- Home

- »

- Electronic Devices

- »

-

Consumer Network Attached Storage Market Report, 2030GVR Report cover

![Consumer Network Attached Storage Market Size, Share & Trends Report]()

Consumer Network Attached Storage Market Size, Share & Trends Analysis Report By Design (Home, Business), By End-user (1-Bay, 2-Bays., 4-Bays, 5-Bays, 6-Bays, Above 6 Bays), By Region, And Segment Forecasts, 2023 - 2030

- Report ID: GVR-1-68038-481-9

- Number of Pages: 84

- Format: Electronic (PDF)

- Historical Range: 2017 - 2021

- Industry: Semiconductors & Electronics

Market Size & Trends

The global consumer network attached storage market size was valued at USD 5.39 billion in 2022 and is expected to expand at a compound annual growth rate (CAGR) of 9.0% from 2023 to 2030. Primarily, the market growth is expected to be driven by increased data storage capacities and network-sharing capabilities. NAS is a storage device that allows you to connect to a personal or business network so the user can access the files stored in the drive from mobile devices and PCs without plugging in the drive externally. Innovative offerings such as access to high-quality data content and access to the stored data from any computerized system or mobile device for a user or others will enhance the customer experience and thus are expected to drive demand for the market.

Growth in disposable income has increased an individual's purchasing power of an individual. Thus, this is expected to improve the market for consumer network attached storage. The modern-age population is becoming more tech-savvy and accepting technologically advanced products. Furthermore, the increasing need for surveillance is a major factor driving the growth of the consumer network attached storage (NAS) industry.

A typical consumer network attached storage consists of a central processing unit (CPU), a memory unit, and an operating system. It is available in diverse types, such as NAS with preinstalled drives, diskless NAS, and so on. It also offers an advanced way of retrieving the stored data without needing a physical device. The improved level of security has increased the regulatory need to store and share data securely within the organization, which has boosted the usage of consumer network attached storage (NAS).

Enterprises operating particularly in BFSI, telecommunications, IT, media, healthcare, retail, and hospitality, among other industries, and government agencies are continuously generating large volumes of data at very high rates. The need to store all this data effectively and securely and facilitate convenient retrieval for analysis whenever required is also growing.

The increasing security concerns have triggered the demand for video surveillance solutions for residential and commercial establishments. The growing preference for replacing physical security with video surveillance and the advent of IP cameras drive the demand for video surveillance solutions. Video surveillance is very useful in countering thefts and gathering evidence for legal purposes. On the other hand, law enforcement agencies, government agencies, and regulatory bodies opt for video surveillance as part of several initiatives to improve public safety, including traffic management. Body cameras and drones are also being integrated into video surveillance systems in line with technological advances. However, a reliable storage system would be paramount if the video surveillance footage were stored safely and conveniently.

The growing preference for cloud-based services is becoming a significant threat to the NAS market. Several organizations have started opting for cloud-based solutions to store their data owing to the enhanced security, flexible application design, and resilience cloud-based solutions can ensure. Moreover, organizations willing to switch to cloud-based solutions can choose from several providers of cloud-based solutions that offer cloud services at competitive prices. The growing competition is prompting providers of cloud services to offer flexible and customizable options, including free storage space for limited usage and free trials for up to 1 year. As a result, the number of organizations opting for cloud services is increasing continuously.

As the number of individual users, large and small- and medium-sized enterprises using consumer network attached storage (NAS) solutions continues to increase, the demand for high-performance storage units is growing. However, despite increasing the processing speed and RAM capacities, the slower response times of hard drives that form a part of the consumer network attached storage (NAS) solutions tend to affect the overall performance of the consumer network attached storage (NAS) solutions.

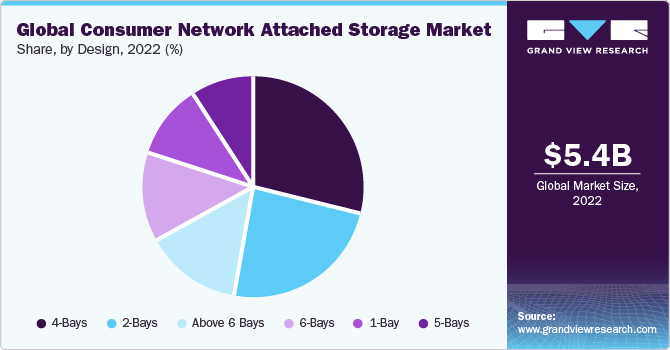

Design Insights

The 4-bays segment held a significant market share of 29.2% in 2022. Consumers require more storage space with the growing consumption of digital media, including high-resolution photos and videos. A 4-bay NAS balances capacity and convenience, allowing users to expand their storage needs while maintaining a manageable size.

