- Home

- »

- Electronic Devices

- »

-

Computer Numerical Control Machines Market Report, 2030GVR Report cover

![Computer Numerical Control Machines Market Size, Share & Trends Report]()

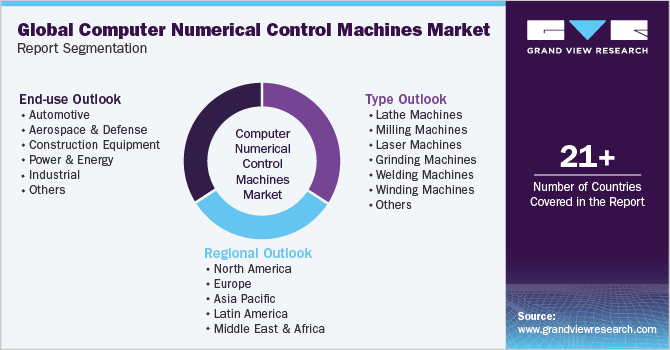

Computer Numerical Control Machines Market Size, Share & Trends Analysis Report By Type (Lathe Machines, Milling Machines, Laser Machines), By End-use (Automotive, Industrial, Construction Equipment), By Region, And Segment Forecasts, 2023 - 2030

- Report ID: GVR-2-68038-077-4

- Number of Pages: 129

- Format: Electronic (PDF)

- Historical Range: 2018 - 2021

- Industry: Semiconductors & Electronics

Report Overview

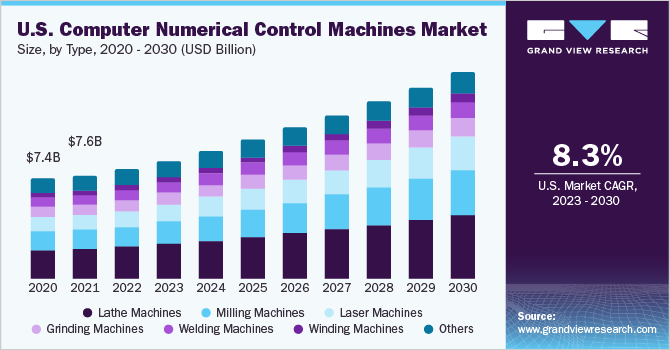

The global computer numerical control machines market size was valued at USD 60.90 billion in 2022 and is expected to grow at a compound annual growth rate (CAGR) of 10.3% from 2023 to 2030. The widespread adoption of computer numerical control (CNC) machines can be attributed owing to their ability to automate manufacturing processes. Computer numerical control machines can execute complex tasks with high precision and consistency, reducing human error and labor costs. These machines can work continuously, 24/7, significantly improving productivity and efficiency in various industries, such as automotive, aerospace, and electronics.

The CNC machine market recovered well in 2022 due to increased machine orders across industries, especially from North America. Asia Pacific, and Europe. In 2021, the market recorded positive growth owing to the pent-up demand and backlog orders resulting from the pandemic. Furthermore, technological advancements are expected to drive the growth of CNC machines. These machines are becoming more sophisticated, incorporating features such as multi-axis capabilities, improved spindle speeds, advanced tooling options, and real-time monitoring systems. The integration of Internet of Things (IoT) technology and Artificial Intelligence (AI) further enhances their capabilities, enabling predictive maintenance, adaptive machining, and data-driven optimizations.

One significant restraint is the substantial initial investment needed to acquire and establish these advanced manufacturing systems. CNC machines entail significant costs for procurement, installation, and training, creating a financial barrier that can impede their adoption, particularly among Small and Medium-sized Enterprises (SMEs) with constrained budgets. The high capital expenditure associated with CNC machines may restrict their widespread utilization in specific industries or regions.

Additionally, computer numerical control machines market is anticipated to face challenges due to the escalation of raw material prices and an impending shortage of semiconductors used in these machines. The market conditions are expected to drive an increase in demand for used CNC machines, thereby impeding the growth of the market for new CNC machines. This trend is projected to persist throughout the forecast period. Over the long term, fluctuations in raw material prices are expected to result in an upward trend in the average unit prices of CNC machines.

