- Home

- »

- Consumer F&B

- »

-

Coffee Market Size, Share & Trends Analysis Report, 2030GVR Report cover

![Coffee Market Size, Share & Trends Report]()

Coffee Market Size, Share & Trends Analysis Report By Distribution Channel (B2B, B2C), By Product (Roasted, Instant, RTD), By Nature (Conventional, Organic), By Region (Europe, Asia Pacific), And Segment Forecasts, 2023 - 2030

- Report ID: GVR-4-68040-153-1

- Number of Pages: 120

- Format: Electronic (PDF)

- Historical Range: 2017 - 2021

- Industry: Consumer Goods

Coffee Market Size & Trends

The global coffee market size was estimated at USD 461.25 billion in 2022 and is expected to grow at a compound annual growth rate (CAGR) of 5.2% from 2023 to 2030. The overall product demand is a significant driver of the market growth. Coffee is one of the most consumed beverages worldwide, and its popularity continues to grow, particularly in emerging markets, such as Asia Pacific. Increasing disposable incomes, changing lifestyles, and a rising coffee culture among consumers across the globe are contributing to the overall market growth. According to the data published by the National Coffee Association of U.S.A., Inc. in March 2020, the overall product consumption in the U.S. has increased by 5% since 2015.

The availability and production of coffee beans significantly impact the market growth. Factors, such as weather conditions, natural disasters, diseases affecting coffee plants (e.g., coffee rust), and geopolitical issues, can affect the supply and prices of these beans. Brazil, Vietnam, and Colombia are among the leading coffee-producing countries, and their production levels influence market dynamics. According to a report published by the U.S. Department of Agriculture in June 2023, the coffee harvest in Brazil is expected to reach 66.4 million bags in 2023/24. In addition, the coffee harvest in Vietnam and Colombia is expected to reach 31.3 million and 11.6 million bags respectively in 2023/24.

Changing demographics, including shifts in lifestyles, influence the global market. Younger generations, such as millennials and Gen Z, are more likely to be avid coffee consumers and have specific preferences regarding specialty coffee, sustainable sourcing, and unique flavors. The aging population and their evolving tastes also impact the market, as older adults may seek milder or decaffeinated options. According to a survey from The Fall 2021 National Coffee Data Trends (NCDT), 65% of millennials (25 to 39 years) reported having coffee within the past day compared to 46% of Gen Z-ers (18 to 24 years).

Increasing awareness about health and wellness among consumers can affect caffeine consumption patterns. Studies highlighting potential health benefits associated with moderate caffeine consumption, such as antioxidants and potential protection against certain diseases, can influence consumer attitudes and preferences. Product consumption in adequate amounts provides various health benefits, such as supporting brain & heart health, lowered diabetes risk, and longevity. However, concerns regarding caffeine intake and potential adverse health effects can hinder market growth. In addition, excessive consumption can lead to caffeine-related issues, such as anxiety, insomnia, gastrointestinal disturbances, and increased heart rate.

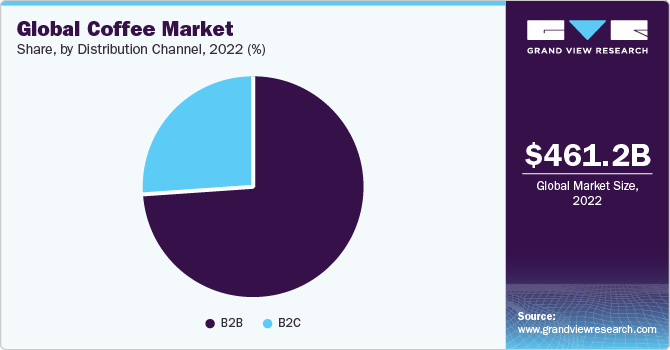

Distribution Channel Insights

The B2B segment accounted for a share of 73.7% in 2022 and is anticipated to grow at a CAGR of 4.9% from 2023 to 2030. B2B coffee sales often involve bulk purchases by businesses, such as restaurants, cafes, hotels, and others. These establishments require a large supply of coffee to meet the consumer demands. B2B sales channel allows for customization to meet the specific needs of businesses. This could include custom blends, packaging, and even branding tailored to the business's preferences. Moreover, the increasing number of cafes, hotels, and restaurants is boosting the product demand, thereby driving the global market growth.

The B2C segment is projected to grow at the highest CAGR of 5.8% from 2023 to 2030. The global rise of specialty coffee culture has led to an increased demand for unique and high-quality coffee beans among consumers. B2C channels allow consumers to explore and purchase specialty coffees directly from hypermarkets & supermarkets, convenience stores, specialty stores, or online platforms. In addition, the growth of e-commerce has facilitated direct-to-consumer sales models. Coffee producers, roasters, and brands can now sell their products directly to consumers through online platforms, reaching a wider audience and bypassing traditional retail channels.