The 2-bays segment is estimated to register the fastest CAGR of 10.3% over the forecast period. 2-bay NAS devices serve as entry-level solutions for individuals new to network-attached storage. They offer a relatively cost-effective way to experience the benefits of NAS without investing in larger, more complex systems.

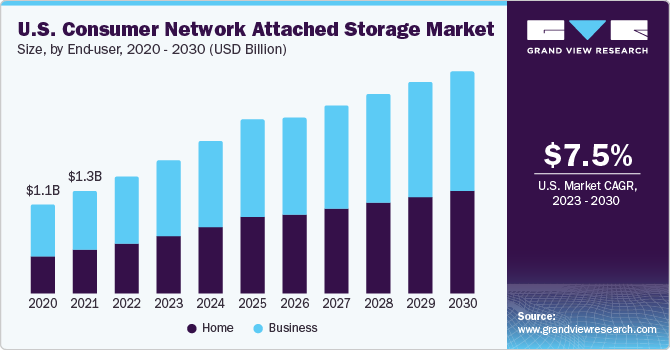

End-user Insights

Growing demand for efficient data backup systems, speedy data transfer, and cost-effective storage systems are key drivers for the consumer network attached storage market.

The business segment dominated the market with a revenue share of 58.9% in 2022. Small businesses often need reliable data management and backup solutions. Consumer network attached storage (NAS) devices offer an accessible way for these businesses to store and protect their critical data, including financial records, customer information, and business documents.

The home segment is estimated to register the fastest CAGR of 9.6% over the forecast period, owing to most consumers implementing consumer network attached storage (NAS) as a backup system, media streaming device, and home surveillance. The deployment of network-attached storage in small and medium businesses facilitates the reduction in ownership cost to the enterprise, thus driving the growth of the market for consumer network attached storage (NAS).

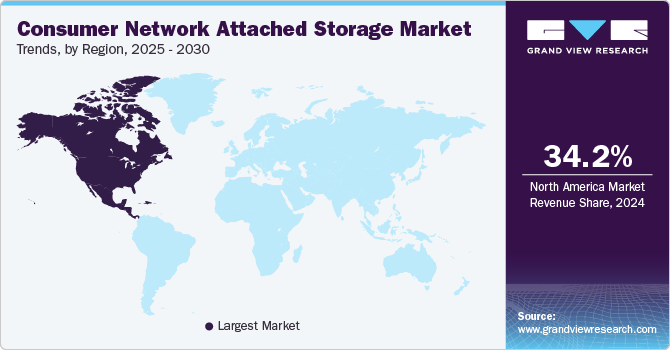

Regional Insights

North America accounted for the largest market share of 34.2% in 2022. The presence of large technology companies and significant investments made in R&D are major factors driving market growth in the North American region. North America occupies a significant market share in the overall global market. Increasing usage network attached storage by technology startups in the U.S. would significantly increase demand for the overall U.S. market. Additionally, the region is one of the world's startup hubs and is expected to boost market revenue significantly.

On the other hand, Europe is projected to demonstrate growth at the fastest CAGR of 10.6% over the forecast period. European countries have been actively embracing digital transformation across various sectors. It includes businesses and individuals adopting technologies to enhance productivity, data management, and communication. Consumer network attached storage (NAS) devices can play a role in this transformation by providing efficient storage and data-sharing solutions.

The Asia Pacific regional market is anticipated to account for a considerable CAGR, owing to the increasing awareness among users regarding the benefits offered by technology. Growth in the standard of living and increasing disposable income are the driving factors for market growth in this region. The growth in the European region is attributed to a growing number of startups in the past few years. Many businesses and enterprises increasingly adopt consumer network attached storage (NAS). The UK region is driven by the country's high penetration of consumer electronics. The rising standard of living and evolving technologies in the storage segment are expected to boost the demand for consumer network attached storage (NAS).

Key Companies & Market Share Insights

Key industry participants in the market include Western Digital Corporation, Netgear Inc., Synology Inc., QNAP Systems, Inc., Asustor Inc., Buffalo America Inc., ZyXEL Communications Inc., and Thecus Technology Corporation. Consumer network attached storage (NAS) systems have grown among small and medium enterprises as they offer features such as easy data storage and backup solutions.

