- Home

- »

- Advanced Interior Materials

- »

-

Composite Adhesive Market Size Report, 2022-2030GVR Report cover

![Composite Adhesive Market Size, Share & Trends Report]()

Composite Adhesive Market Size, Share & Trends Analysis Report By Product (Acrylic, Epoxy), By Application (Automotive & Transportation, Aerospace & Defense), By Region, And Segment Forecasts, 2022 - 2030

- Report ID: GVR-4-68039-051-1

- Number of Pages: 100

- Format: Electronic (PDF)

- Historical Range: 2017 - 2020

- Industry: Advanced Materials

Report Overview

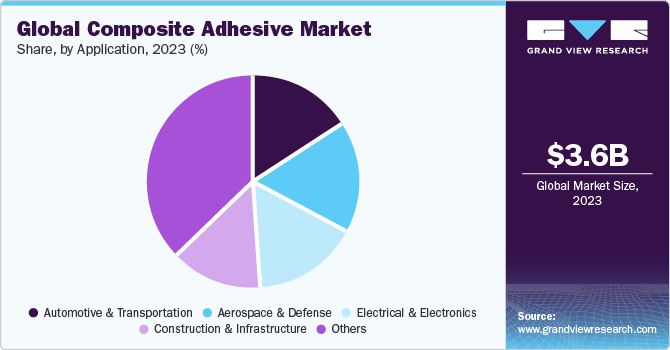

The global composite adhesive market size was valued at USD 3.35 billion in 2021 and is expected to grow at a compound annual growth rate (CAGR) of 4.7% from 2022 to 2030. The penetration of lightweight composites in different industries like aerospace & defense, electric vehicles (EVs), sports, and others is expected to propel the demand for the product during the forecast period.

Owing to the surge in the demand for EVs, key automotive players are investing to set up new manufacturing plants across the world. For instance, in January 2022, an announcement regarding the construction of a new EV plant in Hubei Province, China by Dongfeng Honda Automobile Co Ltd was made. The production is anticipated to start in 2024 and its annual production capacity is expected to be 120,000 units.

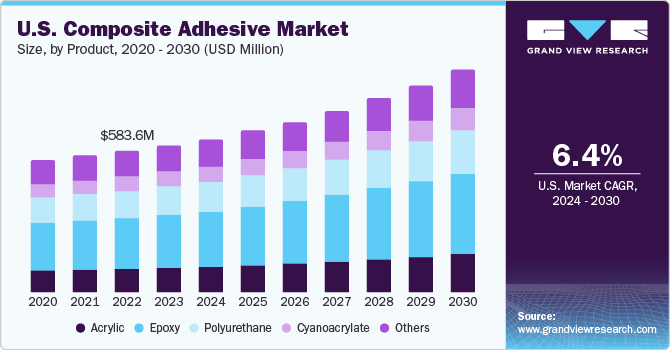

The U.S. was the largest market for composite adhesives in North America in 2021 and this trend is anticipated to continue during the forecast period. Composites are extensively used in the production of automotive and aerospace components owing to their lightweight nature. The country is taking initiatives to boost domestic manufacturing, which is anticipated to augment the production of composites and demand for adhesives over the coming years.

Although the country is witnessing a decline in automobile production, the rise in the production of EVs is expected to positively impact the demand for composite adhesives. For instance, in December 2021, Rivian Automotive Inc announced to build of a USD 5 billion plant in Georgia, the U.S. for manufacturing EVs. The plant is scheduled to open in 2024 and will manufacture 400,000 vehicles a year. Furthermore, growth in the U.S. construction industry is stimulating the demand for composite adhesives.

For instance, in October 2021, Scott Bader Company Ltd invested USD 16 million to set up a new production site in North Carolina. The new state-of-the-art facility will produce adhesives and gel coats for the construction industry. The U.S. has recovered from the economic contraction in 2020 caused by the COVID-19 pandemic. The economy expanded by 6.9% in Q4 2021, on a year-on-year basis. The growth was attributed to the goods and services produced in the U.S., which increased 5.7% year on year.

Product Insights

Epoxy held the largest revenue share of more than 36.0% in the product segment in 2021 in the global market. It is a widely used product owing to benefits such as low cost, high strength, durability, mechanical shock resistance, high-temperature resistance, low shrinkage, and cryogenic resistance.

On the other hand, the acrylic segment is expected to witness the fastest growth rate of 5.5%, in terms of revenue, during the forecast period. The product is used for adhesion in various rigid and semi-rigid bonding applications in the automotive and medical industries. It provides high-strength bonds to composites along with high peel strength. It is highly preferred in a wide range of end-use industries owing to characteristics such as fast curing time and acid & solvent resistance.

The cyanoacrylate product segment is anticipated to witness a CAGR of 5.1%, in terms of revenue, across the projection period. It offers faster curing than epoxy and acrylic because of its ionic nature. Owing to its fast curing and ability to adhere to most surfaces, it is also known as superglue. It is often used for bonding small plastic parts and is suitable for situations where instant strong bonds are needed, and high impact or peel resistance is not required.

Application Insights

Aerospace & defense held a revenue share of over 17.0% in 2021 of the global market regarding the application. The deployment of composite adhesives increases assembly productivity, reduces weight, and also helps in cost management, as most of the major parts of an aircraft use composite materials. For instance, in October 2021, Saab AB opened an aerospace facility in West Lafayette, U.S., which will produce the aft airframe section for T-7A Red Hawk trainer aircraft. The plant will manufacture various composite parts.