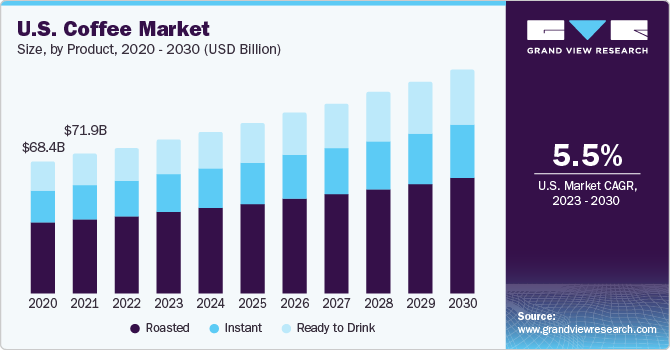

Product Insights

The roasted product segment size was estimated at USD 246.32 billion in 2022 and is expected to grow at a CAGR of 4.8% from 2023 to 2030. The globalization of coffee culture, driven by the expansion of international food & beverage chains, such as Starbucks, has led to increased consumption of roasted coffee. These chains have popularized the idea of freshly roasted coffee, emphasizing its premium quality. In addition, there is a growing interest in craft and specialty coffee, with consumers seeking unique and high-quality coffee experiences. This trend has driven the demand for freshly roasted beans, often sourced from specific regions and with distinct flavor profiles. Moreover, the rising trend of home brewing has fueled the sales of roasted beans.

Many consumers now invest in high-quality coffee beans and brewing equipment to replicate the coffee shop experience at home. The ready-to-drink (RTD) product segment is expected to register a CAGR of 6.0% from 2023 to 2030. The hectic lifestyle of consumers has led to an increased demand for convenient options, and RTD coffee fits well into this lifestyle. It allows consumers to enjoy their favorite coffee beverages without the need for brewing or waiting in long queues. Moreover, RTD caffeine products offer a wide range of flavors and formulations, catering to diverse consumer preferences. The ability to choose from various flavors, brewing types, etc. has contributed to the popularity of these beverages.

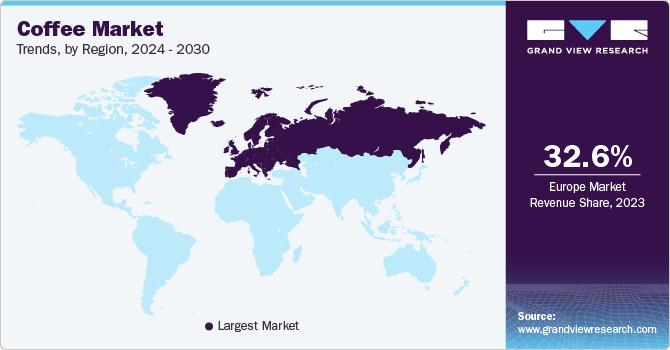

Regional Insights

Europe accounted for a revenue share of 32.7% in 2022 and is expected to grow at a CAGR of 5.0% from 2023 to 2030. There has been a rising consumption of high-quality coffees in the region owing to increased consumption of products at specialty coffee shops in Western Europe. As per the data published by the Centre for the Promotion of Imports from Developing Countries (CBI), in Europe, the number of coffee shops serving specialty coffee increased to 24,290 in 2020, a surge of 18% between 2018 and 2020. European consumers are becoming increasingly interested in both Arabica and Robusta specialty coffees, thus creating growth opportunities for suppliers. Exporters who can regularly provide high-quality products are expected to find these prospects to be particularly interesting.

Asia Pacific accounted for a market share of 23.0% in 2022 and is expected to grow at a CAGR of 6.1% from 2023 to 2030. Coffee culture is gaining traction in many Asian countries due to the influence of Western coffee trends and the rise of a younger, more cosmopolitan population. Urban areas, in particular, have seen a surge in the popularity of coffee shops. Asia Pacific has a large population of young people who are more open to adopting global trends. This demographic is increasingly drawn to the café culture and experience of specialty coffees, which will create growth opportunities for the regional market.

Nature Insights

The conventional coffee segment size was estimated at USD 407.61 billion in 2022 and is expected to grow at a CAGR of 4.7% from 2023 to 2030. Conventional coffee is often more affordable than its organic counterpart. This lower price point makes it accessible to a broader consumer base, attracting price-sensitive consumers. In addition, conventional coffee is typically produced on a larger scale, benefiting from economies of scale. This allows for mass production and distribution, meeting the high product demand, globally.

The organic coffee segment is expected to register a CAGR of 8.4% from 2023 to 2030. Consumers are looking for goods that are viewed as healthier and more sustainable as a result of rising health and environmental concerns. These issues are addressed by organic coffee, which is produced without synthetic pesticides and fertilizers. Consumers are increasingly becoming aware of the environmental impact of their choices. Organic coffee production typically involves more environmentally friendly practices resulting in their increased demand.

