- Home

- »

- Electronic Devices

- »

-

Commercial Printing Market Size, Share & Trends Report, 2030GVR Report cover

![Commercial Printing Market Size, Share & Trends Report]()

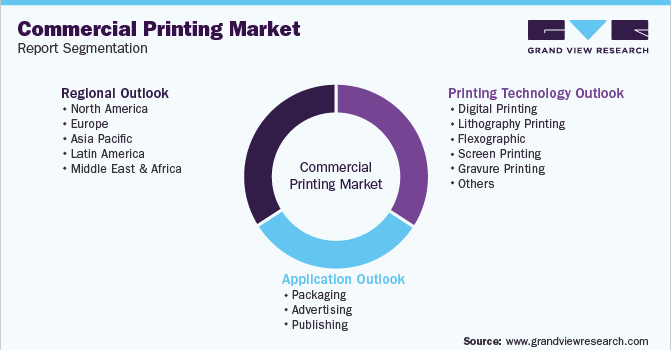

Commercial Printing Market Size, Share & Trends Analysis Report By Printing Technology (Digital Printing, Lithography Printing, Flexographic, Screen Printing, Gravure Printing), By Application, By Region, And Segment Forecasts, 2023 - 2030

- Report ID: GVR-4-68040-001-2

- Number of Pages: 120

- Format: Electronic (PDF)

- Historical Range: 2017 - 2021

- Industry: Semiconductors & Electronics

Report Overview

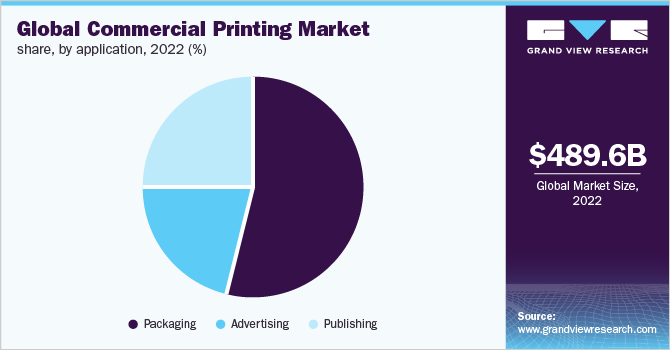

The global commercial printing market size was valued at USD 489.63 billion in 2022 and is anticipated to grow at Compound Annual Growth Rate (CAGR) of 2.8% from 2023 to 2030. The increasing need of businesses and enterprises for advertising materials such as brochures and pamphlets is driving the demand for commercial printing services. Advertising is one of the excellent marketing tools. Increasing technological proliferation, such as faster presses and new color & toner technology, allows better production capabilities and superior quality. Additionally, technical development of printing techniques proves to provide cost-effectiveness and efficiency for bulk printing. The cost-effectiveness can prevent the restraining impacts of digital media on printing services to a certain extent.

The booming demand for packaging and labeling from the e-commerce industry contributes significantly to the growth of the target market. The e-commerce vendors such as Amazon, eBay, and Target are adopting innovative packaging solutions such as additive manufacturing and AI-powered design tools to enhance the packaging. Market players from the logistics, warehousing, and retail sectors are investing in hybrid print technologies. Hybrid technology helps in combining the benefits offered by analog and digital technologies. This is accomplished by combining the dependability and effectiveness of flexographic printing with the artistic potential of digital technology.

Despite the increasing adoption of digital media for the publication of books and advertising, commercial printing still holds relevance since the experience that printed materials and publications offer is unique. It cannot be duplicated in an online medium. Avid book readers and magazine buyers prefer the printed form over online reading, as physical books add to the experience. Printed books also offer benefits to users, such as better readability.

The sale of print books in the United States increased by nearly USD 68 million in 2021. The growing popularity of print-on-demand among consumers also contributes to the expansion of the market. Print-on-demand (POD) is an order delivery method in which goods are printed as soon as an order is placed. POD allows users to get customized designs for a wide range of products. Increasing consumers’ preference for customization & personalization also contributes to the target market growth.

The rising cost of input materials such as ink, paper, and pigments, among others, is one of the restraining factors of the market's growth over the forecast period. In addition, consumers' increasing adoption of digital media is further anticipated to hinder the market. However, the adoption of green commercial printers among vendors is expected to create lucrative opportunities for the market. The green technology uses eco-friendly papers, soy inks, and coatings which are expected to broaden the demand for green commercial printers, thereby opening new opportunities for market growth.