According to Grand View Research analysis the demand for computer numerical control machines is estimated to reach over 2,800 thousand units by 2030. The computer numerical control machines market growth is anticipated to be fueled by the rising demand for semiconductor production equipment, Electric Vehicles (EV), medical devices, and telecom communication devices. Additionally, the increasing need for five-axis mill machines and ultra-precision machines to cater to the requirements of EV manufacturing is expected to drive further growth.

The computer numerical control machines market is anticipated to experience growth in the forecast period, driven by the integration of automated CNC systems with industrial robots and simulation software to enhance production. The adoption of automated CNC machines is primarily motivated by the need to overcome the challenges posed by the scarcity of skilled labor in various industries. This enables manufacturing sectors to improve efficiency and maximize production output. To meet this demand, key players in the industry, such as Fanuc Corporation and OKAMA America Corporation, are focused on integrating new technologies into their existing product portfolios.

For instance, in March 2021, FANUC America Corporation announced to upgrade its CNC portfolio by integrating the rapid as well as Simple Startup of Robotization (QSSR) G-code feature with ss. The company delivers improved computer numerical control machines that machine operators and tool builders to program the robots more efficiently through this integration. Likewise, in August 2021, Made4CNC ApS, announced the launch of a an automated door opener for CNC machines named Safedoor SD100. Safedoor SD100 integrates easily with collaborative robots and offers greater convenience for tending machine operations.

Type Insights

Based on type, the CNC lathe machines segment accounted for largest market share of over 28.0% in 2022. The segment growth of CNC lathe machines is anticipated to be fuelled by the increasing demand from the automotive sector. This demand is driven by the need to manufacture customized parts like cylinder heads, gearboxes, starter motors, and for prototyping applications. Additionally, the segment is expected to benefit from technological advancements in existing CNC lathe systems. The incorporation of new features to cater to diverse applications is expected to contribute positively to the segment growth.

The CNC milling machines demand is expected to register highest CAGR of nearly 12.0% over forecast period. The global growth of milling machines can be attributed to factors such as the growing emphasis on industrial automation and advancements in technology. The emergence of Industry 4.0 and the integration of advanced technologies like artificial intelligence, machine learning, and robotics have transformed milling machines into intelligent and efficient tools capable of executing intricate tasks. Automation reduces the need for human intervention, leading to increased productivity, enhanced accuracy, and seamless integration within manufacturing processes.

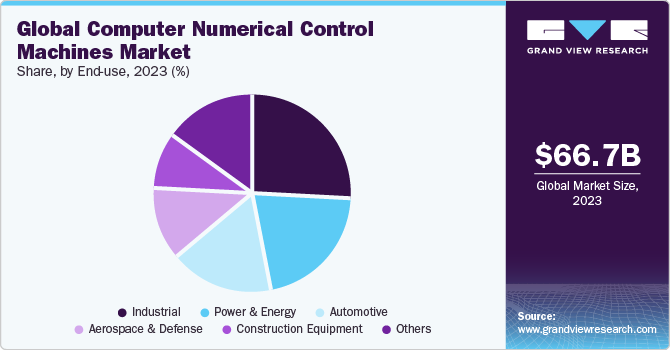

End-use Insights

The industrial segment accounted for largest market share of approximately 26.0% in 2022. The industrial sector's adoption of CNC machines is driven by the aim to achieve greater automation and improved efficiency. These machines can execute intricate manufacturing tasks with minimal human intervention, resulting in heightened productivity and reduced production times. Moreover, the industrial segment encompasses various manufacturing industries such as packaging, electronics, medical, and others. The growing demand for fully automated and turnkey CNC machines, aimed at addressing production backlogs from 2020, is expected to drive segment growth over the forecast period.

Moreover, the automotive sector is expected to register highest CAGR of nearly 12.0% over the forecast period. The automotive sector has consistently been a pioneer in technological advancements, driven by the pursuit of precision, efficiency, and innovation. The growing popularity of electric vehicles (EVs) and the rising demand for processing ultra-precision parts for EVs are anticipated to positively impact the growth of the automotive segment. The increasing demand for customized automotive components like crankshafts, cylinder heads, and motor pumps is also expected to contribute to market growth. Consequently, the automotive sector's requirement for CNC machines is anticipated to drive the segment's growth over the forecast period.