Automotive was the second-largest application segment of the market, in terms of revenue, in 2021. Penetration of adhesives in the industry is increasing significantly owing to the rising trend of lightweight vehicles. To achieve this, automotive companies are inclining towards the incorporation of composites. For instance, in April 2021, SFHL entered into a partnership with Mind S.r.l., marking the entry of SFHL into the composites industry to reduce the weight of vehicles.

Electrical & electronics is another vital application segment of the market. Composites have various applications in the industry, including electromagnetic shielding, wearable devices, batteries, electrical switching & insulations, and sensors. The growing penetration of composites in this segment is propelling the demand for adhesives for the assembling of the components.

Regional Insights

Asia Pacific held a revenue share of more than 47.0% in 2021 of the global market. The increasing requirement for composite-based products in EVs, renewables, aerospace & defense, and construction industries is anticipated to propel the demand for the product over the forecast period.

The growing demand for adhesives from industries such as automotive and electronics has pushed major players to invest in the region. For instance, in May 2021, Henkel AG & Co. KGaA invested CNY 500 million (~USD 77.58 million) to set up a special adhesive Asia Pacific innovation center in Shanghai, China. The center will develop high-quality adhesives for consumers in the Asia Pacific region.

North America is anticipated to register the fastest growth, in terms of revenue, across the forecast period. Increasing focus on the production of EVs, aircraft, and electronics is expected to drive the product demand in the region. For instance, in November 2021, Tesla Inc. announced plans to establish a new factory to produce battery manufacturing equipment in Canada. EV battery packs use a wide variety of adhesives in their production.

Europe accounted for the second-largest share, in terms of revenue, of the global market in 2021. Emphasis on using lightweight composite materials in aircraft is anticipated to benefit market growth over the forecast period. For instance, in February 2022, the Netherlands-based Venturi Aviation partnered with Airborne, a company engaged in offering solutions for advanced composites, for using lightweight structures for an all-electric commuter aircraft.

Key Companies & Market Share Insights

The market is highly competitive with the presence of numerous players worldwide. Owing to the increasing demand for adhesives, companies are investing in expanding their manufacturing units. For instance, in April 2021, Tesa SE announced that they will invest EUR 32 million (~USD 36.38 million) to expand the production capacity of their plant in Suzhou, China. This expansion will cater to the high demand coming from electronic manufacturers.

The key players are carrying out mergers and acquisitions to expand their businesses. For instance, in December 2021, Meridian Adhesives Group announced the acquisition of American Sealants Inc., a manufacturer of assembly adhesives and sealants. The acquisition is expected to add value to the product portfolio of Meridian Adhesives Group by extending its reach as a full-service provider of high-performance adhesives and sealants to customers Some of the prominent players in the composite adhesive market include:

-

3M

-

Bostik

-

Dow

-

Henkel AG & Co. KGaA

-

H.B. Fuller Company

-

Huntsman Corporation LLC

-

Illinois Tool Works Inc

-

Permabond LLC

-

Parker Hannifin Corp

-

Sika AG

Composite Adhesive Market Report Scope

Report Attribute

Details

Market size value in 2022

USD 3.47 billion

Revenue forecast in 2030

USD 5.07 billion

Growth Rate

CAGR of 4.7% from 2022 to 2030

Base year for estimation

2021

Historical data

2017 - 2020

Forecast period

2022 - 2030

Quantitative units

Revenue in USD Million, volume in Kilotons, and CAGR from 2022 to 2030

Report coverage

Revenue & volume forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, application, region

Regional scope

North America; Europe; Asia Pacific; Central & South America; Middle East & Africa

Country scope

U.S.; Germany; UK; France; China; India; Japan; Brazil

Key companies profiled

3M; Bostik; Dow; Henkel AG & Co.KGaA; H.B Fuller Company; Huntsman Corporation LLC; Illinois Tool Work Inc; Sika AG

Customization scope

Free report customization (equivalent to up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Segments Covered in the Report

This report forecasts revenue and volume growth at the global, regional, and country levels and provides an analysis of the latest industry trends and opportunities in each of the sub-segments from 2017 to 2030. For the purpose of this study, Grand View Research has segmented the global composite adhesive market report on the basis of product, application, and region:

-

Product Outlook (Revenue, USD Million; Volume, Kilotons, 2017 - 2030)

-

Acrylic

-

Epoxy

-

Polyurethane

-

Cyanoacrylate

-

Others

-

-

Application Outlook (Revenue, USD Million; Volume, Kilotons, 2017 - 2030)

-

Automotive & Transportation

-

Aerospace & Defense

-

Electrical & electronics

-

Construction & Infrastructure

-

Other

-

-

Regional Outlook (Revenue, USD Million; Volume, Kilotons, 2017 - 2030)

-

North America

-

U.S.

-

-

Europe

-

Germany

-

UK

-

France

-

-

Asia Pacific

-

China

-

India

-

Japan

-

-

Central & South America

-

Brazil

-

-

Middle East & Africa

-

Frequently Asked Questions About This Report

b. The global composite adhesive market was estimated at USD 3.35 billion in 2021 and is expected to reach USD 3.47 billion in 2022.

b. The global composite adhesive market is expected to grow at a compound annual growth rate of 4.7% from 2022 to 2030 to reach USD 5.07 billion by 2030.

b. Epoxy was the key product segment of the market with a revenue share of above 36.0% of the market in 2021.

b. Some of the key players operating in the composite adhesive market are 3M, Bostik, Dow, Henkel AG & Co. KGaA, and Huntsman Corporation LLC, among others.

b. Increasing investments in electric vehicle production and the construction industry are the growth drivers for the composite adhesive market.

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![ESOMAR Certified Member]()

![Great Place to Work Certified]()

ESOMAR & Great Work to Place Certified

![ISO 9001:2015 & 27001:2022 Certified]()

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."