COVID-19 Impact Analysis

The COVID-19 pandemic limited the target market's growth during the outbreak's peak. Owing to the COVID-19 epidemic, the demand for commercial printing services was significantly reduced, which impacted the market negatively. Also, the printing operations were affected across the globe owing to the closing down of the facilities and support operations. Most firms across the globe adopted remote working, which led to a complete transition to paperless processes. Also, consumers significantly shifted to digital media due to safety concerns. These factors led to a reduced need for commercial printing, thereby considerably impacting the market.

Furthermore, due to the cancellation of numerous events, there was a decreased demand for printed promotional materials. Also, the advertising strategy was shifted to the digital medium, and demand for printed advertising products was reduced during the pandemic. However, the pandemic resulted in increased demand for packaging owing to the booming demand for packaged products.

The pandemic resulted in the rise of online food delivery services, thereby contributing to the increased demand for packaging products. The negatively impacted consumer spending and consumer demand started picking up at a slow pace post the lifting of the restrictions. The market is limping back to normalcy as players are striving to accommodate the business with the market realities.

Printing Technology Insights

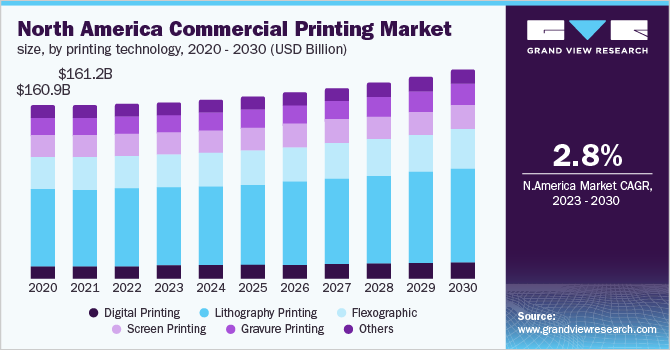

The digital printing segment is expected to grow at the fastest CAGR of 3.9% during the forecast period. The growth is attributed to the rapid adoption of inkjet and laser printing solutions across the paper and packaging printing sector due to the cost-efficient and flexible nature of the technology. Furthermore, the segment is anticipated to be driven by the adoption of Artificial Intelligence (AI), and Internet of Things (IoT) based technologies. Digital printing also provides reduced costs for color prints and has a better return on investments, and hence is adopted widely for printing applications.

The lithography printing segment held the largest share of 43.82% in 2022. The dominant nature of the segment is owing to the growing demand for printing from packaging applications. Lithography technology offers various advantages, such as consistent and high image quality, leading to higher adoption. Lithographic printing is ideal for high-volume batches of static mailings, such as directories and product advertisements. Flexographic technology is also one of the most used technologies. However, the post-printing processes required for it limits its adoption.

Application Insights

The packaging segment accounted for the largest revenue share of over 53.77% in 2022. The packaging segment includes printing on labels, tags, and flexible packaging. Commercial printers have been noted to be incorporating digital technology to improve packaging print quality. In addition, Quick response (QR) codes are now a standard print on product packaging that may be scanned with a smartphone to display additional data, like product details and promotional content, to name a few.

The regulatory requirement of packaging printing on products such as pharmaceuticals, cigarettes, and alcoholic beverages is one of the driving factors for the segment's growth. The advertising segment is anticipated to grow at a promising CAGR of about 2.0% during the forecast period.

Print advertisements provide coverage of events, in-depth analysis, and mass-circulation of tangible promotions and news, thus resulting in higher conversion rates and building credibility. Gravure and digital print processes are generally utilized for short runs, such as newspapers, newsletters, posters, flyers, and brochures. Publishing comprises books, newspapers, magazines, and others. The rising prevalence of newspaper and newsletter subscribers is one of the key factors driving the publishing application market.

Regional Insights

Asia Pacific is expected to grow at the highest CAGR of 3.2% over the forecast period, and it was also the dominant region in the global market in 2022. The regional growth is attributed primarily to advancements in the print industry, such as digital technologies, particularly in China and India. With such improvements, traditional printers have been replaced by high-tech commercial printers due to their high-speed capabilities. Moreover, the region’s e-commerce boom and organization of the retail sector offer enormous potential for packaging growth in the packaging application, supporting the target market.

North America held the second-largest share in the commercial printing market in 2022 and accounted for a share of over 33.15% of the global revenue. The regional growth is attributable to the high demand for commercial printing for marketing, packaging, labeling, and advertising purposes. Furthermore, the presence of key players in the region, such as Quad/Graphics Inc., Acme Printing, Cenevo, and RR Donnelley is anticipated to further propel the industry’s growth.