Key Companies & Market Share Insights

Key players are adopting various strategies, such as partnerships, mergers & acquisitions, development & launch of new products, global expansions, and redesigning their packaging solutions, to strengthen their presence in the market.

Key Coffee Companies:

- Nestlé

- Starbucks Coffee Company

- JDE Peet's

- Tchibo Coffee

- Luigi Lavazza SPA

- Strauss Coffee BV

- The J.M. Smucker Company

- Melitta

- UCC Ueshima Coffee Co., Ltd.

- Massimo Zanetti Beverage USA

Coffee Market Report Scope

Report Attribute

Details

Market size value in 2023

USD 483.91 billion

Revenue Forecast in 2030

USD 690.09 billion

Growth rate

CAGR of 5.2% from 2023 to 2030

Base year for estimation

2022

Historical data

2017 - 2021

Forecast period

2023 - 2030

Quantitative units

Revenue in USD million/billion and CAGR from 2023 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, nature, distribution channel, region

Regional scope

North America; Europe; Asia Pacific; Central & South America; Middle East & Africa

Country scope

U.S.; Canada; Mexico; Germany; UK; France; Italy; Spain; China; Japan; India; South Korea; Indonesia; Brazil; Ethiopia

Key companies profiled

Nestlé; Starbucks Coffee Company; JDE Peet's; Tchibo Coffee; Luigi Lavazza SPA; Strauss Coffee BV; The J.M. Smucker Company; Melitta; UCC Ueshima Coffee Co., Ltd.; Massimo Zanetti Beverage USA

Customization scope

Free report customization (equivalent up to 8 analysts’ working days) with purchase. Addition or alteration to country, regional & segment scope

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Coffee Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest trends in each of the sub-segments from 2017 to 2030. For this study, Grand View Research has segmented the coffee market report on the basis of product, nature, distribution channel, and region:

-

Product Outlook (Revenue, USD Billion, 2017 - 2030)

-

Roasted

-

Roast & Ground

-

Pods & Capsules

-

Whole Beans

-

-

Instant

-

Ready to Drink

-

-

Nature Outlook (Revenue, USD Billion, 2017 - 2030)

-

Conventional

-

Organic

-

-

Distribution Channel Outlook (Revenue, USD Billion, 2017 - 2030)

-

B2B

-

Cafes & Bars

-

Hotels & Restaurants

-

Workplace

-

Others

-

-

B2C

-

Hypermarkets & Supermarkets

-

Convenience Stores

-

Specialty Stores

-

Online

-

Others

-

-

-

Regional Outlook (Revenue, USD Billion, 2017 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

Italy

-

Spain

-

-

Asia Pacific

-

China

-

Japan

-

India

-

South Korea

-

Indonesia

-

-

Central & South America

-

Brazil

-

-

Middle East & Africa

-

Ethiopia

-

-

Frequently Asked Questions About This Report

b. The global coffee market size was estimated at USD 461.25 billion in 2022 and is expected to reach USD 483.91 billion in 2023.

b. The global coffee market is expected to grow at a compounded growth rate of 5.2% from 2023 to 2030 to reach USD 690.09 billion by 2030.

b. Roasted coffee was valued at USD 246.32 billion in 2022 of the global revenue and is expected to grow at a CAGR of 4.8% over the forecast period from 2023 to 2030. The globalization of coffee culture, driven by the expansion of international coffee shop chains like Starbucks, has led to increased consumption of roasted coffee. These chains have popularized the idea of freshly roasted coffee, emphasizing its premium quality.

b. Some key players operating in coffee market are Nestlé, Starbucks Coffee Company, JDE Peet's, Tchibo Coffee, LUIGI LAVAZZA SPA, Strauss Coffee BV, The J.M. Smucker Company, Melitta, UCC UESHIMA COFFEE CO., LTD., and Massimo Zanetti Beverage USA

b. Evolving consumer preferences and trends play a crucial role in shaping the coffee market. Factors such as the increasing demand for specialty and gourmet coffees, organic and sustainable sourcing, and the popularity of premium and single-origin coffee varieties impact market dynamics. Specialty coffee and gourmet coffee are often associated with higher quality and unique flavor profiles. Consumers are increasingly willing to pay a premium for these coffees, which drives up the overall value of the coffee market. This demand for specialty and gourmet coffee contributes to increased revenue and profitability for coffee producers, roasters, and retailers. Additionally, the rise of convenient coffee formats like coffee pods and capsules has transformed the market.

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![ESOMAR Certified Member]()

![Great Place to Work Certified]()

ESOMAR & Great Work to Place Certified

![ISO 9001:2015 & 27001:2022 Certified]()

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."