- Home

- »

- Consumer F&B

- »

-

Craft Spirits Market Size, Share And Trends Report, 2030GVR Report cover

![Craft Spirits Market Size, Share & Trends Report]()

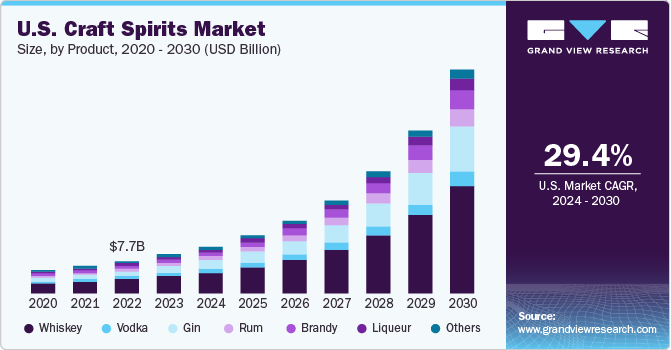

Craft Spirits Market Size, Share & Trends Analysis Report By Product (Whiskey, Vodka, Gin, Rum, Brandy, Liqueur, Others), By Distribution Channel (On-trade, Off-trade), By Region, And Segment Forecasts, 2023 - 2030

- Report ID: GVR-1-68038-695-0

- Number of Pages: 100

- Format: Electronic (PDF)

- Historical Range: 2017 - 2021

- Industry: Consumer Goods

Report Overview

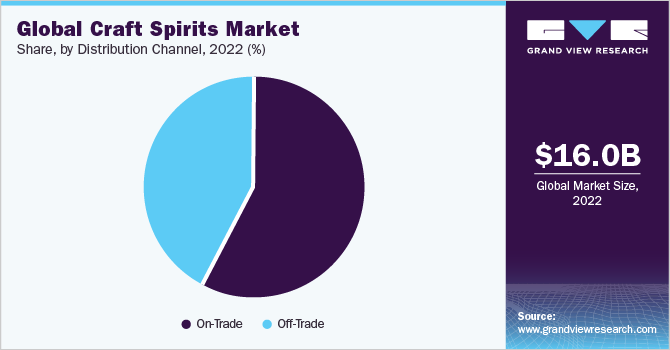

The global craft spirits market size was valued at USD 16.02 billion in 2022 and is expected to grow at a CAGR of 29.2% from 2023 to 2030. Some of the primary reasons driving market expansion are rising demand for craft spirits and an increase in the number of craft distilleries, and rising disposable incomes. The millennial population with considerable purchasing power is expected to drive the market during the forecast period.

Licensed distillers with a set production volume make craft spirits. They should have separate operations with less than 25% capital from an alcoholic beverage sector player and operational control. The product must have a label certified by the Alcohol and Tobacco Tax and Trade Bureau in the United States (TTB). Due to the large demand in the United States, the sector is primarily centered in North America. Due to advantageous approval regulations, investments in the United States have expanded at a promising rate in recent years. In 2012, the Alcohol and Tobacco Tax and Trade Bureau (TTB) received 13,867 new applications, up 24.4 percent from 2009 and 82 percent from 2006.

Furthermore, Millennials, those born between the 1980s and the early 2000s, make up a considerable demographic of alcoholic beverage consumers, as they make up a large portion of those who frequently visit restaurants and pubs. They appear to be the most powerful buyers of a wide range of foods and beverages, including craft spirits. Moreover, many craft distilleries have closed their tasting rooms in the last few months to comply with local and state public health guidance and to protect their employees.

According to a survey of nearly 300 American distilleries conducted by the Distilled Spirits Council of the United States (DISCUS) and the American Distilling Institute in august 2021. And, as one might assume, the number of customers for those who could open securely was restricted. As a result, over 40% of craft distilleries reported a significant decrease in on-site sales (i.e., 25% or more). More than a quarter of respondents claimed their tasting rooms were entirely closed.

Despite COVID-19 negative impact in 2020, the market for craft spirits continues to increase, according to the US Craft Spirits Association. Surprisingly, the most steadfast product domain that was unaffected by the pandemic was booze. Between August 2020 and August 2021, the number of craft distilleries increased by 1.1%. In 2020, the market is expected to generate revenues of more than USD 5 billion. In terms of market suffering, the numbers demonstrate resiliency.

Type Insights

The whiskey segment led the market and accounted for a 45.5% share of the global revenue in 2022. The growth of this segment is due to the extraordinary and one-of-a-kind flavor that the mentioned product domain provides. Whiskey has been able to deliver certain medical benefits as a result of product developments over the years. Distillers are increasingly adding a variety of herbs and spices to lengthen the offering for both taste and medical purposes. Moreover, whiskey contains a lot of polyphenols, an antioxidant that has been shown to lower LDL (bad cholesterol) and raise HDL (good cholesterol). Around 51% of persons in the U.S. have dangerously high cholesterol, which whiskey can assist with.

The gin segment is anticipated to grow at the fastest CAGR of 32.0% from 2023 to 2030. Brands are increasing their consumer appeal by including regional botanicals, aged expressions, new flavors, and other innovations. While the average retail price of a 750ml bottle of gin sold in the United States last year was USD16.77, the average artisan gin retails for more than USD 30.

Distribution Channel Insights

Off-trade is expected to grow at a CAGR of 33.1% from 2023 to 2030. Hypermarkets, supermarkets, convenience stores, micro-markets, and wine and spirit shops all fall into this category. People choose these establishments because they provide substantial discounts and exclusive incentives.