Key Companies & Market Share Insights

The industry can be described as a highly competitive market characterized by several prominent players. The players pursue strategies to enhance their offerings, such as strategic partnerships and regional expansion. For instance, in May 2022, R.R. Donnelley (RRD) launched Helium, an editorial solution offering professionals access to specialized copywriting, content optimization, and project management. This service could provide brands with a central access point to hundreds of content-generation subject matter experts.

In another instance, in October 2018, Quad/Graphics announced the acquisition of LSC Communications US, LLC. This acquisition enabled Quad to focus on the company’s 3.0 strategy to expand its capabilities with appropriate resources.

Due to market products' homogeneity, many market participants are being pushed to compete on price. These factors have resulted in fierce competition in the target market. In addition, companies are under pressure to save money and be as innovative as possible, and competition is thriving in the print services sector.Some prominent players in the global commercial printing market include:

-

Quad/Graphics Inc.

-

Acme Printing

-

Cenveo

-

RR Donnelley

-

Transcontinental Inc.

-

LSC Communications US, LLC.

-

Gorham Printing, Inc.

-

Dai Nippon Printing

-

The Magazine Printing Company

-

Cimpress plc

-

Quebecor World Inc.

-

Duncan Print Group

Commercial Printing Market Report Scope

Report Attribute

Details

Market size value in 2023

USD 494.53 billion

Revenue forecast in 2030

USD 598.06 billion

Growth rate

CAGR of 2.8% from 2023 to 2030

Base year of estimation

2022

Historical data

2017 - 2021

Forecast period

2023 - 2030

Quantitative units

Revenue in USD million and CAGR from 2023 to 2030

Report coverage

Revenue forecast, company market share, competitive landscape, growth factors, and trends

Segments covered

Printing technology, application, region

Regional scope

North America; Europe; Asia Pacific; Latin America; Middle East and Africa

Country scope

U.S.; Canada; Mexico; Germany; France; U.K.; China; India; Japan; Brazil

Key companies profiled

Quad/Graphics Inc.; Acme Printing; Cenveo; RR Donnelley; Transcontinental Inc.; LSC Communications US, LLC.; Gorham Printing, Inc.; Dai Nippon Printing; The Magazine Printing Company; Cimpress plc; Quebecor World Inc.; HH Global; Cimpress PLC

Customization scope

Free report customization (equivalent to up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Commercial Printing Market Segmentation

The report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2017 to 2030. For this study, Grand View Research has segmented the global commercial printing market report based on printing technology, application, and region:

-

Printing Technology Outlook (Revenue, USD Million, 2017 - 2030)

-

Digital Printing

-

Lithography Printing

-

Flexographic

-

Screen Printing

-

Gravure Printing

-

Others

-

-

Application Outlook (Revenue, USD Million, 2017 - 2030)

-

Packaging

-

Advertising

-

Publishing

-

Books

-

Newspaper

-

Magazines

-

Others

-

-

-

Regional Outlook (Revenue, USD Million, 2017 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

U.K.

-

France

-

-

Asia Pacific

-

China

-

India

-

Japan

-

-

South America

-

Brazil

-

-

Middle East & Africa

-

Frequently Asked Questions About This Report

b. The global commercial printing market size was estimated at USD 489.63 billion in 2022 and is expected to reach USD 494.53 billion in 2023

b. The global commercial printing market is expected to witness a compound annual growth rate of 2.8% from 2023 to 2030 to reach USD 598.06 billion by 2030

b. Asia Pacific is expected to grow at the highest CAGR of 3.2% over the forecast period. The growth can be attributed to the growing demand for ptinting from packaging and advertising applications in countries such as India, China, and Japan.

b. Some key players operating in the commercial printing market include ACME Printing, Dai Nippon Printing Co. Ltd., R.R. Donnelley & Sons Co., Quad/Graphics Incorporated, Quebecor World Inc., Transcontinental Inc., Cimpress plc, and Ceneveo.

b. Key factor driving the growth of the commercial printing market include technological proliferation especially digital printing, along with the increasing demand and need for advertising across several business sectors.

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![ESOMAR Certified Member]()

![Great Place to Work Certified]()

ESOMAR & Great Work to Place Certified

![ISO 9001:2015 & 27001:2022 Certified]()

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."

Important: Covid19 pandemic market impact

The global electronics devices market (including consumer electronics and industrial electronics devices) is expected to be impacted significantly by COVID-19 as China is one of the major suppliers for the raw materials (used to manufacture devices) as well as the finished products. The industry is on the brink of facing a reduction in production, disruption in supply, and price fluctuations. While this can vastly encourage local manufacturers to step up and address the growing demand, the scarcity of raw material can still pose a challenge to this industry. The sales of prominent electronic companies is expected to be affected in the near future. The report will account for COVID-19 as a key market contributor.