Key Consumer Network Attached Storage Companies:

- Synology Inc.

- NETGEAR

- Western Digital Corporation

- QNAP Systems, Inc.

- ASUSTOR Inc.

- Buffalo Americas, Inc.

- Thecus.COM

- Zyxel

Recent Developments

-

In January 2023, QNAP Systems, Inc., a computing, networking, and storage solutions company, unveiled a series of groundbreaking NAS solutions that embrace cutting-edge storage interfaces and technologies. This advancement meets the demands of performance-intensive video production and enhances serviceability.

-

In March 2021, the Hitachi VSP 5000 was launched - an innovation that redefines storage. This remarkable NVMe flash array stands as the world's fastest, setting new benchmarks in performance. Its versatility shines through with support for various workloads, from mainframes to container environments. Combining mixed NVMe and SAS technologies achieves a fine balance between optimized performance and workload cost efficiency.

Consumer Network Attached Storage Market Report Scope

Report Attribute

Details

Market size value in 2023

USD 6.24 billion

Revenue forecast in 2030

USD 11.39 billion

Growth rate

CAGR of 9.0% from 2023 to 2030

Base year for estimation

2022

Historical data

2017 - 2021

Forecast period

2023 - 2030

Report updated

November 2023

Quantitative units

Revenue in USD million/billion, and CAGR from 2023 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Design, end-user, region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; U.K.; Germany; France; China; Japan; India; Australia; South Korea; Brazil; Mexico; Saudi Arabia; South Africa; UAE

Key companies profiled

Synology Inc.; NETGEAR; Western Digital Corporation; QNAP Systems, Inc.; ASUSTOR Inc.; Buffalo Americas, Inc.; Thecus.COM; Zyxel

Customization scope

Free report customization (equivalent up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional & segment scope

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Consumer Network Attached Storage Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2017 to 2030. For this study, Grand View Research has segmented the global consumer network attached storage market based on design, end user, and region:

-

Design Outlook (Revenue in USD Million, 2017 - 2030)

-

1-Bay

-

2-Bays

-

4-Bays

-

5-Bays

-

6-Bays

-

Above 6 Bays

-

-

End-user Outlook (Revenue in USD Million, 2017 - 2030)

-

Home

-

Business

-

-

Regional Outlook (Revenue in USD Million, 2017 - 2030)

-

North America

-

U.S.

-

Canada

-

-

Europe

-

U.K.

-

Germany

-

France

-

-

Asia Pacific

-

China

-

Japan

-

India

-

Australia

-

South Korea

-

-

Latin America

-

Brazil

-

Mexico

-

-

Middle East and Africa

-

Saudi Arabia

-

South Africa

-

UAE

-

-

Frequently Asked Questions About This Report

b. The global consumer network attached storage market size was estimated at USD 5.39 billion in 2022 and is expected to reach USD 6.24 billion in 2023.

b. The global consumer network attached storage market is expected to grow at a compound annual growth rate of 9.0% from 2023 to 2030 to reach USD 11.39 billion by 2030.

b. North America dominated the consumer network attached storage market with a share of 34.1% in 2022. This is attributable to the presence of large technology companies in the region and significant investments made by them in R&D.

b. Some key players operating in the consumer network attached storage market include Western Digital Corporation, Netgear Inc, Synology Inc., QNAP Systems, Inc., Asustor Inc, Buffalo America Inc., ZyXEL Communications Inc, and Thecus Technology Corporation.

b. Key factors that are driving the market growth include increase in the data storage capacities and network sharing capabilities.

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![ESOMAR Certified Member]()

![Great Place to Work Certified]()

ESOMAR & Great Work to Place Certified

![ISO 9001:2015 & 27001:2022 Certified]()

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."

Important: Covid19 pandemic market impact

The global electronics devices market (including consumer electronics and industrial electronics devices) is expected to be impacted significantly by COVID-19 as China is one of the major suppliers for the raw materials (used to manufacture devices) as well as the finished products. The industry is on the brink of facing a reduction in production, disruption in supply, and price fluctuations. While this can vastly encourage local manufacturers to step up and address the growing demand, the scarcity of raw material can still pose a challenge to this industry. The sales of prominent electronic companies is expected to be affected in the near future. The report will account for Covid19 as a key market contributor.