 52 Inches

-

More than 52 Inches

-

-

Application Outlook (Revenue, USD Million, 2017 - 2030)

-

Retail

-

Hospitality

-

Entertainment

-

Stadiums & Playgrounds

-

Corporate

-

Banking

-

Healthcare

-

Education

-

Transportation

-

-

Regional Outlook (Revenue, USD Million, 2017 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

-

Asia Pacific

-

China

-

Japan

-

India

-

-

South America

-

Brazil

-

-

Middle East & Africa

-

Frequently Asked Questions About This Report

b. The global digital signage market size was estimated at USD 24.86 billion in 2022 and is expected to reach USD 26.76 billion in 2023.

b. The global digital signage market is expected to grow at a compound annual growth rate of 8.0% from 2023 to 2030 to reach USD 45.94 billion by 2030.

b. The video walls segment dominated the global digital signage market and accounted for the largest market share of over 26% in 2022.

b. The hardware component segment led the global digital signage market and accounted for the largest revenue share of more than 57% in 2022.

b. The retail sector dominated the global digital signage market and accounted for the largest market share of over 19% in 2022.

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![ESOMAR Certified Member]()

![Great Place to Work Certified]()

ESOMAR & Great Work to Place Certified

![ISO 9001:2015 & 27001:2022 Certified]()

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."

Important: Covid19 pandemic market impact

The ongoing COVID-19 outbreak has adversely affected the display industry with manufacturing operations temporarily suspended across major manufacturing hubs, leading to a substantial slowdown in the production. Major manufacturers including Samsung, LG Display, and Xiaomi among others have suspended their manufacturing operations in China, India, South Korea, and European countries. In addition to having an impact on the production, the ongoing pandemic has taken a toll on the consumer demand for display integrated devices, likely exacerbated by the lockdown imposed across major countries. Uncertainty regarding the possible length of lockdown makes it difficult to anticipate how and when a resurgence in the display industry will occur. On the flip side, increased demand for displays in medical equipment including ventilators and respirators is expected to keep the demand for displays afloat in the coming months. The report will account for COVID-19 as a key market contributor.