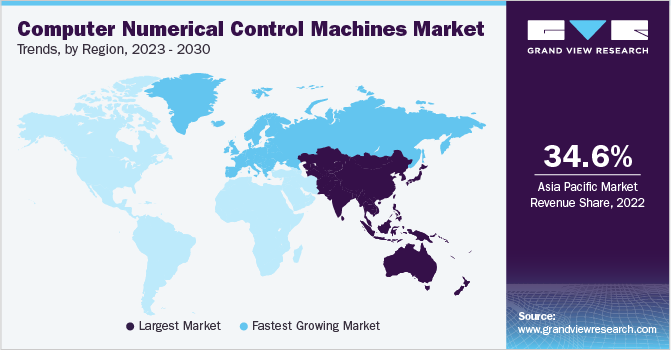

Regional Insights

The Asia Pacific region accounted for the overall market share of 36% in 2022 and is expected to register highest CAGR of nearly 13.0% over the forecast period. The computer numerical control machines sales are expected to reach over 800 thousand units in 2023 and to double by 2030. The region has witnessed significant technological advancements, which have contributed to the proliferation of CNC machines. The market demand is ascribed to the surge in manufacturing outsourcing services for industrial equipment, low operational costs, and the abundance of low-cost raw materials that drive the demand for manufacturing outsourcing, thereby increasing the number of CNC machines sales over the forecast period. Furthermore, the region has experienced rapid industrialization and a substantial expansion of the manufacturing sector. Countries like China, Japan, South Korea, and Taiwan have emerged as global manufacturing powerhouses. The demand for CNC machines has surged due to the need for efficient and precise manufacturing processes across various industries, including automotive, aerospace, electronics, and medical devices.

Europe is expected to expand at a significant CAGR of approximately a 8.8% CAGR over the forecast period. The region has been at the forefront of technological advancements in the manufacturing sector. Continuous innovation and research have led to the development of cutting-edge CNC machines with enhanced capabilities. The growth is driven by Germany, Italy, France, and Central and Eastern European countries. Shortage of labour prompting metalworking companies to increase their investment in automation to enhance the efficiency of their CNC machines is expected to drive market growth over the forecast period.

Key Companies & Market Share Insights

The CNC machines market is turning out to be competitive. The market is characterized by a few established manufacturers and several small-scale regional manufacturers. The incumbents such as Fanuc Corporation, DMG Mori Co. Ltd., and Okama are investing aggressively in R&D efforts to introduce new, innovative, high-precision machine tools and enter into different application segments as part of the efforts to retain the existing customers while attracting new ones. For instance, in February 2021, CITIZEN MACHINERY CO.,LTD. announced the launch of a Sliding Headstock Type Automatic CNC Lathe machine named Cincom L32 XII. Cincom L32 XII features enable to perform complex shapes machining such as implants used in medical treatment as well as simultaneously perform multiple functions. Some of the prominent players in the global computer numerical control machines market include:

-

AMADA MACHINERY CO., LTD.

-

Amera Seiki

-

DMG MORI CO., LTD.

-

General Technology Group Dalian Machine Tool Corporation

-

DATRON AG

-

FANUC CORPORATION

-

Haas Automation, Inc

-

Hurco Companies, Inc.

-

OKUMA Corporation

-

Shenyang Machine Tool Part Co., Ltd.

-

YAMAZAKI MAZAK CORPORATION.