The on-trade channel accounted for the largest market revenue share of 58.3% in 2022. It is due to the opening of restaurants, bars, and pubs, as well as a variety of other ancillaries, whose sales have increased significantly following vaccination and the opening of economies. Furthermore, customers prefer to drink craft spirits in locations where they can connect and bond with other students, and liquor has been related to the overall ambiance.

Regional Insights

North America made the largest contribution to the global market of around 62.9% in 2022. It is accounted to have a 62% market share of the global volume of craft spirits. Over the forecast period, the region's growing millennial population is expected to drive demand. Because of secure approval policies developed by regulatory bodies, the number of manufacturers in the United States has increased at a rapid rate.

Asia Pacific is expected to witness a CAGR of 34.3% from 2023 to 2030 due to growing purchasing parity and the large rise of the millennial generation in emerging nations such as China, India, Malaysia, Thailand, and Indonesia, the market is predicted to expand at the fastest CAGR. Huge potential in these countries' underdeveloped marketplaces is likely to provide lucrative opportunities in this region.

In addition, in Asia Pacific, economically independent millennials are living with their parents, giving them more spending power. As a result, millennials in countries like China and India prefer to spend more on leisure activities, which is expected to have an impact on the region's craft spirit market.

Key Companies & Market Share Insights

The market includes both international and domestic participants. Key market players focus on strategies such as innovation and new product launches in retail to enhance their portfolio offering in the market.

-

In March 2022, Diageo, the world's largest beverage alcohol company, revealed today plans for a new USD 245 million distilleries to support its Crown Royal Canadian Whisky brand's momentum and growth objectives. It will use resource efficiency technology and run on 100 percent renewable energy to ensure that the new distillery is carbon neutral and produces no waste for landfill

-

In March 2022, Diageo plc launched its latest manufacturing complex, which features two high-speed can lines, with the ability to make over 25 million cases of malt-based beverages and spirits-based Ready-to-Drink (RTD) cocktails.

-

In February 2022, Heaven Hill announced the acquisition of ‘Samson & Surrey’ including Widow Jane, Few Spirits, Tequila Ocho, Bluecoat Gin, Mezcal Vago, and Brenne French Whisky. Heaven Hill's portfolio will be bolstered by high-growth, super-premium brands in several of the industry's fastest-growing categories as a result of the acquisition

Some of the key players operating in the global craft spirits market include: -

-

Heaven Hill Distilleries, Inc.

-

Diageo plc

-

Pernod Ricard

-

Constellation Brands, Inc.

-

Suntory Holdings Limited

-

Bacardi Limited

-

Campari Group

-

Sazerac Company, Inc.

-

Highwood Distillers

-

Rogue Ales

Craft Spirits Market Report Scope

Report Attribute

Details

Market size value in 2023

USD 19.92 billion

Revenue forecast in 2030

USD 124.56 billion

Growth Rate

CAGR of 29.2% from 2023 to 2030

Base year for estimation

2022

Historical data

2017 - 2021

Forecast period

2023 - 2030

Report updated

August 2023

Quantitative units

Revenue in USD billion, volume in thousand gallons, and CAGR from 2023 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Type, distribution channel, region

Regional scope

North America; Europe; Asia Pacific; Central & South America and Middle East & Africa

Country scope

U.S.; Canada; Mexico; Germany; UK; France; Italy; Spain; China; India; Japan; Australia & New Zealand; South Korea; Brazil; South Africa

Key companies profiled

Heaven Hill Distilleries, Inc.; Diageo plc; Pernod Ricard; Constellation Brands, Inc.; Suntory Holdings Limited; Bacardi Limited; Campari Group; Sazerac Company, Inc.; Highwood Distillers; Rogue Ales

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Craft Spirits Market Report Segmentation

This report forecasts revenue growth at global, regional & country levels and provides an analysis of the latest trends and opportunities in each of the sub-segment from 2017 to 2030. For the purpose of this study, Grand View Research has segmented the craft spirits market on the basis of type, distribution channel, and region.

-

Type Outlook (Revenue, USD Million; Volume, Thousand Gallons; 2017 - 2030)

-

Whiskey

-

Vodka

-

Gin

-

Rum

-

Brandy

-

Liqueur

-

Others

-

-

Distribution Channel Outlook (Revenue, USD Million; Volume, Thousand Gallons; 2017 - 2030)

-

On-Trade

-

Off-Trade

-

-

Regional Outlook (Revenue, USD Million; Volume, Thousand Gallons; 2017 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

U.K.

-

France

-

Italy

-

Spain

-

-

Asia Pacific

-

China

-

India

-

Japan

-

Australia & New Zealand

-

South Korea

-

-

Central & South America

-

Brazil

-

-

Middle East & Africa

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global craft spirits market was estimated at USD 16.02 billion in 2022 and is expected to reach USD 19.92 billion in 2023.

b. The global craft spirits market is expected to grow at a compound annual growth rate of 29.2% from 2023 to 2030 to reach USD 124.56 billion by 2030.

b. North America dominated the craft spirits market with a share of 62.9% in 2022. This is attributed to the region's growing millennial population is expected to drive demand. Because of secure approval policies developed by regulatory bodies, the number of manufacturers in the United States has increased at a rapid rate.

b. Some key players operating in the craft spirits market include Pernod Ricard; Rémy Cointreau; Diageo Plc; Anchor Brewers & Distillers; House Spirits; William Grant & Sons; Rogue Ales; Copper Fox Distillery

b. Key factors that are driving the craft spirits market growth include rising demand for craft spirits, an increase in the number of craft distilleries, and rising disposable incomes. The millennial population with considerable purchasing power is expected to drive the market over the forecast period.

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![ESOMAR Certified Member]()

![Great Place to Work Certified]()

ESOMAR & Great Work to Place Certified

![ISO 9001:2015 & 27001:2022 Certified]()

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."