Recent Development

- In March 2023, AMADA PRESS SYSTEM CO., LTD. unveiled the LM-16A, a state-of-the-art wire rotation torsion spring machine equipped with a wire-rotating mechanism, eight processing slides, and 15-axis control. Setting a new industry standard, it features a unique double-swing axis with precise numerical control of the lateral movement of the slides, enhancing its capabilities for advanced spring manufacturing

Computer Numerical Control Machines Market Report Scope

Report Attribute

Details

Market size value in 2023

USD 66.74 billion

Revenue forecast in 2030

USD 132.93 billion

Growth rate

CAGR of 10.3% from 2023 to 2030

Base year for estimation

2022

Historical data

2018 - 2021

Forecast period

2023 - 2030

Report updated

May 2023

Quantitative units

Volume in thousand units, revenue in USD billion, and CAGR from 2023 to 2030

Report coverage

Volume forecast, Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Type, end-use, region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S., Canada, U.K., Germany, France, Italy, Spain, China, India, Japan, Australia, South Korea, Brazil, Mexico, Argentina, U.A.E., Saudi Arabia, South Africa

Key companies profiled

AMADA MACHINERY CO., LTD.; Amera Seiki; DMG MORI CO., LTD.; General Technology Group Dalian Machine Tool Corporation; DATRON AG; FANUC CORPORATION; Haas Automation, Inc; Hurco Companies, Inc.; OKUMA Corporation; Shenyang Machine Tool Part Co., Ltd.; YAMAZAKI MAZAK CORPORATION.

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Computer Numerical Control Machines Market Report Segmentation

The report forecasts revenue growth at global, regional, and country level and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global computer numerical control machines market report on the basis of type, end-use, and region:

-

Type Outlook (Volume, Thousand Units; Revenue, USD Billion, 2018 - 2030)

-

Lathe Machines

-

Milling Machines

-

Laser Machines

-

Grinding Machines

-

Welding Machines

-

Winding Machines

-

Others

-

-

End-use Outlook (Revenue, USD Billion, 2018 - 2030)

-

Automotive

-

Aerospace & Defense

-

Construction Equipment

-

Power & Energy

-

Industrial

-

Others

-

-

Regional Outlook (Revenue, USD Billion, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

-

Europe

-

U.K.

-

Germany

-

France

-

Italy

-

Spain

-

-

Asia Pacific

-

China

-

India

-

Japan

-

Australia

-

South Korea

-

-

Latin America

-

Brazil

-

Mexico

-

Argentina

-

-

Middle East & Africa (MEA)

-

U.A.E.

-

Saudi Arabia

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global computer numerical control machines market size was estimated at USD 60.90 billion in 2022 and is expected to reach USD 66.74 billion in 2023.

b. The global computer numerical control machines market is expected to grow at a compound annual growth rate of 10.3% from 2023 to 2030 to reach USD 132.93 billion by 2030.

b. The Asia Pacific dominated the owing to the need for efficient and precise manufacturing processes across various industries, including electronics, aerospace, medical devices, and automotive.

b. Some key players operating in the CNC machines market include AMADA MACHINERY CO., LTD.; Amera Seiki; DMG MORI CO., LTD.; General Technology Group Dalian Machine Tool Corporation; DATRON AG; FANUC CORPORATION; Haas Automation, Inc; Hurco Companies, Inc.; OKUMA Corporation; Shenyang Machine Tool Part Co., Ltd.; and YAMAZAKI MAZAK CORPORATION.

b. Key factors that are driving the CNC machines market growth include owing to their ability to automate manufacturing processes, growing demand for higher productivity & reduction in downtime, and increasing demand for mass production from the industrial sector.

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![ESOMAR Certified Member]()

![Great Place to Work Certified]()

ESOMAR & Great Work to Place Certified

![ISO 9001:2015 & 27001:2022 Certified]()

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."

Important: Covid19 pandemic market impact

Artificial Intelligence (AI), Virtual Reality (VR), and Augmented Reality (AR) solutions are anticipated to substantially contribute while responding to the COVID-19 pandemic and address continuously evolving challenges. The existing situation owing to the outbreak of the epidemic will inspire pharmaceutical vendors and healthcare establishments to improve their R&D investments in AI, acting as a core technology for enabling various initiatives. The insurance industry is expected to confront the pressure associated with cost-efficiency. Usage of AI can help in reducing operating costs, and at the same time, can increase customer satisfaction during the renewal process, claims, and other services. VR/AR can assist in e-learning, for which the demand will surge owing to the closure of many schools and universities. Further, VR/AR can also prove to be a valuable solution in providing remote assistance as it can support in avoiding unnecessary travel. The report will account for COVID-19 as a key market contributor.